When it comes to finding the most cost-effective life insurance, understanding the different coverage options and their associated costs is crucial. The term mode in this context refers to the type of insurance policy and its associated payment structure. In this article, we will explore the various modes of life insurance and discuss how to choose the one that offers the least amount per year, ensuring you get the best value for your financial investment. We'll delve into the pros and cons of each mode, helping you make an informed decision about your life insurance coverage.

What You'll Learn

- Term Life Insurance: Temporary coverage, affordable, and ideal for short-term needs

- Whole Life Insurance: Permanent coverage with a savings component, higher costs

- Universal Life Insurance: Flexible premiums, adjustable coverage, and potential investment options

- Variable Life Insurance: Offers investment options, higher risk, and potential for higher returns

- Review and Adjust: Regularly assess your needs and adjust coverage accordingly

Term Life Insurance: Temporary coverage, affordable, and ideal for short-term needs

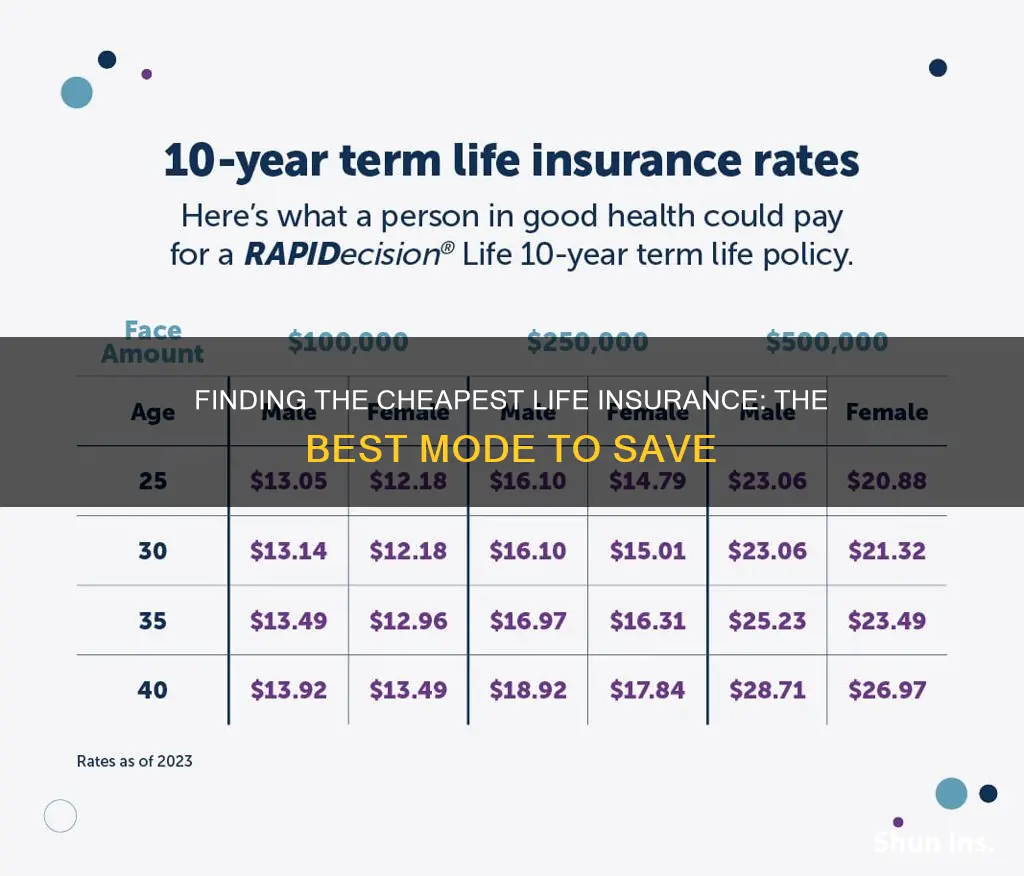

Term life insurance is a type of coverage that provides a specific period of protection, offering a straightforward and cost-effective solution for those seeking insurance. This policy is designed to meet short-term needs, providing a safety net for individuals and their families during critical times. It is an excellent option for those who want to ensure their loved ones are financially protected without the long-term commitment and higher costs associated with permanent life insurance.

The beauty of term life insurance lies in its simplicity and affordability. It is typically more budget-friendly compared to other life insurance types because it focuses on providing coverage for a defined period. This temporary nature allows insurers to offer competitive rates, making it accessible to a wide range of individuals. When considering the least amount per year for life insurance, term life often comes out on top due to its structured and time-bound approach.

For those with short-term needs, such as covering mortgage payments, funding children's education, or providing financial security for a specific period, term life insurance is an ideal choice. It ensures that your loved ones receive the necessary financial support if something happens to you during the specified term. This type of policy is particularly useful for individuals who want to protect their family's financial well-being without the complexity and higher costs of permanent insurance.

One of the advantages of term life insurance is its flexibility. You can choose the duration of the policy, typically ranging from 10 to 30 years, depending on your specific needs and financial goals. This flexibility allows you to align the coverage with your short-term objectives, ensuring that the insurance is tailored to your requirements. Additionally, term life insurance often offers a guaranteed death benefit, providing a fixed amount to your beneficiaries if you pass away during the policy term.

In summary, term life insurance is a practical and affordable solution for individuals seeking temporary coverage. Its structured approach and competitive rates make it an attractive option for those with short-term needs. By choosing term life insurance, you can provide essential financial protection for your loved ones without the long-term commitment, ensuring peace of mind during critical periods. Remember, when considering the least amount per year for life insurance, term life insurance is often a top contender due to its cost-effectiveness and tailored coverage.

Life Insurance Payouts: Who Gets Them and How?

You may want to see also

Whole Life Insurance: Permanent coverage with a savings component, higher costs

Whole life insurance is a type of permanent life insurance that provides coverage for your entire life, offering both a death benefit and a savings component. It is designed to be a long-term financial commitment, ensuring that your loved ones are protected financially even after your passing. One of the key advantages of whole life insurance is its ability to accumulate cash value over time, which can be borrowed against or withdrawn as needed. This feature makes it a popular choice for those seeking both insurance protection and a way to build wealth.

However, it's important to note that whole life insurance typically comes with higher costs compared to other insurance options. The premiums for this type of policy are generally more expensive because of the extended coverage period and the guaranteed death benefit. The savings component of whole life insurance allows the policy to grow tax-deferred, providing a potential source of funds for various financial goals. This growth is achieved through the accumulation of cash value, which is the portion of the premium that is invested rather than paid out as a death benefit.

The higher costs of whole life insurance can be attributed to several factors. Firstly, the extended coverage period ensures that the insurance company has a longer time to invest the premiums, allowing for potential returns on investment. Additionally, the guaranteed death benefit means that the insurance company is committed to paying out a specific amount upon the insured's death, which requires a more substantial financial reserve. These factors contribute to the higher premiums, making whole life insurance less affordable for some individuals.

Despite the higher costs, whole life insurance can be a valuable financial tool for those seeking long-term financial security. It provides a sense of peace of mind, knowing that your loved ones will be financially protected regardless of life's uncertainties. Moreover, the cash value accumulation can be utilized for various purposes, such as funding education expenses, starting a business, or providing a source of income during retirement.

When considering whole life insurance, it is essential to evaluate your financial goals and risk tolerance. While it offers permanent coverage and a savings component, the higher costs may not be suitable for everyone. It is advisable to consult with a financial advisor or insurance professional to determine the most appropriate insurance mode that aligns with your needs and budget. They can provide personalized recommendations and help you navigate the various options available to find the least expensive yet comprehensive solution for your life insurance requirements.

Life Insurance and Taxes: What's the Government's Cut?

You may want to see also

Universal Life Insurance: Flexible premiums, adjustable coverage, and potential investment options

Universal life insurance offers a unique and flexible approach to life coverage, providing policyholders with a range of benefits that can adapt to their changing needs. One of the key advantages is the ability to customize both the premiums and the level of coverage, making it a versatile choice for individuals seeking tailored insurance solutions.

In traditional life insurance, premiums are typically set at a fixed rate for the entire term of the policy. However, with universal life insurance, policyholders have the freedom to adjust their payments. This flexibility allows individuals to choose lower initial premiums, which can be particularly appealing for those on a tight budget. Over time, as the policyholder's financial situation improves, they can increase the premium payments, ensuring that the coverage remains adequate and up-to-date. This adjustable nature of premiums is a significant departure from conventional insurance models, providing a more personalized and cost-effective solution.

The coverage aspect of universal life insurance is equally customizable. Policyholders can decide on the amount of death benefit they wish to have in place, allowing them to tailor the insurance to their specific needs. For instance, someone with a large family and significant financial responsibilities might opt for a higher death benefit to ensure their loved ones are financially secure. Conversely, a younger individual with fewer dependents may choose a lower benefit, keeping costs down while still having essential coverage. This level of customization ensures that the insurance policy aligns perfectly with the policyholder's life circumstances and goals.

Furthermore, universal life insurance often incorporates investment options, adding another layer of flexibility. Policyholders can allocate a portion of their premiums into investment accounts, which are typically separate from the insurance portion. These investment accounts can grow over time, potentially increasing the overall value of the policy. The earnings from these investments can then be used to pay for future premiums, reducing the overall cost of the insurance. This feature is particularly attractive to those who want to make the most of their money and potentially build a substantial financial asset alongside their insurance coverage.

In summary, universal life insurance stands out for its adaptability and customization. With the ability to adjust premiums and coverage, it provides policyholders with a tailored insurance experience. The potential investment options further enhance the policy's value, allowing individuals to potentially grow their money while also securing their loved ones' financial future. This type of insurance is an excellent choice for those seeking a flexible and personalized approach to life insurance, ensuring they get the most out of their premiums while having the coverage they need.

Life Insurance: Understanding 'Paid-Up' Policies

You may want to see also

Variable Life Insurance: Offers investment options, higher risk, and potential for higher returns

Variable life insurance is a unique type of permanent life insurance that offers policyholders a combination of insurance protection and investment opportunities. Unlike traditional whole life insurance, which provides a fixed death benefit and premiums, variable life insurance allows for more flexibility and customization. This type of policy is designed to cater to individuals who are comfortable with a certain level of risk and are seeking to grow their money over time.

One of the key features of variable life insurance is the investment component. Policyholders can choose from a variety of investment options, such as stocks, bonds, and mutual funds, which are managed by the insurance company. These investments can offer the potential for higher returns compared to more conservative investment vehicles. By allocating a portion of the policy's cash value to these investment options, policyholders can benefit from market growth and potentially increase the overall value of their policy. This feature is particularly attractive to those who want to make the most of their insurance premiums and potentially build a substantial investment portfolio over time.

However, it's important to understand that this investment aspect also comes with higher risk. The performance of the investments directly impacts the policy's cash value and, consequently, the death benefit. If the investments underperform or experience losses, the policy's value may decrease, and the death benefit could be reduced. This risk is a trade-off for the potential for higher returns, making variable life insurance more suitable for individuals who are willing to accept market volatility.

For those who are new to investing or prefer a more hands-off approach, variable life insurance can still be a viable option. Policyholders can typically choose from a range of investment strategies, allowing them to align the policy with their risk tolerance and financial goals. Some insurance companies even offer guaranteed minimum death benefits, providing a safety net even if the investments don't perform as expected. This feature ensures that the insurance component remains intact, even during challenging market conditions.

In summary, variable life insurance is an attractive choice for individuals seeking a more dynamic and potentially rewarding insurance product. It offers the opportunity to grow wealth through investments while still providing a safety net in the form of insurance coverage. However, it is crucial to carefully consider the risks involved and ensure that the chosen investment options align with one's financial objectives and risk tolerance. With the right approach, variable life insurance can be a powerful tool for long-term financial planning.

Smart Score Life Insurance: The Smartest Way to Insure

You may want to see also

Review and Adjust: Regularly assess your needs and adjust coverage accordingly

Reviewing and adjusting your life insurance coverage is a crucial aspect of ensuring you have the right amount of protection at the most affordable cost. It's a proactive approach that allows you to stay in control of your financial security. Here's a guide on how to effectively review and adjust your life insurance policy:

Understand Your Current Coverage: Begin by evaluating your existing life insurance policy. Determine the type of coverage you have (term life, whole life, etc.), the death benefit amount, and the duration of the policy. This baseline knowledge will help you identify any gaps or excesses in your coverage. For instance, if your policy's death benefit is no longer sufficient to cover your family's expenses or if it has expired, it's time to reconsider.

Life Changes and Needs Assessment: Life is dynamic, and so are your insurance needs. Regularly assess your life circumstances and financial obligations. Consider factors such as marriage, the birth of children, purchasing a home, or significant career advancements. These life events often lead to increased financial responsibilities, and your insurance should reflect these changes. For example, starting a family might require a higher death benefit to ensure your loved ones' financial stability.

Review and Adjust Periodically: It's essential to schedule regular reviews of your life insurance policy. Life insurance needs can change over time due to various factors. A periodic review, ideally once a year, allows you to make necessary adjustments. During these reviews, consider your current financial situation, health, and any new commitments. For instance, if you've paid off your mortgage, you might want to reduce the death benefit accordingly.

Consult a Financial Advisor: When reviewing and adjusting your policy, consider seeking professional advice. A financial advisor can provide valuable insights and help you make informed decisions. They can assess your overall financial plan, including retirement savings, investments, and other insurance policies, to ensure your life insurance coverage complements your overall financial strategy. This holistic approach can lead to more efficient and cost-effective insurance solutions.

Consider Lifestyle and Health Changes: Your health and lifestyle choices can significantly impact your insurance premiums. If you've made positive changes, such as quitting smoking, improving your diet, or increasing your physical activity, these can lead to lower insurance rates. Conversely, significant health issues or lifestyle changes might require adjustments to your coverage. Regular health check-ups and maintaining a healthy lifestyle can contribute to better insurance rates and coverage.

By following these steps, you can ensure that your life insurance policy remains relevant and cost-effective. Regular reviews and adjustments will help you stay protected without overpaying, providing peace of mind and financial security for you and your loved ones.

Life Insurance: Millions of Contracts Orphaned and Forgotten

You may want to see also

Frequently asked questions

Term life insurance is generally the most cost-effective option for coverage. It provides a death benefit for a specified term, such as 10, 20, or 30 years, and is typically less expensive than permanent life insurance, which offers lifelong coverage. The younger and healthier you are, the lower the premiums will be.

The choice of term length depends on your specific circumstances and financial goals. If you need coverage for a specific period, such as until your children are financially independent or a mortgage is paid off, a shorter-term policy might be suitable. Longer-term policies, like 20 or 30 years, offer more comprehensive coverage but at a higher cost. It's essential to evaluate your financial obligations and future plans when deciding on the term length.

Yes, many term life insurance policies offer the option to convert them into a permanent life insurance policy, usually after a certain period. This conversion privilege allows you to continue your coverage indefinitely without a medical examination. It can be a valuable feature if you want to ensure lifelong protection and are concerned about future health changes that might affect your insurance rates. However, converting to a permanent policy may be more expensive, so it's best to review the terms and conditions of your chosen plan.