Life insurance is a crucial financial tool that provides protection and peace of mind for individuals and their loved ones. PolicyGenius is an online platform that specializes in helping people understand and choose the right life insurance policy for their needs. It offers a comprehensive comparison of various insurance providers, allowing users to explore different options, compare prices, and make informed decisions. With its user-friendly interface and detailed information, PolicyGenius simplifies the process of finding and selecting life insurance, ensuring that individuals can secure the coverage that best suits their unique circumstances.

What You'll Learn

Life Insurance Basics: Understanding coverage, benefits, and types

Life insurance is a financial tool that provides a safety net for individuals and their families in the event of the insured's death. It is a contract between the policyholder and an insurance company, where the insurer promises to pay a designated beneficiary a sum of money upon the insured's passing. This fundamental concept offers financial security and peace of mind, ensuring that loved ones are protected even when the primary breadwinner is no longer around.

The primary purpose of life insurance is to provide financial support to the insured's family, covering various expenses that may arise after their death. These expenses often include funeral costs, outstanding debts, mortgage payments, or the daily living expenses of dependents. By having a life insurance policy, individuals can ensure that their families have the necessary financial resources to maintain their standard of living and achieve their long-term goals, even in the face of tragedy.

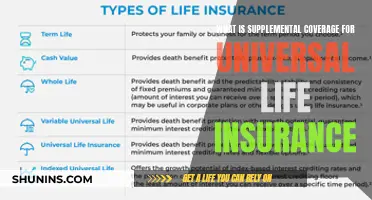

There are several types of life insurance policies available, each with its own unique features and benefits. The most common types include Term Life Insurance, Whole Life Insurance, Universal Life Insurance, and Variable Life Insurance. Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years, and is often more affordable. It offers a straightforward death benefit and is ideal for covering short-term financial obligations. Whole life insurance, on the other hand, is a permanent policy that provides coverage for the entire lifetime of the insured, offering a fixed death benefit and an accumulation of cash value over time. Universal life insurance combines the flexibility of term insurance with the permanent coverage of whole life, allowing policyholders to adjust their premiums and death benefits. Variable life insurance offers investment options, providing potential for higher returns but also carrying more risk.

When considering life insurance, it is essential to understand the coverage options available. The death benefit is the amount the insurance company will pay out upon the insured's death, and it is a critical factor in determining the policy's value. Policyholders can choose between a fixed death benefit, which remains the same throughout the policy's term, and a variable death benefit, which can fluctuate based on market performance. Additionally, some policies offer an additional rider called "accelerated death benefit," which allows the insured to access a portion of the death benefit if they are diagnosed with a terminal illness, providing financial relief without claiming the full benefit.

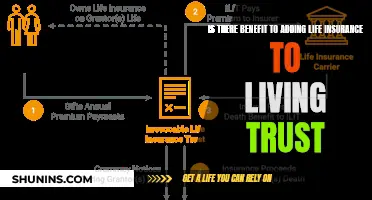

The benefits of life insurance extend beyond financial support. It can also serve as an estate-planning tool, helping to ensure that assets are distributed according to the insured's wishes. Moreover, life insurance can be a valuable asset in business ownership, as it can provide funds to buy out a partner's interest or to cover business debts in the event of the owner's death. Understanding the various types, coverage options, and benefits of life insurance is crucial for making informed decisions and selecting the policy that best suits one's needs and financial goals.

Life Insurance Beneficiary: Who Qualifies and How to Claim

You may want to see also

Policy Comparison: How to choose the right plan

When it comes to choosing the right life insurance policy, a comprehensive comparison is essential to ensure you make an informed decision. Here's a step-by-step guide to help you navigate the process:

Understand Your Needs: Begin by evaluating your personal circumstances and financial goals. Consider factors such as your age, health, income, and the number of dependents you have. Younger individuals might opt for term life insurance, which provides coverage for a specific period, while older adults may prefer permanent life insurance, offering lifelong protection. Understanding your needs will narrow down the options and make the comparison process more manageable.

Research and Compare Policies: Utilize online resources like PolicyGenius, which provides a wealth of information on various insurance providers. Compare different policies side by side, paying attention to coverage amounts, term lengths, and premium costs. Look for policies that offer a good balance between coverage and affordability. Check for any additional benefits or riders that can enhance the policy's value, such as an increase in death benefit or an investment component.

Evaluate Policy Features: Each insurance company offers unique features and benefits. When comparing policies, consider the following:

- Death Benefit: This is the amount paid out upon your passing, so ensure it aligns with your financial goals.

- Premiums: Compare the monthly or annual costs to find a policy that fits your budget.

- Riders and Add-ons: These can provide additional coverage for specific needs, such as critical illness or disability insurance.

- Conversion Options: Some policies allow you to convert term life insurance to a permanent plan without a medical exam, which can be advantageous in the long run.

Assess the Insurer's Reputation and Financial Stability: Choose an insurance company with a strong financial rating from reputable agencies. A stable insurer ensures that your policy is secure and that they can fulfill their obligations in the event of a claim. Check for customer reviews and ratings to gauge the company's reputation and customer satisfaction.

Consult Professionals: Consider seeking advice from independent financial advisors or insurance brokers who can provide personalized recommendations. They can help you understand the technical aspects of policies and ensure you make a choice that aligns with your best interests.

By following these steps and conducting thorough research, you can make an informed decision when comparing life insurance policies. Remember, the right plan should provide adequate coverage, be affordable, and suit your individual needs and preferences.

Unemployed and Seeking Life Insurance: What Are Your Options?

You may want to see also

Term vs. Permanent: Exploring different insurance duration options

When it comes to life insurance, one of the fundamental decisions you'll make is the duration of your policy. This choice is often presented as a trade-off between term insurance and permanent (or whole life) insurance. Understanding the differences between these two types of coverage is crucial for making an informed decision that aligns with your financial goals and needs.

Term Insurance:

Term insurance provides coverage for a specified period, known as the "term." This term can vary, ranging from a few years to several decades. During this period, the policy offers financial protection to your beneficiaries in the event of your death. One of the key advantages of term insurance is its affordability. It is typically less expensive than permanent insurance because it only provides coverage for a defined period. For example, a 10-year term policy will cover you for death during those 10 years, and if you survive, the policy expires without paying out. This type of insurance is ideal for individuals who want coverage for a specific goal, such as paying off a mortgage or covering children's education, without the long-term commitment.

Permanent (Whole Life) Insurance:

In contrast, permanent insurance, also known as whole life, offers lifelong coverage. This means that once you purchase the policy, your beneficiaries will receive a death benefit regardless of your age or health status at the time of your passing. The primary difference between permanent and term insurance is the long-term commitment. With permanent insurance, you pay premiums for the rest of your life, providing a sense of security that term insurance cannot. While it is more expensive, the value of a whole life policy grows over time, and it includes an investment component, allowing your money to accumulate tax-free. This type of policy is suitable for those seeking long-term financial security and the peace of mind that comes with knowing their loved ones will be protected indefinitely.

Choosing the Right Option:

The decision between term and permanent insurance depends on various factors. If your primary goal is to provide financial security for a specific period, such as during your working years, term insurance might be the better choice. It offers coverage when it's needed most and allows you to allocate your resources to other financial priorities. On the other hand, if you desire long-term financial protection and are willing to invest in a policy that grows in value over time, permanent insurance could be the ideal solution. It provides a safety net for your loved ones and can serve as an asset in your overall financial strategy.

In summary, understanding the duration of your life insurance policy is essential for making an informed decision. Term insurance offers affordable, temporary coverage, while permanent insurance provides lifelong protection and investment benefits. By evaluating your financial goals, risk tolerance, and long-term plans, you can determine which option best suits your needs and secure the financial future of your loved ones.

Life Insurance Deposits: IRS Reporting Requirements?

You may want to see also

Cost Factors: Age, health, and lifestyle impact premiums

The cost of life insurance is influenced by several factors, and understanding these can help you make informed decisions when choosing a policy. Age, health, and lifestyle are three critical aspects that significantly impact the premiums you'll pay.

Age is a primary determinant of insurance rates. Younger individuals typically pay lower premiums because they have a longer life expectancy, reducing the risk for insurance companies. As you age, your risk of developing health issues increases, leading to higher premiums. For instance, a 30-year-old might pay less for a term life policy compared to a 50-year-old, who may face higher rates due to the potential health concerns associated with older age.

Health plays a pivotal role in determining insurance costs. Insurance providers often consider medical history, current health status, and any pre-existing conditions. Individuals with chronic illnesses, such as diabetes or heart disease, may face higher premiums as their life expectancy is generally lower. Additionally, lifestyle choices like smoking, excessive alcohol consumption, or a sedentary lifestyle can also impact rates. For example, a non-smoker with a healthy diet and regular exercise routine may be offered more competitive rates compared to a smoker with health issues.

Lifestyle choices can significantly affect the cost of life insurance. Insurance companies often assess the risk associated with certain lifestyles. For instance, a high-risk profession like skydiving or a dangerous hobby like rock climbing may result in higher premiums. Similarly, extreme sports enthusiasts might pay more due to the increased likelihood of accidents or injuries. On the other hand, leading a healthy and active lifestyle can lead to lower rates, as it suggests a reduced risk of health-related issues.

In summary, age, health, and lifestyle are key factors that insurance companies consider when calculating premiums. Younger individuals, those with good health, and people with a healthy lifestyle are likely to benefit from lower insurance costs. Conversely, older individuals, those with pre-existing health conditions, and individuals with high-risk lifestyles may face higher premiums. Understanding these cost factors can help you navigate the insurance market and make choices that align with your budget and risk profile.

Life Insurance for the Differently Abled: Possibilities and Challenges

You may want to see also

Claim Process: Navigating death claims and policy settlements

The claim process for life insurance can be a complex and often emotional journey, especially during a time of grief. When a loved one passes away, the focus is understandably on honoring their memory and supporting the family. However, it's crucial to understand the steps involved in claiming the insurance policy to ensure a smooth and efficient process. Here's a comprehensive guide to help you navigate death claims and policy settlements:

- Notify the Insurance Company: The first step is to inform the insurance provider about the death of the policyholder. This can typically be done by contacting the company's customer service department. Provide them with the necessary details, including the full name of the deceased, their date of birth, and the policy number. Be prepared to offer any additional information they may require, such as proof of death certificates or funeral arrangements.

- Gather Required Documents: Insurance companies will need specific documents to process the claim. These may include a certified copy of the death certificate, which confirms the individual's passing. You might also need to provide the original policy document, which outlines the terms and conditions of the insurance plan. In some cases, the insurance provider may request additional paperwork, such as the policyholder's will or a legal declaration of death.

- Choose a Payout Option: Life insurance policies often offer various payout options, and it's essential to understand these choices. Common options include a lump-sum payment, which provides a one-time settlement, or periodic payments, such as monthly, quarterly, or annual installments. The chosen option should align with the family's financial needs and goals. Some policies may also offer a combination of both, providing flexibility in the settlement process.

- Complete and Submit the Claim Form: The insurance company will provide a claim form, which needs to be filled out accurately and completely. This form typically includes details about the deceased, the beneficiary, and the chosen payout method. Ensure that all information is correct and up-to-date. Submit the completed form, along with the required documents, to the insurance company's designated department.

- Review and Settle the Claim: Once the insurance company receives all the necessary documentation, they will review the claim. This process may take some time, and the company will verify the policy details, the cause of death, and the beneficiary's information. If the claim is approved, the insurance provider will initiate the payout process according to the chosen method. The settlement amount will be transferred to the designated beneficiary or beneficiaries as per the policy's terms.

- Seek Support and Guidance: Navigating the claim process can be overwhelming, especially during a challenging time. Consider seeking support from a trusted advisor or a financial professional who can provide guidance and ensure that your rights as a beneficiary are protected. They can assist in understanding the policy, making informed decisions, and ensuring a fair and timely settlement.

Remember, each insurance company may have its own specific procedures and requirements, so it's essential to follow their instructions carefully. Being proactive and organized in gathering the necessary documents and providing accurate information will contribute to a smoother claim process.

Term Life Insurance: Exclusion Decision Factors

You may want to see also

Frequently asked questions

Life Insurance PolicyGenius is an online platform that provides comprehensive information and resources about life insurance. It offers a user-friendly interface to help individuals understand different life insurance policies, compare options, and make informed decisions. The platform aims to simplify the process of choosing and managing life insurance coverage.

PolicyGenius offers a personalized approach to finding the best life insurance policy for your needs. You can input your specific requirements, such as age, health status, coverage amount, and preferred term length. The platform then provides tailored recommendations from various insurance providers, allowing you to compare features, benefits, and premiums to make an informed choice.

Yes, PolicyGenius facilitates the process of obtaining quotes and applying for life insurance. After exploring the available options, you can request quotes from multiple insurers, and the platform will guide you through the application process. This streamlined approach saves you time and effort in comparing and securing life insurance coverage.

PolicyGenius stands out by offering a more interactive and educational experience. It provides detailed explanations of different life insurance types, coverage options, and industry terms. The platform also includes a knowledge base and blog with informative articles, ensuring users can make well-informed decisions. Additionally, PolicyGenius offers personalized recommendations based on individual circumstances.

No, PolicyGenius is not an insurance company. It is a technology platform that connects users with licensed insurance providers. The platform's role is to provide unbiased information, comparison tools, and guidance, ensuring users can make informed choices. PolicyGenius does not sell insurance policies but assists in the process of finding suitable coverage.