Whether or not Globe Life Insurance covers accidental overdoses depends on the specific policy and the circumstances of the overdose. While some life insurance policies do cover accidental deaths, including overdoses, Globe Life Insurance's accidental death and dismemberment insurance policy specifically excludes deaths resulting from drug overdoses and suicide. However, it is important to carefully review the coverage restrictions and exclusions of any insurance policy before making a purchase. Additionally, state laws and the type of drug involved in the overdose may also influence whether an accidental overdose is covered by a life insurance policy.

| Characteristics | Values |

|---|---|

| Coverage of accidental death | Yes |

| Coverage of accidental overdose | Sometimes |

| Coverage of accidental overdose from prescribed drugs | Likely |

| Coverage of accidental overdose from illegal drugs | Unlikely |

What You'll Learn

Globe Life's accidental death insurance

Accidents can cause tremendous emotional and financial grief for families. Globe Life's accidental death insurance policy provides up to $250,000 for a covered accidental death or loss, costing just $1 to start. This policy is designed to help families with the financial burden of medical bills, debt, mortgage payments, and final expenses. Acceptance is guaranteed, with no health questions or medical exams, for individuals aged between 18 and 69.

The monthly premiums for this policy will never increase, and additional features are included at no extra cost. These features include an inflation benefit, an education benefit, a seat belt benefit, a common disaster benefit, a dismemberment benefit, a paralysis benefit, and a commercially scheduled airline benefit.

It is important to note that most accidental death and dismemberment policies do not cover deaths resulting from drug overdoses and suicide. However, there may be nuances depending on the specific circumstances of the overdose, such as whether the drugs were prescribed or illegal, and whether the insured was under the care of medical professionals.

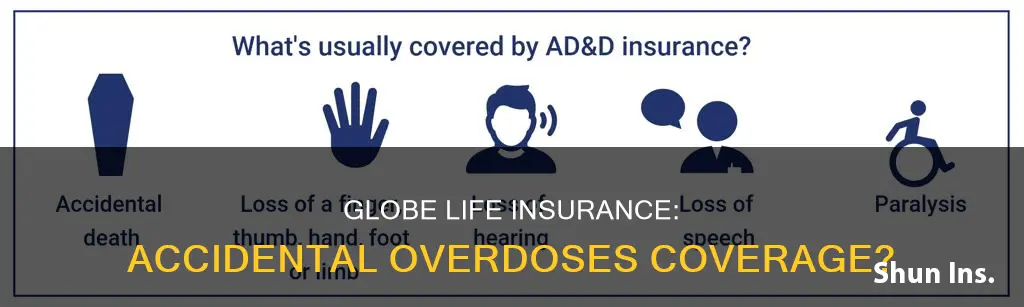

Understanding Accidental Death Insurance

Accidental death insurance, also known as accidental death and dismemberment insurance (AD&D), offers coverage for unexpected events such as life-altering injuries or accidental death. This type of insurance is different from regular life insurance, which typically pays out death benefits regardless of the cause of death.

AD&D policies are relatively inexpensive and can be purchased as stand-alone policies or as riders to existing life insurance policies. In the event of an accidental death, the designated beneficiary would receive benefits from both the regular life insurance policy and the AD&D rider.

Accidental death policies typically cover events such as car accidents, exposure to elements, falls, and drowning. It is important to carefully review the coverage restrictions and exclusions before purchasing an AD&D policy. Exclusions often include deaths resulting from drug overdoses, suicide, and natural causes such as heart attacks and strokes.

In the unfortunate event of a policyholder's death, the named beneficiaries would receive the payout. Accidental death policies require documentation, such as a death certificate, police reports, and medical examiner reports, to prove that the death was accidental.

Accidental death insurance cannot replace regular life insurance but can provide additional financial protection for your loved ones in the event of an accidental death or life-altering injury.

Drunk Driving and Life Insurance: What's the Verdict?

You may want to see also

Overdose from prescribed drugs

It is important to note that there is no definitive "yes or no" answer to whether life insurance covers accidental overdoses from prescribed drugs. The answer depends on several factors, including the type of policy, the duration of the policy, and the specific circumstances of the overdose. Here is an overview of how these factors come into play:

Type of Policy

Life insurance policies typically cover most causes of death, while accidental death coverage is more limited and only pays out for accidents. Accidental death policies usually have several exclusions, and one common exclusion is drug exclusion. This means that the policy does not cover any loss resulting from an injury sustained while taking drugs that require a prescription, unless the drug was taken as prescribed by a licensed physician.

Duration of the Policy

The duration of the policy before the overdose occurs is also a crucial factor. Most life insurance policies have a contestability period, usually the first two years, during which the insurer can contest or deny claims more easily. After this period, insurers can only deny claims for serious reasons, such as fraud or explicit exclusions within the policy.

Circumstances of the Overdose

The circumstances surrounding the overdose will play a significant role in determining coverage. If the overdose was accidental, involving a prescribed medication taken as directed, the claim will likely be covered. However, if the policyholder did not disclose the medications and their reasons for taking them when purchasing the insurance, the claim may be denied.

Additionally, if the overdose occurs soon after the policy goes into effect (during the contestability period), the insurer may investigate whether it was intentional. In such cases, the determination of whether the overdose was accidental or intentional may involve court proceedings and the testimony of both the insurer and beneficiaries.

Coroner's Report and Toxicology

The coroner's report is essential in determining the cause of death. Common causes of accidental death that coroners may list include accidental ingestion of the drug, unintentional ingestion of too much of the drug, the drug being given in error by someone else, or a medical professional accidentally administering too much of the drug.

In the case of prescribed medications, insurance companies may hire medical experts to analyse toxicology reports and determine whether the drug was taken within a therapeutic range and according to the physician's advice.

In summary, while there is no definitive answer, life insurance policies are more likely to cover accidental overdoses from prescribed drugs if the policy has been in place for more than two years, the policyholder disclosed their medications and reasons for taking them, and the overdose was determined to be accidental by a coroner or medical examiner. However, each case is unique, and it is always advisable to carefully review the specific terms and exclusions of the policy in question.

Chase Bank: Life Insurance for Account Holders?

You may want to see also

Overdose from illegal drugs

Life Insurance Coverage for Illegal Drug Overdose

Life insurance policies typically cover deaths from illegal drug overdoses, but there are certain conditions and considerations to keep in mind. The specific circumstances surrounding the overdose will play a significant role in determining whether the life insurance policy will provide coverage.

Accidental or Intentional Overdose

One crucial factor is whether the overdose was accidental or intentional. If the overdose is ruled as accidental, most life insurance policies will provide coverage. However, if the overdose is deemed intentional or suicidal, the claim may be denied. This determination can be challenging, especially when illegal drugs are involved, as there is a presumption of risk associated with their use.

Timing of Death

The timing of the death in relation to the life insurance policy's issuance is also important. Many policies have a "contestability period," typically lasting two years from the policy's start date. During this period, insurance companies can challenge and deny claims if they discover any misrepresentations or fraud in the application process. After this period, claims are generally only denied for gross misrepresentation or explicit exclusions within the policy.

Exclusions and Clauses

Life insurance policies often contain specific exclusions and clauses that may impact coverage for illegal drug overdoses. For example, some policies may exclude coverage for any death resulting from an activity that could lead to a felony charge or substantially risk the insured's health and well-being. Additionally, suicide clauses are common in life insurance policies and may result in denied claims if the overdose is ruled as a suicide.

Role of Coroner and Investigations

In cases of illegal drug overdose, the determination of the coroner or medical examiner plays a crucial role. Insurance companies will review the coroner's report, police reports, and medical examiner reports to assess whether the death was accidental or intentional. They may also conduct their own private investigations.

Importance of Transparency

Transparency during the application process is vital. Misrepresenting or failing to disclose drug use or addiction issues can lead to denied claims, especially if the death occurs within the contestability period. It is essential to be honest about any substance use or related health issues to avoid issues with coverage.

Accidental Death Insurance

It is important to distinguish between life insurance and accidental death insurance. Accidental death insurance typically does not cover illegal drug overdoses and has more exclusions. These policies are designed to cover accidental deaths or severe injuries resulting from accidents and do not provide the same level of coverage as comprehensive life insurance policies.

In summary, while life insurance policies generally cover deaths from illegal drug overdoses, the specific circumstances of each case will determine the outcome. It is essential to carefully review the terms and conditions of the policy, understand the applicable laws, and seek legal advice if needed to navigate these complex situations.

Credit Union Life Insurance: What You Need to Know

You may want to see also

Overdose exclusions in insurance policies

Life insurance policies vary in their coverage of drug and alcohol overdoses. While some policies may cover overdoses as accidental deaths, others may exclude them, especially if the overdose is a result of illegal drug use or if the policy includes a suicide clause.

It is important to carefully review the specific terms and exclusions of a life insurance policy to understand what is covered and what is not. In general, life insurance policies cover deaths from natural causes, accidents, and suicide (after a certain period, typically the first two years of the policy). However, there are certain exclusions and circumstances under which the insurer may deny a claim.

One common exclusion is deaths resulting from drug overdoses, especially if the drugs are illegal or not prescribed to the deceased. Insurance companies may consider an overdose as a suicide attempt, which is often excluded from coverage. Additionally, if the insured died while engaging in illegal activity, such as drug use, the claim may be denied.

Another important factor is the timing of the death. If the death occurs during the contestability period, which is usually the first two years of the policy, the insurance company may investigate the circumstances and deny the claim if they believe the death was intentional. This period allows the insurance company to void coverage in cases of inaccurate information on the application or failure to disclose relevant information, such as risky behaviours or mental health issues.

In summary, while life insurance policies may cover accidental overdoses, it is crucial to carefully review the policy's exclusions and understand the specific circumstances of the overdose to determine if the claim will be covered.

Florida's Insurance Agent Licensing: Life and Health Exclusivity

You may want to see also

Filing an accidental death claim

Globe Life Insurance offers a $1* accidental death insurance policy that provides up to $250,000 in coverage for a covered accidental death or loss. This policy can help your family with the financial burden of medical bills, debt, mortgage payments, and final expenses. Acceptance is guaranteed, regardless of health, if you are between the ages of 18 and 69. There are no health questions or medical exams required for this policy.

To file an accidental death claim with Globe Life Insurance, you will need to submit the following documentation:

- Proofs of Death - Claimant Statement: This form must be completed in its entirety and as accurately as possible. You can find the printable claim form on the Globe Life Insurance website.

- Certified Death Certificate: The death certificate should indicate the cause or manner of death. If your benefit amount is $50,000 or less, a copy of the death certificate is allowed.

- Copy of Obituary (if available)

- Autopsy, toxicology, and police reports: These reports are required for accidental death claims and claims where the manner of death is homicide.

- Coroner's Report: A copy of the coroner's report is also required for accidental death claims and claims involving homicide.

Once you have gathered all the required documentation, you can submit your claim by mailing the completed forms and supporting documents to the following address:

Globe Life & Accident Life Claims Division

PO Box 8076

McKinney, TX 75070

If your policy is more than 2 years old and your benefit amount is $50,000 or less, you also have the option to email or fax the required information. The email address is [email protected], and the fax number is 405-270-1496.

It is important to note that Globe Life Insurance may have different definitions of "accidental death" compared to other insurance companies and state laws. Additionally, there may be nuances in coverage depending on whether the overdose was from a prescribed drug, an illegal drug, or alcohol. Therefore, it is always a good idea to carefully review your policy and understand the specific coverage and exclusions before filing a claim.

Fibromyalgia's Impact: Life Insurance Considerations and Challenges

You may want to see also

Frequently asked questions

Globe Life Insurance covers accidental death, but it is not clear whether this includes accidental overdoses. It is important to carefully review the coverage restrictions of your policy.

Accidental death and dismemberment insurance (AD&D) offers coverage for when the unexpected occurs, such as a life-altering injury or accidental death. AD&D policies can be purchased as stand-alone policies or as riders.

AD&D policies typically have lower benefit caps than traditional life insurance policies, making them a more affordable option. They also cover the insured in the event of dismemberment or other covered life-altering injuries.