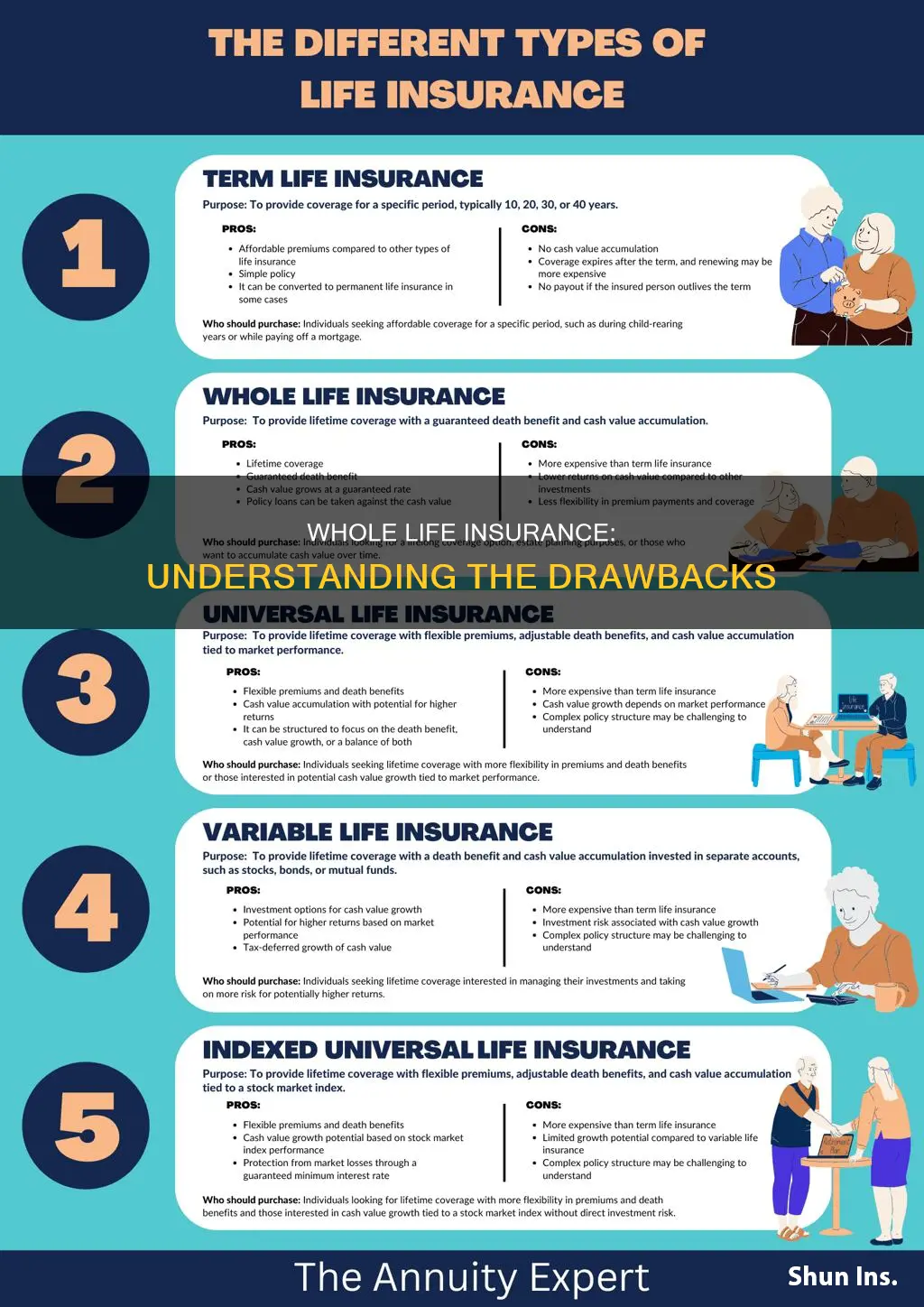

Whole life insurance, while offering lifelong coverage and a guaranteed death benefit, comes with several potential drawbacks. One significant disadvantage is its cost; whole life insurance policies can be expensive, especially for older individuals or those with health issues, as premiums tend to increase over time. Additionally, the cash value accumulation in whole life policies, which can be borrowed against or withdrawn, may be subject to taxes and penalties if not managed properly. Another drawback is the lack of flexibility; once a policy is in place, it is difficult to adjust coverage or terms without incurring additional fees. Lastly, the investment component of whole life insurance, which is designed to grow over time, may not keep pace with market returns, potentially resulting in lower returns compared to other investment vehicles.

What You'll Learn

- High Premiums: Whole life insurance can be expensive, especially for older individuals, due to its lifelong coverage

- Limited Flexibility: The fixed premiums and cash value accumulation may not suit those seeking more adaptable policies

- Slower Growth: The investment component of whole life may offer slower returns compared to other investment vehicles

- Complexity: Understanding the policy's intricacies and long-term implications can be challenging for some policyholders

- Limited Access: Withdrawing funds or changing the policy might be restricted, making it less flexible than term life

High Premiums: Whole life insurance can be expensive, especially for older individuals, due to its lifelong coverage

Whole life insurance, while offering lifelong coverage and a range of benefits, can be a costly financial commitment, particularly for older individuals. One of the primary disadvantages of this type of insurance is the high premium associated with it. As with any insurance product, the premium is the amount you pay regularly to maintain your policy. For whole life insurance, these premiums can be significantly higher compared to other insurance types, especially as you age.

The reason for this lies in the nature of whole life insurance. It provides permanent coverage, meaning the policy remains in force for the entire life of the insured individual. This lifelong commitment requires the insurance company to account for long-term risks, which often results in higher costs. Additionally, as you age, the likelihood of developing health issues increases, and insurance companies adjust their rates accordingly to reflect these higher risks.

For older individuals, the financial burden of high premiums can be substantial. It may require careful budgeting and financial planning to accommodate this regular expense. Moreover, the cost of whole life insurance can be a significant factor when comparing it to other insurance options, such as term life insurance, which typically offers coverage for a specified period and may be more affordable for younger individuals.

Despite the higher premiums, it's essential to consider the long-term benefits and security that whole life insurance provides. This type of policy builds cash value over time, which can be borrowed against or withdrawn, offering financial flexibility. However, the trade-off is the immediate financial outlay, which can be a significant disadvantage for those seeking more affordable insurance solutions.

In summary, while whole life insurance offers lifelong coverage and valuable features, its high premiums can be a significant disadvantage, especially for older individuals. It is a long-term financial commitment that requires careful consideration and planning to ensure it aligns with one's financial goals and capabilities.

Lupus and Life Insurance: What You Need to Know

You may want to see also

Limited Flexibility: The fixed premiums and cash value accumulation may not suit those seeking more adaptable policies

Whole life insurance, while offering lifelong coverage and a guaranteed death benefit, has certain limitations that may not align with everyone's financial and insurance needs. One of the primary disadvantages is the Limited Flexibility it presents, especially when compared to other insurance products. This lack of flexibility stems from the fixed nature of whole life insurance premiums and the structured accumulation of cash value.

In whole life insurance, the premium payments are set for the entire term of the policy, typically for the entire life of the insured individual. This means that once the policy is in force, the premium cannot be adjusted upwards or downwards, even if the insured's health or financial situation changes. For instance, if an individual's health improves significantly over time, they may feel that a lower premium would be more appropriate, but this option is not available with whole life insurance. This fixed premium structure can be a drawback for those who prefer policies that are more responsive to their evolving circumstances.

Additionally, the cash value component of whole life insurance, which accumulates over time, is another aspect that may limit the policy's adaptability. The cash value is the portion of the premium that is invested and grows over the life of the policy. While this can provide a financial benefit, it also means that the policy's value is tied to the performance of the investment market. If the investment returns are lower than expected, the cash value growth may be slower, and the policyholder might not have the flexibility to access this value in a way that suits their immediate needs. For instance, some insurance policies offer policy loans or withdrawals, allowing policyholders to access their cash value without surrendering the policy, but these options are not universally available and may have restrictions.

For individuals who prioritize financial flexibility and the ability to adapt their insurance policies to changing life events, whole life insurance's lack of flexibility can be a significant consideration. Those who may benefit from more adaptable policies include young professionals who might want to adjust their coverage as their career and financial situation evolve, or individuals who prefer the option to increase or decrease their coverage based on their life's milestones, such as marriage, the birth of children, or significant financial achievements. In these cases, term life insurance or adjustable-rate policies might be more suitable, as they offer more flexibility in terms of premium adjustments and coverage changes.

In summary, while whole life insurance provides a stable and secure form of coverage, its fixed premiums and the structured accumulation of cash value can be seen as a disadvantage for those seeking policies that are more adaptable to their changing needs and circumstances. Understanding these limitations is essential for individuals to make informed decisions when choosing the right insurance product for their specific requirements.

Life Without Insurance: A Risky Gamble

You may want to see also

Slower Growth: The investment component of whole life may offer slower returns compared to other investment vehicles

The investment component of whole life insurance, while a key feature, can present a significant disadvantage in terms of growth potential. Unlike other investment options, whole life insurance's investment aspect is designed with a long-term, secure approach, which often results in slower returns. This is primarily due to the insurance company's conservative investment strategies, which prioritize capital preservation and long-term stability over rapid growth.

The investment portion of whole life insurance is typically tied to the performance of a separate account or an investment fund. These funds are managed by the insurance company and are designed to provide a steady, reliable return over time. While this approach ensures a level of security, it often means that investors in whole life insurance may not experience the same level of rapid growth as they would with more aggressive investment vehicles.

One of the main reasons for this slower growth is the insurance company's risk management policies. They are required to maintain a certain level of liquidity and security, which often limits the types of investments they can make. As a result, the investment portfolio may not include high-risk, high-reward assets that could potentially yield faster returns. This conservative approach can be a significant drawback for investors seeking higher growth potential.

Additionally, the investment returns from whole life insurance are often guaranteed, which means they are typically lower than the potential returns from other investment options. This is because the insurance company must ensure that the policyholder's premiums are sufficient to cover the death benefit and other associated costs. As a result, the investment returns may not keep pace with inflation or other market benchmarks, leading to a slower accumulation of wealth.

In summary, while whole life insurance offers the security of a death benefit and a guaranteed investment component, the slower growth potential can be a significant disadvantage for those seeking higher returns. Investors should carefully consider their financial goals and risk tolerance before choosing whole life insurance, especially if they are looking for more aggressive investment opportunities.

Life Insurance: Norfolk Southern's Employee Benefits Explored

You may want to see also

Complexity: Understanding the policy's intricacies and long-term implications can be challenging for some policyholders

The complexity of whole life insurance policies can indeed be a significant disadvantage for some individuals, especially those who are not well-versed in financial matters. These policies are designed to provide lifelong coverage, offering both death benefit and an accumulation of cash value over time. While this can be a valuable financial tool, the intricacies of the policy can be daunting for the average consumer.

One of the main challenges lies in understanding the long-term implications. Whole life insurance is a long-term commitment, often spanning several decades. Policyholders must consider the potential changes in their financial situation, health, and personal circumstances over this extended period. For instance, an individual's health may deteriorate, affecting their ability to maintain the policy, or their financial goals might shift, requiring adjustments to the policy's coverage. Navigating these changes requires a deep understanding of the policy's terms and conditions, which can be complex and often requires professional advice.

Additionally, the investment component of whole life insurance can be intricate. The cash value portion of the policy grows over time, earning interest, and can be borrowed against or withdrawn. However, the investment strategies and associated risks are not always transparent, and policyholders might struggle to comprehend the potential returns and associated fees. This lack of clarity can lead to poor decision-making, such as prematurely accessing the cash value, which may result in penalties or reduced coverage.

Furthermore, the policy's complexity can make it difficult for individuals to assess the overall cost-effectiveness of the insurance. Whole life insurance premiums are typically higher than term life insurance due to the guaranteed death benefit and cash value accumulation. However, understanding the trade-off between the higher premiums and the long-term financial security can be challenging. Policyholders must carefully evaluate their financial situation and goals to determine if the higher costs are justified, especially when compared to other insurance or investment options.

In summary, the complexity of whole life insurance policies can be a significant disadvantage, making it challenging for some individuals to fully comprehend the long-term implications, investment strategies, and overall cost-effectiveness. It is essential for policyholders to seek professional guidance and carefully review the policy's terms to ensure they make informed decisions regarding their financial well-being.

Life Insurance: Epidemic Coverage and Your Policy

You may want to see also

Limited Access: Withdrawing funds or changing the policy might be restricted, making it less flexible than term life

Whole life insurance, while offering long-term financial security, does come with certain drawbacks that potential policyholders should be aware of. One significant disadvantage is the limited flexibility it provides compared to other insurance types, particularly term life insurance.

When it comes to policy adjustments, whole life insurance can be quite restrictive. Policyholders may face challenges when attempting to withdraw funds or make changes to their coverage. This is primarily because whole life insurance policies are designed to provide lifelong coverage, and any modifications can be complex and may require the approval of the insurance company. The process of withdrawing funds, for instance, might involve penalties or fees, and it may not be as straightforward as in other insurance types. This lack of flexibility can be a significant drawback for individuals who prefer the adaptability of term life insurance, which allows for easier adjustments and policy cancellations without penalties.

The restricted nature of whole life insurance policies can make it less suitable for those who anticipate future changes in their financial situation or life circumstances. For example, individuals who may want to adjust their coverage based on their career progression, marriage, or the birth of children might find it challenging to do so with a whole life policy. The rigid structure of whole life insurance can limit the ability to adapt to life's unpredictable events, making it a less versatile choice compared to term life insurance.

In contrast, term life insurance offers a more flexible approach. Policyholders can easily adjust their coverage or cancel the policy without incurring penalties, providing a sense of financial freedom and adaptability. This flexibility is particularly beneficial for individuals who want to ensure their insurance coverage aligns with their current life stage and financial goals.

In summary, the limited access and restricted flexibility associated with whole life insurance can be a significant disadvantage for those seeking a more adaptable insurance solution. Understanding these limitations is essential for individuals to make informed decisions when choosing between different insurance options, ensuring they select the policy that best suits their needs and preferences.

Maximizing Life's Benefits: Understanding the Best Insurance Terms

You may want to see also

Frequently asked questions

While whole life insurance offers lifelong coverage and a guaranteed death benefit, it also has some disadvantages. One of the main drawbacks is the cost; whole life insurance policies can be expensive, especially for older individuals or those with pre-existing health conditions. The premiums are typically higher compared to term life insurance, and they remain fixed for the entire policy term. Additionally, the cash value accumulation in whole life insurance can be slow, and it may take several years or even decades to build a significant amount of cash value.

Yes, whole life insurance policies can be quite complex and may require a thorough understanding of the terms and conditions. These policies often involve various features and riders that can significantly impact the overall cost and benefits. For instance, some policies offer an investment component, allowing policyholders to invest a portion of their premiums in an investment account. However, this can make the policy more complicated, and the investment performance is not guaranteed. It's essential for buyers to carefully review and understand all the policy details to ensure they are making an informed decision.

One of the disadvantages of whole life insurance is the lack of flexibility in terms of policy adjustments. Once a policy is in force, changing the coverage amount or modifying the policy terms can be challenging and may require a medical examination. If the policyholder's circumstances change, such as a significant improvement or deterioration in health, they might want to adjust the policy accordingly. However, making these changes can be costly and may not be readily available, especially if the policy is considered a 'no-lapse' policy, designed to ensure the death benefit is always paid.