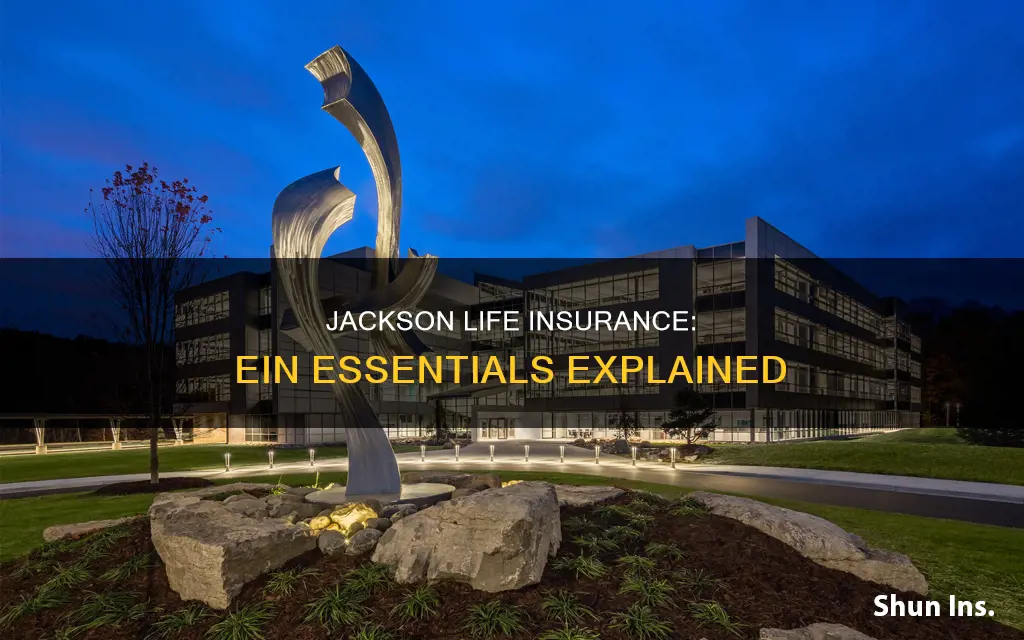

Jackson National Life Insurance Company, also known as Jackson, is a US company that provides annuities for retail investors and fixed-income products for institutional investors. The company was founded in 1961 and is headquartered in Alaiedon Township, Lansing, Michigan. Jackson was a subsidiary of British insurer Prudential plc until 2021, when it was spun off into two separately listed companies. In this article, we will be discussing Jackson's EIN.

| Characteristics | Values |

|---|---|

| Name | Jackson National Life Insurance Company |

| Marketing Name | Jackson |

| Parent Company | Prudential plc |

| Year Founded | 1961 |

| Headquarters | Alaiedon Township, Lansing, Michigan |

| Area of Focus | Annuities for retail investors and fixed income products for institutional investors |

What You'll Learn

Jackson National Life Insurance Company

Jackson was founded in 1961 in Jackson, Michigan, and moved to its headquarters in Lansing, Michigan, in 1976. In the early years, the company focused on offering term insurance to individuals as an alternative to whole life products. Jackson was named after Andrew Jackson, the seventh President of the United States.

Prior to being spun off in 2021, Jackson was a subsidiary of the British insurer, Prudential plc, which acquired the company for $608 million in 1986. The company is unrelated to the American insurance conglomerate, Prudential Financial.

In March 2003, Jackson entered the registered investment adviser channel with the launch of Curian Capital LLC. Jackson's acquisitions of Life Insurance Company of Georgia in 2005 and SRLC America Holding Corp. (SRLC) in 2012 each added 1.5 million in-force life insurance and annuity policies to Jackson's books.

Primerica Life Insurance: Is Cash Value a Feature?

You may want to see also

Jackson Financial Inc

Jackson was a subsidiary of the British insurer Prudential plc from 1986 until 2021, when it was spun off into two separately listed companies. Prior to this, Prudential shareholders were entitled to receive one share of Jackson’s Class A common stock for every 40 Prudential ordinary shares held.

Jackson is committed to helping clarify the complexity of retirement planning for financial professionals and their clients. Through their range of annuity products, financial know-how, history of award-winning service and streamlined experiences, they strive to reduce the confusion that complicates retirement planning. They take a balanced, long-term approach to serving all their stakeholders, including customers, shareholders, distribution partners, employees, regulators and community partners.

The Ultimate Guide to Understanding Blanket Life Insurance

You may want to see also

Jackson National Life Insurance Company of New York

Jackson National Life Insurance Company provides annuities for retail investors and fixed-income products for institutional investors. The company's subsidiaries and affiliates also provide specialised asset management and retail brokerage services.

In the early years, Jackson focused on offering term insurance to individuals as an alternative to whole life products. In 2003, Jackson entered the registered investment adviser channel with the launch of Curian Capital LLC. The company's acquisitions of the Life Insurance Company of Georgia in 2005 and SRLC America Holding Corp. in 2012 each added 1.5 million in-force life insurance and annuity policies to Jackson's books.

Prior to being spun off in 2021, Jackson was a subsidiary of the British insurer, Prudential plc, which acquired the company for $608 million in 1986. The company is unrelated to the American insurance conglomerate, Prudential Financial. Jackson was named after Andrew Jackson, the seventh President of the United States.

Is Ladder Life Insurance Worth the Climb?

You may want to see also

Jackson's acquisitions

Jackson National Life Insurance Company (often referred to as simply Jackson) is a US company that provides annuities for retail investors and fixed-income products for institutional investors. Jackson was founded in 1961 in Jackson, Michigan, and moved to its headquarters in Lansing, Michigan, in 1976. The company was named after Andrew Jackson, the seventh President of the United States.

In the early years, Jackson focused on offering term insurance to individuals as an alternative to whole life products. In March 2003, Jackson entered the registered investment adviser channel with the launch of Curian Capital LLC. Jackson's acquisitions of the Life Insurance Company of Georgia in 2005 and SRLC America Holding Corp. (SRLC) in 2012 each added 1.5 million in-force life insurance and annuity policies to Jackson's books.

Prior to being spun off in 2021, Jackson was a subsidiary of the British insurer, Prudential plc, which acquired the company for $608 million in 1986. Prudential announced on 28 January 2021 its intention to demerge Jackson, resulting in two separately listed companies. Prudential shareholders as of 2 September 2021, were entitled to receive one share of Jackson’s Class A common stock for every 40 Prudential ordinary shares held on that date.

Understanding the Life Insurance Conversion Period: Flexibility and Options

You may want to see also

Jackson's history

Jackson National Life Insurance Company, often referred to as simply Jackson, was founded in 1961 in Jackson, Michigan, and moved to its headquarters in Lansing, Michigan in 1976. The company is named after Andrew Jackson, the seventh President of the United States. In its early years, Jackson focused on offering term insurance to individuals as an alternative to whole life products.

In March 2003, Jackson entered the registered investment adviser channel with the launch of Curian Capital LLC. In 2005, Jackson acquired the Life Insurance Company of Georgia, adding 1.5 million in-force life insurance and annuity policies to its books. In 2012, Jackson acquired SRLC America Holding Corp. (SRLC), again adding 1.5 million in-force life insurance and annuity policies to its books.

Jackson was acquired by the British insurer, Prudential plc, in 1986 for $608 million. In 2021, Prudential announced its intention to demerge Jackson, resulting in two separately listed companies. Shareholders of Prudential as of 2 September 2021 were entitled to receive one share of Jackson’s Class A common stock for every 40 Prudential ordinary shares held on that date.

Marriage and Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

Jackson is the marketing name for Jackson Financial Inc., Jackson National Life Insurance Company and Jackson National Life Insurance Company of New York.

Jackson Life Insurance Company is headquartered in Lansing, Michigan.

Jackson Life Insurance Company was founded in 1961 in Jackson, Michigan.

Jackson Life Insurance Company provides annuities for retail investors and fixed income products for institutional investors.