Life insurance is a way to protect your loved ones from financial strain in the event of your death. Permanent life insurance policies, such as whole life, universal life, or variable universal life, cover you for your entire lifetime and feature a cash value account. Term life insurance, on the other hand, covers you for a specified number of years and does not feature a cash account.

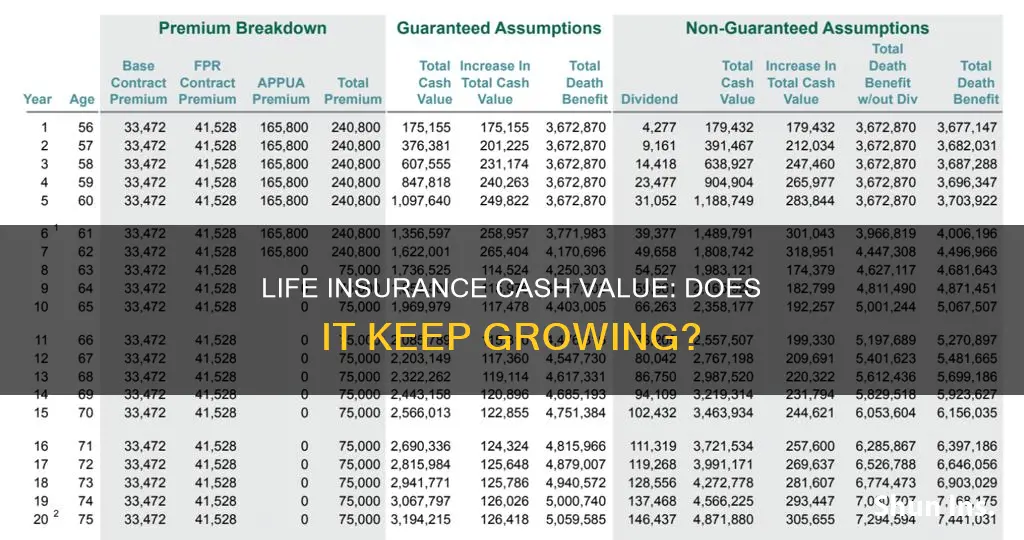

Cash value life insurance policies provide lifelong coverage combined with an investment account. A portion of your premiums is directed to the investment account, which is called the cash value, and this money grows with interest over time. The cash value of life insurance earns interest, and taxes are deferred on the accumulated earnings. As the cash value increases, the insurance company's risk decreases as the accumulated cash value offsets part of the insurer's liability.

There are several ways to access the cash value of your life insurance policy while you are still alive. You can borrow against the cash value, withdraw money from it, or use it to pay your life insurance premiums. However, it is important to note that if you withdraw more than you have paid into the cash value, that portion may be taxed as ordinary income. Additionally, any loans or withdrawals will reduce the death benefit, and if you withdraw everything, the policy will terminate.

| Characteristics | Values |

|---|---|

| Definition | Paid-up life insurance is a permanent life insurance policy where the cash value is large enough that you can stop paying premiums out of pocket. |

| Types | Whole life insurance, universal life insurance, variable universal life insurance |

| Cash Value | The cash value of a paid-up life insurance policy can be used to pay premiums, take out a loan against the policy, or partially/fully withdraw money from the policy. |

| Taxation | Withdrawing money from a paid-up life insurance policy is tax-advantaged as withdrawals up to the amount of money you've paid into the policy are not taxed. |

| Considerations | Before cashing in a paid-up life insurance policy, policyholders should consider their death benefit needs and the tax considerations of cashing in the policy. |

What You'll Learn

Paid-up additions can increase the cash value of a whole life insurance policy

Paid-up life insurance is a state or condition where your coverage is paid-in-full, and you do not need to make any additional premium payments to maintain the policy. This is usually only available with whole life policies.

Paid-up additions (PUAs) are available in whole-life insurance policies, allowing policyholders to use dividends to purchase additional coverage. These additional coverage increments are fully paid for and add immediate value to the death benefit and the policy's cash value.

Immediate Increase in Cash Value and Death Benefit

Each PUA immediately increases the policy’s cash value and death benefit upon purchase. The increase in cash value provides more funds that accumulate interest or dividends, compounding the policy's growth over time.

Compounding Growth

The cash value of PUAs earns interest or additional dividends, further enhancing the policy’s financial strength. This compounding effect can significantly increase the policy's financial benefits over the long term.

Flexibility for the Policyholder

The additional cash value added by PUAs provides greater liquidity for the policyholder. This cash can be accessed through loans or withdrawals, subject to the terms of the policy. It offers a financial resource that can be used in times of need or to capitalize on investment opportunities.

Enhanced Permanent Coverage

With each dividend reinvestment into PUAs, the permanent death benefit of the policy grows. This enhanced coverage continues to grow throughout the policy's life without requiring additional out-of-pocket premiums, making it an effective tool for increasing legacy wealth.

Optional Participation

Purchasing PUAs is optional. Policyholders can choose other dividend options, such as receiving them in cash, using them to reduce premiums, or leaving them to accumulate interest.

Pros of PUAs

- Increased cash value

- Enhanced death benefit

- Compounded growth

- Premium flexibility

- Policy loan options

- Customization and control

- Long-term security

- Non-forfeiture benefit

Cons of PUAs

- Complexity of management

- Dependence on dividend performance

- Potential for reduced liquidity

- Opportunity costs

- Impact on policy loans

- Initial lower returns

Cancer Diagnosis: Life Insurance Premiums, What to Expect?

You may want to see also

Cash value can be used to pay premiums

Cash value life insurance policies allow you to use the cash value to pay your premiums. This can be particularly helpful if you're struggling to make payments, as it could provide some relief and help you keep the life insurance in force.

However, it's important to note that the cash value of your policy may take several years to build up. In most cases, it doesn't accrue for two to five years, and even after that, the cash value accumulation slows down as you get older. As you age, more of your premium payments are applied to the cost of insurance, rather than the cash value.

If you're considering using the cash value to pay your premiums, be sure to speak with your insurance agent to understand the rules and potential impact on your policy. Additionally, keep in mind that the cash value of your life insurance policy is intended to be a tool to protect your loved ones from financial strain in the event of your death. By using the cash value to pay premiums, you may be reducing the death benefit that your beneficiaries will receive.

Before making any decisions, it's always recommended to consult with a trusted financial professional to fully understand your options and the potential consequences.

Depression and Life Insurance: Does Diagnosis Impact Coverage?

You may want to see also

Cash value can be withdrawn or borrowed against

Cash value life insurance policies allow you to withdraw or borrow against the cash value that has built up in your policy. This can be done in several ways, each with its own pros and cons.

Withdrawing Money from the Policy

You can make a partial or full withdrawal from the cash value of your life insurance policy. This option provides you with cash while you are still alive and can be useful if you have fewer financial obligations that you are worried about covering after your death. However, withdrawing money from your policy will reduce the death benefit for your beneficiaries. If you withdraw more money than you have paid into the policy, you may also have to pay taxes on the withdrawal.

Taking Out a Loan Against the Policy

You can borrow against the cash value of your life insurance policy and use the money for anything you need. The loan typically comes with a low-interest rate and there are no underwriting requirements or credit checks. However, you will owe interest on the loan for each year that it is outstanding, and if you pass away before the loan is repaid, the value of the loan will be deducted from the death benefit paid to your beneficiaries.

Using the Cash Value to Pay Premiums

If you have built up enough cash value in your policy, you may be able to use it to pay your life insurance premiums. This can provide some relief if you are struggling to make payments and help you keep the policy in force. However, you will need to carefully monitor the cash value to ensure it doesn't drop too far, or you may lose your coverage.

Surrendering the Policy for Cash

If you no longer need your life insurance policy, you can surrender it to the insurer and receive the net cash value, minus any surrender charges and unpaid premiums or outstanding loan balances. This option provides you with a lump sum of cash, but it is important to consider the tax implications and the fact that your beneficiaries will no longer receive the death benefit.

Life Insurance and Mental Illness: What's Covered?

You may want to see also

Cash value is separate from the death benefit

Cash value is a component of some types of life insurance. It is a feature that is typically offered within permanent life insurance policies, such as whole life and universal life insurance. Term life insurance, on the other hand, does not have a cash value component.

The death benefit is a tax-free payout to your beneficiaries when you pass away. Cash value, on the other hand, can be withdrawn or borrowed from the policy while you are alive. However, taking out cash value reduces the future death benefit for your beneficiaries.

Any unused cash value is forfeited to the insurer when you pass away, though some policies let you add it to the death benefit for an extra fee. This is known as a paid-up additional insurance rider, which allows the death benefit to increase alongside the cash value. This rider is not widely available, so you need to check with your insurer if you have access to this option.

While you are alive, you can borrow against the cash value or withdraw money. You can also use the cash value to pay your premiums. However, you have to wait until the cash account has accumulated enough value, which can take decades.

All of this comes at a cost. If you borrow from the cash value, you have to pay interest if you repay the loan. If you decide not to repay the loan and take the money as a withdrawal, the amount, plus interest, will be deducted from the death benefit. In some cases, more than the withdrawal amount plus interest is deducted, which could wipe out the death benefit.

Any outstanding loans at the time of your death will reduce the death benefit for your beneficiaries. Also, any non-loan withdrawals will get taxed at your ordinary-income tax rate.

Country Life Insurance: Accident Forgiveness and You

You may want to see also

Cash value can be used to buy paid-up additions

Cash value is a component of some types of life insurance, typically offered within permanent life insurance policies such as whole life and universal life insurance. It is a feature that allows you to access the cash value of your policy while you are still alive.

Paid-up additional insurance is an optional extra that can be added to a whole life insurance policy through a rider. Paid-up additional insurance allows policyholders to purchase small chunks of whole life insurance, known as paid-up additions (PUAs), using the dividends from their whole life policy. Each paid-up addition has its own death benefit and cash value and also earns dividends. This makes paid-up additional insurance an effective way to increase the overall death benefit and cash value of a whole life insurance policy over time, without increasing the premium payment or requiring additional medical underwriting.

When you purchase a paid-up additional insurance rider, you are given the option to buy additional paid-up insurance on top of your existing whole life insurance policy. This increases the policy's cash value accumulation. Every dollar of premium that is allocated to the paid-up additions rider creates a small paid-up insurance policy with its own cash value that is created instantly. Whole life insurance policies that have a significant portion of premiums allocated to paid-up additions will generally perform better than those that do not.

Paid-up additions can be a powerful tool for accumulating wealth and are particularly useful for those seeking to create a life insurance retirement plan (LIRP) to avoid taxes on retirement income. They are also a good option for those who want to tap into their life insurance money while they are still alive.

Life Insurance and SSI Disability: How Does OPM Affect You?

You may want to see also

Frequently asked questions

Cash value life insurance is a permanent life insurance policy that features a cash value savings component. This means that the policyholder can use the cash value for many purposes, including borrowing or withdrawing cash from it, or using it to pay policy premiums.

Cash value life insurance provides lifelong coverage combined with an investment account. Whole life, universal life and variable life policies are all types of cash value life insurance. A portion of your premiums is directed to the investment account, which is called the cash value, and this money grows with interest over time.

Cash value life insurance offers tax advantages. Your cash value accumulates on a tax-deferred basis, so as your cash value grows, the IRS doesn't take a cut. Also, if you borrow money against the policy, you won't have to pay taxes on the loan.

Cash value life insurance costs more than term life insurance. If you don't need insurance for your whole life and you don't care about building cash value, term life insurance will give you the most coverage for your money.