Having a thyroid condition can impact your ability to buy life insurance, but it is still possible to get coverage. The two main thyroid conditions are thyroid nodules and thyroid cancer. For those with thyroid nodules, insurance underwriters will consider family and medical history, and whether the nodule size is stable. For those with thyroid cancer, underwriters will consider the type and stage of cancer, treatment, and any complications. In both cases, it is important to shop around and apply through a broker to increase your chances of getting affordable life insurance.

What You'll Learn

Hypothyroidism and insurance rates

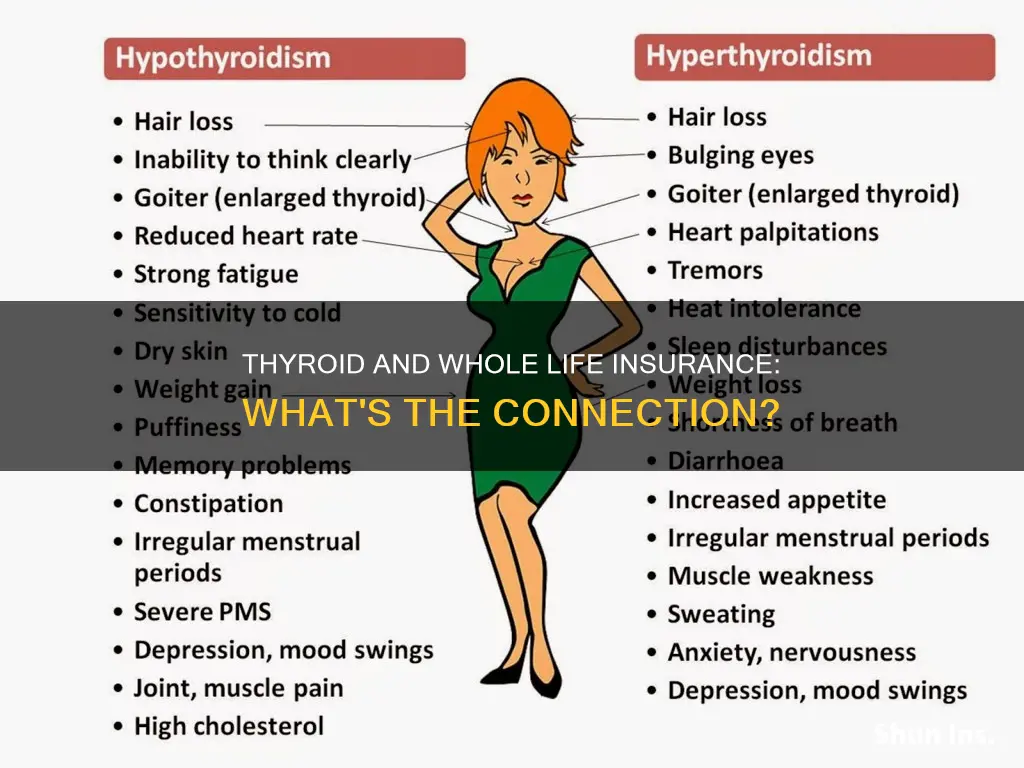

Hypothyroidism is a thyroid condition that affects the body's ability to produce sufficient thyroid hormones, which are necessary for regulating metabolism and energy levels. This condition can lead to a range of symptoms, including fatigue, weight gain, constipation, dry skin, and thinning hair. While it is a manageable disease, left untreated, it can cause severe complications.

When it comes to insurance rates, individuals with hypothyroidism can qualify for life insurance policies, including traditional term or whole life insurance. However, insurance companies will typically ask a series of medical questions to understand the severity of the condition and rule out potential risks. The rate for individuals with hypothyroidism is often determined by factors beyond the condition itself, such as height, weight, family medical history, driving record, and participation in dangerous activities.

For those seeking life insurance with hypothyroidism, it is recommended to work with a broker who can shop the market and find the best rates. Additionally, ensuring that hypothyroidism is well-controlled through proper treatment is crucial for obtaining insurance at standard rates. Underactive thyroid life insurance is typically available on the standard market if TSH levels are normal and the condition is stable. If there are secondary conditions or complications, insurers may offer life insurance at non-standard rates with a premium increase.

In summary, while hypothyroidism can impact insurance rates, individuals with this condition can still obtain life insurance by working with brokers, managing their health, and understanding that rates may vary depending on individual circumstances.

Life Insurance: Dave Ramsey's Take on 10-Year Term Policies

You may want to see also

Hyperthyroidism and insurance rates

Hyperthyroidism, or an overactive thyroid, is a condition where the thyroid gland produces an excessive amount of thyroid hormones. This results in a quickening of the body's chemical processes and

When it comes to life insurance, hyperthyroidism may impact the rates and the approval process. Life insurance companies assess applicants with medical conditions through a process called underwriting, where they evaluate the applicant's risk profile to determine their eligibility for coverage and set premium rates. For individuals with hyperthyroidism, insurers will consider several factors, including:

- Severity of the condition: A mild, well-controlled condition may have a lesser impact on the applicant's risk profile compared to a severe, uncontrolled condition.

- Treatment history: A well-documented treatment history that demonstrates effective management of hyperthyroidism can help the applicant receive favorable terms on their life insurance policy.

- Overall health: The insurance company will also consider the applicant's overall health, including other pre-existing conditions, weight, blood pressure, and lifestyle factors such as smoking and exercise habits.

- Complications: Insurers will assess any complications or secondary conditions related to hyperthyroidism, such as heart problems or osteoporosis. These complications can affect the applicant's risk profile and premium rates.

- Compliance with medical care: Demonstrating consistent compliance with prescribed medical care, including regular check-ups and medication adherence, can lead to better policy terms.

- Duration and stability of the condition: A long-standing, stable condition with no significant fluctuations in thyroid hormone levels is generally viewed more favorably by insurers.

- Lab results: Recent lab results, such as thyroid hormone levels and thyroid-stimulating hormone levels, can help insurers assess the current state of the applicant's condition and the effectiveness of their treatment.

Individuals with hyperthyroidism can take several steps to increase their chances of obtaining favorable life insurance rates:

- Follow prescribed treatment: Adhering to the recommended treatment plan demonstrates effective management of the condition and is favored by insurance companies.

- Monitor thyroid hormone levels: Keeping thyroid hormone levels within the normal range can positively influence life insurance rates.

- Maintain a healthy lifestyle: Adopting a healthy lifestyle, including a balanced diet, regular exercise, and adequate sleep, can contribute to better overall health and more favorable insurance rates.

- Avoid high-risk behaviors: Refraining from smoking, excessive alcohol consumption, and drug use can lead to better insurance rates, as insurers view these behaviors as risk factors.

- Manage other health conditions: Effectively managing other pre-existing health conditions can positively impact insurance rates, as demonstrating overall good health makes the applicant a more attractive candidate.

- Regular doctor visits: Consistent monitoring of the condition through regular doctor appointments can help address any issues promptly and demonstrate a commitment to maintaining good health.

- Work with an experienced insurance agent or broker: Collaborating with an insurance professional who understands the unique needs of individuals with hyperthyroidism can help navigate the application process and identify the most suitable coverage options.

In summary, hyperthyroidism can impact life insurance rates and the approval process, but it is still possible for individuals with this condition to obtain coverage. By effectively managing their health, providing comprehensive medical information during the application process, and working with an experienced insurance agent, individuals with hyperthyroidism can secure life insurance to protect their loved ones.

ERISA and Life Insurance: What's the Connection?

You may want to see also

Thyroid nodules and insurance

Thyroid nodules are an unusual lump or growth of cells on the thyroid gland, which is located in the lower front of the neck, below the voice box (larynx) and above the collarbones. They are very common, especially in the US, and can be solid, fluid-filled cysts, or mixed. They are more common in women than in men, and the risk of occurrence increases with age.

The good news is that the vast majority (more than 90%) of thyroid nodules are benign (noncancerous). However, any time a lump is discovered in thyroid tissue, the possibility of malignancy (cancer) must be considered. Ultrasound imaging can help evaluate a thyroid nodule and determine the need for a biopsy. A thyroid fine-needle aspiration biopsy can collect samples of cells from the nodule to determine whether it is cancerous.

When it comes to life insurance, underwriters will consider various factors, including the age and medical history of the applicant. If there is no personal or family history of cancer, regular doctor follow-ups, and the nodule size is stable, it is possible to receive a positive underwriting outcome and get insurance coverage.

It is important to note that even if there is a history of thyroid nodules, it does not mean that life insurance is out of reach. Working with a broker who has access to multiple insurance companies can increase the chances of finding a suitable policy.

Dr. Scott Mosby: Sun Life Insurance Acceptance and Benefits

You may want to see also

Thyroid cancer and insurance

Thyroid cancer is the most common malignancy of the endocrine system, affecting over 50,000 Americans each year, with the majority of cases being in young people. As a result, most patients diagnosed with thyroid cancer are working-age adults who do not qualify for government health insurance benefits. This means that health insurance plays a significant role in accessing treatment. Studies have shown that thyroid cancer patients are at high risk of financial difficulty and bankruptcy.

When it comes to life insurance, individuals with thyroid cancer are eligible to purchase it. However, the insurance company will consider various factors before making an offer, such as the type and stage of cancer, treatment history, age of the applicant, and medical history. The premium may be higher than average, or an additional cost for the illness may be added.

The type of insurance held by a patient can also impact the treatment they receive. For example, patients with Medicaid are more likely to present with advanced thyroid cancer and are less likely to undergo appropriate surgical treatment or receive radioactive iodine when indicated. On the other hand, patients with private insurance are more likely to be treated with a total thyroidectomy, lymph node dissection, and radioactive iodine therapy.

The long-term prognosis for thyroid cancer varies depending on the cell type and stage. The types of thyroid cancer include papillary, papillary-follicular, follicular, medullary, and anaplastic. The most common type is papillary thyroid cancer, which has a good prognosis, especially in patients aged 20 to 40.

In summary, while thyroid cancer patients can obtain life insurance, the specific offers will depend on their medical history and the type of insurance they have. The impact of insurance status on the clinical management and quality of life of thyroid cancer patients is an important consideration in the United States, especially given the relatively high incidence of this type of cancer.

Farmers Term Life Insurance: Double Indemnity Protection?

You may want to see also

Thyroid medication and insurance

Thyroid conditions can impact your ability to obtain life insurance, but it is still possible to get coverage. The impact of thyroid issues on life insurance depends on the type and severity of the condition, the treatment required, and any resulting complications. Here's what you need to know about thyroid medication and insurance:

Impact of Thyroid Conditions on Insurance

Thyroid problems can affect your life insurance options, but it's important to note that every individual with a thyroid condition is still eligible to purchase life insurance. The specific type of thyroid condition you have will influence the insurance company's evaluation. The two main types of thyroid issues are:

- Hyperthyroidism: This is when your thyroid gland produces too much thyroid hormone. Symptoms can include rapid weight loss, high blood pressure, anxiety, insomnia, and heart palpitations.

- Hypothyroidism: This occurs when your thyroid gland doesn't produce enough thyroid hormone. Symptoms may include weight gain, fatigue, constipation, dry skin, thinning hair, and intolerance to cold.

Insurance Company Considerations

When assessing an applicant with a thyroid condition, insurance companies will consider various factors to determine the potential risk. These factors include:

- Medical history: They will review your past and current medical conditions, including any treatments for your thyroid condition.

- Medications: The insurance company will want to know what medicines you're taking, the dosage, and how often you take them.

- Symptoms: They will inquire about the symptoms you're experiencing and how they impact your daily life.

- Healthcare provider: The insurance company may ask for details about your healthcare provider, such as their name, specialty, and contact information.

- Family history: They will also consider your age and family medical history when making their decision.

Getting the Best Insurance Rates

To increase your chances of getting affordable life insurance rates, it's recommended to apply through a broker who can shop the market and find the best policy for your specific situation. Being honest and forthcoming when answering the insurance company's questions is crucial, as it helps them make an informed decision.

If your thyroid condition is well-controlled with medication and doesn't significantly affect your daily life, you may be able to obtain life insurance at standard rates. However, if there are secondary conditions or complications, such as goitre or high cholesterol, the insurer may offer coverage at non-standard rates with a premium increase.

In summary, while thyroid conditions can pose challenges in obtaining life insurance, it is still possible to find suitable coverage. Working with a broker and being transparent about your medical history and current health status will help you secure the best insurance options.

First Citizens Bank: Life Insurance Offerings and Benefits

You may want to see also

Frequently asked questions

Yes, individuals with low thyroid function can qualify for whole life insurance policies. However, insurance companies may require you to answer a series of medical questions to ensure that your condition is being managed appropriately and does not pose a significant risk.

Insurance companies are primarily concerned with assessing the risk associated with insuring individuals. They will ask basic questions about your low thyroid function to ensure that you are correctly treating the condition and to rule out any potential future complications.

Insurance companies may inquire about your medical history, medications, symptoms, and healthcare providers. They may also be interested in the underlying causes of your low thyroid function and any resulting complications.

The rate you qualify for is typically determined by various factors beyond your low thyroid function diagnosis, such as your height, weight, family medical history, driving record, criminal record, and participation in risky activities.