Supplemental coverage for universal life insurance is an additional layer of protection that enhances the benefits of a standard universal life policy. It provides extra financial security by offering a range of riders or add-ons that can be tailored to an individual's specific needs. These riders may include accelerated death benefits, which allow policyholders to access a portion of their death benefit before their passing, providing financial support during critical illnesses or other emergencies. Other riders could offer income replacement, waiving premiums, or additional critical illness coverage, ensuring that the policyholder's loved ones are financially protected even in unforeseen circumstances. Understanding these supplemental options is crucial for individuals seeking to maximize the value of their universal life insurance policy and ensure comprehensive financial security for their beneficiaries.

What You'll Learn

- Definition: Supplemental coverage enhances universal life insurance benefits, providing additional financial protection

- Benefits: It offers extra coverage for specific needs, like long-term care or critical illness

- Customization: Policies can be tailored to individual needs, allowing for personalized insurance solutions

- Cost: Premiums are typically lower than base policies, offering affordable additional protection

- Flexibility: Policyholders can adjust coverage as their needs change, ensuring ongoing relevance

Definition: Supplemental coverage enhances universal life insurance benefits, providing additional financial protection

Supplemental coverage, in the context of universal life insurance, is an additional layer of financial protection that extends beyond the basic insurance policy. It is a strategic enhancement designed to provide policyholders with extra benefits and security. This type of coverage is particularly valuable as it allows individuals to customize their insurance plans to better suit their unique needs and financial goals. By opting for supplemental coverage, policyholders can ensure that their insurance policy becomes a comprehensive and robust financial tool.

The primary purpose of supplemental coverage is to offer increased financial protection during unforeseen circumstances. Universal life insurance policies typically provide a death benefit to beneficiaries in the event of the insured's passing. However, supplemental coverage takes this a step further by offering additional benefits, such as accelerated death benefits, which can be used to cover expenses like medical bills, final arrangements, or even provide financial support to the policyholder during a critical illness or injury. This additional layer of coverage ensures that the insured and their loved ones are protected against a wide range of potential financial challenges.

One of the key advantages of supplemental coverage is its flexibility. It allows policyholders to tailor their insurance plan according to their specific requirements. For instance, individuals may choose to add an accelerated death benefit, which enables them to access a portion of their death benefit early if they are diagnosed with a critical illness or condition. This feature can be particularly beneficial for those facing significant medical expenses or who wish to provide financial support to their family during a challenging time. Additionally, supplemental coverage can include options like waiver of premium, which relieves the policyholder of premium payments if they become disabled, ensuring the policy remains in force even during periods of ill health.

When considering supplemental coverage, it is essential to understand the various options available. These may include different types of death benefits, such as a guaranteed death benefit, which provides a fixed amount upon the insured's passing, or a flexible death benefit, which allows the policyholder to adjust the death benefit amount over time. Other potential supplements could involve critical illness riders, which provide financial assistance for specific illnesses, or long-term care riders, which offer coverage for extended care needs. Each of these options can be customized to fit the policyholder's preferences and financial situation.

In summary, supplemental coverage for universal life insurance is a powerful tool for enhancing financial protection. It empowers individuals to take control of their insurance benefits and adapt them to their specific needs. By offering additional layers of security, such as accelerated death benefits and various riders, supplemental coverage ensures that the insured and their beneficiaries are prepared for a wide array of financial challenges. Understanding the available options and customizing the coverage accordingly can lead to a more comprehensive and effective insurance strategy.

Canceling HSBC Life Insurance: A Step-by-Step Guide

You may want to see also

Benefits: It offers extra coverage for specific needs, like long-term care or critical illness

Supplemental coverage, in the context of universal life insurance, is an additional layer of protection that can be tailored to meet specific financial needs. This type of coverage is designed to enhance the benefits of a universal life insurance policy, providing policyholders with extra financial security and peace of mind. It is a customizable feature that allows individuals to address unique circumstances and potential risks that may not be fully covered by the base policy.

One of the primary benefits of supplemental coverage is its ability to provide extended financial support during critical life events. Long-term care, for instance, can be an expensive and challenging experience for both the individual and their family. With supplemental coverage, policyholders can ensure that they have the necessary financial resources to cover the costs associated with long-term care facilities, in-home care, or even assisted living. This extra layer of protection can significantly ease the financial burden during a difficult time.

Additionally, supplemental coverage can offer critical illness insurance, which provides financial assistance when an individual is diagnosed with a serious or life-threatening illness. This coverage can help with medical expenses, lost income, and other related costs, ensuring that the policyholder and their family are financially protected during a critical illness. It provides a safety net, allowing individuals to focus on their health and recovery without the added stress of financial worries.

The beauty of supplemental coverage is its flexibility. It can be customized to fit individual needs and preferences. For example, one might choose to add coverage for nursing home care, which is a common and significant expense, or opt for coverage that includes specific critical illnesses. This customization ensures that the insurance policy adapts to the policyholder's evolving circumstances and provides relevant protection.

In summary, supplemental coverage for universal life insurance is a valuable addition that empowers individuals to take control of their financial future. It offers tailored protection, ensuring that specific needs, such as long-term care or critical illness, are adequately addressed. With this extra layer of security, policyholders can navigate life's challenges with greater confidence and financial stability.

Business Life Insurance: A Funding Tool for Entrepreneurs?

You may want to see also

Customization: Policies can be tailored to individual needs, allowing for personalized insurance solutions

Universal life insurance offers a unique advantage in its ability to provide customizable coverage, ensuring that each policyholder's needs are met with precision. This level of personalization is a cornerstone of universal life insurance, setting it apart from traditional insurance products. When it comes to supplemental coverage, the concept of customization takes center stage, allowing individuals to enhance their insurance protection in ways that are uniquely suited to their circumstances.

Supplemental coverage refers to additional benefits that can be added to a universal life insurance policy to provide extra financial security. These add-ons are designed to be flexible and adaptable, catering to the diverse needs of policyholders. For instance, an individual might choose to add a rider that provides coverage for long-term care, ensuring that their policy adapts to changing healthcare needs over time. This level of customization is particularly valuable for those who want to future-proof their insurance, ensuring it remains relevant and beneficial as their life circumstances evolve.

The beauty of supplemental coverage lies in its ability to provide tailored solutions. For example, a young professional might opt for a rider that offers accidental death and dismemberment (AD&D) coverage, providing financial protection in the event of a traumatic accident. Conversely, an older individual might prioritize critical illness coverage, ensuring that a serious health diagnosis is met with financial support. This level of customization ensures that the insurance policy becomes a dynamic tool, capable of adapting to the policyholder's changing priorities and financial goals.

Creating a personalized insurance plan involves a detailed understanding of one's unique situation. This includes assessing risk factors, considering future financial goals, and evaluating the potential impact of various life events. For instance, a policyholder might choose to add a waiver of premium rider, which would ensure that their policy remains in force even if they become unable to make payments due to illness or injury. Such customization ensures that the insurance policy becomes a reliable financial partner, providing peace of mind and security throughout life's journey.

In summary, the customization aspect of universal life insurance, particularly in the form of supplemental coverage, empowers individuals to take control of their financial security. By tailoring policies to individual needs, universal life insurance offers a level of flexibility and personalization that is rare in the insurance industry. This approach ensures that policyholders can build a robust financial safety net, one that adapts and grows with them over time.

American Life Insurance: Scam or Legit?

You may want to see also

Cost: Premiums are typically lower than base policies, offering affordable additional protection

Supplemental coverage for universal life insurance is an additional layer of protection that can be added to an existing universal life policy. It provides extra financial security and benefits, often at a lower cost compared to the base policy. This type of coverage is designed to enhance the overall protection of the insurance, ensuring that the policyholder and their beneficiaries receive the full value of their investment.

The cost of supplemental coverage is typically more affordable because it is an add-on feature rather than a standalone policy. When purchasing universal life insurance, the base policy covers the primary insurance needs, and the premiums for this base coverage are usually higher. However, supplemental coverage allows individuals to pay lower premiums for additional protection, making it an attractive option for those seeking extended financial security without a significant increase in costs.

This additional coverage can be tailored to meet specific needs, providing a customized solution for the policyholder. For example, it might include benefits such as accelerated death benefits, which can provide a lump sum payment if the insured person is diagnosed with a critical illness or condition, allowing them to access funds for medical expenses and other related costs. Another benefit could be the option to increase the death benefit, ensuring that the beneficiaries receive a higher payout in the event of the insured's passing.

By offering lower premiums, supplemental coverage becomes an accessible way to increase insurance protection without breaking the bank. It provides a flexible and cost-effective solution, allowing individuals to adapt their insurance needs as their circumstances change over time. This is particularly beneficial for those who want to ensure their loved ones are financially protected without compromising their financial goals or current insurance commitments.

In summary, supplemental coverage for universal life insurance is an affordable way to enhance protection, offering a range of benefits at a lower cost. It provides flexibility and customization, ensuring that individuals can secure their financial future with tailored insurance solutions. This additional layer of security can be a valuable asset for anyone looking to maximize their insurance coverage without incurring excessive expenses.

Unraveling the Mystery: Jackson Life Insurance EIN Demystified

You may want to see also

Flexibility: Policyholders can adjust coverage as their needs change, ensuring ongoing relevance

Supplemental coverage for universal life insurance offers a unique advantage that empowers policyholders with the flexibility to adapt their insurance plans to their evolving circumstances. This feature is particularly valuable as it ensures that the insurance policy remains relevant and aligned with the policyholder's changing needs over time.

The concept of flexibility in insurance is crucial, especially in the context of universal life insurance, which is a type of permanent life insurance that provides coverage for the entire life of the insured individual. As life progresses, people's financial goals, family structures, and risk tolerances can shift. For instance, a young professional might initially purchase a universal life insurance policy to secure their family's financial future. However, as they advance in their career, get married, or have children, their insurance needs may evolve. This is where supplemental coverage comes into play, allowing policyholders to make adjustments.

With supplemental coverage, policyholders can increase or decrease their insurance benefits based on their current financial situation and goals. For example, a policyholder might opt to increase their coverage during a period of financial stability and growth, ensuring that their loved ones are adequately protected. Conversely, if they experience a significant life change, such as a career transition or a reduction in income, they can adjust the coverage downward to match their new financial reality. This flexibility is a powerful tool, allowing individuals to stay in control of their insurance decisions and ensuring that their coverage remains relevant and effective.

The process of adjusting supplemental coverage is typically straightforward and can often be done without extensive paperwork. Policyholders can work with their insurance provider to review and modify the policy, ensuring that the changes reflect their current needs. This level of customization is a significant advantage, as it allows individuals to make informed decisions about their insurance without feeling constrained by a one-size-fits-all approach.

In summary, the flexibility offered by supplemental coverage in universal life insurance is a valuable asset for policyholders. It enables them to adapt their insurance plans as their lives change, ensuring that their coverage remains a reliable and relevant safeguard for their loved ones. This feature is a testament to the adaptability and responsiveness of universal life insurance, making it a versatile and powerful financial tool.

Universal Life Insurance: Can You Sell Your Policy?

You may want to see also

Frequently asked questions

Supplemental coverage, also known as an enhancement option, is an additional benefit offered by some universal life insurance policies. It provides an opportunity to increase the death benefit or policy value beyond the basic coverage. This extra coverage can be particularly useful for individuals who want to ensure their loved ones are fully protected in the event of their passing.

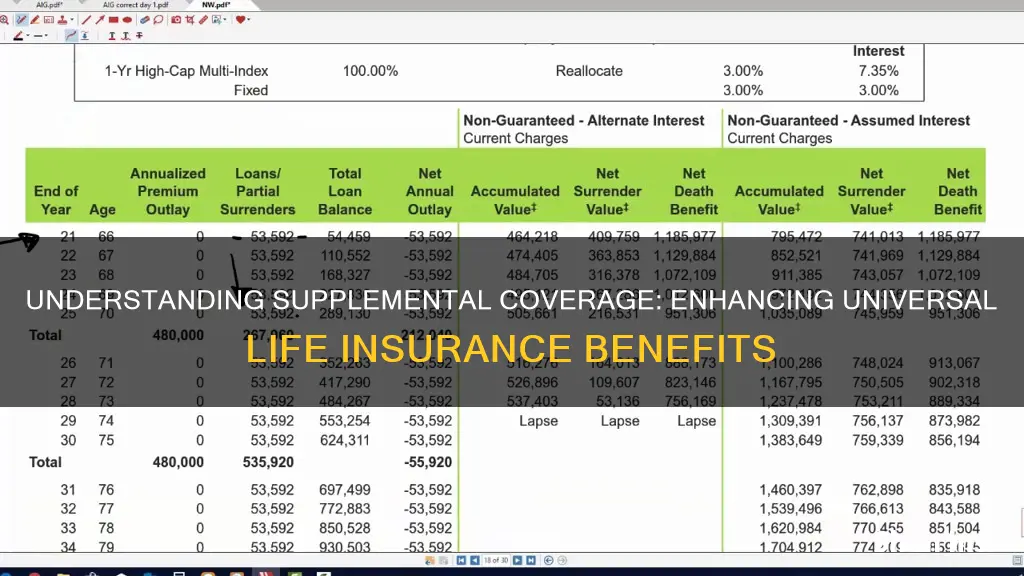

When you purchase a universal life insurance policy, the insurer typically offers the option to add supplemental coverage. This additional benefit is usually a percentage of the basic policy's death benefit. For example, if your base death benefit is $100,000, the supplemental coverage might allow you to increase it by 20%, resulting in a new death benefit of $120,000. The premium for this enhanced coverage will be higher than the standard policy premium.

Supplemental coverage offers several advantages. Firstly, it provides an extra layer of financial security, ensuring that your beneficiaries receive a larger payout in the event of your death. This can be crucial for covering significant expenses like funeral costs, outstanding debts, or providing long-term financial support to dependents. Secondly, it allows you to customize your policy to better fit your specific needs and financial goals. By increasing the death benefit, you can leave a more substantial legacy to your family.