Term life insurance is a type of insurance that provides coverage for a specific period, or term, typically ranging from 10 to 30 years. It is a straightforward and affordable way to protect your loved ones financially during a particular period. One of the key characteristics of term life insurance is its simplicity; it offers a death benefit if the insured person passes away during the term, and the policy expires at the end of the term without providing further coverage. This type of insurance is often chosen for its cost-effectiveness compared to permanent life insurance, making it an attractive option for those seeking temporary coverage to meet specific financial goals, such as covering mortgage payments, providing for children's education, or ensuring financial security for a set period.

| Characteristics | Values |

|---|---|

| Coverage Duration | Limited to a specific term, typically 10, 20, or 30 years |

| Cost | Generally lower than permanent life insurance due to temporary coverage |

| Simplicity | Straightforward policy with no cash value accumulation |

| Flexibility | Can be renewed at the end of the term, often with the option to convert to permanent insurance |

| No Investment Component | No investment or savings element, focuses solely on death benefit |

| Tax-Advantaged | Proceeds paid to beneficiaries are typically tax-free |

| Affordable | Premiums are typically lower compared to whole life insurance |

| Predictable Premiums | Premiums remain consistent for the duration of the term |

| No Lapse | Premiums are guaranteed not to increase or decrease during the term |

| Renewable | Policy can be renewed without a medical exam, often at a higher premium |

What You'll Learn

- Fixed Duration: Term life insurance has a specific period, typically 10-30 years, and ends when the term expires

- Level Premiums: Premiums remain constant throughout the policy term, providing predictable costs

- No Cash Value: Unlike whole life, it doesn't accumulate cash value, focusing solely on death benefits

- No Investment Component: The primary function is to provide coverage for a defined period

- No Lapse in Coverage: Premiums are guaranteed, ensuring coverage doesn't lapse if payments are made on time

Fixed Duration: Term life insurance has a specific period, typically 10-30 years, and ends when the term expires

Term life insurance is a type of coverage that provides protection for a specified period, offering a straightforward and effective solution for individuals seeking temporary life insurance. One of its key characteristics is the fixed duration, which is a defining feature that sets it apart from other insurance products. This type of policy is designed to meet the needs of those who require insurance for a particular period, such as covering mortgage payments, providing financial security for a growing family, or ensuring coverage during a specific career phase.

The duration of term life insurance is typically between 10 and 30 years, making it a versatile option for various life stages. During this period, the policyholder pays a fixed premium, and in return, the insurance company provides a death benefit if the insured individual passes away within the specified term. This benefit is a crucial aspect of the policy, as it ensures financial security for the policyholder's loved ones or beneficiaries. Once the term expires, the policy ends, and the coverage no longer remains in effect.

The fixed nature of the term is a significant advantage for those who want a clear and defined period of coverage. It provides a sense of certainty and control, allowing individuals to plan their finances and make informed decisions. For example, a young professional taking out a 20-year term life insurance policy can rest assured that their family will be protected during their most productive years, and the coverage will end when their children are likely to be financially independent.

This type of insurance is particularly attractive to those who prefer simplicity and predictability in their financial planning. With a fixed duration, there are no concerns about the policy lasting indefinitely, and the cost of premiums is stable throughout the term. This predictability can be a significant factor in making the decision to purchase term life insurance, especially for those who want a straightforward and manageable insurance solution.

In summary, the fixed duration of term life insurance is a critical characteristic that provides a clear and defined period of coverage. This feature ensures that individuals can plan and manage their finances effectively, offering a sense of security and control during specific life stages. Understanding this aspect is essential for anyone considering term life insurance as a means of protecting their loved ones and achieving their financial goals.

Life Insurance: Term End Options and Your Coverage

You may want to see also

Level Premiums: Premiums remain constant throughout the policy term, providing predictable costs

Term life insurance is a type of coverage that offers a straightforward and cost-effective solution for individuals seeking protection for a specific period. One of its key characteristics is the stability and predictability it provides in terms of premium payments. When you opt for a term life insurance policy, you agree to pay a fixed amount, known as the premium, for the duration of the policy term. This level of consistency is a significant advantage, ensuring that your financial commitment remains the same throughout the entire period of coverage.

The concept of level premiums is designed to offer peace of mind and financial planning certainty. Unlike some other insurance products, where premiums may increase over time, term life insurance maintains a steady rate. This means that your monthly, quarterly, or annual payments will be the same from the start of the policy until its expiration. As a result, you can easily budget and plan your finances without worrying about unexpected premium hikes.

This predictability is particularly beneficial for those who want to ensure their loved ones' financial security without the complexity of variable-rate policies. By locking in a level premium, you can focus on other financial goals and objectives, knowing that your insurance coverage remains affordable and consistent. It allows individuals to make informed decisions about their insurance needs and ensures that the policy remains accessible and manageable over the long term.

In the context of term life insurance, level premiums are a crucial aspect that attracts many policyholders. This characteristic simplifies the insurance process, making it more transparent and user-friendly. With level premiums, you can easily compare different policies and choose the one that best suits your requirements without the added complexity of fluctuating costs.

Furthermore, the predictability of level premiums enables individuals to make timely decisions regarding their insurance needs. Whether it's extending the policy term or reviewing coverage options, knowing that premiums will remain constant allows for swift and informed actions. This aspect of term life insurance ensures that you can adapt to changing circumstances while maintaining a stable and reliable financial commitment.

Chlamydia and Life Insurance: Does It Affect Your Premiums?

You may want to see also

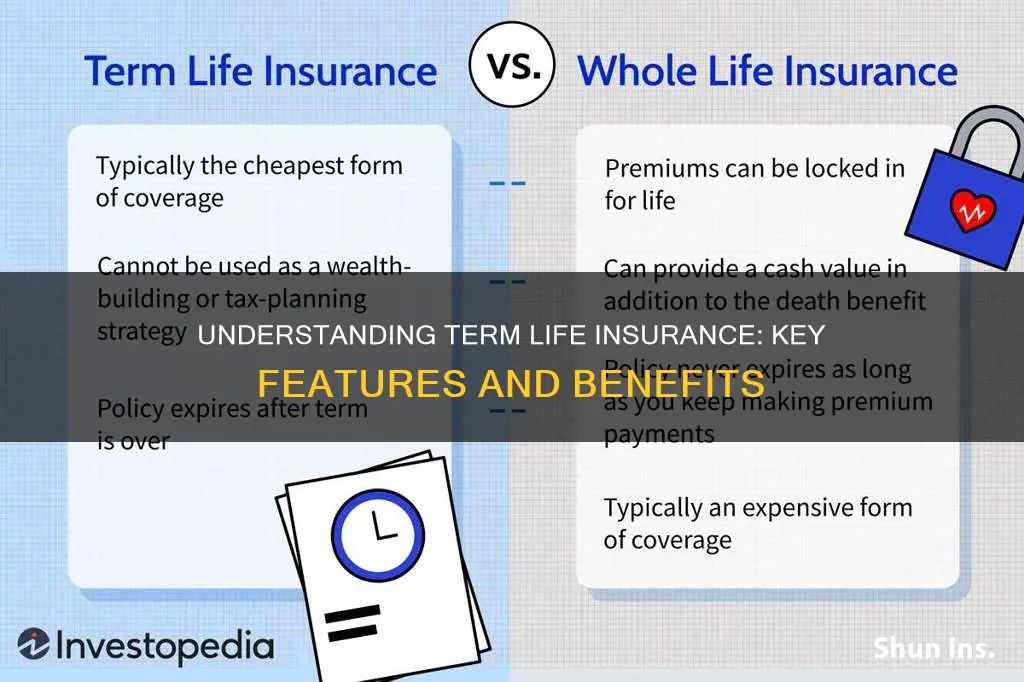

No Cash Value: Unlike whole life, it doesn't accumulate cash value, focusing solely on death benefits

Term life insurance is a type of insurance that provides coverage for a specific period, or "term," typically ranging from 10 to 30 years. One of its key characteristics is that it does not accumulate cash value, unlike whole life insurance. This means that the primary purpose of term life insurance is to provide financial protection and coverage during a defined period, with no savings or investment component.

When you purchase term life insurance, you pay regular premiums to the insurance company. In return, the insurer promises to pay a predetermined death benefit to your beneficiaries if you pass away during the specified term. This death benefit is a fixed amount agreed upon at the time of policy inception and remains the same throughout the policy's duration. The focus is entirely on providing financial security to your loved ones in the event of your untimely death.

The lack of cash value accumulation in term life insurance is a significant difference from whole life insurance. With whole life, a portion of your premiums goes towards building cash value, which can be borrowed against or withdrawn. In contrast, term life insurance premiums are used exclusively to fund the death benefit and the administrative costs of the policy. This structure ensures that the insurance company can fulfill its promise to pay the death benefit when needed.

This characteristic of term life insurance makes it a more straightforward and cost-effective option for those seeking temporary coverage. It is particularly popular among individuals who want to protect their families during a specific life stage, such as when they have young children or a mortgage. By choosing a term life insurance policy, you can ensure that your loved ones are financially secure during the years when they need it most, without the added complexity of a savings component.

In summary, the 'no cash value' aspect of term life insurance is a defining feature that sets it apart from whole life. It allows for a focused and efficient approach to providing death benefits, making it an attractive choice for those seeking temporary coverage without the investment element. Understanding this characteristic is essential for individuals to make informed decisions when selecting life insurance coverage that aligns with their specific needs and financial goals.

Life Insurance: Maximizing Income Tax Advantages

You may want to see also

No Investment Component: The primary function is to provide coverage for a defined period

Term life insurance is a type of life insurance that provides coverage for a specific period, often 10, 20, or 30 years. One of its key characteristics is the absence of an investment component, which sets it apart from other insurance products. This feature is crucial for those seeking straightforward coverage without the complexities of investment-based policies.

The primary function of term life insurance is to offer financial protection during a defined period. When you purchase a term policy, you agree to pay a premium for a set duration. In return, the insurance company promises to pay a death benefit to your beneficiaries if you pass away during that term. This coverage is particularly valuable for individuals who want to ensure their family's financial security for a specific period, such as covering mortgage payments, children's education, or other long-term financial commitments.

Unlike permanent life insurance, which includes an investment component, term life insurance does not accumulate cash value. The insurance company uses the premiums to fund the death benefit and administrative costs, ensuring that the policy remains affordable and focused on providing coverage. This simplicity is a significant advantage for those who prefer a more direct and transparent approach to life insurance.

The 'no investment' aspect of term life insurance means that the policy does not grow or accumulate wealth over time. It is a pure insurance product, designed solely to provide financial protection. This characteristic makes term life insurance an excellent choice for individuals who want a straightforward and cost-effective way to secure their family's future without the added complexity of investment-based features.

In summary, the absence of an investment component in term life insurance is a defining feature that sets it apart. It ensures that the primary function of the policy is to provide coverage for a defined period, offering financial protection without the complexities of investment-based products. This simplicity and focus on coverage make term life insurance an attractive option for those seeking a straightforward and effective way to secure their family's financial well-being.

Utilizing Life Insurance to Fund Your College Education

You may want to see also

No Lapse in Coverage: Premiums are guaranteed, ensuring coverage doesn't lapse if payments are made on time

Term life insurance is a straightforward and cost-effective way to protect your loved ones financially. One of its key advantages is the guaranteed no-lapse coverage, which provides peace of mind and financial security. This feature ensures that your insurance policy remains in force as long as you make the required premium payments on time.

When you purchase a term life insurance policy, you typically pay a fixed premium for a specified period, known as the 'term'. During this term, the insurance company promises to provide a death benefit to your beneficiaries if you were to pass away. The beauty of this arrangement is that the premiums are set in advance, and as long as you fulfill your payment obligations, the coverage remains uninterrupted.

The 'no-lapse' aspect is crucial because it eliminates the risk of your policy lapsing due to missed payments. Unlike some other insurance products, term life insurance does not accumulate cash value, which means there are no investments or savings components to worry about. As a result, the premiums are solely dedicated to providing the agreed-upon death benefit, ensuring that your coverage remains active without any gaps.

This guaranteed no-lapse coverage is particularly valuable for those who want a simple and reliable form of life insurance. It provides a clear understanding of the policy's cost and benefit, allowing individuals to plan and budget effectively. With term life insurance, you can rest assured that your loved ones will receive the intended financial support when it matters most, all while maintaining continuous coverage.

In summary, the 'no lapse in coverage' feature of term life insurance is a significant advantage, offering a straightforward and reliable approach to financial protection. By guaranteeing no-lapse coverage, insurance companies ensure that policyholders can maintain their desired level of protection without the worry of policy lapses, providing a valuable tool for individuals seeking a simple and effective way to secure their family's future.

Life Insurance Gaps: What's Not Covered and Why

You may want to see also

Frequently asked questions

Term life insurance is a type of life insurance that provides coverage for a specific period, known as the "term." It offers a death benefit if the insured individual passes away during this term, and the policy expires at the end of the term if the insured is still alive.

Term life insurance is designed for a specific period, typically 10, 20, or 30 years, and it focuses solely on providing coverage during that time. Permanent life insurance, on the other hand, offers lifelong coverage and includes an investment component, allowing the policy to accumulate cash value over time.

One of the key advantages is its affordability. Term life insurance is generally more cost-effective than permanent life insurance because it doesn't have an investment component. It provides a straightforward and temporary solution for life coverage, making it suitable for individuals who need insurance for a specific period, such as covering mortgage payments or providing for children's education.

Yes, many term life insurance policies offer the option to convert the term policy to a permanent policy before the term ends. This conversion privilege allows policyholders to continue their coverage indefinitely without a medical examination, providing long-term financial protection.

If you outlive the term period and the policy has not been converted to permanent insurance, the coverage will terminate, and the policy will no longer provide a death benefit. However, if the policy includes a conversion option, you can choose to convert it to a permanent policy, ensuring lifelong coverage.