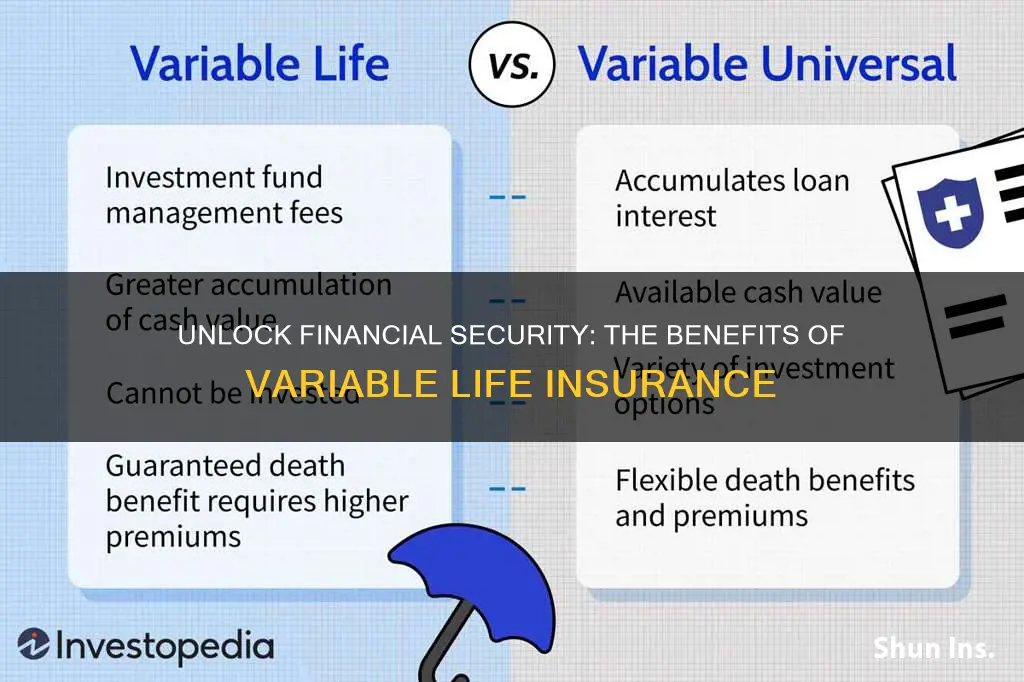

Variable life insurance offers a unique blend of protection and investment opportunities, making it an attractive choice for those seeking both financial security and potential growth. Unlike traditional life insurance, variable policies provide policyholders with the flexibility to allocate their premiums across various investment options, allowing them to potentially increase their savings over time. This feature is particularly appealing to those who want to actively manage their insurance portfolio, as it enables them to adapt to changing financial goals and market conditions. With variable life insurance, individuals can enjoy the peace of mind that comes with knowing their loved ones are protected while also having the potential to build a substantial financial asset.

What You'll Learn

- Flexibility: Adjust coverage and premiums to fit changing financial needs

- Longevity: Provides coverage for a longer period, ensuring financial security

- Cost-Effectiveness: Lower initial costs compared to permanent life insurance

- Tax Advantages: Potential tax benefits on premiums and death benefits

- Customizable: Tailor coverage to individual risk tolerance and financial goals

Flexibility: Adjust coverage and premiums to fit changing financial needs

Variable life insurance offers a unique level of flexibility that can be highly beneficial for individuals with changing financial circumstances. One of the key advantages is the ability to adjust the coverage and premiums according to your evolving needs. This adaptability is particularly useful for those who experience fluctuations in their financial situation over time. For instance, a young professional might start with a lower coverage amount and more affordable premiums, which can be increased as their career progresses and income rises. This flexibility ensures that the insurance policy remains relevant and cost-effective throughout the policyholder's life.

As your financial goals and obligations change, so might your insurance requirements. For example, a new parent might initially opt for a higher coverage amount to ensure their family's financial security in the event of an unforeseen tragedy. However, as the children grow and the financial burden lessens, the policy can be adjusted to reflect this new reality, potentially reducing premiums and keeping the insurance affordable. This level of customization allows individuals to make the most of their insurance investment, ensuring it aligns with their current and future financial goals.

The ability to customize variable life insurance policies also provides an opportunity to optimize the investment component. Policyholders can choose to allocate a portion of their premiums to an investment account, which can grow tax-deferred. This investment aspect offers the potential for long-term growth, allowing the policy to accumulate value over time. As your financial needs change, you can decide to adjust the investment strategy, perhaps increasing the allocation to more aggressive investments if you're in a higher tax bracket or seeking higher returns. This flexibility in investment strategy can be a powerful tool for those who want to make the most of their insurance policy.

Furthermore, the flexibility of variable life insurance extends to the policy's cash value. The cash value of the policy can be borrowed against or withdrawn, providing a source of funds that can be used for various purposes. This feature can be particularly useful during periods of financial strain, allowing policyholders to access funds without the need for a loan or selling assets. By accessing the cash value, individuals can ensure that their insurance coverage remains intact while also having access to a financial safety net.

In summary, variable life insurance provides a flexible financial solution that can adapt to the changing needs of individuals. The ability to adjust coverage, premiums, and investment strategies allows policyholders to make the most of their insurance investment, ensuring it remains relevant and beneficial throughout their lives. This flexibility is a key reason why many people choose variable life insurance, as it provides a dynamic and personalized approach to financial security.

Life Insurance Clearinghouse: Does It Exist?

You may want to see also

Longevity: Provides coverage for a longer period, ensuring financial security

Variable life insurance offers a unique advantage when it comes to longevity and financial security. Unlike traditional term life insurance, which provides coverage for a specific period, variable life insurance is designed to offer protection for the entire lifetime of the insured individual. This means that as long as the policyholder remains alive, the insurance coverage will continue, providing a sense of security and peace of mind.

The extended coverage period is a significant benefit, especially for those who want to ensure their loved ones are financially protected over a more extended timeframe. With variable life insurance, the policyholder can rest assured that their family will have the necessary financial support even if they outlive the initial term of the policy. This is particularly valuable for individuals who want to provide long-term financial stability for their dependents, such as children or spouses.

One of the key advantages of this type of insurance is the flexibility it offers in terms of policy duration. Unlike permanent life insurance, which typically offers coverage for the entire life of the insured, variable life insurance allows policyholders to adjust the coverage period as their needs change. This adaptability is crucial, as it enables individuals to manage their insurance strategy effectively, ensuring that the coverage remains relevant and adequate over time.

Moreover, the extended coverage period of variable life insurance can be particularly beneficial for those who want to build a substantial cash value within their policy. As the policyholder lives longer, the cash value of the policy grows, providing a valuable financial asset. This growing cash value can be utilized for various purposes, such as funding education expenses, starting a business, or even providing additional financial security in retirement.

In summary, variable life insurance's longevity feature is a powerful tool for individuals seeking long-term financial security. By providing coverage for the entire lifetime, it offers peace of mind and ensures that the insured's loved ones are protected even in the event of the insured's longevity. The flexibility to adjust coverage periods and the potential for building cash value make variable life insurance an attractive choice for those who want to manage their insurance strategy effectively and adapt to changing life circumstances.

Smoking and Life Insurance: Lying on Your Application

You may want to see also

Cost-Effectiveness: Lower initial costs compared to permanent life insurance

Variable life insurance offers a unique advantage in terms of cost-effectiveness, especially when compared to its counterpart, permanent life insurance. One of the primary reasons for this is the lower initial premium payments associated with variable life policies. When you purchase a variable life insurance policy, you are essentially investing in a product that combines insurance with an investment component. This dual nature allows for a more efficient allocation of funds, resulting in reduced costs for the policyholder.

The lower initial costs of variable life insurance can be attributed to the flexibility it provides. Unlike permanent life insurance, which guarantees coverage for the entire duration of the policy, variable life insurance allows policyholders to adjust their coverage and investment strategies over time. This flexibility means that the insurance company doesn't need to allocate as much capital upfront to secure the policy, as the coverage can be tailored to the policyholder's needs and preferences. As a result, the premiums are often more affordable, making it an attractive option for those seeking long-term financial protection without breaking the bank.

In traditional permanent life insurance, the policyholder pays a fixed premium that covers the entire term, ensuring a steady income for the insurer. However, this model often results in higher costs for the policyholder, especially in the early years of the policy. Variable life insurance, on the other hand, allows for adjustments to the coverage and investment components, ensuring that the policyholder pays only for the protection and growth they actually require. This personalized approach can significantly reduce the overall cost of insurance, making it a more affordable and flexible choice.

The cost-effectiveness of variable life insurance is further emphasized when considering the potential for long-term savings. With variable life policies, the policyholder can access the cash value of the policy, which grows tax-deferred, providing a source of funds that can be used for various financial goals. This feature allows individuals to build a financial safety net while also investing in their future. Over time, the accumulated cash value can be utilized to enhance the policy's coverage or even provide additional financial benefits, all while maintaining lower initial costs compared to permanent life insurance.

In summary, the lower initial costs of variable life insurance are a significant advantage for those seeking cost-effective long-term financial protection. The flexibility and personalized nature of these policies allow individuals to tailor their coverage and investment strategies, ensuring they pay only for what they need. This approach not only makes variable life insurance more affordable but also provides a potential for long-term savings, making it an attractive choice for those who want both insurance and investment benefits in a single, efficient package.

Unlocking Collateral Loans with Your Life Insurance Policy

You may want to see also

Tax Advantages: Potential tax benefits on premiums and death benefits

Variable life insurance offers several tax advantages that can be beneficial for policyholders. One of the key benefits is the potential for tax-deductible premiums. When you pay premiums for a variable life insurance policy, you can claim a deduction for the amount paid, provided it meets the IRS's criteria for qualified insurance. This deduction can be particularly advantageous for those in higher tax brackets, as it allows them to reduce their taxable income and potentially lower their overall tax liability. By strategically timing premium payments, individuals can optimize their tax benefits, especially during years when their income is lower, as this can result in a more significant tax deduction.

The tax treatment of death benefits in variable life insurance is another area where this type of policy shines. Upon the insured's death, the death benefit is generally paid out tax-free to the designated beneficiaries. This is a significant advantage compared to other forms of insurance, where death benefits might be subject to income tax. The tax-free nature of the death benefit ensures that the entire amount received by the beneficiaries goes a long way in providing financial support, especially in the event of the insured's untimely passing.

Furthermore, the investment component of variable life insurance, known as the investment account, offers tax advantages. The earnings and gains within the investment account can grow tax-deferred, allowing the policy's value to accumulate over time. This means that the policyholder can benefit from potential investment growth without incurring immediate tax liabilities. As the policy's value grows, it can provide a substantial financial resource that can be used for various purposes, such as funding education, starting a business, or planning for retirement.

In summary, variable life insurance provides tax advantages through deductible premiums, tax-free death benefits, and tax-deferred investment growth. These benefits can result in significant financial savings for policyholders, especially over the long term. Understanding these tax advantages can be a compelling reason for individuals to consider variable life insurance as a valuable component of their financial planning strategy.

Who Can Get Life Insurance on Your Behalf?

You may want to see also

Customizable: Tailor coverage to individual risk tolerance and financial goals

Variable life insurance offers a unique advantage in its customization, allowing policyholders to tailor their coverage to their specific needs and circumstances. This level of customization is particularly appealing to those who want to ensure their insurance policy aligns with their personal risk tolerance and financial objectives. By offering flexibility, variable life insurance empowers individuals to make informed decisions about their insurance coverage, ensuring it meets their evolving requirements over time.

One of the key benefits of customization is the ability to adjust the death benefit, which is the amount paid out upon the insured's passing. Policyholders can choose to increase or decrease this benefit based on their financial goals and risk assessment. For instance, those with a higher risk profile or a substantial financial burden may opt for a higher death benefit to provide comprehensive coverage. Conversely, individuals with a more conservative approach to risk might prefer a lower benefit, ensuring that the insurance remains affordable and aligned with their current financial situation.

The customization options in variable life insurance also extend to the investment component of the policy. Policyholders can select from various investment options, allowing them to grow their policy's cash value over time. This feature is advantageous for those who want to take control of their insurance's financial aspect and potentially earn higher returns compared to traditional fixed-rate policies. By choosing investment options that suit their risk tolerance, individuals can optimize the growth of their insurance policy while also ensuring it remains a valuable financial asset.

Furthermore, customization enables policyholders to set their premium payments. This flexibility allows individuals to choose payment schedules that fit their financial capabilities, whether monthly, quarterly, or annually. For those with fluctuating income or specific financial goals, this option provides the freedom to manage their insurance expenses effectively. It also ensures that the insurance policy remains accessible and affordable, even as the policyholder's financial circumstances change.

In summary, the customizable nature of variable life insurance is a significant advantage, offering individuals the power to shape their insurance coverage according to their unique circumstances. By tailoring the death benefit, investment options, and premium payments, policyholders can ensure that their insurance policy is a perfect fit. This level of customization not only provides peace of mind but also allows individuals to make the most of their insurance, adapting it to their evolving risk tolerance and financial aspirations.

Life Insurance After COVID: What You Need to Know

You may want to see also

Frequently asked questions

Variable life insurance offers a unique combination of life coverage and an investment component. It provides a death benefit to your beneficiaries if you pass away, similar to traditional life insurance. However, the key advantage lies in its investment features, allowing policyholders to potentially grow their money through various investment options.

With variable life insurance, a portion of your premium is allocated to an investment account. This account can be invested in a variety of options, such as stocks, bonds, or mutual funds. The performance of these investments directly impacts the cash value of your policy. If the investments perform well, the cash value can grow, providing you with potential financial gains.

Absolutely! One of the appealing features of variable life insurance is the flexibility it offers. Policyholders can choose from a range of investment options and adjust their strategy according to their financial goals and risk tolerance. You can allocate your premium across different investment sub-accounts to diversify your portfolio and potentially maximize returns.

Like any investment, variable life insurance carries certain risks. The investment options within the policy can fluctuate in value, and there is a chance of losing some or all of the invested amount. It's important to carefully review the investment options and understand the associated risks before making any decisions. Additionally, the performance of the investments may impact the overall value of your policy and the death benefit provided.