Dairyland does offer SR-22 insurance for high-risk drivers with traffic violations, including DUIs and DWIs, accidents caused without insurance, and driving with a suspended or revoked license. The SR-22 form is filed with the state to prove that the driver meets the minimum level of insurance coverage required by the state to drive. Dairyland provides SR-22 insurance for free as part of its insurance policy, although its rates are generally higher than competitors.

| Characteristics | Values |

|---|---|

| SR22 Insurance | Dairyland provides SR-22 insurance for drivers with traffic violations, but rates are high. |

| SR22 Filing Fee | Dairyland does not charge a fee for filing an SR-22 form. |

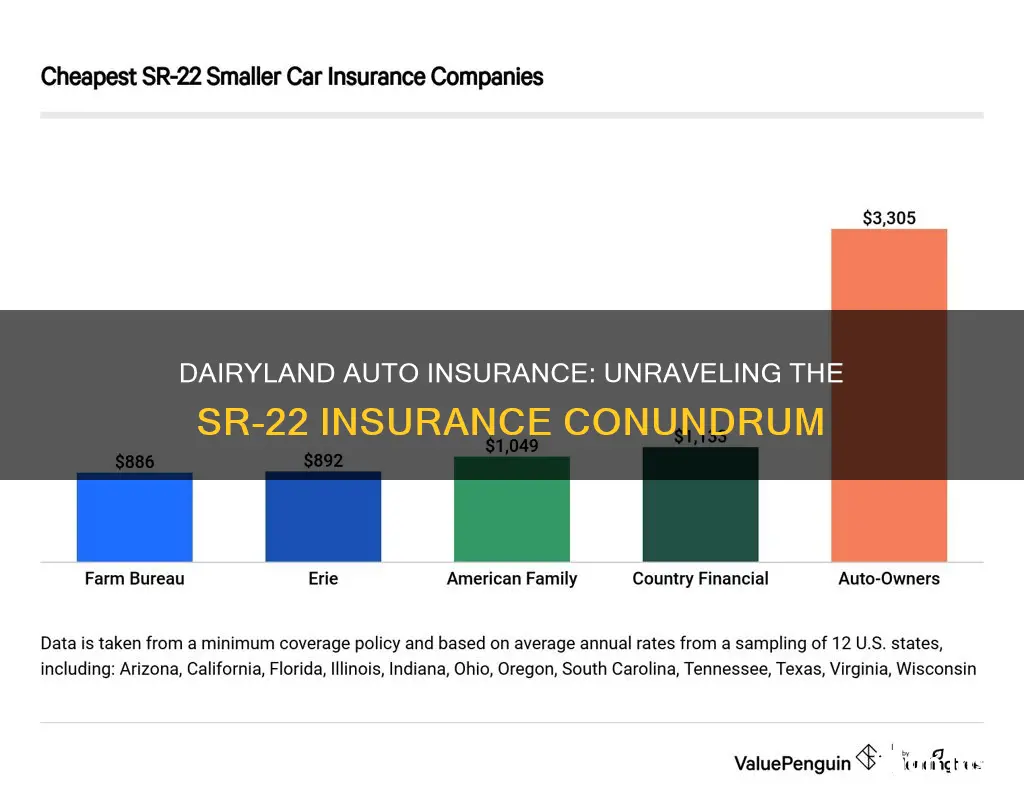

| SR22 Policy Cost | Dairyland SR-22 policies can cost upwards of $4,000 per year, which is significantly more than other insurance providers. |

| SR22 Policy Duration | Most states require drivers to have an SR-22 for about three years, but this can vary by state and circumstance. |

| SR22 Policy Coverage | Dairyland SR-22 policies include the state's minimum liability insurance requirements, but can also include other forms of coverage such as collision and comprehensive coverage. |

| Non-Owner SR22 Insurance | Dairyland offers non-owner SR-22 insurance for those who need it to regain their driver's license privileges. |

What You'll Learn

Dairyland SR22 insurance for high-risk drivers

Dairyland SR22 insurance is available for high-risk drivers. SR22 insurance is a certificate of financial responsibility that proves you carry car insurance and meet your state's minimum insurance requirements. It is often required for high-risk drivers with violations such as DUIs, DWIs, driving without insurance, or causing accidents.

Dairyland provides SR22 insurance for drivers with various traffic violations, including DUI and DWI. The company offers SR22 filings with state DMVs and provides the necessary minimum liability insurance required by the state. Dairyland's SR22 insurance can also include other forms of coverage mandated by the DMV, such as collision and comprehensive coverage.

While Dairyland's SR22 insurance rates are typically higher than competitors, they do offer a range of premium discounts. Dairyland also specializes in non-standard insurance policies and has been in the industry since 1953. They are known for providing excellent customer service and reasonable prices, especially for high-risk drivers.

The process of obtaining an SR22 insurance quote from Dairyland is straightforward. You will need to provide personal information, including your name, date of birth, address, contact details, and Social Security Number or Taxpayer Number. Additionally, you will need to specify the manufacturing date and model of the car that needs to be insured.

Dairyland's SR22 insurance is a viable option for high-risk drivers seeking compliance with state requirements and peace of mind while on the road.

Health Insurance and Auto Accidents: Understanding the Coverage

You may want to see also

SR22 insurance for non-owners

Dairyland Auto Insurance does offer SR22 insurance, and it can be purchased online. SR22 insurance is a certificate of financial responsibility that proves you carry car insurance and meet your state's minimum insurance coverage requirements. It is not a type of insurance itself, but a form that is filed with your state.

SR22 insurance is typically required for high-risk drivers who have committed serious driving violations, such as driving under the influence (DUI), driving without insurance, or causing an accident while uninsured. It is usually mandated for a certain period, often at least three years, and is required before your driver's license can be reinstated.

Non-owner SR22 insurance is for people who need to meet their state's SR22 requirements but do not own a car. This type of insurance is typically cheaper than standard SR22 insurance as these drivers are not on the road as often. It acts as a secondary form of coverage, meaning that if a driver with non-owner SR22 insurance damages a borrowed car, the car owner's insurance will pay first, and the non-owner policy will cover any additional costs.

Dairyland's non-owner SR22 insurance is available to those who need an SR22 form to regain their driving privileges, even if they do not own a car. While Dairyland does offer SR22 insurance, their premiums are typically much higher than those of their competitors.

The Sneaky Side of AARP Auto Insurance: Annual Premium Increases

You may want to see also

SR22 insurance for non-standard policies

An SR-22 is a certificate of financial responsibility that shows you have the required amount of liability coverage on your auto policy. It is not a type of insurance, but rather a document that proves you have insurance. It is often required for high-risk drivers who have committed certain traffic violations, such as driving under the influence (DUI) or driving without insurance.

Dairyland offers SR-22 insurance for drivers with all sorts of traffic violations, but their rates are typically much higher than competitors. Dairyland's SR-22 policy includes the state's minimum liability insurance requirements, and may also include other forms of coverage required by the DMV. They offer "full-coverage" plans that include collision and comprehensive coverage. Dairyland can file SR-22 forms with the state electronically and often on the same day as the purchase, with no filing fee.

If you are a high-risk driver in need of SR-22 insurance, there are a few things to keep in mind. First, not all auto insurance companies offer SR-22s, so be sure to do your research and contact insurance companies directly to find out their coverage options. Second, SR-22 insurance is typically more expensive than standard auto insurance due to the associated driving infractions. Finally, the length of time you need to maintain an SR-22 certificate will depend on your state's requirements, but it is usually required for about three years.

Grubhub Auto Insurance Requirements

You may want to see also

SR22 insurance for full-coverage plans

Dairyland provides SR-22 insurance for drivers with various traffic violations, including DUI convictions, reckless driving, and driving without a valid license. While Dairyland does offer "full-coverage" plans to SR-22 policyholders, it is important to note that SR-22 insurance is not actually a type of insurance, but rather a certificate of financial responsibility. This certificate proves that a driver carries the minimum amount of auto insurance required by their state.

Full-coverage plans offered by Dairyland to SR-22 policyholders typically include collision coverage and comprehensive coverage in addition to the state's minimum liability insurance requirements. Collision coverage pays for repairs to your car if you are involved in an accident, while comprehensive coverage protects against damage to your vehicle caused by something other than a collision, such as hail, water, or a fallen tree.

It is worth mentioning that SR-22 insurance is usually associated with high-risk drivers, and as a result, Dairyland's rates for SR-22 insurance are typically much higher than those of its competitors. The precise cost of an SR-22 policy will depend on the driver's specific circumstances, including the reason for the SR-22 requirement, the desired level of coverage, and their location.

In summary, while Dairyland does offer SR-22 insurance and full-coverage plans for SR-22 policyholders, it is important to understand that SR-22 insurance is not a substitute for full auto insurance coverage. SR-22 serves as a certification that a driver meets the minimum insurance requirements mandated by their state, and it is often necessary for high-risk drivers to regain their driving privileges after suspensions or revocations.

Auto Insurance and Funeral Expenses: What's Covered?

You may want to see also

SR22 insurance for free

SR22 insurance is not actually insurance but a certificate of financial responsibility that proves you have auto insurance. It is sometimes required for high-risk drivers who have committed serious driving violations, such as a DUI or driving without a valid license. While SR22 insurance itself is free, high-risk drivers who need to file an SR22 form can expect to pay higher insurance premiums.

Dairyland does offer SR-22 filings with state DMVs after providing insurance coverage to high-risk drivers. While Dairyland typically files your SR-22 form for free as part of your policy, the precise cost of your SR-22 policy will depend on why you need an SR-22, what kind of coverage you need, and where you’re located. These factors are taken into account with the usual considerations, such as your age, gender, car make and model, and other factors that insurance providers look at when calculating your premium.

Dairyland SR-22 policy carriers can expect to pay upwards of $4,000 per year for their policies, which is significantly more than other insurance providers charge for SR-22 insurance. This number may be higher or lower depending on your state’s specific coverage requirements.

If you’re looking for non-owner SR-22 insurance, Dairyland does offer this type of policy to those who need an SR-22 form. Non-owner SR-22 insurance is for people who need to meet their state’s SR-22 requirements but do not own a car.

Auto Insurance Claims Sharing: What Drivers Need to Know

You may want to see also

Frequently asked questions

An SR22 is a form filed with your state that proves you carry car insurance. It's also known as a "certificate of financial responsibility". It confirms that you meet your state's car insurance coverage requirements for driving during a required period.

The process for getting an SR22 varies by state. Generally, you need to indicate that you need to file an SR22 when purchasing your auto insurance policy. You'll need to provide your driver's license number or other identification number. Dairyland can issue an SR22 immediately and file it with your state electronically on the same day, with no filing fee.

An FR44 is a document similar to an SR22, proving that you carry car insurance. However, it is required in Florida and Virginia for drivers with serious violations on their record. FR44 insurance may require your liability coverage limits to be higher than the state minimum.