If you're a cricket fan, you might be wondering how to ensure your phone is protected in case of damage or loss. Knowing if your cricket phone is insured is crucial for peace of mind. This guide will provide a step-by-step approach to help you determine the insurance coverage for your cricket phone, ensuring you're aware of any protection you might already have.

What You'll Learn

- Check Policy Documents: Review your insurance policy documents for coverage details and terms

- Contact Insurance Provider: Reach out to your insurance company for verification and assistance

- Verify Phone Model: Ensure your Cricket phone model is listed in the insurance coverage

- Understand Coverage Limits: Know the limits of your insurance coverage for repairs or replacements

- Review Claim Process: Familiarize yourself with the steps to file a claim and provide necessary documentation

Check Policy Documents: Review your insurance policy documents for coverage details and terms

To determine if your Cricket phone is insured, the first step is to review your insurance policy documents thoroughly. This is a crucial process to ensure you understand the coverage and terms provided by your insurance provider. Here's a detailed guide on how to check your policy documents:

Locate Your Policy Documents: Start by finding your insurance policy documents. These documents typically include the insurance policy, rider(s), and any other relevant paperwork. They might have been sent to you via email, post, or provided during the purchase of your phone insurance. If you can't find the physical documents, contact your insurance company's customer support to request a copy.

Review the Coverage Section: The coverage section of your policy is where you'll find the details of what is insured and the extent of the coverage. Look for specific mentions of 'mobile devices' or 'smartphones' and the associated coverage limits. Check if your Cricket phone is listed as a covered item and understand the terms and conditions associated with its insurance.

Understand the Terms and Conditions: Insurance policies often have specific terms and conditions that define what is covered and what is not. Pay close attention to these terms, especially those related to the phone's condition, usage, and any exclusions. For example, some policies might not cover damage caused by user error or water damage, so understanding these terms is essential.

Check for Add-Ons or Riders: Insurance companies often offer additional coverage options or riders that can extend the insurance benefits. Review these sections to see if you have opted for any additional coverage, such as extended warranty, theft protection, or data recovery services. These add-ons can provide extra peace of mind and ensure comprehensive protection for your Cricket phone.

Contact Your Insurance Provider: If you have any doubts or need clarification, don't hesitate to reach out to your insurance provider. Their customer support team can guide you through the policy and answer any questions you may have. They can also assist in making any necessary adjustments or additions to your coverage if needed.

By carefully reviewing your insurance policy documents, you can gain a clear understanding of the coverage provided for your Cricket phone. This process ensures that you are aware of the terms and conditions, allowing you to make informed decisions and take appropriate action if any issues arise.

Understanding Insurance: A Simple Guide to Navigating the World of Protection Plans

You may want to see also

Contact Insurance Provider: Reach out to your insurance company for verification and assistance

If you're unsure about the insurance status of your Cricket phone, the first step is to contact your insurance provider directly. This is a crucial step to ensure you have the necessary coverage and to address any potential issues promptly. Here's a guide on how to proceed:

Reach Out to Your Insurance Company:

Start by contacting your insurance provider's customer service team. You can typically find their contact information on your policy documents or on their official website. When you call or email, be prepared to provide your personal details, such as your name, policy number, and any relevant information about the Cricket phone in question. Clearly state that you want to verify the insurance coverage for this specific device.

Ask for Verification:

Inquire about the insurance status of your Cricket phone. Ask if the device is covered under your policy and, if so, what the coverage details are. Request a confirmation in writing, such as an email or a letter, stating that the phone is insured and providing the terms and conditions of the coverage. This documentation will serve as proof of insurance and can be useful if any disputes arise in the future.

Provide Necessary Information:

Ensure that you have all the required details about the phone, including the make, model, purchase date, and any unique identifiers. This information will help the insurance company verify the phone's authenticity and its eligibility for coverage. If you have a receipt or any purchase documentation, provide that as well, as it can aid in the verification process.

Explore Assistance Options:

Insurance providers often offer various assistance services. Discuss any issues or concerns you might have with your Cricket phone. For example, if it's damaged or lost, you can seek guidance on the appropriate steps to take. Insurance companies may provide repair or replacement options, and they can also assist with filing claims if necessary. Understanding these options can help you navigate any potential problems efficiently.

Remember, direct communication with your insurance provider is essential to obtaining accurate information and ensuring that your Cricket phone is adequately protected. By reaching out and asking the right questions, you can gain clarity on your insurance coverage and take appropriate action if any issues arise.

Simplifying Your Sprint: A Guide to Removing Insurance

You may want to see also

Verify Phone Model: Ensure your Cricket phone model is listed in the insurance coverage

To determine if your Cricket phone is insured, it's crucial to verify that your specific model is included in the insurance coverage. Here's a step-by-step guide on how to do this:

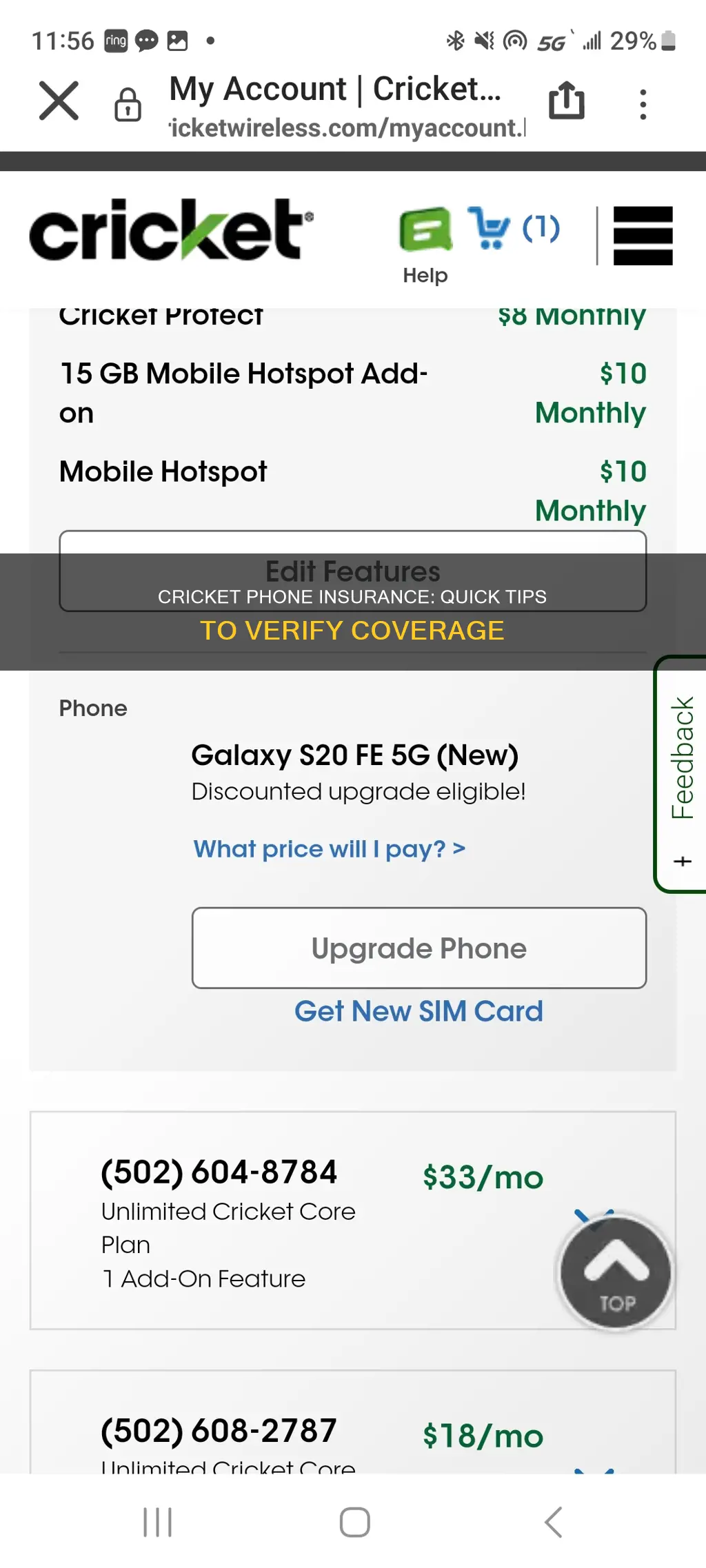

- Contact Cricket Customer Support: The most direct way to verify your phone's insurance coverage is to reach out to Cricket's customer support team. You can typically do this by calling their dedicated support line or using their online chat service. When you contact them, inform them about your phone model and inquire about its insurance status. They will be able to provide you with accurate and up-to-date information regarding your device's coverage.

- Check Cricket's Website: Visit Cricket's official website and navigate to their support or insurance section. Look for a list of covered devices or a model-specific insurance policy page. Often, insurance providers list the models they cover, and Cricket might have this information readily available for their customers. If you find your phone model on this list, it's a good indication that it is insured.

- Review Your Purchase Receipt or Contract: If you have the original purchase receipt or the contract you signed when buying the phone, review these documents carefully. They often contain details about the device's warranty and insurance coverage. Look for any mentions of the specific phone model and its associated insurance benefits. This method might be less reliable for older purchases, but it's worth checking if you have these records.

- Check for Insurance Labels or Stickers: Some phone models might have insurance labels or stickers attached to the device itself. These labels can provide information about the manufacturer's warranty and insurance coverage. While this method is less common, it's worth checking if your phone has any such labels, especially if you purchased it recently.

Remember, insurance coverage can vary depending on the plan you chose and the time of purchase. It's essential to verify this information to ensure you have the correct details about your Cricket phone's insurance coverage.

MRI & X-Ray: Insurance Coverage Differences

You may want to see also

Understand Coverage Limits: Know the limits of your insurance coverage for repairs or replacements

To ensure you are aware of the extent of your insurance coverage for your Cricket phone, it is crucial to understand the coverage limits. These limits define the maximum amount your insurance provider will pay for repairs or replacements in the event of damage or loss. Here's a step-by-step guide to help you navigate this aspect:

Review Your Policy Documents: Start by carefully reading through your insurance policy documents, which should include the terms and conditions related to device coverage. Look for sections that specifically mention 'coverage limits' or 'maximum payout amounts' for device repairs or replacements. These documents will provide detailed information about what is covered and the associated financial limits.

Identify the Coverage Type: Different insurance plans may offer various coverage types, such as standard coverage, extended warranty, or accidental damage coverage. Understand which type of coverage you have for your Cricket phone. Standard coverage typically includes basic protection, while extended warranties provide additional benefits. Accidental damage coverage, if applicable, will have its own set of coverage limits.

Check for Deductibles and Co-pays: In addition to coverage limits, be aware of any deductibles or co-pays associated with your policy. Deductibles are the amount you must pay out of pocket before the insurance coverage kicks in. Co-pays, on the other hand, are the fees you pay at the time of service. Understanding these costs is essential to know when and how much you'll be responsible for during the claims process.

Understand Exclusions and Limitations: Insurance policies often have exclusions, which are specific situations or events not covered by the insurance. For example, natural disasters, theft due to your negligence, or pre-existing damage might be excluded. Familiarize yourself with these exclusions to ensure you don't expect coverage for certain scenarios. Additionally, some policies may have limitations on the age or condition of the device that can be covered.

Contact Your Insurance Provider: If you have any doubts or need clarification on the coverage limits, don't hesitate to reach out to your insurance provider. They can provide you with accurate and up-to-date information regarding your policy's coverage limits, deductibles, and any other relevant details. It's essential to have a clear understanding of these terms to make informed decisions when it comes to protecting your Cricket phone.

Insurance Trust: Funded When?

You may want to see also

Review Claim Process: Familiarize yourself with the steps to file a claim and provide necessary documentation

To ensure a smooth and successful claim process, it's crucial to familiarize yourself with the steps involved and the required documentation. Here's a comprehensive guide to help you navigate the process:

Understand the Claim Process: Begin by thoroughly reading the insurance policy provided by Cricket. This document outlines the specific procedures and requirements for filing a claim. Pay close attention to the sections related to coverage, exclusions, and the steps to initiate a claim. Understanding these details will help you avoid potential pitfalls and ensure you meet all the necessary criteria.

Identify the Claim Trigger: Determine the reason for your claim. Whether it's a damaged phone, theft, or loss, each scenario may have unique requirements. For instance, if your phone is stolen, you'll need to provide proof of the incident, such as a police report. If it's damaged, you might need to arrange for an independent repair estimate. Understanding the claim trigger will guide you in gathering the appropriate evidence.

Gather Required Documentation: The documentation needed can vary depending on the type of claim. Here are some common documents you might require:

- Proof of Ownership: This could be a purchase receipt, invoice, or any other document that confirms your ownership of the Cricket phone.

- Police Report: In cases of theft or loss, a police report is essential. It provides official documentation of the incident.

- Repair or Replacement Estimate: If your phone is damaged, obtain estimates from authorized repair centers or service providers. These estimates should detail the cost of repairs or replacement.

- Photos/Videos: Visual evidence can be powerful. Take clear photos or videos of the damaged phone, especially if it's a smartphone with a visible issue.

- Original Packaging: In some cases, having the original packaging or accessories can be useful for claims related to loss or damage.

Follow the Claim Filing Procedure: Cricket's insurance provider will typically have a specific process for filing a claim. This might involve filling out an online form, submitting documents via email, or mailing them to a designated address. Ensure you adhere to the provided instructions and deadlines to avoid delays. Keep all communication and documentation related to the claim process for future reference.

Stay Informed and Follow Up: After submitting your claim, stay in touch with the insurance provider. Inquire about the status of your claim and provide any additional information they may request. Being proactive and responsive will help expedite the process. If you encounter any issues or have questions, don't hesitate to reach out to Cricket's customer support for guidance.

Hurricane Shutters and Insurance Payouts: Does Preparation Impact Claims?

You may want to see also

Frequently asked questions

You can verify your insurance coverage by logging into your Cricket account online or by contacting Cricket customer support. They will provide you with details about your current insurance plan and whether your device is covered.

When checking insurance, Cricket may require your device's unique identifier (IMEI/MEID), your account details, and proof of purchase. These details help them authenticate your device and ensure the accuracy of the insurance information.

Yes, Cricket offers various insurance plans that you can add to your device. You can choose from extended warranty options or insurance programs provided by Cricket or third-party partners. These plans often provide coverage for damage, theft, and accidental loss.

In the event of a lost or damaged device, you should immediately contact Cricket's customer support. They will guide you through the claims process, which may involve providing proof of purchase, device details, and a description of the incident. Cricket's insurance team will then assess the claim and provide appropriate assistance.