Life insurance is a financial safety net for your family in case of your untimely demise. But are there taxes on the cash balance of life insurance?

The answer is: it depends. Cash value life insurance is generally not taxable as it grows within the policy. However, taxes may apply in certain situations, such as when you withdraw funds, take out a loan, or surrender the policy.

If you withdraw up to the total amount of premiums paid, it is typically tax-free. But withdrawing any gains, such as dividends, will be taxed as ordinary income. Similarly, loans taken against the cash value are usually not taxable, but if the policy lapses with an outstanding loan balance, the unpaid portion may be treated as taxable income.

Surrendering or cashing out a policy may also trigger taxes on any amount exceeding the total premiums paid. Additionally, if the proceeds go to a taxable estate, such as when the beneficiary passes away before you or no beneficiary is named, the cash value may be subject to estate taxes.

It's important to understand the specific rules and consult a tax advisor to navigate the tax implications of life insurance policies.

| Characteristics | Values |

|---|---|

| Are cash value life insurance proceeds taxable? | Cash value life insurance proceeds are generally not taxable. |

| Are there instances where cash value life insurance proceeds are taxable? | Yes, cash value life insurance proceeds may be taxable in the following instances: - Withdrawing more than the total amount of premiums paid into the policy - Surrendering the policy - Taking out a loan from the policy and the policy terminates before the loan is repaid - The policy is a modified endowment contract (MEC) |

| Are life insurance death benefits taxable? | Life insurance death benefits are generally not taxable. |

| Are there instances where life insurance death benefits are taxable? | Yes, life insurance death benefits may be taxable in the following instances: - The beneficiary receives the benefit in installments and any interest that builds up on those payments - The policyholder leaves the death benefit to their estate instead of directly naming a person as the beneficiary - The policy is a MEC |

What You'll Learn

Taxes on cashing out a life insurance policy

Cashing out a life insurance policy, also known as "surrendering" it, can be a quick way to get cash, but it may come with tax implications. When you surrender your policy, you will receive the cash surrender value (CSV), which is the amount remaining after any fees are deducted. However, if the CSV is higher than the amount of premiums you've paid into the policy (your cost basis), the excess is typically taxed as ordinary income.

For example, if you've paid $30,000 in premiums and the CSV of the policy is $45,000, the $15,000 difference would be taxed as ordinary income, possibly pushing you into a higher tax bracket for that year. Therefore, it's important to consider the potential tax implications before surrendering your life insurance policy.

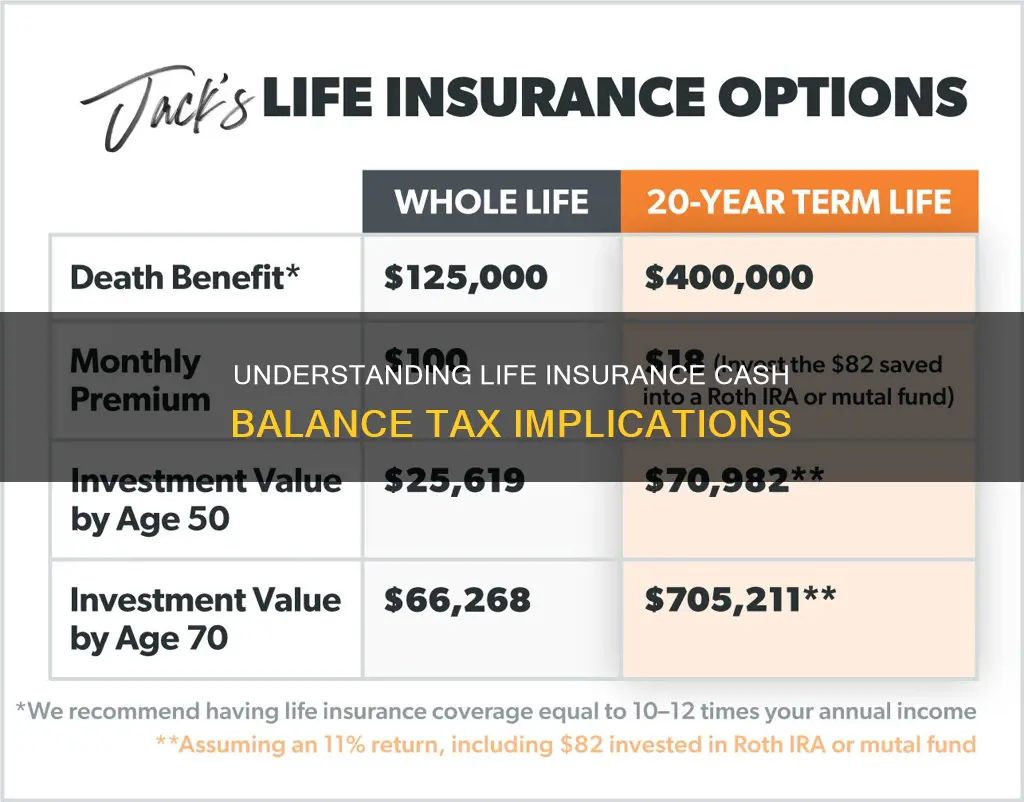

It's worth noting that the rules for taxing life insurance proceeds vary depending on the type of policy you have. With a permanent life insurance policy, such as whole life or universal life, you can generally withdraw or borrow money from the policy's cash value without incurring taxes, as long as you don't withdraw more than you've paid in premiums. However, if you cash out the entire policy, you may have to pay taxes on any amount that exceeds your cost basis.

On the other hand, term life insurance does not have a cash value component, so there are no tax implications for withdrawals or borrowing. However, if you sell a term life insurance policy or surrender it for cash, you may have to pay taxes on any gain you make from the sale.

In addition, there are a few other situations where taxes could be owed on a life insurance policy. If you take out a loan from your life insurance plan and the policy terminates before you've repaid it, you may be taxed on the outstanding loan balance. Additionally, if you choose to receive the life insurance payout in installments instead of a lump sum, any interest that accumulates on those payments will be taxed as regular income. Finally, if you leave the death benefit to your estate instead of directly naming a person as the beneficiary, the payout may be subject to estate taxes.

Insurers' Investment Risk: Whole Life Insurance Explained

You may want to see also

Tax on interest earned on beneficiary life insurance proceeds

Life insurance is often seen as a reliable way to provide for loved ones after you're gone, and one of its biggest advantages is the tax relief it offers. Typically, the death benefit your beneficiaries receive isn't taxed as income, meaning they get the full amount to use for expenses like paying off debts, covering funeral costs, or securing their future. However, there are a few situations where taxes could come into play, and it's important to know when that might happen.

Interest on Life Insurance Proceeds

Interest earned on beneficiary life insurance proceeds or periodic (annuity) payments is generally taxable. Insurance companies often pay interest when beneficiaries refrain from immediately accessing the proceeds of a policy. Those interest earnings are usually reported on each beneficiary's annual tax return and may result in taxes due.

If the death benefit is paid out in installments and the remaining portion earns interest, that interest would be taxable. This is because any interest earned on the death benefit is subject to tax. The death benefit itself is typically not taxed, but any interest that accumulates on those installment payments will be taxed as regular income. If the payout is spread over time, your beneficiaries should be prepared to report the interest on their taxes.

Other Exceptions

There are a few other exceptions where life insurance proceeds may be taxed. For example, if the policyholder elects to delay the benefit payout and the money is held by the life insurance company for a given period, the beneficiary may have to pay taxes on the interest generated during that period. When a death benefit is paid to an estate, the person or persons inheriting the estate may have to pay estate taxes.

Another exception occurs when a policyholder leaves the death benefit to their estate instead of directly naming a person as the beneficiary. If the estate's total value is large enough, it may trigger estate taxes, reducing what your loved ones ultimately receive.

In summary, while life insurance proceeds are typically not taxed, there are a few situations where taxes may be owed, such as on interest earned on the proceeds or in certain estate-related scenarios. It's important to carefully review your policy and understand the potential tax implications to ensure that your beneficiaries receive the full benefit you intend.

Thyroid and Whole Life Insurance: What's the Connection?

You may want to see also

Tax on withdrawals from cash value life insurance

The cash value of life insurance is generally not taxable as it grows within the policy. However, taxes may apply to withdrawals, loans, or surrenders that exceed the total premium payments made.

Withdrawals from a permanent policy can be tax-free, but only up to the total premiums paid. Once withdrawals exceed the amount put into the policy, income tax will generally be owed on those withdrawals.

For example, if a policy has a cash value of $18,000 and the basis in the policy is $12,000, a withdrawal of $12,000 or less will not incur income tax. However, a withdrawal of $15,000 will incur income tax on $3,000 of it.

It is important to note that surrender charges may also apply when withdrawing from a policy, even if the withdrawal amount is within the basis. One way to avoid this is to take a policy loan from the insurance company, using the cash value in the policy as collateral. The amount borrowed is generally not treated as taxable income as long as the loan is repaid, and there are no surrender charges because no money is actually withdrawn. However, interest must be paid on the loan, which is not tax-deductible.

In the case of a modified endowment contract, taxes on withdrawals are different. Withdrawals are treated as last-in-first-out (LIFO), meaning that all withdrawals are considered taxable income until they equal the total interest earned on the contract.

To summarise, while cash value life insurance can offer tax advantages, careful planning is necessary to avoid unexpected tax liabilities. Consulting a tax advisor or insurance professional is recommended to understand the specific rules and regulations.

Bankers Life Insurance: Colorado's Policy Changes and Their Impact

You may want to see also

Tax on loans from cash value life insurance

Cash value life insurance is generally not taxable as it grows within the policy. However, taxes may apply to withdrawals, loans, or surrenders that exceed the total premium payments made. It is, therefore, essential to understand the specific rules and consult a tax advisor for guidance.

The cash value of life insurance grows tax-free. This means that, in many cases, you won’t have to worry about paying taxes on it. But there are some instances where you may owe taxes on the cash value.

If you take out a loan from your life insurance plan, the loan won’t be taxable. The exception to this is if the policy terminates before you’ve repaid the loan. In this case, you might get hit with a tax bill.

Loans against the cash value aren’t taxable while the policy is in force. But if your policy ends and you still have an outstanding loan balance, you may have to pay taxes on part of the loan amount.

The taxable portion of your loan amount is only what’s above the basis — meaning interest or investment earnings. The money you put into your cash value through premium payments isn’t taxable, even if your policy ends with an outstanding loan balance.

If you borrow against your cash value account — even if you borrow above the basis — you won't be taxed on the loan proceeds if you keep your policy in force. Letting your policy lapse or surrounding it with an outstanding loan balance could mean you’re liable for taxes on gains.

How to Avoid Tax on Life Insurance Cash Value

The easiest way to avoid paying taxes on the cash value component of a life insurance policy is to only take out as much as you’ve put into the policy through premiums. Most people will only pay taxes on cash value when they distribute more than their cost basis. In general, you can expect to owe taxes if you take out interest earnings or investment gains.

The earnings on the cash value of your life insurance policy usually grow tax-free or tax-deferred, but you might owe taxes if you withdraw the money. You’ll generally owe taxes on money earned from investment or interest gains, known as your “above basis” amount. Money that accrues from your premium payments (your “policy basis”) is typically not taxable.

Surrendering Your Life Insurance Policy

Policyowners of a cash-value life insurance policy can surrender it to the insurance company for a cash payout. The exact amount — or cash surrender value — of the policy depends on how much cash value you’ve accrued and any outstanding loan balances you carry. Most policies also have a surrender fee that the insurance company charges when you surrender a contract.

Similar to ending a life insurance contract with an outstanding loan balance, there are tax implications on any cash value proceeds above cost basis if you surrender your policy.

Withdrawing Funds From Cash Value

A policy loan isn’t the only way to access your cash value. You can withdraw money from your cash value balance without having to pay it back. The downside, however, is that you’ll almost certainly reduce the life insurance death benefit. In some cases, you might cause the policy to lapse with withdrawals.

Just like policy loans and the surrender value, the IRS only taxes you on distributions you make above the amount you’ve paid into your cash value through premiums. That means if you have $20,000 of cash value and earned $1,000 of that in interest or investments, you could take out $19,000 tax-free.

Ethos' Whole Life Insurance Offer: Is It Worth It?

You may want to see also

Tax on death benefit payouts

Death benefit payouts are typically not taxed as income. However, there are some exceptions to this rule.

If the payout is spread out in installments, any interest that accumulates on those payments will be taxed as regular income. The death benefit itself is not taxed, but the interest is considered taxable income.

Another exception is when the policyholder leaves the death benefit to their estate instead of naming a person as the beneficiary. In this case, if the estate's total value is large enough, it may trigger estate taxes, reducing what the beneficiaries receive.

If the policyholder and the insured are different people, this may also trigger taxes.

If the policy is a modified endowment contract (MEC), withdrawals are treated as taxable income until they equal all interest earnings in the contract.

If the policyholder receives proceeds from an employer-paid life insurance policy, any death benefit beyond $50,000 is taxed as income, according to the IRS.

Depression's Impact on Life Insurance: A Historical Concern?

You may want to see also

Frequently asked questions

Cash value life insurance is generally not taxable as it grows within the policy. However, taxes may apply to withdrawals, loans, or surrenders that exceed the total premium payments made.

Interest earned on the cash balance of life insurance is generally taxable.

The death benefit of a life insurance policy is typically not taxable. However, if the beneficiary chooses to receive the payout in installments, any interest that accumulates on those payments will be taxed as regular income.

Surrendering a life insurance policy for cash may result in tax implications on any cash value proceeds above the cost basis.