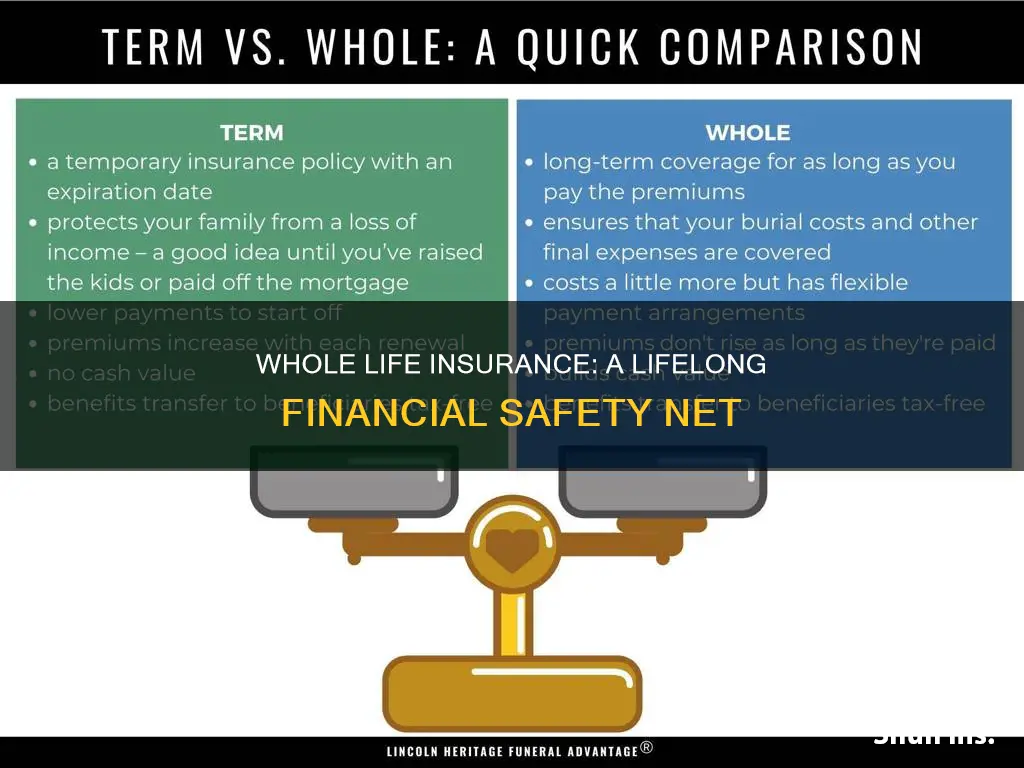

Whole life insurance offers a range of benefits that make it an attractive financial tool for individuals and families. One of its key advantages is the guaranteed payout upon the insured's death, providing financial security to beneficiaries. Unlike term life insurance, whole life insurance offers lifelong coverage, ensuring that the policy remains in force as long as the premiums are paid. This long-term commitment allows for the accumulation of cash value over time, which can be borrowed against or withdrawn, providing financial flexibility. Additionally, whole life insurance offers a fixed interest rate, ensuring that the policy's value and death benefit grow at a predictable rate. This type of insurance also provides income replacement for the insured's family, helping to maintain their standard of living in the event of the insured's death.

What You'll Learn

- Long-term financial security: Provides coverage for a lifetime, ensuring financial protection for beneficiaries

- Accumulates cash value: Builds a cash reserve, offering potential investment opportunities and loan access

- Tax advantages: May offer tax benefits, including deductions and tax-free growth of cash value

- Fixed premiums: Offers consistent premium payments, providing budget stability over time

- Legacy planning: Helps create a financial legacy, passing on wealth to heirs or charitable causes

Long-term financial security: Provides coverage for a lifetime, ensuring financial protection for beneficiaries

Whole life insurance is a powerful financial tool that offers long-term security and peace of mind to individuals and their loved ones. One of its primary benefits is the provision of coverage for a lifetime, ensuring that financial protection extends far beyond the initial investment period. This type of insurance is designed to provide a steady and reliable income stream for beneficiaries, offering a sense of security that is often lacking in other forms of insurance.

The concept of long-term financial security is at the heart of whole life insurance. Unlike term life insurance, which provides coverage for a specified period, whole life insurance offers permanent coverage. This means that once the policy is in force, the insurance company guarantees a death benefit to the policyholder's beneficiaries, regardless of the future. This is particularly valuable as it ensures that the financial needs of the family or dependents are met even if the primary earner passes away.

The coverage provided by whole life insurance is comprehensive and adaptable. It includes a death benefit, which is a fixed amount paid out upon the insured's death. Additionally, whole life policies accumulate cash value over time, which can be borrowed against or withdrawn, providing an additional layer of financial security. This cash value growth is a unique feature, allowing policyholders to build a substantial financial asset that can be used for various purposes, such as funding education, starting a business, or providing a retirement nest egg.

For beneficiaries, the financial protection offered by whole life insurance is invaluable. It ensures that they are not left with the burden of unexpected expenses or the stress of financial instability in the event of the insured's passing. The guaranteed death benefit provides a stable source of income, allowing beneficiaries to maintain their standard of living and achieve their financial goals without the worry of insufficient funds.

In summary, whole life insurance provides a robust solution for long-term financial security. Its lifetime coverage and the associated cash value accumulation make it an excellent choice for individuals seeking to protect their loved ones and build a financial safety net. By understanding the benefits of whole life insurance, individuals can make informed decisions to secure their financial future and provide lasting peace of mind.

Life Insurance Proceeds and Maryland's Inheritance Tax Laws

You may want to see also

Accumulates cash value: Builds a cash reserve, offering potential investment opportunities and loan access

Whole life insurance is a type of permanent life insurance that offers a range of benefits, one of which is the ability to accumulate cash value over time. This feature is particularly advantageous for individuals seeking long-term financial security and growth. Here's a detailed explanation of how this works and its benefits:

When you purchase a whole life insurance policy, a portion of your premium payments goes towards building a cash reserve. This reserve is essentially a savings account within the insurance policy. Over time, as you make regular payments, the policy's cash value grows. This growth is primarily due to the investment of the premiums by the insurance company. The company typically invests the funds in a diversified portfolio of assets, which can include stocks, bonds, and other securities. As these investments mature and grow, so does the cash value of your policy.

The accumulated cash value can be a valuable asset for several reasons. Firstly, it provides a financial safety net. If you ever need immediate funds, you can borrow against the cash value of your policy through a policy loan. This allows you to access the money without having to surrender the policy or withdraw from other savings. Policy loans typically have favorable interest rates, making it an affordable way to borrow. Additionally, the interest you pay on the loan goes back into the policy, further growing the cash reserve.

Moreover, the cash value can be a powerful tool for long-term financial planning. You have the option to invest this accumulated wealth in various investment options offered by the insurance company. These may include mutual funds, stocks, or other investment vehicles. By diversifying your investments, you can potentially earn higher returns over time, which can be used to build a substantial financial portfolio. This aspect of whole life insurance provides a unique opportunity to grow your money while also having the security of life coverage.

In summary, the ability of whole life insurance to accumulate cash value is a significant advantage. It allows policyholders to build a financial reserve, providing access to loans and potential investment opportunities. This feature ensures that your insurance policy not only offers protection but also contributes to your overall financial well-being and growth. Understanding the mechanics of cash value accumulation can help individuals make informed decisions about their insurance and investment strategies.

Whole Life Insurance: Is It Worth the Investment?

You may want to see also

Tax advantages: May offer tax benefits, including deductions and tax-free growth of cash value

Whole life insurance offers several advantages, and one of the key benefits is the potential for tax advantages. When it comes to tax benefits, whole life insurance can provide a significant advantage to policyholders. One of the primary tax benefits is the ability to deduct the premiums paid for whole life insurance. This means that the amount you pay in premiums can be subtracted from your taxable income, reducing your overall tax liability. This deduction can be particularly valuable for individuals and families who are looking to optimize their tax situation and keep more of their hard-earned money.

In addition to deductions, whole life insurance also offers tax-free growth of cash value. As the policy accumulates cash value over time, this value can grow tax-free. Unlike some other investment vehicles, where gains and interest are subject to taxes, the cash value in a whole life insurance policy can accumulate without incurring any tax obligations. This tax-free growth can be a significant advantage, especially for long-term savings and investment goals. Policyholders can benefit from compound interest and the power of compounding, allowing their money to grow exponentially over the years.

The tax advantages of whole life insurance are particularly appealing for long-term financial planning. As the policyholder, you can build a substantial cash value reserve, which can be used for various purposes. This includes funding education expenses, starting a business, or providing financial security for retirement. The tax-free nature of the cash value growth ensures that your savings remain intact and can be utilized when needed without incurring additional tax costs.

Furthermore, the tax benefits of whole life insurance can be especially advantageous for high-income earners or those in higher tax brackets. By deducting premiums and benefiting from tax-free growth, individuals in these categories can optimize their financial planning and potentially reduce their tax burden significantly. It provides a structured approach to saving and investing, allowing individuals to build a substantial financial safety net while also enjoying the tax advantages associated with whole life insurance.

In summary, whole life insurance offers valuable tax advantages, including the ability to deduct premiums and the tax-free growth of cash value. These benefits can provide individuals with a powerful tool for financial planning, allowing them to optimize their tax situation, build long-term savings, and secure their financial future. Understanding these tax advantages can be a crucial factor in making informed decisions about insurance and investment strategies.

Income Provider Option: Life Insurance's Financial Safety Net

You may want to see also

Fixed premiums: Offers consistent premium payments, providing budget stability over time

Whole life insurance is a type of permanent life insurance that offers a range of benefits, one of which is the stability and predictability of fixed premiums. When you purchase a whole life insurance policy, you agree to pay a set amount of premium for the duration of the policy. This fixed premium payment structure is a significant advantage for several reasons.

Firstly, it provides financial planning and budget stability. With a whole life insurance policy, you know exactly how much you will pay each year, month, or even week, depending on the payment frequency. This predictability allows you to factor the insurance cost into your long-term financial planning. You can allocate your income more effectively, ensuring that your insurance premiums are covered without causing financial strain or disrupting your budget for other essential expenses. This is particularly beneficial for individuals and families who rely on consistent financial planning to secure their future.

The consistency of fixed premiums is especially advantageous for long-term financial goals. For example, if you are saving for your child's education or planning for retirement, knowing the exact insurance cost can help you allocate funds accordingly. You can set aside the required amount each month or year without worrying about sudden increases in premiums, which could impact your savings or investment plans. This predictability encourages individuals to stay committed to their financial goals and provides a sense of security.

Moreover, fixed premiums in whole life insurance can be an attractive feature for those seeking financial stability and control. Unlike some other insurance types, where premiums may increase over time based on various factors, whole life insurance offers a consistent and unchanging premium. This means that your insurance coverage remains at the agreed-upon level, providing a reliable safety net for your loved ones. The fixed nature of the premiums allows you to plan and manage your finances with greater confidence, knowing that your insurance costs will not unexpectedly rise.

In summary, the fixed premium structure of whole life insurance is a valuable benefit that contributes to financial stability and peace of mind. It enables individuals to budget effectively, plan for the long term, and maintain consistent insurance coverage without the worry of premium fluctuations. This predictability is a key advantage of whole life insurance, making it an attractive option for those seeking reliable and stable financial protection.

Smoker's Life Insurance: Affordable Coverage After Quitting

You may want to see also

Legacy planning: Helps create a financial legacy, passing on wealth to heirs or charitable causes

Legacy planning is an essential aspect of financial strategy, especially when considering the long-term impact of your decisions on your loved ones and the causes you care about. Whole life insurance can play a significant role in this process, offering a structured and secure way to pass on your wealth and ensure your legacy is well-maintained.

One of the primary benefits of whole life insurance is its ability to provide financial security for your beneficiaries. When you purchase a whole life policy, you are essentially creating a trust fund that can be used to cover various expenses and provide for your heirs. This is particularly useful for those who want to ensure their family's financial stability in the event of their passing. The policy's death benefit, which is the amount paid out upon your death, can be a substantial sum, allowing your loved ones to cover immediate costs like funeral expenses, outstanding debts, and even everyday living expenses during a challenging time.

Moreover, whole life insurance can be an effective tool for charitable giving. Many individuals are passionate about supporting specific causes or charities, and legacy planning can facilitate this. By naming a charitable organization as a beneficiary, you can ensure that a portion of your death benefit is directed towards the charity of your choice. This not only supports the organization's mission but also contributes to a meaningful legacy, knowing that your financial contributions will have a lasting impact.

The process of legacy planning with whole life insurance is a strategic one. It involves assessing your financial goals, understanding the needs of your beneficiaries, and determining the appropriate policy amount. Working with a financial advisor can be invaluable here, as they can help you navigate the complexities of insurance policies and ensure your legacy plan is tailored to your specific wishes. They can also assist in structuring the policy to minimize tax implications, providing a more efficient way to pass on your wealth.

In summary, whole life insurance is a powerful tool for legacy planning, offering financial security and the ability to support charitable causes. It provides a structured approach to passing on wealth, ensuring your heirs are protected and your chosen charities benefit from your generosity. By incorporating this into your financial strategy, you can create a lasting legacy that reflects your values and provides for those who matter most.

Irrevocable Life Insurance Trust: Protecting Your Wealth and Legacy

You may want to see also

Frequently asked questions

Whole life insurance offers a lifelong coverage, providing a sense of security and financial protection to the policyholder and their beneficiaries. It is a permanent policy that guarantees a death benefit, which means the insurance company will pay out a predetermined amount upon the insured individual's death.

The key difference lies in the duration of coverage. Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. Once the term ends, the policy may lapse unless renewed. In contrast, whole life insurance provides permanent coverage, ensuring that the death benefit is paid out for the entire life of the insured, as long as the premiums are paid.

Yes, one of the significant advantages of whole life insurance is its potential as an investment tool. The policy includes an investment component, where a portion of the premium is allocated to an investment account. This account grows tax-deferred, and the earnings can be used to increase the death benefit or taken out as loan proceeds. Over time, the investment component can accumulate cash value, providing a source of funds for various financial needs.

Absolutely. The cash value accumulation in a whole life insurance policy can be utilized to pay for long-term care expenses. Policyholders can access the cash value through policy loans or surrender the policy for its full value. This flexibility allows individuals to use their insurance as a financial resource for healthcare costs, which can be particularly valuable as people age and face potential long-term care needs.

While whole life insurance offers numerous benefits, it may not be the best fit for everyone. The premiums for whole life insurance are typically higher compared to term life insurance due to the permanent coverage and investment features. Younger individuals may find term life insurance more affordable and sufficient for their immediate needs. It's essential to assess your financial situation, long-term goals, and risk tolerance before deciding on the most appropriate type of life insurance.