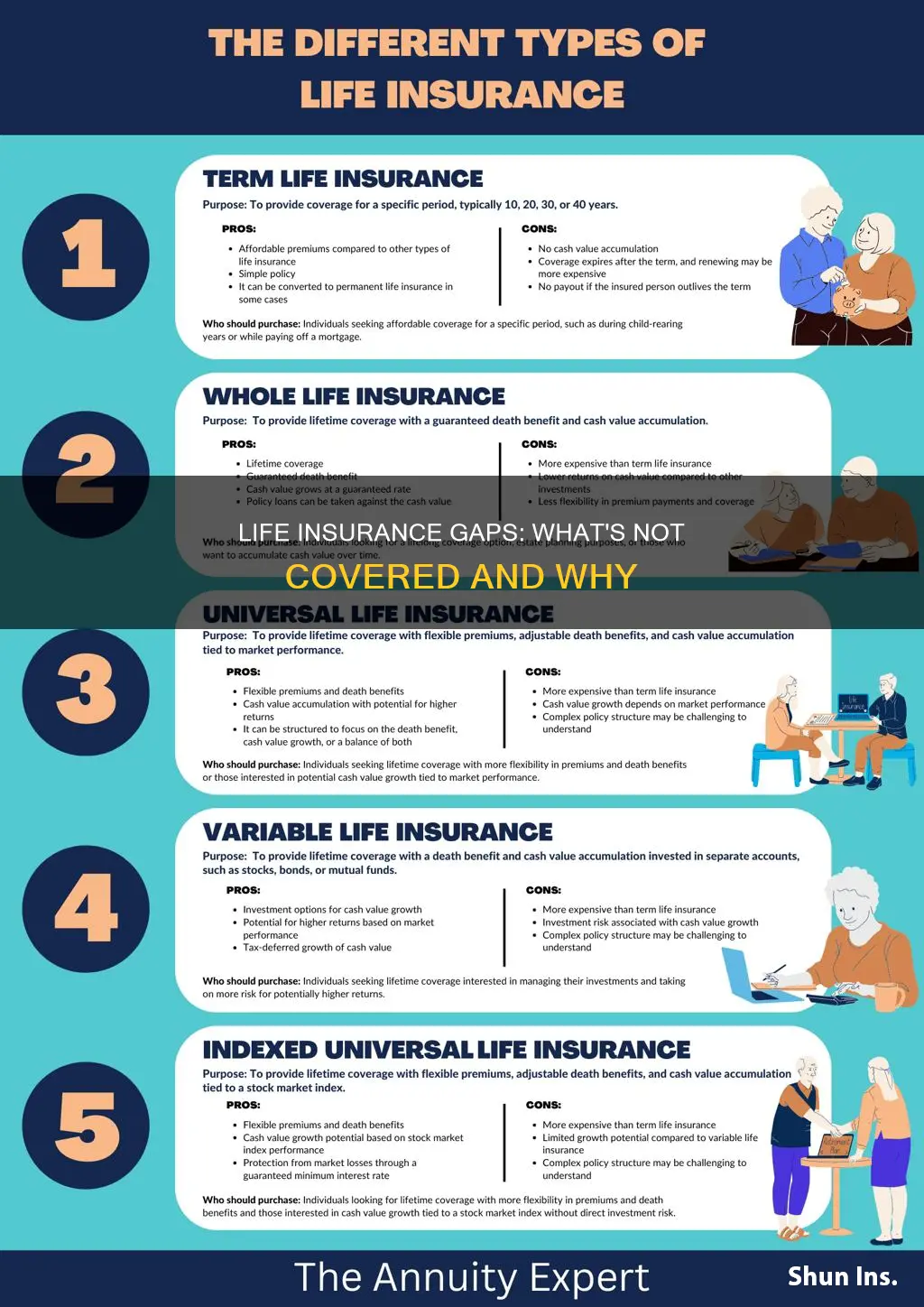

Life insurance is a valuable tool for providing financial security and peace of mind, but it's important to understand its limitations. While life insurance can offer financial protection to your loved ones in the event of your passing, it's crucial to recognize that there are certain situations and circumstances that are typically not covered. These may include pre-existing health conditions, intentional self-harm, or certain high-risk activities like skydiving or scuba diving. Understanding what life insurance doesn't cover can help you make informed decisions about your coverage and ensure that your loved ones are adequately protected in the event of unforeseen circumstances.

What Life Insurance Doesn't Cover:

| Characteristics | Values |

|---|---|

| Age-related limitations | Generally, life insurance coverage is more expensive for older individuals, especially those over 60. Some policies may not cover individuals above a certain age. |

| Pre-existing conditions | Life insurance companies often exclude coverage for pre-existing health conditions, especially if they are severe or require ongoing treatment. This includes conditions like terminal illnesses, heart disease, and certain types of cancer. |

| Suicide or self-harm | Many life insurance policies have a waiting period of one to two years before providing coverage if the death is caused by suicide or self-inflicted injuries. |

| Drug and alcohol abuse | Policies may exclude coverage if the death is a result of drug or alcohol abuse, especially if it is considered a contributory factor. |

| Extreme sports and hobbies | High-risk activities like skydiving, scuba diving, rock climbing, and racing cars may lead to higher premiums or exclusion of coverage. |

| Criminal activities | Life insurance may not cover deaths resulting from criminal activities, such as murder or manslaughter. |

| Acts of war or terrorism | Major incidents like wars, terrorist attacks, or civil unrest are often excluded from life insurance coverage. |

| Natural disasters | Some policies may not cover deaths caused by natural disasters like earthquakes, hurricanes, or floods. |

| Illegal activities | Engaging in illegal activities can void the policy and exclude coverage. |

| Lying on application | Misrepresentation or fraud during the application process can lead to policy rejection or exclusion of coverage. |

What You'll Learn

- Health Conditions: Pre-existing health issues may not be covered

- Suicide: Suicide is often excluded from coverage

- Extreme Sports: Activities like skydiving are typically not insured

- War and Terrorism: Life insurance may exclude coverage during conflicts

- Illicit Drug Use: Engaging in illegal drug activities can void coverage

Health Conditions: Pre-existing health issues may not be covered

When considering life insurance, it's crucial to understand what is typically not covered by these policies. One significant aspect is the impact of pre-existing health conditions on your insurance coverage. Pre-existing health issues can present challenges when applying for life insurance, as they may lead to higher premiums or even denial of coverage.

Life insurance companies often assess an individual's health history to determine the risk associated with insuring them. If you have a pre-existing medical condition, such as heart disease, diabetes, cancer, or a history of mental health disorders, the insurer may view you as a higher-risk candidate. This is because these conditions can affect life expectancy and the likelihood of requiring financial support through insurance. For instance, individuals with a history of heart disease may face difficulties in obtaining coverage, especially if the condition is severe or requires ongoing medical management.

In some cases, life insurance providers might offer coverage but at a higher cost. They may require additional medical exams or ask for detailed medical records to assess the severity and management of your pre-existing condition. This process ensures that the insurer can accurately determine the level of risk they are taking on by providing you with a policy. It's important to be transparent about your health history during the application process to avoid any surprises or potential issues with claim settlements.

Furthermore, certain health conditions may be explicitly excluded from coverage. For example, terminal illnesses like advanced cancer or severe heart failure might be specifically mentioned as exclusions in the policy terms. In such cases, individuals with these conditions may need to explore alternative insurance options or seek specialized coverage tailored to their unique needs.

Understanding the impact of pre-existing health issues on life insurance is essential for making informed decisions. It highlights the importance of maintaining a healthy lifestyle and regularly reviewing your medical coverage to ensure you have adequate protection for yourself and your loved ones.

Adjustable Life Insurance: Cash Value Accessibility Explained

You may want to see also

Suicide: Suicide is often excluded from coverage

Suicide is a complex and sensitive issue, and it's important to understand how it impacts life insurance policies. When considering life insurance, it's crucial to know that many policies have specific exclusions related to suicide, which can significantly affect the coverage and benefits for beneficiaries. This exclusion is a critical aspect of life insurance that policyholders and potential buyers should be aware of.

Life insurance companies generally have a clause that explicitly states that death by suicide within the first two years of taking out a policy is not covered. This exclusion is a standard practice in the industry and is often a primary reason why life insurance companies may deny claims in such cases. The reasoning behind this exclusion is twofold: risk assessment and financial stability. Insurance providers want to ensure that the policy is not voided by fraudulent activities or intentional self-harm, which can lead to significant financial losses.

The impact of this exclusion can be significant for those who have recently purchased a life insurance policy. If an individual takes their own life within the initial two-year period, the insurance company may not honor the claim, leaving the beneficiaries with no financial support. This exclusion is a critical factor for individuals to consider before purchasing life insurance, especially if they have a history of mental health issues or are at risk of self-harm.

It is essential to carefully review the terms and conditions of any life insurance policy to understand the coverage and exclusions. Many policies provide clear guidelines on what is covered and what is not, including the specific mention of suicide. Prospective policyholders should seek professional advice to ensure they are fully informed about their rights and the potential risks associated with life insurance.

Furthermore, the insurance industry's approach to suicide coverage has evolved over time. Some companies now offer policies with longer waiting periods before excluding suicide claims, providing a more comprehensive safety net for policyholders. However, it is still crucial to disclose any relevant information during the application process to avoid potential issues with coverage.

Life Insurance and Drug Overdoses: What's the Verdict?

You may want to see also

Extreme Sports: Activities like skydiving are typically not insured

Extreme sports enthusiasts often face a unique challenge when it comes to life insurance. Activities such as skydiving, bungee jumping, white-water rafting, and base jumping are considered high-risk endeavors by insurance companies. As a result, these thrilling pursuits typically fall outside the scope of standard life insurance policies.

The primary reason for this exclusion is the inherent danger associated with extreme sports. These activities often involve a high degree of physical risk, and participants willingly engage in potentially life-threatening situations. Insurance providers are generally more cautious about insuring individuals who actively seek out such risks. The likelihood of a claim being made in these cases is significantly higher compared to more conventional activities.

For instance, consider the act of skydiving. While it offers an exhilarating experience, it also carries a substantial risk of injury or death. Insurance companies may view this as a high-risk activity, especially for beginners or those with limited experience. The potential for severe injuries, such as spinal damage, broken bones, or even fatalities, is a significant concern for insurers. As a result, they may refuse coverage or charge higher premiums for individuals involved in skydiving.

Similarly, other extreme sports like bungee jumping and white-water rafting present their own set of challenges. These activities often require specialized equipment and training, and participants may face unpredictable environmental conditions. The potential for accidents, equipment failures, or natural disasters can lead to serious injuries or fatalities. Insurance providers, therefore, may deem these activities too risky to insure, especially for those with limited experience or proper safety measures in place.

In summary, life insurance companies often exclude coverage for extreme sports due to the heightened risk and potential for severe consequences. While these activities offer an adrenaline rush, they may not be financially protected by a standard life insurance policy. It is essential for individuals engaging in such pursuits to carefully consider their insurance options and potentially explore specialized insurance plans that cater to their unique needs and hobbies.

Life Insurance General Agents: Their Role and Importance

You may want to see also

War and Terrorism: Life insurance may exclude coverage during conflicts

War and terrorism are often considered high-risk events, and as such, they can significantly impact life insurance policies. Many insurance companies may choose to exclude coverage during these times due to the inherent dangers and the potential for widespread chaos. When a country is at war or experiencing a terrorist attack, the risks associated with insuring individuals increase exponentially.

During a war, the likelihood of death or injury is extremely high, and insurance providers may deem it too risky to offer coverage. The same applies to terrorist activities, which often involve unpredictable and violent events. These situations can lead to a rapid and chaotic response from the authorities, making it challenging to assess and manage risks effectively. As a result, insurance companies might opt to exclude coverage for any claims arising from war-related incidents or terrorist attacks.

In the event of a war or terrorist incident, life insurance policies may specifically state that coverage is void or suspended. This exclusion is a common clause in many insurance contracts, ensuring that the insurer is not held liable for any claims that could potentially arise from such dangerous circumstances. It is essential for policyholders to carefully review their insurance documents to understand the terms and conditions, especially in relation to war and terrorism.

The impact of this exclusion can be significant for individuals and families who rely on life insurance for financial security. During times of conflict, the need for financial protection is often at its highest, but the lack of coverage can leave policyholders vulnerable. It is crucial for individuals to consider alternative risk management strategies and explore additional insurance options that might provide coverage during such challenging periods.

In summary, life insurance policies often exclude coverage during wars and terrorist incidents due to the increased risks and potential for widespread harm. Policyholders should be aware of these exclusions and explore other avenues to ensure their financial well-being, especially in regions or during periods where such risks are prevalent. Understanding the limitations of life insurance can help individuals make informed decisions and take appropriate measures to protect themselves and their loved ones.

Life Insurance Policy Surrender: What You Need to Know

You may want to see also

Illicit Drug Use: Engaging in illegal drug activities can void coverage

Engaging in illicit drug use is a critical factor that can significantly impact your life insurance coverage. Life insurance companies have strict policies regarding drug use, and any involvement with illegal substances can lead to the denial or voiding of your policy. This is primarily due to the inherent risks associated with drug use, which can lead to unforeseen health complications and sudden death, making it challenging for insurers to accurately assess and manage the risk.

When you apply for life insurance, you are required to disclose your medical history, lifestyle choices, and any potential risks that might affect your health. Illicit drug use is considered a high-risk behavior due to its potential for addiction, health complications, and legal consequences. Insurers are particularly concerned about the long-term effects of drug use, as it can lead to chronic health issues, organ damage, and even death. These risks are often deemed too significant to ignore, and as a result, insurance companies may refuse to provide coverage or charge higher premiums.

The impact of drug use on life insurance coverage is twofold. Firstly, if you are currently using illegal drugs, your application for life insurance may be denied outright. Insurance companies have the right to assess your overall health and lifestyle, and drug use can be a red flag, indicating a potential for high-risk behavior and health complications. Secondly, even if you have a history of drug use, insurers may still deny coverage or impose additional restrictions. This is because past drug use can be seen as a predictor of future behavior, and insurers want to minimize the risk of financial loss.

In some cases, insurers may offer coverage with certain conditions or exclusions. For instance, they might provide a policy with a lower death benefit or require regular medical check-ups to monitor your health. However, these options are often limited and may not provide the comprehensive coverage you need. It is essential to be transparent and honest about your drug use history to avoid any surprises or complications during the claims process.

In summary, illicit drug use is a critical factor that can void your life insurance coverage. Insurance companies have strict policies regarding drug use due to the associated health risks and legal implications. Being transparent about your drug use history is crucial to ensure you receive accurate coverage and avoid any potential issues during the claims process. It is always advisable to consult with an insurance professional to understand the specific policies and exclusions related to drug use in your region.

Life Insurance for the Young: A Smart Move?

You may want to see also

Frequently asked questions

Life insurance generally does not provide coverage for risks that are considered high-risk or dangerous. This includes activities like extreme sports (e.g., skydiving, rock climbing), certain criminal activities, or pre-existing medical conditions that are not disclosed during the application process. Additionally, life insurance may not cover natural disasters or acts of war, as these events are often considered unpredictable and beyond the control of the insured individual.

Yes, certain lifestyle choices can impact your life insurance coverage. For instance, if you smoke cigarettes, use tobacco, or consume excessive amounts of alcohol, your premiums may increase, and some policies might even exclude coverage for these habits. Similarly, pre-existing health conditions, such as diabetes, heart disease, or cancer, might be excluded or require a waiting period before coverage begins.

Absolutely. Life insurance policies often have specific exclusions for certain causes of death or injury. For example, death or injury caused by self-inflicted wounds, suicide (within a certain period, often two years), or criminal activities might be excluded. Additionally, pre-existing conditions, such as mental health disorders or chronic illnesses, may have waiting periods or limitations on coverage. It's important to review the policy details to understand what is and isn't covered.