Life insurance is a valuable tool for businesses of all sizes, and it can be leveraged in several ways to protect and benefit the company, its owners, employees, and their families. One of the primary uses of business life insurance is to provide financial protection to the company in the event of the owner's death, disability, or retirement. The death benefit can be used to pay off business debts, supplement cash flow, and cover expenses needed to find a replacement. Business life insurance can also be a funding tool, especially when the policy has a cash value component. This cash value can be borrowed against to fuel tax-free business growth or to provide supplemental cash flow during challenging economic times. Additionally, life insurance can be used to fund partnership agreements, equalize estates in family businesses, and attract and retain top talent by offering additional protection and benefits to key executives. In some cases, life insurance policies can even be used as collateral for loans, providing businesses with access to capital without surrendering their policies.

What You'll Learn

Using life insurance to fund a buy-sell agreement

Life insurance policies are often used to fund a potential buyout in the event of a partner's death. This provides a lump sum of cash to the surviving family members, helping to sustain them financially and ensuring business continuity. The life insurance proceeds are usually paid out quickly and are generally income tax-free, making it an attractive option.

There are two common types of buy-sell agreements: cross-purchase agreements and entity-purchase (or redemption) agreements. In a cross-purchase agreement, the remaining owners or partners purchase the share of the business for sale. In an entity-purchase agreement, the business entity itself buys the deceased's share. Some businesses also opt for a hybrid or "wait-and-see" agreement, which combines elements of both types.

When using life insurance to fund a buy-sell agreement, the company or the individual co-owners buy life insurance policies on the lives of each co-owner (but not on themselves). If a co-owner passes away, the policyowners (the company or the other co-owners) receive the death benefits, which are then paid to the surviving family members as payment for the deceased's interest in the business.

While life insurance can be a valuable funding tool for buy-sell agreements, there are some disadvantages to consider. Life insurance premiums are generally paid with after-tax dollars, and they represent an ongoing expense. Additionally, age, illness, or varying ownership percentages can impact the cost and availability of insurance for co-owners.

Overall, using life insurance to fund a buy-sell agreement can provide financial security for surviving family members and ensure a smooth transition of ownership and business continuity. However, it is important to carefully consider the advantages and disadvantages before implementing this strategy.

Life Insurance Options for People Living with COPD

You may want to see also

Using life insurance as collateral for loans

Benefits

- Access to Capital: This approach allows individuals and business owners to unlock the value of their life insurance policies without surrendering or liquidating them, providing an additional source of funding.

- Lower Interest Rates: Loans secured with collateral, such as life insurance, often come with lower interest rates compared to unsecured loans, making borrowing more affordable.

- Retain Investment Growth: By using the life insurance policy as collateral, policyholders can continue to benefit from the growth of the policy's cash value over time.

- Maintain Policy Benefits: The primary benefits of the life insurance policy, including the death benefit, remain intact, ensuring that beneficiaries are protected even while the policy is used as collateral.

Considerations

- Premium Payments: Regular premium payments must be maintained to keep the policy active. Failure to do so could result in policy lapse, jeopardizing the collateral.

- Impact on Beneficiaries: In the event of the policyholder's death, the lender will be paid first, reducing the death benefit available to the beneficiaries.

- Loan Terms: It is crucial to understand the loan terms and how they align with financial goals. The loan amount and repayment schedule should be manageable within the overall financial strategy.

Process

The process of using life insurance as collateral typically involves the following steps:

- Collateral Assignment Agreement: The policyholder agrees to a collateral assignment with the lender, granting them a claim on the policy's cash value and death benefit up to the loan amount.

- Approval and Documentation: The lender and policyholder complete and submit a collateral assignment form provided by the insurance company, which then records the assignment and notifies all parties.

- Access to Funds: Once the collateral assignment is in place, the lender approves the loan, with the amount based on the cash value of the life insurance policy and the borrower's creditworthiness.

- Loan Repayment: During the loan term, the policyholder continues to make premium payments to maintain the policy. If the loan is fully repaid, the collateral assignment is terminated, and the policyholder regains full control.

- In Case of Default or Death: If the borrower defaults, the lender can access the policy's cash value to cover the outstanding amount. In the event of the policyholder's death, the lender is paid first from the death benefit, with the remaining amount going to the designated beneficiaries.

Examples

- Hospitality and Food Services: A restaurant owner can use a life insurance policy as collateral to secure a loan for expanding their business or renovating their space without disrupting daily operations or depleting cash reserves.

- Pharmacies: A pharmacy owner can leverage their life insurance policy to secure a loan for investing in new technology and equipment, ensuring they remain competitive.

- Veterinary Clinics: A veterinarian can use a life insurance policy to secure a loan to purchase advanced diagnostic equipment and expand their clinic's facilities, enabling them to offer better services.

- Healthcare and Medical Practices: A medical professional can use their life insurance policy to obtain a loan to acquire another practice or invest in cutting-edge medical equipment, expanding their reach and improving patient care.

In summary, using life insurance as collateral for loans can be a strategic financial tool, providing access to funding while protecting assets. It offers benefits such as access to capital, lower interest rates, and the retention of investment growth and policy benefits. However, it is important to carefully consider the potential impact on beneficiaries and maintain regular premium payments to avoid policy lapse.

Variable Life Insurance vs Roth IRA: Which to Choose?

You may want to see also

Using life insurance to equalize an estate

Business life insurance can be used as a funding tool in several ways. It can be used to fund a buy-sell agreement, for instance, in the case of a stock redemption agreement or a cross-purchase agreement. It can also be leveraged to secure loans with favourable terms, as collateral assignments.

Estate equalization is a strategy that allows an individual, particularly a business owner, to divide their wealth fairly among multiple heirs, especially when business assets are involved. It ensures that all beneficiaries receive assets of equal value, not necessarily shares of the same assets.

Here's how life insurance can be used for estate equalization:

- Establish a distribution plan: Make a list of your distributable assets and decide on the details of their distribution, such as when and to whom. Consider all possible future heirs who may want a share of your assets.

- Determine the value of assets: Work with an estate planner or a similar financial professional to estimate the value of your assets. This information will be crucial when taking out a life insurance policy.

- Get coverage: Purchase a life insurance policy with a death benefit that matches the value of your other distributable assets, such as a family business. A corporate-owned life insurance (COLI) plan can be beneficial in this case.

For example, consider Joe, a sole proprietor of a family business, who passes away. Joe's son wants to sell the business as he has his own company, while Joe's daughter wants to continue running the family business. To prevent legal disputes and ensure a fair distribution, Joe can opt for estate equalization:

- Equal inheritance: Both children receive co-ownership of the house and the business, a 50-50 split of Joe's savings, and an equal share of the life insurance death benefit.

- Equitable inheritance: The daughter receives the full life insurance payout (equal to the value of the business), co-ownership of the house, 25% of Joe's savings, and full ownership of the business. The son receives co-ownership of the house and 75% of Joe's savings.

In this case, estate equalization is a better solution as Joe's assets were distributed equitably, not just monetarily equally. This example highlights the importance of considering an equal vs. equitable divide in estate planning and the value of business assets.

Discover Card: Life Insurance Benefits and Coverage

You may want to see also

Using life insurance to retain key employees

Life insurance can be a valuable tool for businesses to retain their key employees and ensure business continuity. Key person insurance, also known as key employee insurance, is a type of life insurance policy that businesses can purchase to protect themselves from the financial impact of losing indispensable executives or employees. This insurance coverage is crucial when a business heavily relies on one or two employees, and their absence would result in significant financial hardship.

Here's how key person insurance works:

Identifying Key Employees

A key employee is someone whose knowledge, skills, reputation, or client connections significantly contribute to the business's success. Their loss would likely cause substantial negative financial consequences. Examples include business partners, leading salespeople, production managers, or employees with highly specialized knowledge or skills.

Impact of Losing Key Employees

The loss of a key employee can have a devastating impact on an organization. It can disrupt operations, slow down time to market, and result in financial losses. Additionally, recruiting and replacing a key employee can be challenging and costly, requiring management time and effort and significant expenses.

How Key Person Insurance Works

Key person insurance is a life insurance policy purchased by the business to insure the life of a top employee. If the insured employee passes away, the business receives a lump-sum insurance payment. This payment can be used to cover recruiting costs, overhead expenses, or any other operating expenses incurred due to the employee's absence.

Ownership and Consent

It's important to note that the business owns the policy and pays the premiums. However, before a policy can be taken out on a key employee, life insurance companies require the written consent of the person being insured. Additionally, the employee's agreement is necessary, and in some cases, a resolution from the company's board of directors stating the policy's purpose may be required.

Determining the Coverage Amount

There is no set formula to determine the financial impact of a key employee's death. Businesses need to assess the potential financial consequences and decide on an appropriate coverage amount. Factors to consider include the employee's responsibilities, the cost of replacement, and the expected disruption to operations. A common starting point is to add the employee's salary to their direct financial contribution to the company's bottom line and multiply the result by at least five.

Types of Policies

Businesses can choose between term life insurance and permanent life insurance for key person coverage. Term life insurance is more affordable but only provides temporary coverage. On the other hand, permanent life insurance has higher premiums but offers additional benefits, such as building cash value that the business can borrow against or withdraw for future expenses.

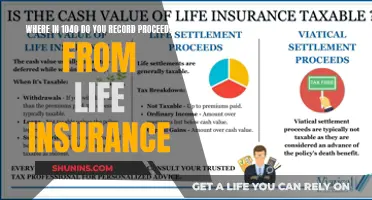

Tax Implications

While premiums paid for key person policies are generally not tax-deductible, any cash value accumulated in a permanent policy is tax-deferred. Small businesses can typically borrow against the monetary value of a permanent policy without triggering a taxable event, and in some cases, the death benefit may also be tax-exempt.

In conclusion, key person insurance is a valuable tool for businesses to protect themselves from the financial impact of losing indispensable employees. It provides a critical financial cushion, helping businesses stabilize operations, recruit replacements, and ensure business continuity. By investing in key person insurance, businesses can retain their top talent and mitigate the risks associated with unexpected employee loss.

Green Card Life Insurance: What's the Deal?

You may want to see also

Using life insurance to protect your family

Life insurance is an important tool for protecting your family, especially if you are a business owner. Here are some ways life insurance can be used to safeguard your loved ones:

Lump Sum Payment and Income Replacement

Life insurance can provide your family with a lump sum of money and/or a monthly income to maintain their current lifestyle if you pass away or become unable to work due to illness or injury. This can help cover funeral expenses, clear outstanding debts, and provide financial stability for your dependents.

Mortgage Protection

If you have a mortgage, life insurance can be essential in securing your home. Mortgage protection life insurance will cover the cost of your mortgage if you die during the term of the policy, ensuring your family has one less financial burden to worry about.

Family Protection Plans

A family protection plan offers financial security in the event of unexpected illness or death. It can help clear loans or debts, pay a monthly income to meet outgoings, and maintain your family's lifestyle if a stay-at-home parent passes away.

Business Succession Planning

If you own a business, life insurance can be used to fund a buy-sell agreement. This ensures that your business can be continued or successfully wound down in the event of your death, disability, or retirement. It also helps your heirs by providing them with the necessary funds to run the business or pay transfer taxes if they inherit it.

Peace of Mind

Life insurance offers peace of mind for you and your family. Knowing that your loved ones will be financially secure, no matter what happens to you, can reduce stress and provide a sense of stability.

When considering life insurance to protect your family, it's important to evaluate your individual circumstances, including your occupation, health, and financial situation. Consult with financial advisors and insurance providers to find the right type and amount of coverage for your specific needs.

Do I Have Mortgage Life Insurance?

You may want to see also

Frequently asked questions

Business life insurance is a versatile tool that provides a solid financial foundation for businesses of all sizes. It can be used to attract top talent, build loyalty, and help employees protect their loved ones. Business owners can also use it to protect their company, family, partners, and key employees from financial strain in the event of an unexpected death.

Business life insurance policies with a cash value component, such as whole life insurance, can be used as collateral for loans. This allows business owners to unlock the value of their policies without surrendering them. The policy's cash value serves as security for the lender, providing the business owner with access to funds that may otherwise be difficult to obtain.

Using business life insurance as a funding tool offers several advantages. It provides access to capital, often with lower interest rates, allowing businesses to secure funds that may otherwise remain untapped. It also enables business owners to retain investment growth and maintain the primary benefits of the policy, including the death benefit, even while using it as collateral.

There are important considerations to keep in mind. The policyholder must continue making regular premium payments to keep the policy active and avoid jeopardizing the collateral. In the event of the policyholder's death, the lender is typically paid first, which may reduce the death benefit available to the beneficiaries. Additionally, the loan terms should align with the business's financial goals and strategy.