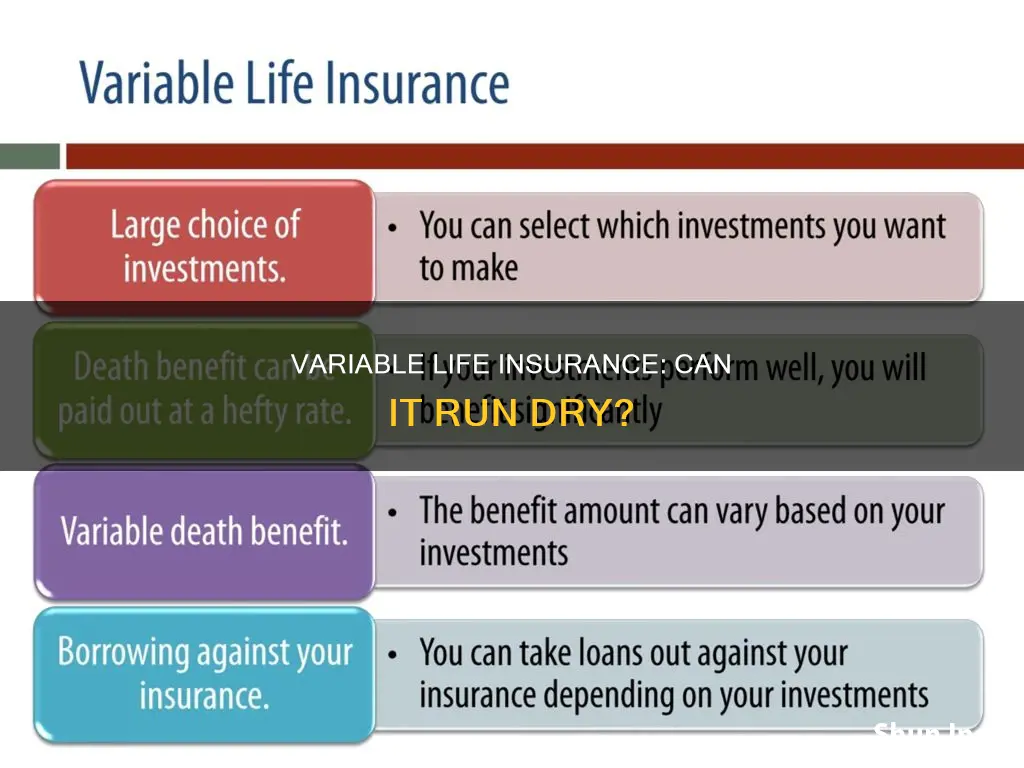

Variable life insurance is a type of permanent life insurance policy that combines a death benefit with a cash-value account. The cash value is invested in securities, typically mutual funds, and its performance determines the payout amount. While variable life insurance offers tax advantages and the potential for higher returns, it also carries more risk than standard life insurance policies. The major risk is that the cash value can decrease due to poor investment performance, which may cause the policy to lapse if the cash value drops too low.

| Characteristics | Values |

|---|---|

| Type of insurance policy | Permanent life insurance |

| Payout | Death benefit to beneficiaries |

| Investment component | Cash-value account |

| Risk | Higher than other policies |

| Tax advantages | Yes |

| Volatility | More volatile than standard life insurance policies |

| Premium | Variable |

| Investment options | Mutual funds, index funds, equities, bonds, money market funds, fixed-interest investment |

| Fees | Sales fees, surrender charge, mortality and expense (M&E) risk fees, administration fees, loan interest, transaction fees |

| Lapse | If cash value is insufficient to cover fees and expenses |

What You'll Learn

High fees and management costs

Variable life insurance policies have a range of fees and charges that can reduce the value of the policy and may require additional premium contributions to the policy to prevent termination. These fees and expenses include:

Sales Fees

A percentage of the premium amount that goes towards compensating the insurance company for sales expenses. These fees reduce the amount of the premium payment that is applied to the policy.

Surrender Charges

A fee applied if the policy is surrendered or a withdrawal is made in the early years of the contract. This compensates the insurance company for sales expenses that would otherwise not be covered in the event of early surrender. Surrender charges can be high, especially in the first 10 to 15 years of coverage, so it's important to check the length of the surrender charge period when evaluating a policy.

Mortality and Expense (M&E) Risk Fees

Ongoing fees that are a percentage of the account value, covering the risks assumed by the insurance company, such as the policy owner dying sooner than expected or administrative and sales costs being higher than expected.

Cost of Insurance

An ongoing fee that varies based on factors such as the insured person's age, gender, health, and death benefit amount. This compensates the insurance company for providing the death benefit.

Administration Fees

Ongoing fees that cover the insurance company's costs of issuing and administering the policy, such as processing claims, maintaining records, and communicating with the policyholder. These may be charged as a flat account maintenance fee or as a percentage of the account value.

Loan Interest

If a policy permits loans, interest will be charged on any outstanding loan amount.

Underlying Fund Expenses

The fees and expenses of the mutual funds that are the underlying investment options for the variable life insurance policy. These are in addition to the fees charged by the insurance company and are reflected in the performance of the investment options.

Fees for Optional Features

There are a number of additional features that can be added to a variable life insurance policy for an extra fee, such as no-lapse features, disability riders, accelerated death benefits, long-term care insurance, income benefits, additional term insurance, and accidental death benefits. It is important to carefully consider whether these features are necessary and to compare the cost of adding them to the policy versus purchasing them separately.

Variable life insurance policies also tend to have higher administrative fees than other types of life insurance policies because they are investments regulated by the U.S. Securities and Exchange Commission (SEC). These higher administrative fees, along with other costs such as sales and investment management fees, mean that variable life insurance policies typically have the highest fees of all permanent life insurance policies.

In addition to these fees, the financial performance of the investments chosen for a variable life insurance policy can also impact its value. The cash value of these policies can decrease in value during bad years and appreciate during good years, and most insurance companies put a cap on the rate of return. This means that even with careful management of the investment options, the earning potential of a variable life insurance policy will be limited compared to a regular investment.

Life Insurance: Child Coverage and Your Options

You may want to see also

Poor investment performance

Variable life insurance is a type of permanent life insurance policy that combines a death benefit with a cash-value account. The cash-value account is typically invested in mutual funds, but it can also be invested in index funds, equities, bonds, or money market funds. The value of the cash-value account can increase or decrease depending on the performance of the investments.

When the cash value of a variable life insurance policy decreases due to poor investment performance, the policyholder may need to pay additional premiums to maintain the policy. If the policyholder cannot afford to pay the additional premiums, the policy may lapse and terminate. This means that the policy will no longer be in effect, and the beneficiary will not receive any death benefit.

Additionally, poor investment performance can impact the loan interest charged on policy loans. Policy loans are typically available to policyholders who have accumulated cash value in their policies. The loan interest rate is usually based on the performance of the investments. If the investments perform poorly, the loan interest rate may increase, making it more difficult for the policyholder to repay the loan.

In summary, poor investment performance can cause a variable life insurance policy to run out of money by decreasing the cash value of the policy, increasing policy fees and expenses, and affecting loan interest rates. It is important for policyholders to carefully consider the investment options and potential risks associated with variable life insurance policies to avoid running out of money.

Life Mortgage Insurance: Disability Coverage?

You may want to see also

Risk of losing money

Variable life insurance is a permanent life insurance policy with an investment component. The policy has a cash-value account with money that is invested, typically in mutual funds. As the policyholder, you can choose how that money is invested.

Because the cash value component of variable life insurance is invested in assets, it may rise or fall in value. This means that these policies carry more risk compared to other life insurance policies. There is no guaranteed rate of return, and you could lose money, including your initial investment.

The performance of your investments will determine the value of your policy's cash value. If your investments perform poorly, your cash value will decrease. This could lead to a policy lapse if the cash value drops too low, leaving you uninsured.

Variable life insurance policies also tend to have higher fees and management costs than other types of permanent life insurance. These fees can include mortality and expense (M&E) risk fees, administration fees, underlying fund expenses, and transaction fees. If you take out a loan against your cash value, you will also have to pay interest.

Overall, the risk of losing money in a variable life insurance policy is relatively high compared to other types of life insurance. Poor investment performance can reduce your cash value, which can cause your policy to lapse if its value drops too low. The fees and costs associated with these policies can also be significant, further increasing the risk of losing money.

Life Insurance Cash Value: Does It Keep Growing?

You may want to see also

Lapsing policies

A lapsed life insurance policy is when you stop paying the premiums and, as a result, lose your coverage. This means that your beneficiaries won't receive any life insurance money when you die. However, missing a payment won't automatically result in a policy lapse. All life insurance companies have a grace period, usually around 30 days, during which your policy will remain in force if you need to make a late payment. You need to resume payments before the grace period ends to avoid a gap in coverage.

There are several common reasons for a life insurance policy to lapse. One is that people buy more coverage than they can afford. Another is that they forget to update their address or banking details with their insurance company, resulting in missed payments.

If your policy has lapsed, you can usually reinstate it within two years of the lapse. Contact your insurer to find out their specific guidelines for reinstatement. You will likely need to provide evidence of insurability, pay back missed premiums (plus late fees or interest), and restart your contestability period.

To avoid a life insurance policy lapse, you can take several steps:

- Enroll in automated premium payments.

- Switch to an annual payment schedule.

- Add a waiver of premium rider to your policy, which exempts you from paying premiums if you become disabled.

- Lower your coverage amount.

Life Insurance: Childbirth Death Coverage Explained

You may want to see also

Tax implications

Variable life insurance is a permanent life insurance product with investment risks. It is considered a securities contract and is regulated under federal securities laws. Variable life insurance policies have specific tax benefits, but the federal tax rules that apply can be complicated.

Variable life insurance policies offer the benefit of tax-deferred accumulation of earnings. Policyholders can access the cash value via a tax-free loan, provided the policy remains in force. However, unpaid loans, including principal and interest, will reduce the death benefit. Additionally, interest or earnings included in partial and full surrenders of the policy are taxable at the time of distribution.

Upon surrender of the policy, loan interest may become taxable. If the policy terminates with an outstanding loan, the policyholder may owe federal income taxes on the loan.

The death benefit paid to beneficiaries is generally not subject to federal income tax. Under certain circumstances, it may also be exempt from federal estate tax.

Variable life insurance policies are not suitable as a short-term savings vehicle due to substantial fees, expenses, and tax implications. The fees and expenses associated with the policy may be significant, and failure to pay them could result in policy termination.

It is important to consult a tax adviser about the tax consequences of investing in variable life insurance, as there may also be state tax implications.

Zurich Life Insurance: Does Suicide Get Covered?

You may want to see also

Frequently asked questions

Variable life insurance is a permanent life insurance policy with an investment component. The policy has a cash-value account with money that is invested, typically in mutual funds. The cash value can be invested in several ways, but the most common way is to invest in mutual funds.

Variable life insurance has a few benefits that make it a good option for certain people. One of the biggest advantages of a variable life policy is the investment component. Compared to some other types of life insurance, you have a much wider range of funds for investing your cash value. You have total control over your investments, and you can also allocate money to different funds, based on your risk tolerance and financial goals.

Despite the benefits of variable life insurance, there are several major downsides to this type of policy. Variable life insurance policies often have higher fees and management costs than other kinds of permanent life insurance. For example, you might have to pay ongoing mortality and expense (M&E) risk fees, administration fees, underlying fund expenses, and transaction fees. Another risk of variable life insurance is that poor investment performance will reduce your cash value, which can cause your policy to lapse if its cash value total drops too low.

Term life insurance, whole life insurance, universal life insurance, guaranteed life insurance, and final expense insurance are all alternatives to variable life insurance.