Variable life insurance is a type of permanent life insurance that combines a death benefit with an investment feature. It is often sold as a retirement account, but it is expensive and comes with more risk than a Roth IRA. Roth IRAs are usually the best vehicles to save for retirement. However, a permanent life insurance policy with a cash value component can be a good supplement for some high-net-worth individuals.

If you are considering cancelling your variable life insurance for a Roth IRA, you should take into account your income, tax-protected investment space, and the fees and risks associated with each option.

| Characteristics | Values |

|---|---|

| Type of account | Roth IRA |

| Variable Life Insurance | |

| Annual contribution limit | $6,500 in 2023 |

| $130 per month | |

| Tax treatment | No tax deduction in the year of contribution |

| No tax on accrued funds if the account is owned for at least five years and the owner has reached age 59½ before making a withdrawal | |

| Tax-deferred growth in investments | |

| Subject to income taxation upon withdrawal | |

| Penalties for early withdrawal | |

| Fees | No fee to open |

| No closing fees | |

| Expense ratio for investments can be as low as 0.05% a year | |

| Large commissions (40-80% of the first year's premium) | |

| Ongoing expenses, which are about 3% per year |

What You'll Learn

Variable life insurance has low gains

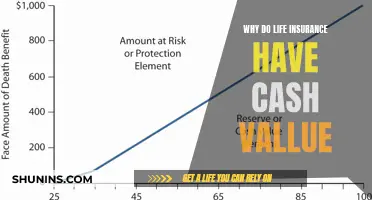

Variable life insurance policies are permanent life insurance policies that have a higher potential for earning cash compared to traditional policies. However, they often have higher fees and management costs than other kinds of permanent life insurance. These fees can eat into the investment gains made by the policyholder, resulting in low net gains.

Variable life insurance policies have a cash value component that can be invested in securities such as stocks, mutual funds, index funds, and bonds. The policyholder has control over how this money is invested, but there is a risk of losing money if, for example, a stock dips in price or the company goes bankrupt. The investments are also subject to market volatility, which can lead to losses during poor-performing years.

In addition to the risks associated with market performance, variable life insurance policies come with various fees and charges that can impact the overall returns. These include mortality and expense risk charges, sales and administrative fees, investment management fees, policy loan interest, and surrender charges. These fees can be quite high, especially for actively managed investments, and they may offset any potential earnings.

While variable life insurance policies offer the potential for higher returns compared to traditional policies, the fees and investment risks associated with them can result in low net gains for policyholders. Therefore, it is essential to carefully consider the costs and potential benefits before investing in variable life insurance.

Trusts and Life Insurance: A Smart Combination?

You may want to see also

Variable life insurance is a poor investment for retirement

Variable life insurance also has high costs, including insurance costs, which can be higher for the elderly, and surrender charges. These costs can reduce returns and flexibility. For example, if you decide you no longer want the policy, you may face a surrender charge and lose a significant portion of your cash balance. Variable life insurance also has a long-term commitment, which may not suit everyone.

There are better alternatives to variable life insurance for retirement. These include a 401(k), IRA, or Roth IRA, which offer tax advantages. Term life insurance is also a more affordable option for those who need a death benefit.

Life Insurance in Canada: Who Can You Insure?

You may want to see also

Variable life insurance is a complex product

Variable life insurance is a combination of insurance and investments. The odds of the company offering the best of both are slim. Variable life insurance is also generally sold with large commissions, which are a conflict of interest and never come back to the buyer.

Variable life insurance can be beneficial for high-net-worth individuals who have already maxed out their contributions to traditional retirement accounts and have income to spare. However, there are a lot of variables and assumptions that need to be considered when deciding if variable life insurance is right for you.

Life Insurance with a Stent: Is It Possible?

You may want to see also

Variable life insurance is expensive

High Commissions

Variable life insurance is sold by commissioned salespeople. These commissions are often very high, sometimes as much as 40-80% of the first year's premium. This is a conflict of interest, as the salesperson has a strong incentive to recommend the product which pays the highest commission, which is often the worst product for the customer.

Complexity

Variable life insurance is a complex product with a lot of moving parts and assumptions. The prospectuses and disclosures for these products are often hundreds of pages long. This complexity makes it difficult for customers to understand what they are buying, and makes it easier for salespeople to sell products which are not in the customer's best interests.

Mixing Insurance and Investing

Variable life insurance combines insurance and investing. This means that customers end up with inferior insurance and investments. It is unlikely that the company has combined the best possible insurance with the best possible investments.

Surrender Charges

Variable life insurance policies often have surrender charges, which means that if you cancel the policy within the first few years, you will lose not only your death benefit but also a considerable portion of your cash balance.

High Investment Fees

Variable life insurance policies often have high investment fees, typically around 3% per year. By contrast, the average expense ratio for open-end mutual funds and ETFs is between 0.5% and 1.0%.

Poor Investment Options

Variable life insurance policies often have poor investment options, such as actively managed funds with high expense ratios. Even if a variable life insurance policy has good investment options, there is no guarantee that the insurance company will not substitute them for terrible loaded high-expense-ratio funds in the future.

Lack of Flexibility

Variable life insurance policies require long-term commitments, often of several decades. This means that customers are locked in to making large premium payments for many years, even if their financial situation changes.

Risk of Regulatory Change

Variable life insurance policies are subject to regulatory change, which could make them less advantageous in the future. For example, the US government could change the tax rules around these policies, or the insurance company could change the rules around the policy.

Whole Life Insurance Dividends: Are They Guaranteed Payouts?

You may want to see also

Variable life insurance is not flexible

Variable life insurance policies are complex and require more hands-on attention. They typically have higher premiums than other cash-value life insurance policies. The fees tend to be the highest of any permanent life insurance policy, including mortality and expense risk charges, sales and administrative fees, and investment management fees.

Variable life insurance policies also have a surrender period, during which you will pay fees if you withdraw part of the cash value or cancel your coverage. This can be costly, especially in the first 10 to 15 years of the policy when the cash value is typically not equal to the actual surrender value.

In addition, if you use the cash value of the policy as collateral for a loan, the insurer will charge interest on the loan. This loan interest, along with the other fees associated with variable life insurance, makes it a costly option.

Variable life insurance may be a good choice for individuals who are comfortable with risk and want the potential for higher returns. However, it is important to carefully consider the fees and charges associated with these policies, as they can add up quickly and eat into any potential gains.

Baby Gerber Life Insurance: Is It Worth the Hype?

You may want to see also

Frequently asked questions

Variable life insurance is a type of permanent life insurance that offers both a death benefit and a cash value account. The cash value account is invested in stocks, bonds, and money market accounts, which can offer higher returns than other types of permanent life insurance. However, variable life insurance is complex, and the investments can be expensive and risky.

A Roth IRA is a tax-advantaged retirement account that offers tax-free growth and withdrawals in retirement. There are no required minimum distributions, and you can withdraw contributions at any time without penalty. However, there are income limits for contributing to a Roth IRA, and there are restrictions and tax penalties for withdrawing earnings before age 59½.

Cancelling variable life insurance and investing the money in a Roth IRA can offer higher returns and more flexibility. However, there may be tax implications and penalties for cancelling the policy, and you will lose the death benefit. You should consult a financial advisor to determine the best course of action for your specific situation.

There are several alternatives to cancelling variable life insurance for a Roth IRA. You could keep the variable life insurance policy and invest additional funds in a Roth IRA. You could also consider other types of permanent life insurance, such as whole life or universal life, or explore other retirement savings options such as a 401(k) or annuity.