Life insurance is a financial product that pays out a lump sum to a chosen person when the policyholder dies. The length of cover for life insurance, also known as the 'term', is chosen by the policyholder and can range from 12 months to 50 years. The length of cover is usually determined by the purpose of the policy, which is often to cover mortgage payments and/or living costs for the policyholder's dependents in the event of their death. The most common length for a life insurance policy is between 20 and 25 years, which is often the length of a mortgage term.

| Characteristics | Values |

|---|---|

| Purpose | To provide financial security for loved ones in the event of death |

| Factors to consider | How much you need, how much you can afford to pay each month, beneficiaries, and length of cover needed |

| Age | Younger people will have lower premiums |

| Minimum age | 18 |

| Maximum age | Policy must not end before 29th birthday |

| Types of cover | Life Insurance, Decreasing Life Insurance, Critical Illness Cover, Whole of Life Insurance, Level Term Insurance, Over 50s Life Insurance, Family Income Benefit, Increasing Term Insurance |

| Typical length | 20-25 years |

| Minimum length | 12 months |

| Maximum length | 50 years |

| Considerations | Mortgage, family members or financial dependents, whole life |

| Calculating cover | Income, needs, budget, dependents, mortgage, debts, inheritance tax, income replacement, child's education, other debts |

What You'll Learn

- The length of your life insurance policy is personal to you and should be based on the reason you need cover

- The cover length is dictated by what you want the insurance to cover, e.g. mortgage, funeral costs, inheritance tax, etc

- Life insurance policies typically run for 10, 20, 25, or 40 years

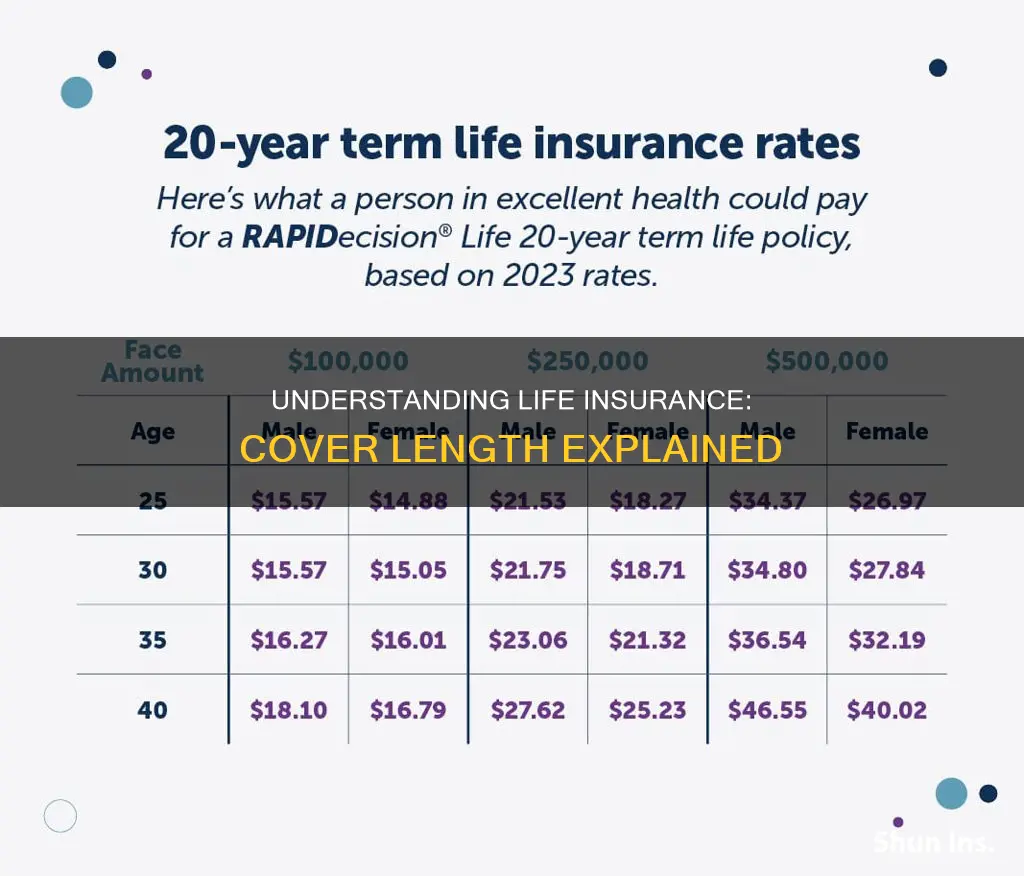

- The longer you are insured, the higher your premiums will be

- You can choose how long you want to be covered for, from 12 months to 50 years

The length of your life insurance policy is personal to you and should be based on the reason you need cover

Term life insurance, for example, is set for the length of the policy, often until your youngest child reaches the age of 18, and the amount that is paid out. This can help cover your family's living costs and your mortgage. The typical length of a term life insurance policy is 20 to 25 years, but it can be shorter or longer depending on your needs. If you're taking out life insurance to cover your mortgage, it's recommended that the term of the policy matches the term of the mortgage. That way, your loved ones can continue to live in the family home without worrying about the mortgage.

Decreasing life insurance is another option, which is usually cheaper in terms of premiums. The payout decreases over time, making it ideal for covering a repayment mortgage as the amount owed will also decrease.

Whole-of-life insurance covers your entire life and is designed to cover funeral costs. The premiums are generally more expensive than with term or decreasing life insurance.

When deciding on the length of your policy, consider factors such as how many years you have left on your mortgage, when your children might start earning their own income, and whether you have any other financial dependents. The amount of cover you need will depend on your income, needs, and budget.

It's important to remember that the longer you are insured, the higher your premiums will be, and it's always a good idea to seek advice from a financial adviser to ensure you're getting the right cover for your personal circumstances.

Key Man Life Insurance: Coding for Beginners

You may want to see also

The cover length is dictated by what you want the insurance to cover, e.g. mortgage, funeral costs, inheritance tax, etc

The cover length of a life insurance policy is typically influenced by the purpose for which it is taken out. Life insurance is designed to provide financial security for loved ones in the event of the policyholder's death. Here are some common reasons for taking out life insurance and how the cover length is influenced by these factors:

Mortgage Protection

One of the primary reasons individuals take out life insurance is to protect their mortgage. In this case, the cover length is typically aligned with the remaining length of the mortgage term. For example, if you have a 25-year mortgage, your life insurance policy should ideally match this duration. This ensures that your loved ones can continue living in the family home without worrying about mortgage payments.

Financial Protection for Dependents

Life insurance can also be taken out to provide financial protection for dependents, such as a partner or children, after the policyholder's death. In this case, the cover length is determined by how long the dependents are expected to be financially dependent. This could be until the youngest child turns 18 or finishes their education, or it could be longer if you want to cover university fees.

Funeral Costs

Funeral costs can be another reason to consider life insurance. In this case, the cover length may be shorter, as it is designed to cover the immediate costs associated with a funeral, which typically occur within a year of the policyholder's death.

Inheritance Tax

Life insurance can also help settle inheritance tax. The cover length in this case may depend on the specifics of the estate and the expected tax liability.

Age and Affordability

While the purpose of the insurance is a key factor in determining the cover length, other factors also come into play. Age is one such factor, as the younger you are when you take out a policy, the lower the premiums tend to be. Affordability is another consideration, as the cover length may be influenced by how much you can afford to pay each month.

In conclusion, the cover length of life insurance is dictated by the purpose of the policy and the specific circumstances of the individual taking out the insurance. It is important to carefully consider your own situation and seek advice if needed to ensure you choose the most appropriate cover length for your needs.

Life Alert: Insurance Coverage and Your Options

You may want to see also

Life insurance policies typically run for 10, 20, 25, or 40 years

The length of a life insurance policy is usually determined by the needs and circumstances of the policyholder. The most common term lengths for life insurance policies are 10, 20, 25, or 40 years. These policies are often chosen to cover the length of a mortgage or until children are old enough to support themselves financially.

A 10-year term life insurance policy may be suitable for parents or guardians with older children who still rely on their income or for someone approaching retirement. A 20-year term policy is a popular choice as it is affordable and easy to buy due to competition between insurance companies. This option is often chosen by new parents or newlyweds as their family grows. A 30-year term life insurance policy can be useful for covering large, long-term financial obligations, such as a mortgage or college debt, and may be preferred by young applicants who want to cover most of their earning years. A 40-year term life insurance policy is typically chosen by families and people protecting a mortgage debt.

When selecting a term length, it is important to consider factors such as the length of your mortgage, how long until your children are financially independent, and your retirement plans. It is recommended to round up the term length if your longest-lasting financial responsibility falls between the available term periods. For example, if your mortgage will be paid off in 17 years, you should consider choosing a 20-year term length.

Ethos Life Insurance: Reliable or Risky Business?

You may want to see also

The longer you are insured, the higher your premiums will be

Life insurance is a policy taken out to insure your life, and it is designed to provide financial support for your loved ones after you pass away. The length of your life insurance policy is influenced by personal factors, such as the reason for the insurance, your age, and your financial situation.

Additionally, if you are taking out life insurance to provide financial support for your family, you should consider how long they will need this support. For instance, you may want to ensure that your children are covered until they complete their full-time education or become financially independent.

It is worth noting that the younger you are when you take out a policy, the lower the premiums will be. Delaying your application may result in more expensive premiums in the future. Therefore, it is advisable to start your policy earlier to benefit from lower monthly costs.

Understanding Off-Term Life Insurance Claims and Payouts

You may want to see also

You can choose how long you want to be covered for, from 12 months to 50 years

The length of your life insurance policy is a personal choice and will depend on your reasons for taking out the policy. You can choose how long you want to be covered for, from 12 months to 50 years.

The most common reasons for taking out life insurance are to cover mortgage payments and to provide financial protection for loved ones. The length of your policy should reflect these reasons. For example, if you want to take out life insurance to cover your mortgage, the length of your policy should match the length of your mortgage. If you're taking out life insurance to provide financial protection for your family, you should consider how long they will be financially dependent on you. For example, you might want to take out a policy that lasts until your children have completed their education.

There are different types of life insurance policies, including term life insurance, decreasing life insurance, and whole-of-life insurance. Term life insurance is usually bought for between 25 and 40 years and is most common for families and people protecting a mortgage debt. Decreasing life insurance is usually cheaper and is designed to cover a repayment mortgage, so the amount of cover decreases over time. Whole-of-life insurance covers you for your entire life and is designed to cover funeral costs.

When deciding on the length of your policy, you should also consider your age. The younger you are when you take out a policy, the lower the premiums will be. Additionally, you should review your policy regularly and make changes if your circumstances change, such as paying off your mortgage early.

Surrendering Life Insurance: Tax Implications and You

You may want to see also

Frequently asked questions

Cover length in life insurance refers to the duration of the policy, i.e. how long you are insured for. The length of your life insurance policy is based on your personal circumstances and the reason you need life cover.

The cover length of your life insurance policy depends on factors such as your age, the purpose of the policy (e.g. covering mortgage payments, funeral costs, inheritance tax), and the number of years needed to ensure your family is financially independent.

Yes, you can change the cover length of your life insurance policy at any time by speaking to your insurer. However, changing the cover length may result in changes to your monthly premiums.