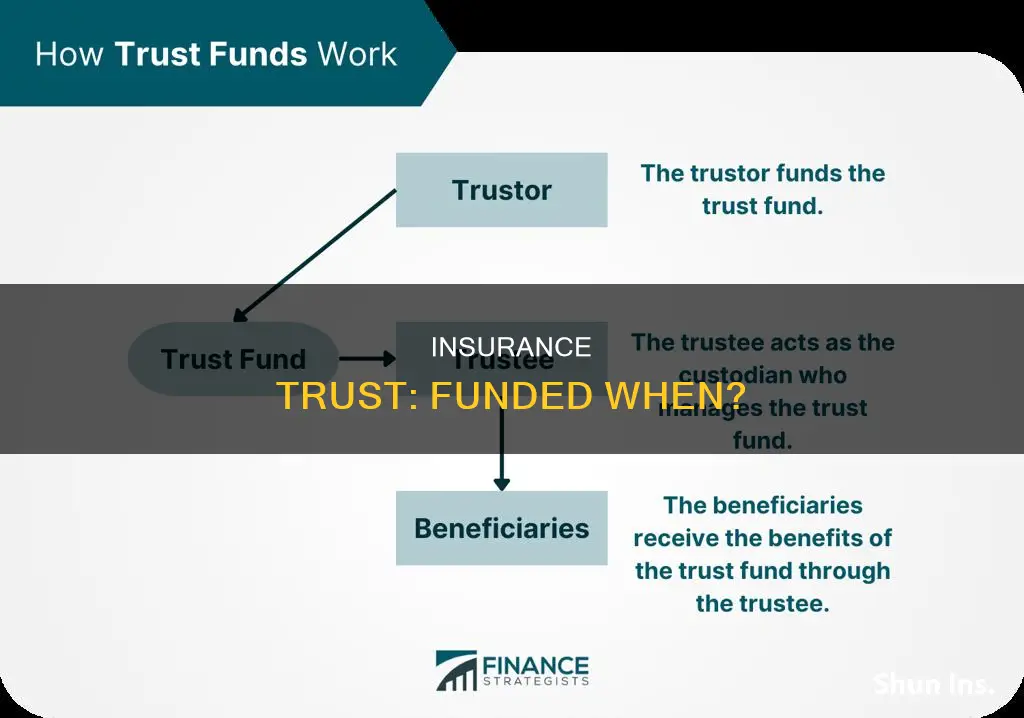

An insurance trust is a type of irrevocable trust where the trust assets consist of a life insurance policy. The trust owns the policy, even though the grantor is the insured person. This type of trust is beneficial for protecting an estate and its beneficiaries, controlling how insurance policy proceeds are used after the grantor's death, and avoiding large estate taxes. The grantor funds the trust by putting their life insurance policy into it, and the trust becomes the owner of the policy. The trust is a legal entity that exists outside of the grantor's estate, so it is exempt from overall estate taxes. When the grantor passes away, the life insurance benefit is paid out to the trust, and the trustee distributes the payout to the named beneficiaries following the guidelines stated in the trust documents.

What You'll Learn

- Irrevocable life insurance trusts (ILITs) are established with the grantor as the insured and the trust as the owner of the life insurance policy

- ILITs are used to minimise the estate tax due for wealthier individuals

- Life insurance trusts are shielded from creditors and the IRS

- A revocable trust can be changed, altered or revoked

- A revocable trust becomes irrevocable after the grantor's death or incapacitation

Irrevocable life insurance trusts (ILITs) are established with the grantor as the insured and the trust as the owner of the life insurance policy

Irrevocable life insurance trusts (ILITs) are a type of trust that holds one or more life insurance policies. They are created during the insured's lifetime and are typically used to own and control a term or permanent life insurance policy. ILITs are established with the grantor as the insured and the trust as the owner of the life insurance policy.

When a life insurance policy is placed in an ILIT, the insured person no longer owns the policy. Instead, it is managed by a trustee on behalf of the policy beneficiaries when the insured person dies. As the trust is irrevocable, it cannot be rescinded, amended, or modified once it has been established. This means that the grantor cannot change the terms of the policy or reclaim it.

There are several benefits to setting up an ILIT. Firstly, it can help to avoid estate taxes by excluding the death benefit from the insured's gross estate. Secondly, it can protect the death benefit from creditors and judgments. Thirdly, it can provide control over how the death benefit is used and distributed, ensuring it is in line with the deceased's wishes. Finally, it can be used as part of a larger estate plan, helping to secure a family's future.

However, there are also some drawbacks to consider. ILITs can be expensive and time-consuming to set up, and there may be tax implications for beneficiaries. Additionally, once the ILIT has been established, it cannot be modified or recalled, which means the grantor loses control over the policy.

Securing Computers: Preventing Unauthorized Changes

You may want to see also

ILITs are used to minimise the estate tax due for wealthier individuals

Irrevocable life insurance trusts (ILITs) are a popular method of estate planning for wealthier individuals. They are used to minimise the estate tax due for wealthier individuals by ensuring that the proceeds of a life insurance policy are not included in their taxable estate.

An ILIT is an irrevocable trust, meaning it cannot be rescinded, amended, or modified once it has been established. The grantor of the policy is the insured, and the trust is the owner of the life insurance policy. The insured person no longer owns the policy, which will be managed by the trustee on behalf of the policy beneficiaries when the insured person dies.

To avoid the incidence of ownership, the trust grantor can have the trust itself apply for the insurance policy and be the owner from the beginning. This is important because, for the life insurance policy to be excluded from one's personal estate, there must have been no incidence of ownership within the three years prior to the insured's death.

By setting up an ILIT, the trust becomes the owner of the policy, and the proceeds from the death benefit are therefore not included in the insured's gross estate. This minimises the potential estate tax exposure.

However, there are certain drawbacks to an ILIT arrangement. For instance, creating an insurance trust may not always be in line with the wishes of the insured or the best interests of their beneficiaries. For those with relatively small estates that would not normally be subject to estate tax in the first place, creating an ILIT can be expensive and time-consuming.

Unraveling the Intricacies of LIC Term Insurance: A Comprehensive Guide

You may want to see also

Life insurance trusts are shielded from creditors and the IRS

Life insurance trusts are an effective way to protect your assets from creditors and the IRS. This is especially useful if you have a large estate that you want to pass on to your beneficiaries without incurring hefty taxes.

Life insurance trusts are typically set up as irrevocable trusts, meaning they cannot be changed, altered, or revoked once they are established. This is an important distinction because it ensures that the assets in the trust are shielded from creditors and taxes. If the trust were revocable, it would still be considered part of the grantor's estate and taxed accordingly.

By placing a life insurance policy into an irrevocable trust, the insured person is no longer the owner of the policy. Instead, the policy is managed by a trustee on behalf of the beneficiaries when the insured person dies. This arrangement offers several benefits, including more favourable tax treatment, asset protection, and control over how the death benefit is used.

The primary goal of a life insurance trust is to reduce or eliminate estate taxes, which can consume up to 55% of life insurance proceeds. By establishing an irrevocable life insurance trust, the trust becomes the owner of the policy, and the proceeds are no longer included in the insured's taxable estate. This can result in significant tax savings for both the grantor and their beneficiaries.

In addition to tax advantages, life insurance trusts also provide asset protection. The proceeds from the life insurance policy are held in trust for the benefit of the settlor's spouse or beneficiaries, and they cannot be taxed in the spouse's or beneficiaries' estates. This ensures that the beneficiaries receive the full benefit of the insurance policy without having to share any portion with the IRS.

Furthermore, life insurance trusts can provide liquidity for heirs to pay estate taxes without having to dissolve other assets, such as real estate or a business. This can be especially useful if a large portion of the estate consists of illiquid assets that the family does not want to sell.

While life insurance trusts offer significant benefits, there are also some drawbacks to consider. For example, creating and managing a life insurance trust can be complex and expensive, and once established, it cannot be easily modified or revoked. Additionally, while the proceeds may not be taxed as part of the insured's estate, they could be taxed as part of the beneficiaries' estates, potentially resulting in a larger tax burden for descendants.

Unraveling the Secrets to Mastering Insurance Billing in Pharmacy

You may want to see also

A revocable trust can be changed, altered or revoked

A revocable trust is a flexible legal entity that allows the individual who creates it, known as the grantor, to change, alter, or revoke the trust assets or the trust itself at any point during their lifetime. The grantor can also amend the beneficiaries of the trust.

A revocable trust is often used to transfer assets to heirs while avoiding the time and expenses associated with probate, which would be incurred if assets were simply bequeathed in a will. During the life of the trust, income earned is distributed to the grantor, and only after their death does the property transfer to the beneficiaries.

The first step in dissolving a revocable trust is to remove all the assets that have been transferred into it. The second step is to fill out a formal revocation form, stating the grantor's desire to dissolve the trust. The official revocation declaration must be signed by the grantor, notarized, and, in some cases, filed with a local probate or estates court.

There are several reasons why a grantor might revoke a trust. One of the most common reasons is divorce, if the trust was created as a joint document with the grantor's spouse. A trust might also be revoked if the grantor wishes to make extensive changes, or if they want to change the provisions of the trust completely.

Christian Healthcare Ministries: Insurance or Not?

You may want to see also

A revocable trust becomes irrevocable after the grantor's death or incapacitation

A revocable trust is a trust that gives the grantor better control over assets during their lifetime. Once the grantor of a revocable trust dies, it becomes irrevocable. This means that the terms of the trust cannot be modified, and the trust becomes a separate entity requiring an Employer Identification Number (EIN) for tax purposes.

The death of the grantor is one of two common scenarios in which a revocable trust becomes irrevocable. The other is if the grantor becomes incapacitated and can no longer make decisions regarding the operation of the trust. In this case, a licensed healthcare provider must conduct a thorough medical review to confirm the incapacitation diagnosis. A successor trustee is then named to oversee the trust until the grantor regains capacity. If the grantor recovers enough to regain their capacity, the trust becomes revocable again.

In the case of a revocable trust with two grantors, the general rule is that both grantors must die for the trust to become irrevocable. However, there are legal ways to change this rule. For example, an estate planning lawyer can add language to the trust document to change the rule. Alternatively, a successor trustee can assume legal responsibility for making decisions involving the trust.

The transition of a revocable trust to an irrevocable trust upon the death of the grantor has several implications. For example, the trust will now be considered a separate taxpayer and will be required to obtain a Tax Identification Number (TIN). Additionally, the trust will need to obtain an EIN for filing tax returns.

Full-Time Work Hours: Insurance Eligibility

You may want to see also

Frequently asked questions

An insurance trust is an irrevocable trust set up with a life insurance policy as the asset. The trust owns the policy, and a trustee manages it on behalf of the beneficiaries when the insured person dies.

You can fund an insurance trust by purchasing a life insurance policy and transferring ownership of the policy to the trust.

An insurance trust can provide control over how insurance policy proceeds are used after your death, and it can be used to avoid large estate taxes. It can also protect assets from probate court and depletion due to estate taxes.

Setting up and managing an insurance trust can be complex and expensive, and once it is established, it cannot be modified or revoked. There may also be tax implications for beneficiaries if the grantor dies within three years of setting up the trust.