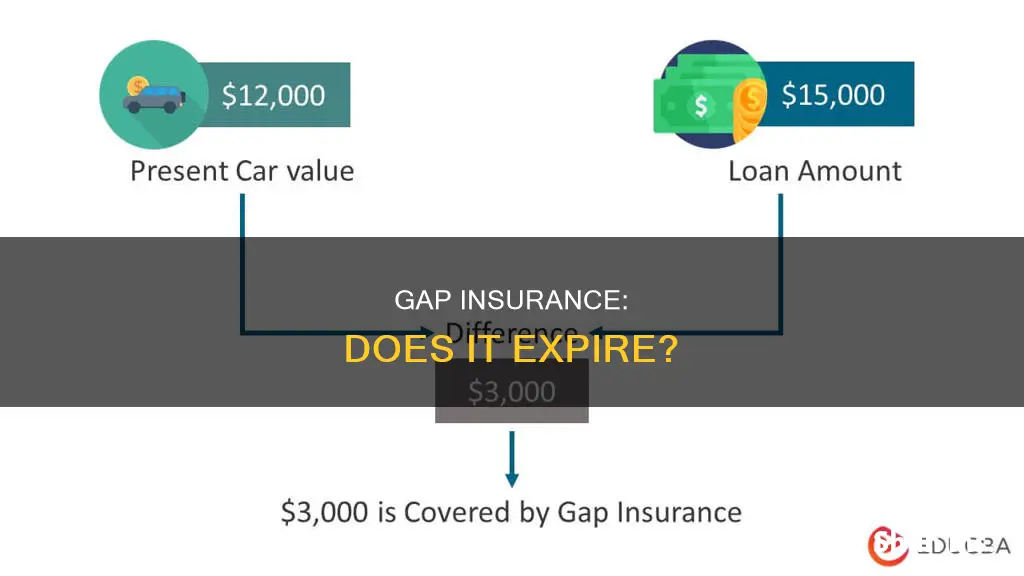

Guaranteed Asset Protection (GAP) insurance is a type of coverage that bridges the financial gap in the event of a total loss, ensuring that you are not burdened with outstanding loan or lease payments for a vehicle you no longer have. GAP insurance covers the difference between what you owe on your car loan or lease and the depreciated value of your car if it is totaled due to a problem covered by your policy, like a car accident. It is important to note that GAP insurance does not expire as long as the policy is active and has not lapsed. However, it becomes ineffective at the break-even point when the actual cash value of the car and the loan balance are equal.

| Characteristics | Values |

|---|---|

| Expiry | GAP insurance does not expire on its own |

| Duration | Standard GAP insurance policies usually last for a specific period, typically aligning with the duration of your car loan or lease. |

| Renewal | You may have the option to renew your GAP insurance for an additional term. Renewal terms and premiums vary among insurance providers. |

| Refund | You may qualify for a refund on an existing policy under certain circumstances, such as if you cancel your GAP insurance policy early or pay off your auto loan early. |

What You'll Learn

- GAP insurance doesn't expire unless the policy lapses

- GAP insurance refunds are possible under certain circumstances

- GAP insurance is usually aligned with the duration of your car loan or lease

- GAP insurance is available from dealerships and insurance companies

- GAP insurance is worth it in certain situations

GAP insurance doesn't expire unless the policy lapses

GAP insurance, or Guaranteed Asset Protection insurance, is a specialised type of insurance that covers the difference between what you owe on a car loan and the actual value of your vehicle if it is stolen or written off in an accident. This type of insurance is particularly useful if you have made a small down payment on a car loan, are financing for a longer loan term, or have purchased a vehicle that depreciates faster than average.

GAP insurance policies usually last for a specific period, typically the duration of your car loan or lease. For example, if you have a 60-month loan, your GAP insurance coverage will usually also be for 60 months. However, GAP insurance does not expire unless the policy lapses. This means that as long as you continue to pay your premiums and do not cancel the policy, it will remain in force.

While GAP insurance does not expire, it may become less useful over time as the difference between the actual cash value of your car and the loan balance decreases. Once the cash value of your car and the loan balance are equal, the policy is no longer of value. At this point, you may want to consider cancelling the policy, especially if the cost of the insurance is more than the potential benefit.

It is important to note that if you cancel your GAP insurance policy, you may be eligible for a refund of any unused premiums. The amount of the refund will depend on various factors, including the value of the vehicle, the amount of the auto loan, the vehicle's current mileage, and the loan repayment term. Be sure to review the terms and conditions of your policy and contact your insurance provider to understand your specific coverage and any potential refund you may be entitled to.

Insuring Your Vehicle in Tennessee

You may want to see also

GAP insurance refunds are possible under certain circumstances

GAP insurance, or guaranteed auto protection, reimburses you if your car is stolen or totaled and you still owe money on the car loan. GAP insurance does not expire until your loan or lease is paid off. However, it becomes useless at the break-even point when the actual cash value of your car and the loan balance are equal. At this point, you should drop the coverage from your insurance policy.

Since GAP insurance does not expire in the traditional sense, refunds are only possible under certain circumstances. You can get a GAP insurance refund if you paid in advance for coverage and cancel the policy early. This usually occurs after you repay your loan early, or if you sell or trade in your vehicle before paying off your loan. The refund will reimburse you for a portion of your unused premiums. If you paid for your GAP insurance monthly, your refund will likely be smaller than if you had paid upfront.

The amount of the refund is typically calculated based on several factors, including the value of the vehicle, the amount of the auto loan, the vehicle's current mileage, and the loan repayment term. To estimate your refund amount, divide the total cost of the insurance by the number of months of coverage to get your monthly premium. Multiply this by the number of months left on your policy to get a rough idea of your refund amount. However, each insurance provider will have a different process for calculating refunds, so be sure to confirm the amount with them.

It's important to note that you won't receive a GAP insurance refund if your vehicle is stolen or totaled and you need to file a claim. Additionally, insurance companies may have specific cutoff deadlines for GAP insurance refunds, so it's best to inquire about their policies before signing up.

Vehicle Insurance Expired? Here's What to Do

You may want to see also

GAP insurance is usually aligned with the duration of your car loan or lease

GAP insurance is a type of supplemental coverage that safeguards your finances in the event of a total loss. It covers the difference between what you owe on your car loan and the actual value of your vehicle if it is stolen or written off. GAP insurance is particularly useful if you have made a small down payment, are financing for a longer loan term, or have purchased a vehicle that depreciates faster than average.

GAP insurance policies usually last for a specific period, typically aligning with the duration of your car loan or lease. For example, if you take out a 60-month loan to finance your car, your GAP insurance coverage will also last for 60 months. This means that if your car is declared a total loss within those five years, the GAP insurance will cover the difference between your vehicle's actual cash value and the outstanding loan balance.

The length of your car loan or lease agreement is the most significant factor in determining the duration of your GAP insurance coverage. Shorter loan or lease terms result in shorter coverage, while longer terms result in extended coverage. It is important to note that GAP insurance does not expire on its own once it stops being of value to you. Therefore, it is essential to regularly compare your car's actual value to the amount you have left on your loan to determine when to cancel your GAP coverage.

Different insurance providers may have varying policies regarding the duration of GAP insurance. Some may offer fixed terms, while others may allow for more flexibility to tailor the coverage to your specific needs. As such, it is crucial to review the terms and conditions provided by your chosen insurance provider to fully understand your coverage period. Additionally, some dealerships may include the cost of GAP insurance in your auto loan, so it is important to carefully review the terms of your loan agreement.

Burning Vehicle for Insurance: The 'How-To' Guide

You may want to see also

GAP insurance is available from dealerships and insurance companies

On the other hand, insurance companies usually offer GAP insurance as an add-on to an existing policy. Major insurance providers like State Farm, Nationwide, Progressive, Allstate, USAA, AAA, and Esurance offer standalone GAP insurance or coverage as an add-on. Adding GAP insurance to your current auto insurance policy can result in significant savings compared to purchasing separate coverage from a car dealer or financing company.

It is worth noting that not all insurance companies offer GAP insurance, and specific requirements may vary. For instance, some insurers may only provide GAP coverage for vehicles up to two to three years old, and you may need to be the original owner of the vehicle. Additionally, GAP insurance from an insurance company typically lasts as long as it is part of an active policy.

Before purchasing GAP insurance, it is recommended to compare prices and coverage options from different providers to find the best deal. It is also essential to review the terms and conditions of the policy, including coverage limits, the duration of the policy, and cancellation policies.

Insurance: Drive Your Vehicle With Confidence

You may want to see also

GAP insurance is worth it in certain situations

GAP Insurance: Worth It in Certain Situations

GAP insurance is an optional form of financial protection that covers the difference between the amount owed on a car loan or lease and the vehicle's actual cash value in the event of total loss or theft. While GAP insurance is not necessary for all drivers, it can be beneficial in specific circumstances.

GAP insurance is worth considering if you meet any of the following criteria:

- You made a small down payment on your vehicle (typically less than 20%.)

- You have a long-term loan (60 months or longer).

- You purchased a vehicle that depreciates faster than average.

- You rolled over negative equity from a previous car loan into the new loan.

- You owe more on your auto loan than your car is worth.

- You drive more than the average person in your area.

- You are leasing your car.

Understanding the Value of GAP Insurance

The value of GAP insurance lies in its ability to protect you from financial loss in specific situations. If you find yourself in any of the above scenarios, GAP insurance can provide valuable peace of mind and financial protection. However, it's important to note that GAP insurance is not a requirement for all drivers and may not be necessary if you have a substantial down payment, a shorter loan term, or a vehicle that holds its value.

Factors to Consider

When deciding if GAP insurance is worth it for your situation, consider the following factors:

- The cost of GAP insurance: It is typically inexpensive, but the price can vary depending on the provider and your vehicle's characteristics.

- The coverage options available: Review what is included in the GAP insurance policy and ensure it aligns with your needs.

- The available providers: Research different insurance companies and compare their GAP insurance offerings to find the best fit for your situation.

- Your eligibility: Ensure you qualify for GAP insurance, as it may not be available for older vehicles or if you are not the original owner.

Duration of GAP Insurance Coverage

GAP insurance does not have a set expiration date but remains in effect as long as you maintain the policy and continue making payments. However, it becomes less useful once the actual cash value of your vehicle exceeds the remaining loan balance. At that point, you may consider dropping the coverage from your insurance policy.

Insuring Non-Operational Vehicles: Is It Necessary?

You may want to see also

Frequently asked questions

GAP insurance doesn't expire as long as you don't allow the policy to lapse. However, it's no longer useful at the break-even point when the actual cash value of your car and the loan balance are equal.

Standard GAP insurance policies usually last for a specific period, typically aligning with the duration of your car loan or lease. For example, if you have a 60-month loan, your GAP insurance coverage will last for the same 60-month period.

Yes, you may be able to get a refund on GAP insurance if you cancel your policy early. The amount of the refund will depend on various factors, including the value of the vehicle, the amount of the auto loan, and the vehicle's current mileage.

You can cancel GAP insurance by contacting either the dealership or insurance company that provided the coverage. Cancelling through an insurance company is generally simpler than through a dealership.