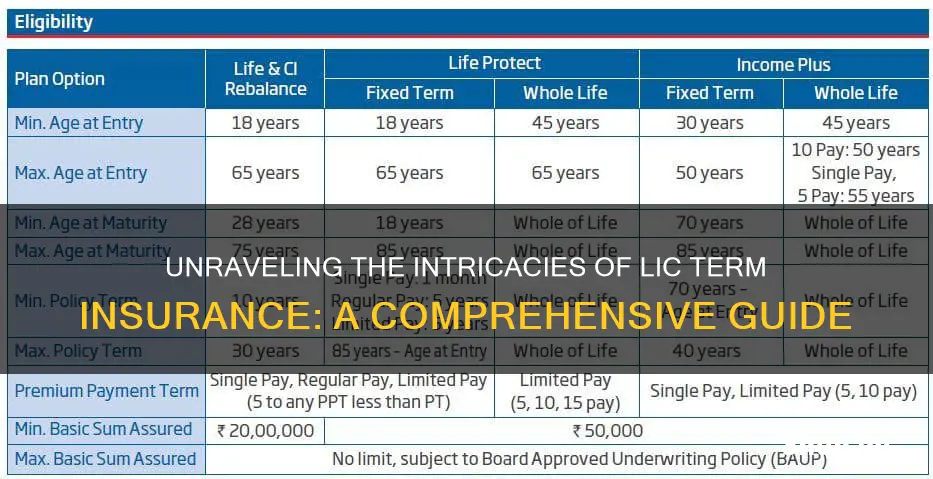

Term insurance plans from the Life Insurance Corporation of India (LIC) provide financial protection to your family in the event of your death. LIC term plans are flexible and offer comprehensive coverage at an affordable cost. The entry age for these plans is 18-65 years, with a policy term of 10 to 40 years. LIC term insurance plans can secure your family against any loss of income that may occur in your absence. LIC term plans do not offer any maturity benefits, but they do allow insurance buyers to purchase high levels of coverage at very low premiums.

| Characteristics | Values |

|---|---|

| Company | Life Insurance Corporation of India (LIC) |

| Type of Insurance | Term Insurance |

| Purpose | Secure your family against any loss of income in the absence of the policyholder |

| Premium Rates | Affordable |

| Sum Assured | High |

| Age Range | 18-75 years |

| Payment Options | Flexible |

| Additional Benefits | Rider benefits to enhance policy coverage |

| Claim Settlement Ratio | 98.74% |

What You'll Learn

- LIC term insurance plans can secure your family against any loss of income

- LIC term plans do not offer maturity benefits but are still favoured due to their affordability

- LIC term insurance premium rates are flexible and can be paid online or offline

- LIC term insurance plans offer rider benefits to enhance coverage, such as accidental death and disability benefits

- LIC term insurance plans have specific exclusions, such as not covering suicide within the first 12 months of the policy

LIC term insurance plans can secure your family against any loss of income

LIC, or the Life Insurance Corporation of India, is a state-owned organisation and India's largest life insurance company. LIC's term insurance plans can secure your family against any loss of income in the absence of the policyholder. LIC term plans are flexible in nature and offer comprehensive coverage at an affordable cost.

- High insurance coverage at an affordable premium rate.

- The policy provides a rebate on the premium amount for non-smokers.

- The policyholder has the flexibility to choose the sum assured amount of the policy.

- The LIC term plan fulfills the requirements of policy buyers ranging from a minimum of 18 years to a maximum of 75 years of age.

- The LIC term insurance premium rates are flexible in terms of payment.

- Offers additional rider benefits to enhance the policy coverage.

- The policy enables the insured to have a good lifestyle while paying the premiums.

- LIC online term insurance plans can be purchased easily and hassle-free.

- LIC plans have a claim settlement ratio of 98.74%.

LIC offers four types of term insurance plans: LIC Saral Jeevan Bima, LIC Jeevan Kiran, LIC New Tech Term, and LIC New Jeevan Amar.

The Intricacies of Jettison in Insurance: Understanding the Concept and Its Implications

You may want to see also

LIC term plans do not offer maturity benefits but are still favoured due to their affordability

Term insurance plans are a type of life insurance that provides financial protection to the insured's family in the event of their untimely death. LIC, India's largest life insurance company, offers a range of term insurance plans to meet different needs and budgets. While term insurance plans typically do not offer maturity benefits, LIC term plans are still favoured due to their affordability and comprehensive coverage.

- Affordable Premiums: LIC term insurance plans are designed to be budget-friendly, ensuring that individuals can secure their family's financial future without straining their finances. The premiums are very reasonable, allowing individuals to obtain high coverage at a low cost.

- High Sum Assured: LIC term plans offer a high sum assured, providing comprehensive financial protection to the insured's family. The minimum sum assured varies across different plans, but it can go as low as INR 5 lakhs, with no upper limit in some cases.

- Flexibility: LIC term plans offer flexibility in terms of policy term, premium payment options, and coverage. Policy terms can range from 10 to 40 years, and premiums can be paid regularly, as a single payment, or in limited deposits. This flexibility allows individuals to choose a plan that best suits their needs and budget.

- Tax Benefits: LIC term insurance plans offer tax benefits under Sections 80C and 10(10D) of the Indian Income Tax Act, 1961. Policyholders can claim deductions on the premiums paid and receive tax-free benefits upon maturity or death.

- Riders: LIC term plans allow individuals to enhance their coverage by adding riders, such as critical illness, accidental death, and disability benefits. These additional benefits provide extra financial protection and can be purchased by paying an extra premium.

- Claim Settlement Ratio: LIC has a high claim settlement ratio, which indicates a higher likelihood of the nominee receiving the claim amount. As per the IRDAI annual report 2022-23, LIC has successfully settled 2.25 Cr. claims and paid out a significant amount in claims.

- Customer Service: LIC is known for its customer-centric approach and provides 24/7 customer support to its policyholders. This ensures that individuals can easily reach out for assistance and guidance throughout the policy term.

While LIC term plans do not offer maturity benefits, they provide essential financial protection to individuals and their families at affordable rates. The flexibility, high coverage, and tax benefits make LIC term plans a popular choice for those seeking comprehensive life insurance coverage without breaking their budget.

Lease Term Insurance: Understanding the Coverage and Benefits

You may want to see also

LIC term insurance premium rates are flexible and can be paid online or offline

LIC term insurance plans can be purchased online at lower premium rates by visiting the company's website. The LIC term plans can be bought through intermediaries. The LIC term insurance premium can be paid through different payment modes, namely:

- Cheque/DD payment at the branch and related counters

- Payment at the Axis Bank

- Payment at the Corporation Bank

- LIC Online Payment options

- Premium point by empowered agents

- Retired LIC Employee collection

- Authorized Service Provider (in selected cities)

For the online payment mode, the policyholder can pay via:

- Net Banking

- Debit Card

- Credit Card

- UPI

The LIC term insurance premium can be paid anytime and anywhere. A valid premium receipt is received instantly. It is also a secure arrangement, as the policy data is not shared between LIC and the service provider. There are no charges for payments made through Debit Card, Net Banking and UPI.

The Many Faces of Insurance Brokers: Exploring Alternative Terms for Intermediaries

You may want to see also

LIC term insurance plans offer rider benefits to enhance coverage, such as accidental death and disability benefits

- Accidental Death and Disability Benefit Rider: This rider provides financial protection in the event of an accident resulting in permanent disability or death. If the policyholder becomes permanently disabled due to an accident, the rider benefit will be paid in equal monthly instalments over 10 years. Additionally, future premiums for the policy will be waived.

- Accident Benefit Rider: This rider offers a lump sum payment in addition to the death benefit if the policyholder dies due to an accident during the policy term.

- Critical Illness Benefit Rider: This rider provides a lump sum payment if the insured person is diagnosed with one of 15 critical illnesses, including cancer, kidney failure, and stroke.

- New Term Assurance Rider: This rider provides an additional sum assured to the beneficiary in the event of the policyholder's death during the policy term.

LIC term insurance plans offer flexibility in adding these rider benefits to enhance coverage. Policyholders can choose the riders that best suit their needs and budget. These benefits provide valuable protection against unforeseen accidents and critical illnesses, ensuring financial support for the policyholder and their family.

Policybazaar's Term Insurance: A Safe Bet for Long-Term Financial Security?

You may want to see also

LIC term insurance plans have specific exclusions, such as not covering suicide within the first 12 months of the policy

Life Insurance Corporation of India (LIC) is a state-owned organisation and India's largest life insurance company. LIC offers a range of insurance products, including term insurance plans, which provide financial security to the policyholder's family in the event of their death.

LIC term insurance plans have specific exclusions, and suicide within the first 12 months of the policy is one of them. If the policyholder commits suicide within the first 12 months of the policy or its revival, the death benefit will not be paid to the beneficiary. Instead, the beneficiary will receive a percentage of the premiums paid, provided that all premiums are up to date. This exclusion is in place to prevent insurance fraud and give policyholders time to reconsider their decision.

LIC term insurance plans are flexible and can be purchased online or through intermediaries. They offer high coverage at low premium rates, making them a popular choice for individuals seeking financial protection for their loved ones.

The Mystery of EPO Insurance Plans Unveiled: Understanding Exclusive Provider Organizations

You may want to see also

Frequently asked questions

LIC term insurance is a type of life insurance that provides financial protection for your family in the event of your death. It offers high coverage at an affordable premium rate and is flexible in terms of payment options and policy terms.

LIC term insurance offers several benefits, including high insurance coverage, flexible payment options, and the ability to choose the sum assured. It also provides additional rider benefits and has a high claim settlement ratio. Additionally, the premiums paid are eligible for tax benefits under the Income Tax Act.

You can buy LIC term insurance online through the official website or through intermediaries such as agents, brokers, and banks. The process typically involves selecting the desired plan, filling in personal details, calculating the premium, and making the payment.

In the event of the policyholder's death, the nominee should notify LIC and initiate the claim process. This can be done online or by visiting an LIC branch. The required documents, such as the claim form and death certificate, can be submitted online or at any LIC office. LIC will then review the claim and initiate the settlement process.