Veterans Life Insurance is a valuable benefit offered to military veterans and their families, providing financial security and peace of mind. However, understanding the age limits for this insurance is crucial for those seeking coverage. The age requirements for Veterans Life Insurance can vary depending on the specific plan and the veteran's status. Generally, the insurance is available to veterans who are at least 18 years old, but there are also plans designed for younger veterans, often with lower coverage amounts. For more comprehensive coverage, veterans typically need to be at least 21 years old, and in some cases, as young as 17 with parental consent. These age limits ensure that the insurance is tailored to the veteran's needs and provides appropriate financial protection.

| Characteristics | Values |

|---|---|

| Age Limits | Veterans Life Insurance offers coverage for individuals aged 18-75. However, the maximum age for new applications is 65. |

| Underwriting Process | The underwriting process considers factors like health, occupation, and lifestyle. |

| Policy Types | There are two main types: Level Term Life and Whole Life. |

| Coverage Amounts | Coverage amounts can range from $10,000 to $1,000,000 or more. |

| Premiums | Premiums are typically lower for veterans compared to the general public. |

| Benefits | Policies provide financial protection for beneficiaries in the event of the insured's death. |

| Eligibility | Eligibility is primarily for active-duty, retired, and veteran service members, as well as their spouses and dependent children. |

| Spouse's Option | Spouses can be covered under the policy, with coverage amounts varying based on their age and health. |

| Conversion Option | Some policies offer a conversion option, allowing term life to be converted to permanent life insurance. |

| Term Lengths | Policies can be for 10, 15, 20, or 30 years, with the option to renew. |

What You'll Learn

- Eligibility Requirements: Age limits vary based on veteran status and plan type

- Premium Rates: Younger veterans pay lower premiums, but age limits apply

- Coverage Options: Different plans offer varying benefits, with age restrictions

- Waivers and Exceptions: Age limits can be waived for certain veterans

- Application Process: Veterans must meet age criteria to apply for life insurance

Eligibility Requirements: Age limits vary based on veteran status and plan type

The age limits for veterans' life insurance can vary depending on the veteran's status and the specific plan chosen. This insurance is designed to provide financial protection and peace of mind to veterans and their families. Here's an overview of the eligibility requirements:

For veterans who are active-duty service members, the age limit for enrollment in the Servicemembers' Group Life Insurance (SGLI) plan is generally 35 years old. This plan offers coverage of up to $500,000 and is available to active-duty members of the Army, Navy, Air Force, Marines, and Coast Guard. It's important to note that SGLI coverage automatically increases as you progress through your military career, providing higher coverage amounts as you gain more experience.

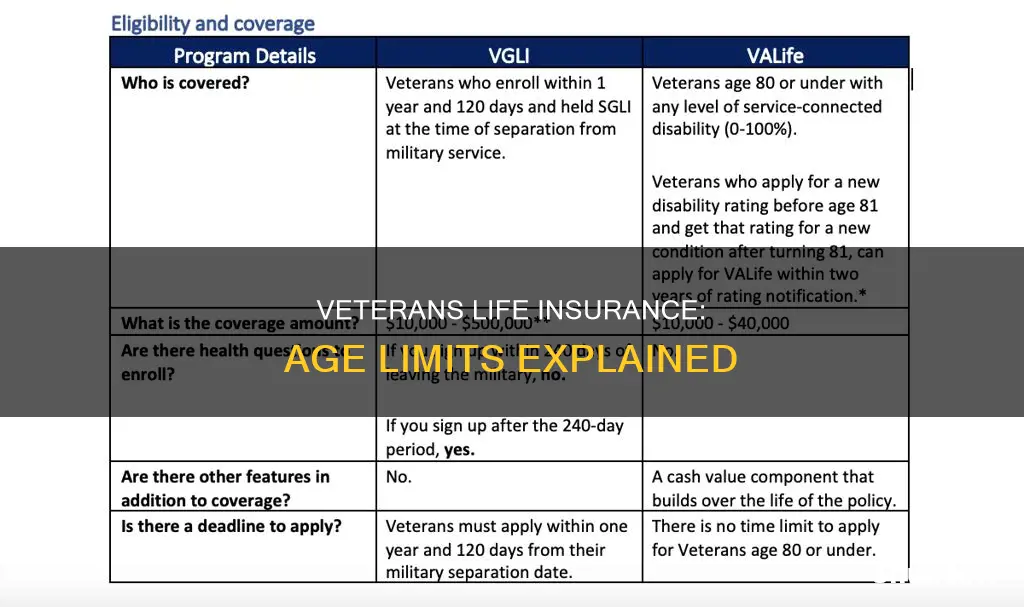

Veterans who have already separated from active duty may have different age limits. For example, the Veterans' Group Life Insurance (VGLI) plan allows veterans to enroll within one year of their separation from active duty. The age limit for VGLI is typically 65 years old, but veterans who enroll within the first year of separation can choose from a range of coverage options, including a 10-year, 20-year, or 30-year term. After the initial enrollment period, veterans can continue to renew their VGLI coverage annually until they reach the age of 70.

In addition to age limits, there are other eligibility criteria to consider. Veterans must be in good health and pass a medical examination to qualify for the most favorable rates and coverage. The insurance company may require a physical examination to assess your overall health and determine the appropriate coverage amount. It's also worth mentioning that veterans with certain disabilities or medical conditions may have different eligibility rules and age limits.

Furthermore, the age limits can vary based on the plan type. Some plans might offer more flexible terms for veterans with specific service backgrounds or those who have served in particular conflicts. For instance, veterans who have served in combat zones or have been deployed to hazardous locations may have access to additional benefits and coverage options.

It is crucial for veterans to understand that the age limits and eligibility criteria can change over time, so staying informed about the latest policies is essential. Veterans should review the current guidelines provided by the Department of Veterans Affairs (VA) or consult with a VA representative to ensure they meet the requirements for their specific situation.

Life Insurance: A Common Benefit for Nurses?

You may want to see also

Premium Rates: Younger veterans pay lower premiums, but age limits apply

Veterans Life Insurance is a valuable benefit for military personnel and their families, offering financial protection and peace of mind. One of the key factors that influence the cost of this insurance is age, as younger veterans typically pay lower premiums, but there are important age limits to consider.

For younger veterans, the insurance rates are indeed more affordable. This is because insurance companies consider younger individuals to be less risky policyholders. As age increases, the likelihood of health issues and mortality rises, which directly impacts the premium rates. Therefore, younger veterans can benefit from lower monthly payments, making it an attractive option for those who want to secure their financial future without incurring high costs.

However, it's crucial to understand the age limits set by the insurance provider. These limits ensure that the insurance remains accessible and affordable for a broad range of veterans. Typically, the age limit for enrollment in the Veterans Life Insurance program is 80 years old. This means that veterans must apply for coverage before reaching this age to be eligible for the full benefits. Once an individual surpasses this age, they may still be able to purchase coverage, but at a higher premium rate, reflecting the increased risk associated with older age.

The age-based premium structure is designed to encourage timely enrollment and provide financial security for veterans at a reasonable cost. Younger veterans are encouraged to take advantage of this benefit early on, as it can offer significant savings over time. By understanding these age-related premium rates, veterans can make informed decisions about their insurance coverage and ensure they receive the necessary protection for themselves and their loved ones.

In summary, younger veterans can benefit from lower premiums for Veterans Life Insurance, but it's essential to be aware of the age limits to ensure timely enrollment. This insurance program provides a valuable safety net, and understanding the premium rates based on age is a critical aspect of making an informed choice.

Life Insurance: Income Protection and Its Coverage

You may want to see also

Coverage Options: Different plans offer varying benefits, with age restrictions

When it comes to veterans' life insurance, the coverage options and age restrictions can vary depending on the specific plan chosen. Understanding these options is crucial for veterans and their families to make informed decisions about their financial security. Here's an overview of the coverage options and the associated age limits:

Standard Plan: This is the most common type of veterans' life insurance offered by the Department of Veterans Affairs (VA). It provides a death benefit to the veteran's beneficiaries and has different coverage amounts based on the veteran's age. For the Standard Plan, the age limits are as follows: Ages 80 and under can purchase a policy with a maximum death benefit of $100,000. Ages 65 to 79 are eligible for a policy with a maximum benefit of $50,000. Veterans between the ages of 45 and 64 can secure a policy with a maximum death benefit of $150,000. And for those aged 44 and younger, the maximum death benefit is $200,000. It's important to note that the younger the veteran, the higher the potential payout in case of death.

Veterans' Protection Plan (VPP): This plan offers additional benefits and is available to veterans who are already enrolled in the Standard Plan. VPP provides an additional death benefit and has its own set of age restrictions. Veterans aged 80 and under can purchase VPP with a maximum additional benefit of $50,000. Ages 65 to 79 are eligible for an additional benefit of $25,000. For veterans aged 45 to 64, the additional benefit is $75,000, and those aged 44 and younger can secure an additional benefit of $100,000. The VPP allows veterans to increase their coverage and provide more financial security for their loved ones.

Age Restrictions: It is essential to be aware of the age limits for each plan. The Standard Plan has a maximum age of 80 for initial enrollment, while the VPP has a maximum age of 75 for veterans who want to add this coverage. Additionally, there are waiting periods for certain benefits, especially for those with pre-existing conditions. These waiting periods can vary, and it's advisable to review the VA's guidelines for specific details.

Veterans should carefully consider their age, health, and financial goals when choosing a life insurance plan. The VA offers various resources and calculators to help veterans estimate their coverage needs. By understanding the coverage options and age restrictions, veterans can select the plan that best suits their requirements and ensures the financial protection of their beneficiaries.

Life Insurance: A Global Perspective on Coverage

You may want to see also

Waivers and Exceptions: Age limits can be waived for certain veterans

Veterans Life Insurance, a valuable benefit provided by the U.S. Department of Veterans Affairs (VA), offers financial protection to veterans and their families. However, like many insurance programs, it comes with specific eligibility criteria, including age limits. These age restrictions can sometimes present challenges for veterans who may have unique circumstances or special needs. Fortunately, the VA recognizes these challenges and provides avenues for waivers and exceptions to ensure that eligible veterans can still access this crucial benefit.

Age limits for Veterans Life Insurance are generally set at 80 years old for new enrollments. This means that veterans who are 80 or older may not be eligible to purchase this insurance. However, the VA understands that some veterans may have medical conditions or other factors that make them eligible for an exception. One such exception is for veterans with a service-connected disability rating of 50% or higher. These veterans can be enrolled in the insurance program regardless of their age, as long as they meet other basic eligibility requirements.

Additionally, the VA offers waivers for veterans who are over the age limit but have a compelling reason. For instance, a veteran who has a terminal illness with a life expectancy of less than two years may be granted a waiver to enroll in the insurance. This ensures that their family is financially protected during a difficult time. Similarly, veterans who have served in active combat and have a documented history of physical or mental health issues related to their service may also be eligible for a waiver.

Another category of veterans who may qualify for a waiver is those who have been discharged from active duty due to a service-related injury or illness. These veterans often face unique challenges, and the VA aims to provide support by waiving the age limit for their insurance coverage. It is important to note that the VA will carefully review each waiver request to ensure that the veteran's circumstances meet the necessary criteria.

In summary, while age limits exist for Veterans Life Insurance, the VA offers a range of waivers and exceptions to ensure that eligible veterans can still access this vital benefit. Veterans with service-connected disabilities, terminal illnesses, combat-related injuries, or other qualifying conditions may be able to enroll or receive coverage despite their age. It is essential for veterans to understand these options and take advantage of them when necessary, as they can provide much-needed financial security for themselves and their loved ones.

Billing Insurance for Life Coaching: Strategies for Success

You may want to see also

Application Process: Veterans must meet age criteria to apply for life insurance

The age limit for veterans' life insurance is a crucial aspect of the application process, as it determines eligibility and the terms of coverage. Veterans who wish to apply for this insurance must meet specific age criteria, which can vary depending on the country and the insurance provider. It is essential to understand these age requirements to ensure a smooth application process and to take advantage of the benefits offered by this insurance.

For the United States, the Department of Veterans Affairs (VA) offers two types of life insurance for veterans: the Veterans' Life Insurance (VLI) and the Servicemembers' Group Life Insurance (SGLI). The age limit for VLI is typically between 18 and 80 years old, while SGLI is available to active-duty service members and veterans between the ages of 18 and 72. These age limits ensure that the insurance is provided to those who are most likely to benefit from it and can contribute to the premiums.

When applying for veterans' life insurance, veterans must provide accurate and up-to-date personal information. This includes their full name, date of birth, contact details, and any relevant medical history. The application process often involves a series of steps, including filling out forms, providing supporting documents, and undergoing a medical examination if required. It is crucial to provide honest and complete information to ensure a successful application.

Age is a critical factor in determining the premium rates and coverage options. Younger veterans may qualify for lower premiums and more comprehensive coverage, while older veterans might have limited options or higher premiums. The insurance provider will assess the veteran's age, health, and other factors to determine the most suitable policy. Therefore, it is essential to be aware of the age criteria and plan the application accordingly.

In summary, the age limit for veterans' life insurance is a significant consideration during the application process. Veterans must ensure they meet the age requirements to access the benefits and coverage options available. By understanding the age criteria and providing accurate information, veterans can navigate the application process successfully and secure the financial protection they deserve. It is always advisable to consult the official guidelines and seek professional advice for personalized assistance.

AXA Equitable Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

The age limit for Veterans Life Insurance is 80 years old. This means that veterans and their spouses can apply for this insurance coverage up to the age of 80.

No, unfortunately, the age limit of 80 is a requirement for eligibility. The insurance is designed to provide coverage for veterans and their families, and the risk associated with insuring individuals over 80 may not be feasible for the insurer.

Yes, there are a few exceptions. First-time enrollees who are between the ages of 60 and 80 can be considered for coverage, but their insurance benefit will be reduced by 5% for each year over 60. Additionally, veterans who have served in combat and are over 80 may be eligible for a special review, but this is a limited exception.

The age limit directly impacts the premium rates. As the age increases, the risk of mortality also increases, which is why the insurance premium tends to be higher for older applicants. The insurer uses age as a factor to determine the level of coverage and the associated costs.

Yes, the age limit applies to both veterans and their spouses. Spouses can apply for coverage, but they must meet the age requirement of 80 or less. The insurance provides coverage for the spouse's life, and the age limit ensures that the insurer can accurately assess the risk and set appropriate premiums.