Changing your address can have an impact on your insurance rate, either increasing or decreasing it. This is because insurance companies use your address to determine your premium, which is the amount you pay for your insurance coverage. Insurance companies keep track of accident reports, claim filings, crime rates, traffic, population, and other relevant statistics in different areas. As a result, moving to a new location with higher crime rates or more traffic can lead to an increase in your insurance rate. On the other hand, if you move to a rural or suburban area with lower crime rates and less traffic, your insurance rate may decrease. Therefore, it is essential to update your insurance company about any changes in your address to ensure that your coverage remains valid and that your rate reflects the risk level associated with your new location.

| Characteristics | Values |

|---|---|

| Insurance rates | Can increase or decrease depending on the new address |

| Reasons for rate change | Crime rates, traffic, population, number of uninsured drivers, parking spot, state-specific insurance requirements |

| Consequences of not updating address | Legal charges, policy cancellation, higher rates, claims denial |

What You'll Learn

Crime rates

Insurers will typically use your zip or postcode to check the crime rate in your area. They will be looking for specific car-related crimes, such as vandalism, theft, break-ins, and damage from hit-and-runs. If you live in an area with high crime rates, insurers will assume that you are at greater risk of having your car vandalised, stolen, or damaged, and will therefore raise your insurance rates. On the other hand, living in an area with lower crime rates will usually grant you access to lower insurance rates.

In addition to car-related crimes, insurers will also consider the overall safety of an area. For example, if you live in an area that is notorious for natural disasters, theft, or crime, your insurance rates may increase. This is because insurers consider the collective risk, and if your neighbours are more likely to file claims due to the higher crime rate, this will impact your rates as well.

It is important to note that providing an incorrect address when registering for insurance can invalidate your policy. Therefore, it is crucial to ensure that your address details are accurate and up to date, especially when moving to a new location.

A Comprehensive Guide to Navigating LIC e-Term Insurance Application Process

You may want to see also

Population density

In addition to population density, insurance companies will also consider the following factors when assessing the risk profile of a given address:

- Crime rates, including theft and vandalism

- Traffic trends

- The number of accidents recorded and the number of claims made

- The presence of any 'high-risk' traffic systems, such as roundabouts and cycle lanes

- The number of uninsured drivers in the area

- The occurrence of fraudulent claims

Insurance companies have their own ratings for every postcode in the UK. These ratings are based on claims statistics at each postcode and the surrounding area. The more claims that are recorded, the higher the risk to the insurer and, therefore, the higher the premiums will be.

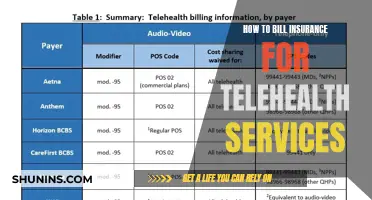

Unraveling the Mystery of Post-Insurance Billing: Understanding a Doctor's Billing Practices

You may want to see also

Parking situation

The parking situation at your address can have an impact on your insurance rate. If you have a secure parking space, such as a garage or driveway, your insurance rate may be lower than if you park on the street. This is because cars parked in secure spaces are less likely to be broken into or damaged.

Additionally, if you live in an area with a high population and busy traffic, your insurance rate may be higher due to the increased risk of accidents and theft. In such cases, it is advisable to consider alternative parking arrangements, such as renting a parking space in a garage.

It is worth noting that insurance companies take various factors into account when determining insurance rates, and the parking situation is just one of them. Other factors include the type of car, age, gender, and marital status of the driver. Therefore, while the parking situation can influence insurance rates, it is not the sole determinant.

It is also important to note that failing to update your insurance company about your change of address and parking situation may result in penalties, policy cancellation, or higher rates. Hence, it is recommended to be transparent and honest with your insurance provider and update them about any changes.

Understanding the Combined Ratio: A Key Metric in Insurance Performance Evaluation

You may want to see also

State-specific insurance requirements

Alabama

Alabama requires name approval from the Alabama Department of Insurance and a fee and name approval form to be sent to the Alabama Secretary of State.

Alaska

Alaska requires annual statements with original signatures or a copy of the signed jurat page with an original certification by the State of Domicile.

Arizona

To qualify for Variable Authority in Arizona, applicants should contact Kimberly Johnson.

Arkansas

Arkansas requires a financial feasibility plan that includes detailed enrollment projections, a methodology for determining premium rates, a projection of balance sheets, cash flow statements, and a statement of the source of working capital.

California

California requires applicants to contact the California Secretary of State directly to qualify to do business in the state.

Connecticut

Connecticut requires applicants to meet seasoning requirements of two years of premium writings before submitting an application for admission.

Delaware

Delaware has no additional state-specific requirements for corporate amendments.

Florida

Florida requires applicants to join the Workers' Compensation Insurance Rating Bureau if they are requesting authority to transact workers' compensation insurance.

These are just a few examples of state-specific insurance requirements in the United States. Each state has its own unique set of regulations and laws governing insurance, and it is essential to refer to the relevant state's official sources for the most up-to-date and comprehensive information.

Understanding Orthodontic Insurance: Billing Brace Treatments

You may want to see also

Number of uninsured drivers

The number of uninsured drivers on the road is a significant issue, with around 28-29 million uninsured drivers in the US. This equates to about one in every seven or eight drivers, or a national rate of 12.6% to 14% of motorists being uninsured.

The percentage of uninsured drivers varies by state, with Mississippi having the highest rate of uninsured drivers at 29-29.4%, and New Jersey the lowest at 3-3.1%. Other states with high rates of uninsured drivers include Michigan (25.5%), Tennessee (23.7%), New Mexico (21.8%), and Washington (21.7%). States with the lowest rates of uninsured drivers, after New Jersey, are Massachusetts (3.5%), New York (4.1%), and Wyoming (5.8%).

The number of uninsured drivers has decreased in recent years, but the rate did increase during the pandemic, jumping in nearly every state in 2020. The cost of insurance is a significant factor in why people drive without it, with 82% of uninsured drivers saying they can't afford it. The average yearly cost of auto insurance has increased from $789.29 in 2010 to $1,070.47 in 2019, and $1,353 for a small sedan in 2021.

Unraveling the Complexities of Insurance Billing for DOs and MDs

You may want to see also

Frequently asked questions

Yes, changing your address can affect your insurance rate. Insurance providers consider the risk associated with your new area, including crime rates, population density, and traffic trends, to calculate your premium.

Moving to a new location with higher crime rates, more traffic, or a higher population density can increase your insurance rate. Conversely, moving to a less populated area with less traffic can decrease your premium.

If your insurance rate increases, you can consider the following options: updating your deductible, looking for discounts, or comparing quotes from different providers to find a better deal. Additionally, you may want to review your policy and understand the factors that impact your rate.