The length of your life insurance policy should be based on your reason for needing cover. Term life insurance is usually bought for between 10 and 30 years, but you can also find shorter and longer terms. The most popular term lengths are 10, 20, and 30 years. If you have a mortgage, you should ensure that the term of the mortgage is covered. If you have children, you should take the policy over a time period that will ensure your family will be taken care of and the children are grown up and able to financially support themselves.

| Characteristics | Values |

|---|---|

| Length of coverage | 5, 10, 15, 20, 25, 30, 40 years or more |

| Type of insurance | Term life insurance, whole life insurance, over 50s life insurance |

| Purpose | Cover mortgage, cover funeral costs, fund inheritance tax, provide for family, pay off debts |

| Age | Younger people pay lower premiums |

| Inflation | Increasing term life insurance covers inflation but has higher premiums |

| Lifestyle | Premiums increase with risky occupation, travel, alcohol consumption, smoking, etc. |

| Health | Premiums increase with poor health |

| Family medical history | Premiums increase with history of inheritable conditions |

| Hobbies | Premiums increase with risky hobbies |

What You'll Learn

Life insurance for your family

Life insurance is a way to protect your family's financial future if you pass away. It's a way to ensure your loved ones are provided for and can maintain their standard of living.

Who Needs Life Insurance?

Life insurance is typically associated with the spouse who is the primary breadwinner of the family. However, it is equally important for the other spouse, even if they stay at home, work part-time, or earn a smaller income. The death benefit from life insurance can help pay for childcare, housekeeping, meals, and other essential services.

Additionally, it is beneficial to get your children covered at a young age. This ensures their insurability in the future, even if they develop health problems later in life that would otherwise make them uninsurable.

When deciding on the duration of your life insurance coverage, consider your financial commitments and obligations. You want the policy to continue until your last significant obligation is taken care of. Here are some factors to consider:

- The length of your mortgage: If you want your life insurance to cover your mortgage, consider how many years you have left until it is paid off.

- Children's dependence: Think about how long your children will depend on you financially, especially if you plan to pay for their college education.

- Years until retirement: If you are buying life insurance primarily to replace your income, you may not need it after retirement.

Types of Life Insurance

There are two main types of life insurance: permanent and term.

- Permanent life insurance: This type of policy does not have an expiration date and covers you for life as long as the premiums are paid. It often includes an investment component that allows you to build cash value by investing in the stock market or earning interest.

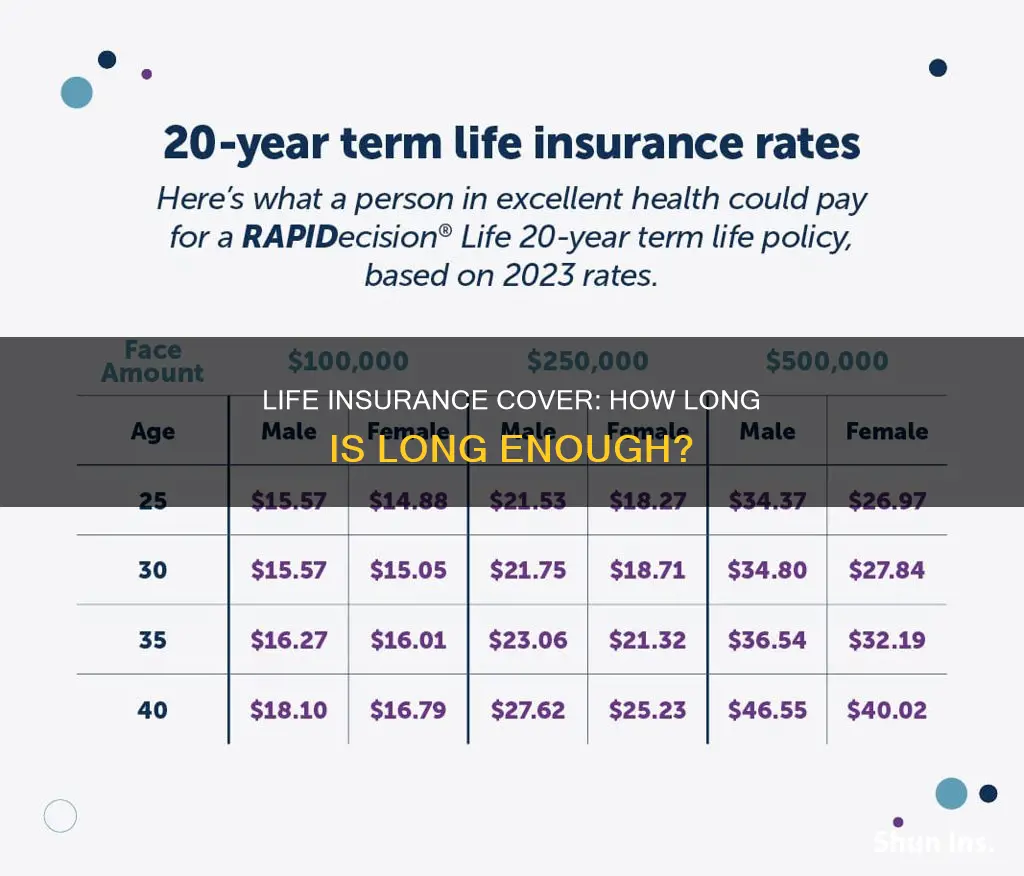

- Term life insurance: This type of insurance covers you for a set number of years and is generally more affordable than permanent life insurance. It is a good choice for parents who need greater protection when their children are young.

The amount of life insurance you need depends on your financial goals and needs. Here are some factors to consider:

- Debts: It is recommended to carry enough life insurance to pay off your debts, including your mortgage, student loans, car loans, credit cards, and personal loans.

- Income replacement: The payout from your policy should be sufficient to replace your income, plus a little extra to account for inflation. Financial experts often suggest having enough coverage to replace at least 10 years of your salary.

- Number of dependents: Consider the number of people who depend on your income, including your spouse and children.

In summary, life insurance for your family is an important consideration to ensure their financial security. By assessing your financial commitments and goals, you can determine the appropriate duration and amount of coverage needed to protect your loved ones.

High Blood Pressure: Getting Life Insurance Coverage

You may want to see also

Life insurance for your mortgage

Life insurance is often taken out when an individual has others depending on them financially, such as a spouse or children. It can also be a good idea to take out life insurance when you have a large financial obligation, like a mortgage.

Mortgage protection life insurance is a type of insurance designed to pay off the policyholder's mortgage if they pass away during the policy term. This helps beneficiaries eliminate significant debt and gives them access to more equity in the home. It can also be used to pay off other expenses, such as credit card debt.

There are two main types of life insurance: term life insurance and whole life insurance. Term life insurance covers you for a set number of years and does not accumulate cash value, whereas whole life insurance covers you for life and often has an investment component that allows you to build cash value.

When deciding how long to get life insurance cover for, consider the length of your mortgage, how long until your children are financially independent, and how many years until you retire. You can also combine a whole life insurance policy for long-term coverage with a term life insurance policy to cover the early years of your mortgage when the amount owed is highest.

It's important to note that life insurance is not always necessary if you have a mortgage. If you have enough assets to provide for your dependents after your death or if your loved ones can afford the mortgage without your income, you may not need life insurance. Additionally, mortgage life insurance can be expensive, and there are other alternatives to consider, such as self-insuring.

Life Insurance and Elective Surgery: What's Covered?

You may want to see also

Life insurance for funeral costs

Life insurance is a contract under which an insurance company agrees to pay a specified amount after the death of an insured party, as long as the premiums are paid. The payout amount is called a death benefit. Policies give insured people the assurance that their loved ones will have financial protection and peace of mind after their death.

There are two main types of life insurance: permanent and term. Permanent life insurance policies do not have an expiration date, meaning you’re covered for life as long as your premiums are paid. Term life insurance, on the other hand, only covers you for a set number of years and does not accumulate cash value.

If you want to buy life insurance purely to cover your funeral costs, medical bills, and other end-of-life expenses, look into burial insurance. Also known as final expense insurance, these policies are designed for seniors who need only a small amount of coverage, and not all insurers offer them. Burial insurance covers the cost of your funeral and/or cremation expenses after you pass away. It can also be used at the beneficiary’s discretion to pay off debts including any medical bills, mortgage loans, or credit card bills.

The average cost of a funeral and burial in the United States is $7,848. If you get a vault—required by many cemeteries—that number rises to $9,420. The average cost of a funeral and cremation is a little lower, at $6,971.

When deciding how long you should get life insurance cover for, consider the following:

- The length of your mortgage: Your mortgage is a big part of your monthly expenses and is often the main reason people buy life insurance.

- How long until children are on their own: Consider how long until you can expect your kids to support themselves financially.

- The number of years until you retire: If you’re buying term life insurance primarily to replace your income, you may not need it after retirement.

Group Life Insurance: PA Tax Laws Explained

You may want to see also

Life insurance for inheritance tax funding

The duration of your life insurance cover depends on your financial goals and needs. If you have financial dependents, you may want a term life insurance policy lasting as long as those obligations. If you're buying term life insurance, you'll need to decide how much life insurance to buy and how long the coverage should last. You want the policy to continue until your last major obligation is taken care of. So, the duration of your financial commitments will generally determine how long your term life insurance policy should last.

- The length of your mortgage: If you want your life insurance to cover your mortgage, consider how many years you have left until you pay off your house. Don't choose a policy that expires before your mortgage is paid off.

- How long until your children are financially independent: Consider how long it will be until your children are old enough to support themselves financially. This may be a few years beyond age 18, especially if you plan to pay for their college education.

- The number of years until you retire: If you're buying term life insurance primarily to replace your income, you may not need it after retirement. Once your children are grown up, the house is paid off, and you're living off your retirement savings, life insurance is one less thing to worry about.

Life insurance can also be used to leave an inheritance for your heirs. The life insurance death benefit goes directly to the policy's beneficiaries and is typically tax-free. However, if you want to use life insurance to cover inheritance tax, there are a few things to keep in mind. Inheritance Tax (IHT) is levied on the estate of a deceased person, which can include their property, money, cars, and other possessions, as well as the proceeds of a life insurance policy. In some countries, if the value of the estate is more than a certain threshold, the part of the estate above the threshold could be liable for IHT at a rate of 40%.

To avoid paying IHT on your life insurance payout, you can put your policy 'in trust'. This means the payout will go directly to your beneficiaries, rather than forming part of your legal estate, and thus no IHT will be due. Writing your policy in trust also ensures that the payout will reach your loved ones faster as it bypasses probate, the legal process of sorting out a deceased person's estate. Setting up a trust is usually simple and shouldn't cost you anything extra. Your life insurance provider will be able to help, and it usually only requires your signature.

Another option to cover inheritance tax is to take out a whole life insurance policy. Whole life insurance will pay out whenever you die and can be used to cover the full amount of the IHT bill. To avoid IHT on the policy proceeds, the whole life insurance policy must also be written in trust. Additionally, the premium paid for the policy will reduce the value of your estate, further reducing the amount of IHT due when you die.

Legal and General Life Insurance: Contact and Claims

You may want to see also

Life insurance for co-signed loans

The length of your life insurance policy should be based on your financial responsibilities, such as your mortgage or children's education. If you have others depending on you financially, you should get a term life insurance policy lasting as long as those obligations.

If you have co-signed loans, such as private student loans, life insurance can protect your co-signer from having to repay the debt in the event of your death. Credit life insurance is a type of policy designed to pay off a borrower's outstanding debts if the policyholder dies. It is typically used for large loans, like mortgages or car loans.

The face value of a credit life insurance policy decreases as the loan amount is paid off over time. Credit life insurance policies often have less stringent health screening requirements and may not require a medical exam. However, the payout on a credit life insurance policy goes to the lender, not your heirs.

Term life insurance is an alternative to credit life insurance. With term life insurance, the benefit will be paid to your beneficiary instead of the lender. Your beneficiary can then use the proceeds to pay off the debt. Term life insurance is usually more affordable than credit life insurance for the same coverage amount. Additionally, the value of a term life insurance policy stays the same, whereas credit life insurance drops in value over the course of the policy.

When deciding how long to get life insurance cover for, consider the length of your financial commitments, such as your mortgage or children's education, to ensure your policy lasts as long as you need it to.

Life Insurance Exam: Multiple Choice or Essay Style?

You may want to see also

Frequently asked questions

If you have children, you should take the policy over a time period that will ensure your family will be taken care of and the children are grown up and able to financially support themselves.

The number of years that your life insurance policy covers should match the number of years until your mortgage is paid off. If you're planning to pay your mortgage off early, you should still consider buying life insurance for the full term and simply cancel it once the mortgage is paid off.

Whole life insurance is usually used to cover funeral costs. This type of policy guarantees that the insurer will pay out a lump sum whenever you die, rather than within a specified time frame.