Suze Orman, a renowned personal finance expert, advocates for term life insurance as a practical and cost-effective solution for families seeking financial protection. Unlike permanent life insurance, term life insurance provides coverage for a specific period, typically 10, 20, or 30 years, making it an affordable option for those who need coverage during their working years. Orman emphasizes that term life insurance is a straightforward and efficient way to secure financial stability for loved ones, ensuring that they are protected in the event of the insured's untimely death. This type of insurance offers a clear and defined purpose, making it a preferred choice for those who prioritize simplicity and financial efficiency in their insurance decisions.

What You'll Learn

- Affordability: Suze Orman praises term life insurance for its cost-effectiveness compared to permanent policies

- Specific Needs: Term insurance is ideal for covering specific financial obligations, according to Orman

- Temporary Coverage: Orman highlights term life as a temporary solution for specific financial needs

- Simplicity: Term life insurance is straightforward and easy to understand, Orman believes

- Flexibility: Orman appreciates term life's flexibility, allowing policyholders to adjust coverage as needed

Affordability: Suze Orman praises term life insurance for its cost-effectiveness compared to permanent policies

Suze Orman, a renowned personal finance expert, often recommends term life insurance as a practical and affordable solution for individuals seeking life coverage. One of the key reasons she endorses term life insurance is its superior cost-effectiveness compared to permanent life insurance policies.

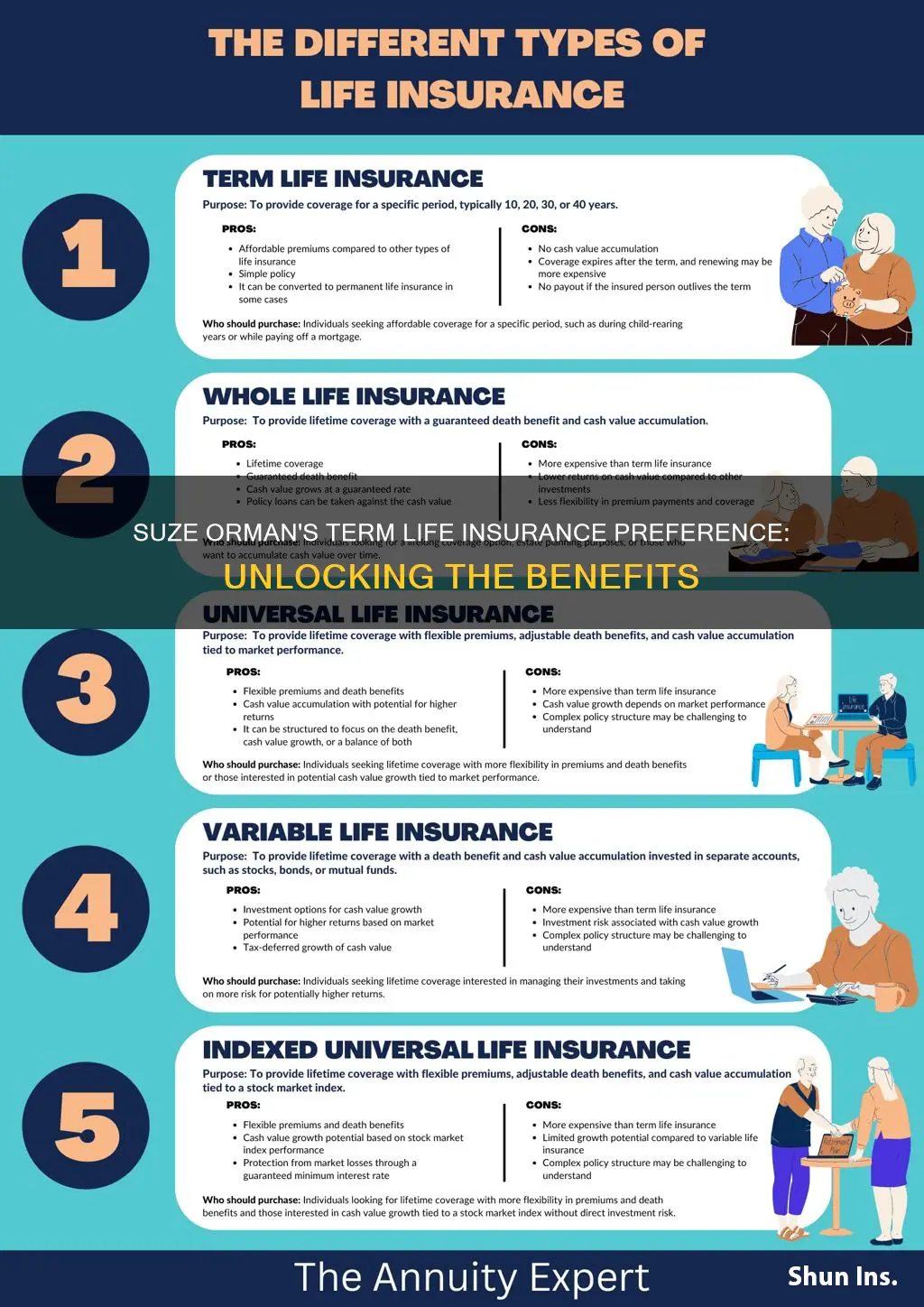

Term life insurance is designed to provide coverage for a specific period, typically 10, 20, or 30 years. During this term, the policy offers a death benefit if the insured individual passes away. The beauty of term life insurance lies in its simplicity and affordability. It is a pure insurance product, focusing solely on the risk of death during the specified period. As a result, the premiums are generally lower than those of permanent life insurance, which includes an investment component.

Permanent life insurance, also known as whole life or universal life, provides lifelong coverage and includes an investment component, allowing the policy to accumulate cash value over time. While this type of policy offers more comprehensive coverage, it comes at a higher cost. The investment aspect of permanent life insurance means a larger portion of the premium goes towards building a cash value, which can be borrowed against or withdrawn. In contrast, term life insurance premiums are more affordable because they are solely dedicated to providing death benefit coverage.

Orman emphasizes that for many people, especially those with families or financial responsibilities, term life insurance is an excellent choice. It allows individuals to secure their loved ones' financial future without the burden of higher premiums associated with permanent policies. By choosing term life insurance, individuals can allocate their financial resources more efficiently, ensuring adequate coverage without breaking the bank.

In summary, Suze Orman's preference for term life insurance is strongly tied to its affordability. The simplicity and lower costs of term policies make it an attractive option for those seeking life insurance without the added complexity and expense of permanent coverage. This recommendation highlights the importance of considering one's financial goals and priorities when making insurance decisions.

Understanding Tax on Life Insurance Cash Surrender Value

You may want to see also

Specific Needs: Term insurance is ideal for covering specific financial obligations, according to Orman

Suze Orman, a renowned personal finance expert, advocates for term life insurance as a powerful tool to address specific financial needs. This type of insurance is designed to provide coverage for a defined period, making it an excellent choice for individuals seeking a tailored solution to their unique obligations. According to Orman, term life insurance is particularly effective in covering financial responsibilities that may change over time, such as mortgage payments, children's education expenses, or business startup costs.

The beauty of term insurance lies in its flexibility and cost-effectiveness. It offers a straightforward approach to securing financial protection without the complexity of permanent life insurance policies. When an individual's financial obligations are at their highest, such as during the early years of a mortgage, term life insurance can provide a safety net. This ensures that if something happens to the policyholder, their loved ones will have the financial resources to meet those specific needs.

Orman emphasizes that term life insurance is a precise match for those seeking to cover particular financial commitments. For instance, if someone is paying off a 30-year mortgage, a 10-year term policy can provide the necessary coverage during the most critical period. As the mortgage is paid off, the insurance coverage can be adjusted or terminated, ensuring that the individual's financial strategy remains aligned with their evolving circumstances.

Furthermore, term life insurance is an affordable way to secure a substantial death benefit. It allows individuals to protect their families or beneficiaries without the long-term financial burden associated with permanent insurance. This affordability is particularly appealing to those with specific financial goals, as it enables them to allocate their resources efficiently while still providing essential coverage.

In summary, Suze Orman's endorsement of term life insurance highlights its suitability for addressing specific financial obligations. By offering tailored coverage for defined periods, term insurance empowers individuals to manage their financial responsibilities effectively. Whether it's securing a mortgage, funding education, or supporting business ventures, term life insurance provides a practical and cost-efficient solution, ensuring that financial obligations are met even in the face of unforeseen circumstances.

Understanding the Law of Large Numbers: Its Impact on Life Insurance

You may want to see also

Temporary Coverage: Orman highlights term life as a temporary solution for specific financial needs

Suze Orman, a renowned personal finance expert, often emphasizes the importance of term life insurance as a strategic financial tool, particularly for those seeking temporary coverage. This type of insurance is designed to provide protection for a specific period, making it an ideal choice for individuals with particular financial goals and circumstances.

Term life insurance offers a straightforward and cost-effective way to secure financial stability during critical times. It is a temporary measure that ensures a family's financial well-being if the primary breadwinner were to pass away. Orman suggests that this type of insurance is particularly beneficial for those with short-term financial obligations, such as paying off a mortgage, funding a child's education, or covering other debts. By taking out a term life policy, individuals can ensure that their loved ones are financially protected until these obligations are met.

The beauty of term life insurance lies in its simplicity and affordability. It provides a fixed amount of coverage for a predetermined period, typically 10, 20, or 30 years. During this term, the policyholder pays regular premiums, and in return, the insurance company promises to pay a death benefit to the designated beneficiaries if the insured individual passes away. This structured approach allows individuals to manage their finances effectively, knowing that their family's financial future is secure for a specific duration.

Orman's preference for term life insurance is evident in her advice to prioritize this coverage when building a comprehensive financial plan. She encourages individuals to view term life as a building block for their overall financial strategy, especially when they have a limited time frame in mind. For instance, a young professional with a growing family and a mortgage might opt for a 20-year term policy, ensuring that their family is protected during the critical years when their financial needs are most significant.

In summary, Suze Orman's endorsement of term life insurance as a temporary coverage solution is based on its ability to provide focused financial protection. By understanding the specific needs and goals of an individual, term life insurance can be tailored to offer the necessary coverage during the most relevant time periods. This approach ensures that financial resources are allocated efficiently, addressing immediate concerns while also contributing to long-term financial security.

Who Gets the Payout? Contesting Life Insurance Beneficiary Designation

You may want to see also

Simplicity: Term life insurance is straightforward and easy to understand, Orman believes

Suze Orman, a renowned personal finance expert, advocates for term life insurance due to its simplicity and ease of understanding. Unlike permanent life insurance, which can be complex and often includes various riders and features, term life insurance is straightforward and focused. Orman emphasizes that the primary purpose of life insurance is to provide financial protection for a specific period, typically 10, 20, or 30 years. This simplicity makes it easier for individuals to grasp the concept and value of the policy.

In her financial advice, Orman highlights that term life insurance is a pure insurance product. It provides coverage for a defined period, and the policyholder pays a fixed premium for the duration of the term. This clarity in pricing and coverage duration is a significant advantage, allowing individuals to make informed decisions without the confusion often associated with other insurance types.

The expert's preference for term life insurance is rooted in the idea that simplicity is essential for financial planning. By keeping the product simple, individuals can better understand their insurance needs and make choices that align with their financial goals. Orman's approach encourages people to focus on the core aspects of life insurance, ensuring they have adequate coverage without unnecessary complications.

Orman's recommendation for term life insurance is particularly appealing to those who prefer a no-frills, straightforward financial product. The absence of additional features or riders means that the policy is easy to manage and understand, providing clear value for the premium paid. This simplicity is a key factor in Orman's advocacy for term life insurance as a practical and efficient way to secure financial protection.

In summary, Suze Orman's endorsement of term life insurance is based on its simplicity and ease of comprehension. By offering a clear and focused product, term life insurance allows individuals to make informed decisions about their financial security without the complexity often associated with other insurance types. This straightforward approach is a significant advantage in Orman's view, making term life insurance a preferred choice for those seeking simple and effective financial protection.

Who is a Claimant in Life Insurance Policies?

You may want to see also

Flexibility: Orman appreciates term life's flexibility, allowing policyholders to adjust coverage as needed

Suze Orman, a renowned personal finance expert, advocates for term life insurance due to its inherent flexibility, a feature she highly values. This flexibility is particularly beneficial for individuals who may experience changes in their financial circumstances or life goals over time. Term life insurance offers a straightforward approach to coverage, providing a set amount of protection for a specified period, typically 10, 20, or 30 years. This structured duration allows policyholders to tailor their insurance to their current needs without the complexity of permanent policies.

One of the key advantages of this flexibility is the ability to adjust coverage as life circumstances evolve. For instance, a young professional starting a family might opt for a higher coverage amount to ensure financial security for their loved ones. As they progress in their career and accumulate more assets, they can review and potentially increase their coverage to reflect their growing financial responsibilities. Conversely, when their children become financially independent or their assets are adequately protected, they can consider reducing the coverage to avoid over-insuring.

Orman's appreciation for this flexibility is rooted in the idea that life insurance should be a dynamic financial tool, adapting to the ever-changing nature of an individual's life. Unlike permanent life insurance, which offers lifelong coverage with an investment component, term life insurance is straightforward and focused on providing protection during specific life stages. This simplicity enables policyholders to make informed decisions about their insurance needs without the added complexity of permanent policies.

The flexibility of term life insurance also extends to the ease of policy adjustments. Policyholders can typically modify their coverage by increasing or decreasing the death benefit, providing an additional layer of customization. This adaptability ensures that individuals can maintain adequate protection without overpaying for unnecessary coverage. As financial situations change, the ability to adjust the policy accordingly becomes a valuable asset, allowing individuals to stay protected without the burden of excess insurance.

In summary, Suze Orman's endorsement of term life insurance is significantly influenced by its flexibility. This feature empowers individuals to make informed decisions about their insurance needs, adapt coverage as their lives change, and ensure they receive the most suitable protection without unnecessary complications. The straightforward nature of term life insurance makes it an attractive option for those seeking a dynamic and customizable approach to life insurance.

Cashing in on Liberty National Life Insurance: A Step-by-Step Guide

You may want to see also

Frequently asked questions

Suze Orman, a renowned personal finance expert, emphasizes term life insurance because it provides high coverage at a lower cost compared to permanent life insurance. This type of insurance is ideal for those seeking affordable protection for a specific period, typically covering a mortgage, children's education, or other financial obligations.

Term life insurance is advantageous for individuals with clear financial goals and a defined period for coverage. It allows them to secure their loved ones' financial future during critical years without the long-term commitment and higher costs associated with permanent insurance.

Term life insurance is preferred by Suze Orman due to its simplicity and cost-effectiveness. It offers pure insurance without an investment component, making it a straightforward and affordable way to protect against financial loss during a specific term.

Young families often require substantial coverage to protect against potential financial disasters. Term life insurance provides an affordable way to ensure that children are financially secure and that mortgage payments are covered if something happens to the primary earner.

Suze Orman believes that term life insurance is a crucial component of financial planning, especially for those with a limited budget. It allows individuals to allocate their resources efficiently, focusing on other financial goals while ensuring their family's well-being during a defined period.