Universal life insurance, while offering flexibility and potential for long-term savings, has faced criticism for several reasons. One major concern is the complexity of the product, which can make it difficult for consumers to fully understand the costs and risks involved. Additionally, the high upfront costs and variable premiums can be a significant financial burden, especially for those on a tight budget. Critics also argue that the investment component of universal life insurance may not perform as well as other investment options, potentially leading to lower returns over time. These factors, among others, have sparked debates about the suitability and transparency of universal life insurance policies.

What You'll Learn

- High costs: Universal life insurance can be expensive, with fees and commissions that may outweigh the benefits

- Complexity: The product's complexity can make it difficult for customers to understand and manage their policies

- Lack of liquidity: Policyholders may face challenges accessing their funds without penalties

- Long-term commitments: Long-term insurance policies can be risky, especially if the insured's health changes

- Limited flexibility: Universal life insurance may not offer the flexibility needed for changing financial goals

High costs: Universal life insurance can be expensive, with fees and commissions that may outweigh the benefits

Universal life insurance, while offering flexibility and potential long-term savings, can be a costly financial commitment. One of the primary concerns is the high expense associated with this type of policy. The initial premiums for universal life insurance can be significantly higher compared to term life insurance, and this is often due to the additional features and benefits it provides. These features include the ability to build cash value over time, which can be borrowed against or withdrawn, and the flexibility to adjust death benefits and premiums. However, this flexibility comes at a price.

The cost structure of universal life insurance policies is complex and often includes various fees and commissions. These expenses can include initial setup fees, annual policy maintenance fees, and commissions paid to insurance agents or brokers. The combination of these costs can result in a substantial portion of the premium being allocated to administrative and sales expenses rather than the actual insurance coverage. Over time, these fees can accumulate and may significantly reduce the overall value and effectiveness of the policy, especially if the policyholder does not utilize the cash value features extensively.

In some cases, the high costs of universal life insurance can outweigh the benefits, particularly for those seeking straightforward and cost-effective life insurance solutions. The complexity of the policy structure and the potential for high fees can make it less attractive for individuals who prefer simpler, more transparent insurance products. Additionally, the investment component of universal life insurance, which is designed to build cash value, may not always perform as expected, and there is a risk that the investment returns could be lower than the fees incurred.

For prospective policyholders, it is crucial to carefully review the policy documents and understand the fee structure. Many insurance companies provide detailed fee schedules and cost breakdowns, allowing individuals to make informed decisions. By comparing different policies and providers, consumers can identify the most cost-effective options without compromising the desired level of coverage. It is also advisable to seek professional financial advice to ensure that the chosen insurance product aligns with one's financial goals and risk tolerance.

In summary, while universal life insurance offers valuable features, its high costs and complex fee structure can be a significant drawback. Prospective buyers should be aware of these expenses and carefully evaluate the benefits against the potential financial burden. With the right information and guidance, individuals can make informed choices and select the most suitable insurance option for their needs.

Beat a Life Insurance Blood Test: Strategies for Success

You may want to see also

Complexity: The product's complexity can make it difficult for customers to understand and manage their policies

Universal life insurance, while offering flexibility and potential long-term savings, can indeed present certain challenges for policyholders due to its intricate nature. One of the primary concerns is the complexity of the product itself. This complexity can be a double-edged sword; while it provides policyholders with a wide range of customization options, it also makes the product harder to navigate and understand.

The intricacies of universal life insurance policies often lie in the various components and riders available. These include death benefit options, investment accounts, and a multitude of riders that can provide additional coverage or benefits. For instance, a rider might offer an accelerated death benefit, allowing the policyholder to access a portion of the death benefit if they are diagnosed with a terminal illness. While these features can be advantageous, they also contribute to the overall complexity. Customers may find it challenging to comprehend the implications of each rider and how they interact with the base policy.

Understanding the investment aspect of universal life insurance is another hurdle. Policyholders are often given the option to allocate a portion of their premiums into investment accounts, which can grow over time. However, the investment options and associated risks can be complex, requiring a certain level of financial literacy. Customers might struggle to grasp the potential returns and risks associated with different investment strategies, especially when considering the long-term nature of these policies.

Moreover, the ongoing management of a universal life insurance policy can be demanding. Policyholders are responsible for ensuring that their premiums are paid on time, monitoring the policy's performance, and making any necessary adjustments to meet their changing needs. This level of management can be particularly challenging for those with limited financial expertise or time constraints. Missteps in policy management could lead to unintended consequences, such as insufficient coverage or unexpected fees.

To address these challenges, insurance providers should focus on transparency and education. Clear and concise policy documents, along with comprehensive customer support, can help policyholders navigate the complexities. Additionally, providing accessible resources and tools for understanding the policy's performance and making informed decisions can empower customers to manage their universal life insurance effectively. While universal life insurance offers valuable benefits, acknowledging and mitigating the complexity of the product is essential to ensuring a positive customer experience.

Contacting Standard of Life Insurance: A Step-by-Step Guide

You may want to see also

Lack of liquidity: Policyholders may face challenges accessing their funds without penalties

Universal life insurance, while offering flexibility and potential for long-term savings, does come with certain drawbacks that investors should be aware of. One significant issue is the lack of liquidity associated with these policies. Policyholders often find themselves in a position where accessing their funds without incurring penalties can be quite challenging.

When individuals purchase universal life insurance, they typically invest a portion of their premium payments into an investment account. This account is designed to grow over time, providing potential returns that can be used to pay for insurance premiums and build cash value. However, the process of accessing this cash value is not always straightforward. Policyholders may need to go through a lengthy and complex process to withdraw funds, and in some cases, they might be required to pay fees or penalties. This lack of liquidity can be a significant disadvantage, especially for those who may need immediate access to their funds for unexpected expenses or other financial needs.

The restrictions on accessing funds can be particularly problematic for policyholders who have invested a substantial amount in universal life insurance. If they require a large sum of money for a significant purchase or to cover unexpected costs, they might be forced to wait for an extended period, potentially losing out on the opportunity to use the funds for other purposes. Moreover, the penalties associated with early withdrawals can be substantial, further reducing the overall value of the policy.

To address this concern, it is crucial for individuals to carefully consider their financial goals and risk tolerance before investing in universal life insurance. They should evaluate the potential returns and the associated risks, including the lack of liquidity. Understanding the policy's terms and conditions regarding fund access and penalties is essential to making an informed decision. Additionally, seeking professional financial advice can provide valuable insights into alternative investment options that offer more immediate liquidity without compromising long-term savings potential.

In summary, the lack of liquidity in universal life insurance policies can be a significant disadvantage, making it challenging for policyholders to access their funds without penalties. This aspect should be carefully considered when evaluating insurance options, as it can impact an individual's financial flexibility and ability to meet short-term financial obligations.

Clinical Trials: Life Insurance Impact and Influence

You may want to see also

Long-term commitments: Long-term insurance policies can be risky, especially if the insured's health changes

Universal life insurance, while offering flexibility and potential long-term savings, does come with certain drawbacks that are worth considering. One significant concern is the inherent risk associated with long-term commitments in insurance policies, particularly when an individual's health status changes over time.

When an insured person's health deteriorates, it can lead to a complex and potentially detrimental situation for their long-term insurance policy. Insurance companies typically assess and underwrite policies based on the health and medical history of the insured individual. If a significant health issue arises after the policy has been in place for an extended period, the insurance provider may re-evaluate the risk associated with the coverage. This re-underwriting process can result in higher premiums or even policy cancellation, leaving the insured individual with limited options and potentially higher costs.

The risk is especially pertinent for universal life insurance, which often involves variable premiums and investment components. As health changes, the insured's investment performance and premium payments may also be affected. For instance, if an individual's health issues lead to increased medical expenses, they might need to allocate more funds towards premiums, potentially impacting their overall financial planning. Conversely, improved health could result in reduced premiums, but this benefit may not always be realized if the insurance company perceives the individual as a higher risk.

Moreover, long-term insurance policies often have surrender charges or penalties, which can be significant if the insured decides to terminate the policy early due to health-related reasons. These charges can be a substantial financial burden, especially if the individual's health has already been a concern. As such, individuals should carefully consider their health and financial situation before committing to long-term insurance policies, ensuring they can manage potential risks and costs associated with health changes.

In summary, while universal life insurance offers valuable benefits, the long-term nature of these policies and the potential impact of health changes on the insured's circumstances can introduce risks. Prospective policyholders should be aware of these challenges and carefully assess their ability to manage any adverse health-related outcomes to make informed decisions regarding their insurance coverage.

California Group Term Life Insurance: Taxable or Not?

You may want to see also

Limited flexibility: Universal life insurance may not offer the flexibility needed for changing financial goals

Universal life insurance, while offering long-term coverage and potential investment opportunities, can sometimes fall short in terms of flexibility, which is a critical aspect for many policyholders. This lack of flexibility can become a significant drawback, especially for those whose financial goals and priorities evolve over time.

One of the primary issues with universal life insurance is the fixed nature of its premiums and death benefits. Once a policy is in force, the premium payments and the death benefit amount are typically set and cannot be easily adjusted. This means that if an individual's financial situation changes, they might find themselves overpaying for insurance or underinsured, depending on their current needs. For instance, if a policyholder's income increases significantly, they may want to increase their death benefit to cover a larger estate or provide more financial security for their family. However, doing so would require a full medical examination and a review by the insurance company, which can be time-consuming and costly.

The investment component of universal life insurance also has limitations. While it provides an opportunity to grow the policy's cash value, the investment options are often limited and may not align with the policyholder's changing financial objectives. The investment returns are typically guaranteed by the insurance company, which means they might not keep pace with market performance, especially during economic downturns. This lack of market-linked returns can be a disadvantage for those seeking to grow their policy's value in line with market trends.

Furthermore, the flexibility to adjust the death benefit or premium payments is often restricted. Policyholders may want to increase or decrease these amounts based on their financial goals, but such changes are usually subject to the insurance company's approval and may require a full medical examination, which can be a complex and lengthy process. This lack of flexibility can make it challenging for individuals to adapt their insurance coverage to their evolving needs, potentially leading to financial strain or inadequate protection.

In summary, while universal life insurance provides valuable coverage and investment opportunities, its limited flexibility can be a significant concern. Policyholders should carefully consider their long-term financial goals and the potential impact of changing circumstances before committing to this type of insurance. Exploring alternative insurance products that offer more adjustable features might be beneficial for those seeking greater flexibility in their insurance plans.

Life Insurance: Understanding Payout Drops and Changes

You may want to see also

Frequently asked questions

While universal life insurance offers flexibility and potential for long-term savings, it also has some drawbacks. One of the main concerns is the complexity of the policy, which can make it challenging for policyholders to fully understand the terms and conditions. Additionally, the investment component of universal life insurance is subject to market fluctuations, and there is a risk that the cash value may not grow as expected.

Yes, there is a risk of losing money in universal life insurance. The investment aspect of the policy means that the cash value is not guaranteed to grow, and it can be affected by market volatility. If the investment performance is poor, the policyholder may experience a decrease in the cash value, and they might need to pay more in premiums to maintain the desired death benefit.

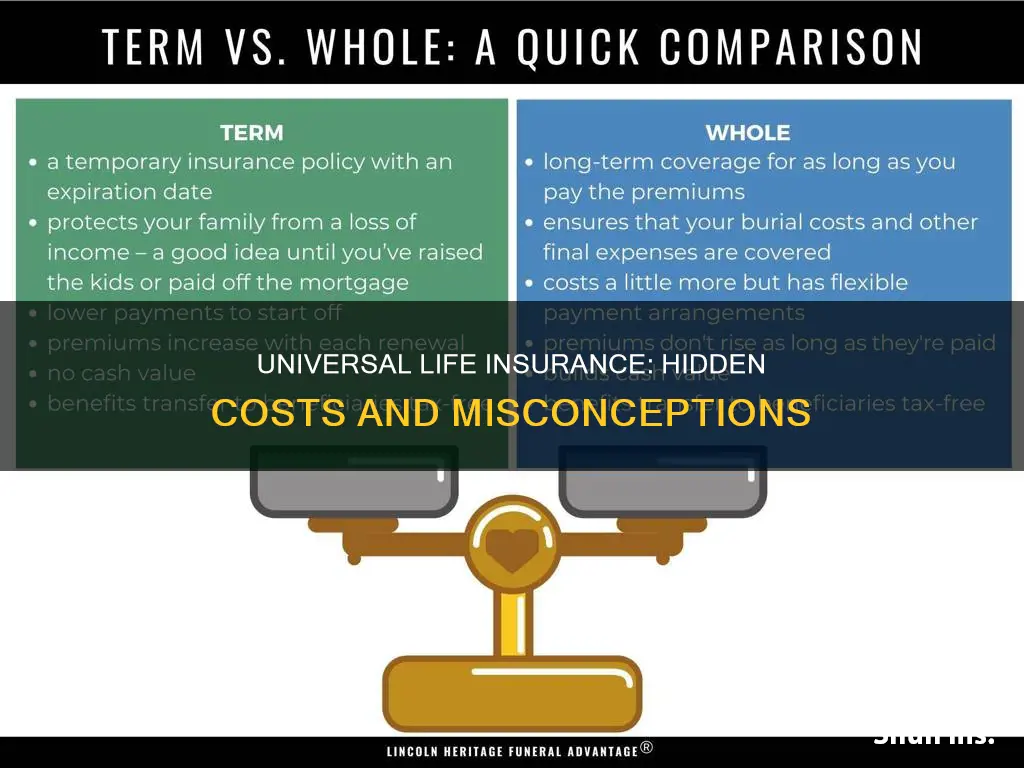

Universal life insurance typically has higher initial costs compared to term life insurance. The reason is that it provides permanent coverage and includes an investment component. These features come with a higher price tag, especially in the early years of the policy. However, over time, the costs can become more competitive as the cash value accumulates.

Yes, like any financial product, universal life insurance may incur various fees and charges. These can include surrender charges, which apply if the policy is surrendered early, and investment management fees. It's important for policyholders to carefully review the fee structure to understand the potential impact on their overall costs.

One of the risks associated with universal life insurance is outliving the policy. If the insured individual passes away and the policy has not been adequately funded, the death benefit may not be sufficient to cover the intended expenses. Additionally, if the policy's cash value is not substantial enough, the policy may lapse, and the coverage could terminate.