GEICO offers auto insurance in Michigan, but the process of getting a quote is more complicated than in other states. While GEICO has insurance agents in Michigan, there are no physical offices in the state, and GEICO does not provide quotes online or by phone to Michigan residents. Instead, interested drivers must contact GEICO via email or the customer service call center to request a paper application form. This is because Michigan's insurance laws are unique, as it is the only state with unlimited lifetime coverage for catastrophic injuries, resulting in higher insurance rates.

| Characteristics | Values |

|---|---|

| GEICO agents in Michigan | None |

| GEICO insurance quote in Michigan | Not available online or by phone |

| Process to get a GEICO insurance quote in Michigan | Email GEICO at [email protected] with your name and mailing address. GEICO will send a paper application to fill out and return. |

| Average time for GEICO to verify and provide a quote | About a month |

| GEICO's special discounts | Military, federal employees, membership discounts for many professional, medical, and alumni organizations |

What You'll Learn

GEICO's Michigan auto insurance quote process

GEICO offers auto insurance in Michigan, and you can get a free quote on their website. Here is a step-by-step guide on how to get a Michigan auto insurance quote from GEICO:

- Go to the GEICO website.

- On the homepage, you will see an option to "Get a Car Insurance Quote." Click on that.

- You will be redirected to a new page where you need to select your state, in this case, Michigan.

- Provide the necessary information, including your ZIP code, to get started with the quote process.

- You will then be asked to provide additional details, such as your vehicle identification number (VIN), the physical address where your vehicle is stored, and your valid driver's license information.

- You will also need to answer questions about your driving history, including any accidents or violations. Be sure to provide accurate and complete information.

- Once you have provided all the required information, GEICO will generate a personalized rate for you.

- Review the coverage options, including state minimum requirements, to choose the best plan for your needs.

- Compare the quote with other insurance providers to ensure you are getting the best value.

- If you are satisfied with the quote and coverage, you can purchase the insurance policy directly online.

By following these steps, you can obtain a Michigan auto insurance quote from GEICO and ensure that you have the appropriate coverage for your vehicle in the state of Michigan.

Auto Insurance: Who Else is Covered?

You may want to see also

GEICO's Michigan auto insurance discounts

GEICO offers a range of discounts on auto insurance in Michigan. These include:

- Good Student Discount: Full-time students who maintain a B average or above are eligible for a discount of up to 15% on certain coverages.

- Multi-Car Discount: Customers with multiple cars insured with GEICO can drive down their premiums.

- Five-Year Accident-Free "Good Driver" Discount: Drivers who have been accident-free for at least 5 years can save up to 22% on most coverages.

- DriveEasy Discount: GEICO offers a discount for customers who download and enrol in the DriveEasy app, which uses telematics technology to monitor driving patterns and provide feedback and savings.

- Multi-Policy Discounts: Customers can save by bundling their auto insurance with other policies from GEICO or the GEICO Insurance Agency, such as homeowners, renters, condo, or mobile home policies.

GEICO also offers discounts for various vehicle safety features, such as:

- Air Bags: Up to 23% discount on the medical payments or personal injury portion of your insurance.

- Anti-Lock Brakes: 5% discount on certain coverages.

- Anti-Theft System: Up to 23% discount on the comprehensive portion of your premium.

- Daytime Running Lights: 3% discount on certain coverages.

- New Vehicle: Up to 15% discount on certain coverages for new vehicles 3 model years old or newer.

Additionally, GEICO offers discounts for students, federal employees, or members of the armed forces.

Hippo: Auto Insurance Options

You may want to see also

Michigan's auto insurance requirements

Michigan is a no-fault insurance state, which means that if you get into a car accident, your no-fault insurance will reimburse you for hospital or medical expenses, wage losses, and funeral costs, regardless of who is responsible for the accident. However, it does not cover any damage to your car.

In Michigan, drivers are required to maintain both property protection insurance (PPI) and personal injury protection (PIP) as part of their auto insurance coverage.

Property Protection Insurance (PPI)

PPI covers damages to someone else's property caused by an accident involving your vehicle. It has a mandated minimum limit of $1 million per accident.

Personal Injury Protection (PIP)

PIP covers expenses resulting from an accident, including medical bills, lost wages, and death benefits, regardless of fault.

In addition to PPI and PIP, Michigan drivers must also carry bodily injury liability insurance to cover injuries or death caused to others in a car accident, as well as any related legal fees.

Michigan law also requires drivers to purchase uninsured and underinsured motorist coverage (UI/UIM) to protect drivers and their passengers in the event of an accident caused by an uninsured or underinsured driver. This coverage helps bridge the gap between the other driver's insurance limits and the actual costs of medical bills, lost wages, and other damages resulting from the accident.

The minimum amount of Michigan auto insurance coverage is $50,000 per person/$100,000 per accident for bodily injury, and $10,000 for damage to another person's property.

AAA and Salvage Vehicle Insurance

You may want to see also

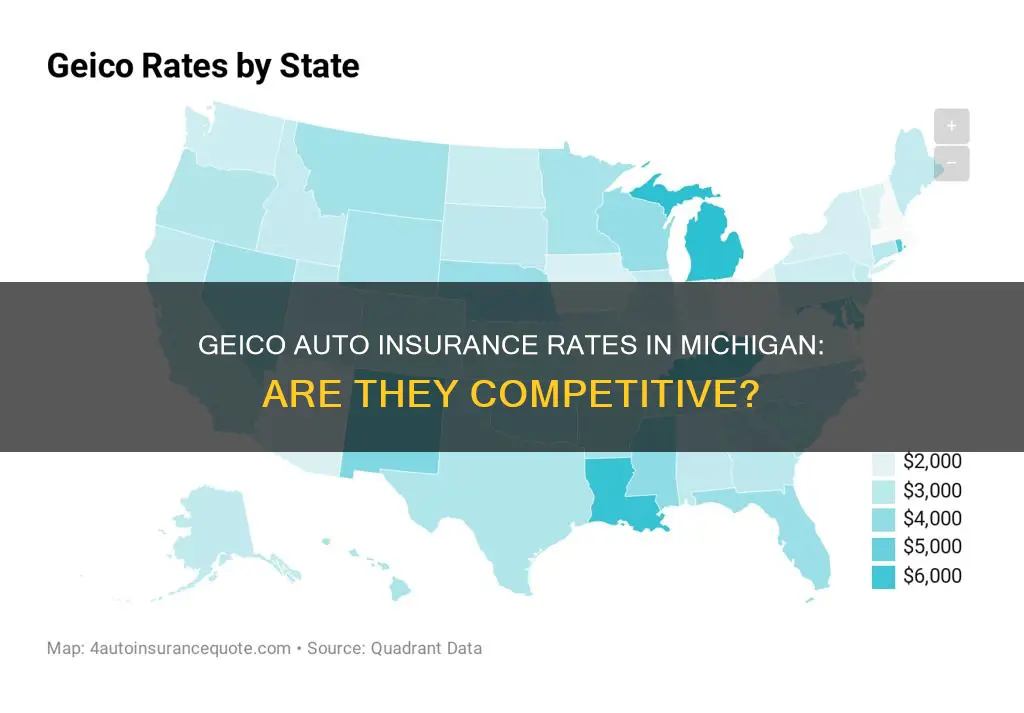

Michigan's auto insurance costs

When it comes to GEICO's auto insurance rates in Michigan, the company does not provide quotes online or by phone to Michigan residents. Instead, interested drivers must contact GEICO via email to request a paper application form, which can be a more complicated and time-consuming process. Despite this, GEICO still offers competitive rates and special discounts for military personnel, federal employees, and members of various professional, medical, and alumni organizations.

In Michigan, drivers have a wide range of choices when it comes to auto insurance providers. State Farm is the most popular insurer in the state, followed by AAA/Michigan Auto Club. Other major companies include Progressive, Allstate, The Hanover, and Farm Bureau Insurance of Michigan. These companies offer various discounts, rewards, and additional services, such as roadside assistance, to attract customers.

Michigan's auto insurance requirements also contribute to the high costs. The state mandates a minimum of $50,000 in bodily injury liability coverage per person, up to $100,000 per accident, along with $10,000 in property damage liability coverage. Additionally, drivers are required to carry personal injury protection (PIP) and $1,000,000 in property protection insurance. These comprehensive coverage requirements ensure that individuals involved in auto accidents in Michigan receive adequate financial protection.

Auto Insurance: Understanding Standard Coverage

You may want to see also

Michigan's unique auto insurance laws

Michigan has historically been one of the more expensive states in which to buy insurance. This is because the state requires far more coverage than others. To be a legal driver in Michigan, you must adhere to the state's guidelines, or you could face steep penalties.

Michigan is a "no-fault" state, meaning that when an accident happens, no matter who is at fault, your own insurance foots the bill. Each driver takes care of themselves, and the chances of someone suing or arguing over culpability are lessened. A perk of such laws is that it guarantees every driver immediate medical treatment in the event of an accident.

Michigan's auto insurance law requires vehicle owners to carry No-Fault auto insurance that covers personal injuries, property damage, and liability for bodily injury. These coverages help pay for medical bills and lost wages, and legal liability if a driver injures another person or causes damage to property.

There are four types of coverage required by Michigan car insurance laws:

- Personal Injury Protection (PIP): This coverage provides what are commonly known as “No-Fault PIP Benefits”. If you’re seriously injured in an auto accident, No-Fault PIP benefits provide reimbursement for medical expenses, a percentage of your lost wages, attendant care (in-home nursing services), and replacement services (help with household duties).

- Property Protection Insurance (PPI): This covers damage to "tangible property", such as parked cars or other property (e.g. buildings, fences, trees, lawns) within the state of Michigan. Every Michigan auto policy has a mandatory $1 million of PPI coverage.

- Residual Bodily Injury Liability (BI): This coverage protects you in the event you cause an auto accident that resulted in serious injuries to someone else. The law requires minimum bodily injury liability coverage limits of $250,000 per person and $500,000 per accident, but drivers may choose to purchase lower limits of $50,000 and $100,000.

- Property Damage (PD): This coverage protects you in the event you cause damage to another person’s vehicle outside the state of Michigan. The Michigan car insurance law requires a minimum of $10,000 of PD coverage, but attorneys recommend carrying a minimum of $100,000.

Michigan's new auto insurance law, signed by Governor Whitmer, introduces lower-cost insurance options and strengthens consumer protections. These changes apply to policies issued or renewed after July 1, 2020.

Auto Insurance and Tax Write-Offs

You may want to see also

Frequently asked questions

Yes, GEICO offers auto insurance in Michigan, which is tailored to the state's requirements.

GEICO does not provide quotes online or over the phone to Michigan residents. To get a quote, you must email GEICO at [email protected] with your name and mailing address. GEICO will then mail an application to your home address.

It usually takes about a month for GEICO to verify everything and provide a quote.

There are no GEICO agents in Michigan, which is why interested drivers have to go through the customer service call center or email to get a quote.

Yes, GEICO offers several discounts for students, federal employees, and memberships in professional, medical, and alumni organizations.