When it comes to finding the best place to get term life insurance, it's important to consider several factors. Many people opt for term life insurance as a cost-effective way to provide financial security for their loved ones during a specific period. The key is to find a reputable insurance provider that offers competitive rates, a range of policy options, and excellent customer service. Some popular choices include comparing quotes from multiple insurance companies, checking online reviews, and seeking recommendations from trusted sources. Additionally, understanding your specific needs and preferences, such as coverage amount, term length, and payment options, will help you make an informed decision.

What You'll Learn

- Cost Comparison: Research and compare prices from different providers to find the most affordable options

- Coverage Options: Understand the various coverage amounts and terms available to suit your needs

- Provider Reputation: Evaluate the financial strength and customer service ratings of insurance companies

- Medical Requirements: Be aware of any health questions or exams needed for a policy

- Online Resources: Utilize online tools and calculators to estimate costs and find suitable plans

Cost Comparison: Research and compare prices from different providers to find the most affordable options

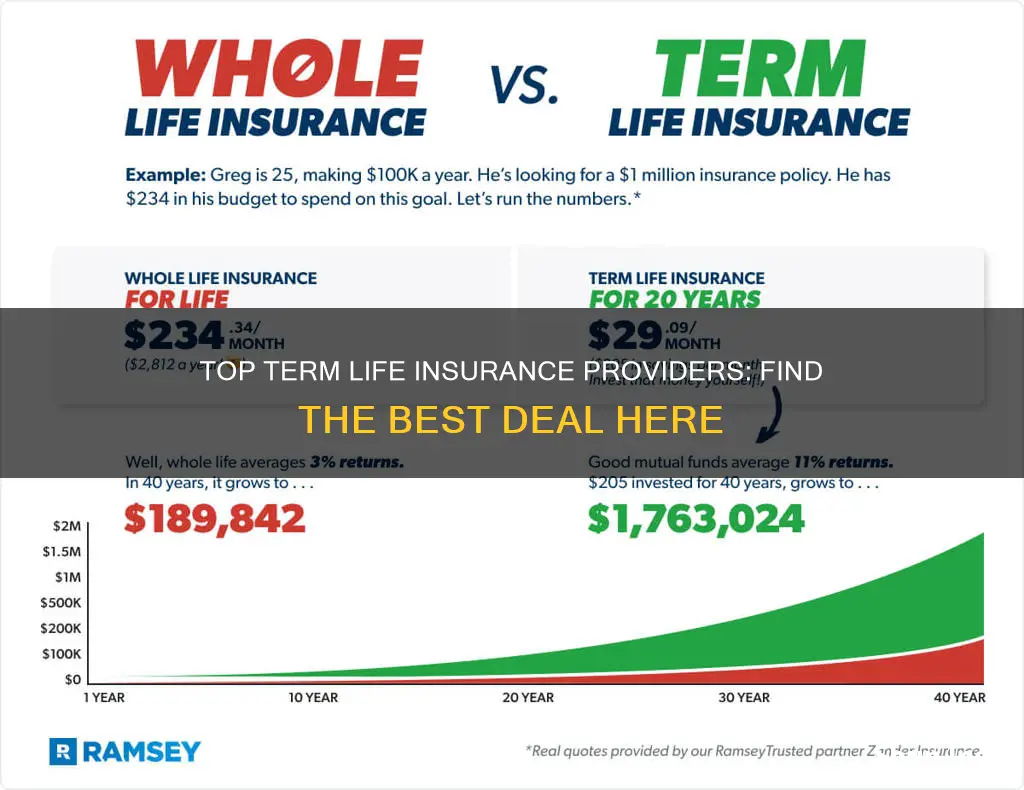

When it comes to finding the best place to get term life insurance, cost comparison is a crucial step in the process. Term life insurance is a type of coverage that provides financial protection for a specific period, typically 10, 20, or 30 years. It is a popular choice for individuals seeking affordable and straightforward life insurance. Here's a detailed guide on how to research and compare prices to find the most affordable options:

- Understand Your Needs: Before diving into the comparison, it's essential to understand your insurance needs. Consider factors such as your age, health, lifestyle, and the desired coverage amount. Younger and healthier individuals often qualify for lower premiums. Determine the term length that aligns with your goals, whether it's for a specific period or long-term coverage.

- Gather Information from Providers: Start by gathering quotes from multiple insurance providers. You can obtain quotes online through their websites or by contacting their customer service representatives. Provide accurate and relevant information, including your personal details, health history, and desired coverage. Obtaining quotes from various companies will give you a comprehensive view of the market prices.

- Compare Quotes: Once you have quotes from different providers, carefully compare the prices. Look for patterns and variations in the cost structures. Consider the following:

- Term Length: Prices may vary based on the term length. Longer terms might offer lower monthly premiums but higher overall costs.

- Coverage Amount: The higher the coverage amount, the more expensive the policy will be. Evaluate your needs and choose a coverage level that provides adequate protection without unnecessary expenses.

- Age and Health: Insurance rates are often influenced by age and health status. Younger and healthier individuals may secure lower premiums.

Consider Additional Factors: Besides the base price, review the following aspects:

- Benefits and Riders: Some policies offer additional benefits or riders, such as an accidental death benefit or a waiver of premium rider. These features can increase the cost but provide valuable protections.

- Customer Service and Reputation: Opt for providers with a strong reputation and excellent customer service. A reliable company will offer support and guidance throughout the policy duration.

- Payment Options: Check the payment plans offered by each provider. Some companies may provide flexible payment options, allowing you to choose the most suitable payment frequency.

Review and Negotiate: After comparing quotes and considering additional factors, review the policies and terms carefully. Ensure you understand the coverage, exclusions, and any potential changes in premiums over time. If you find a policy that meets your needs but seems slightly more expensive, consider negotiating with the provider. Some companies may offer discounts or adjustments based on your profile.

By following these steps, you can effectively research and compare prices from different term life insurance providers. Finding the most affordable options requires a thorough understanding of your needs and a comprehensive evaluation of the market. Remember, the goal is to secure adequate coverage without overspending, ensuring a wise investment in your financial security.

Life Insurance Proceeds: US-Spain Tax Treaty Implications

You may want to see also

Coverage Options: Understand the various coverage amounts and terms available to suit your needs

When considering term life insurance, understanding the coverage options is crucial to ensuring you have the right amount of protection for your loved ones. The primary goal is to provide financial security during a specific period, typically 10, 15, or 20 years, depending on your needs and preferences. Here's a breakdown of the coverage options to help you make an informed decision:

Coverage Amounts: Term life insurance policies offer a wide range of coverage amounts, often starting from $10,000 and going up to several million dollars, depending on the insurer and your overall health. The coverage amount represents the financial benefit that will be paid out to your beneficiaries if you pass away during the term of the policy. It's essential to evaluate your current and future financial obligations to determine the appropriate coverage. For instance, if you have a mortgage, children's education expenses, or a spouse who relies on your income, you might consider a higher coverage amount to ensure their financial stability.

Term Lengths: The term length refers to the duration for which the policy provides coverage. As mentioned, common term lengths are 10, 15, and 20 years. A 10-year term is often the most affordable, making it an attractive option for those seeking temporary coverage or those on a tight budget. On the other hand, a 20-year term provides longer-term security, which can be beneficial if you want to ensure your family's financial needs are met over an extended period. Some insurers also offer longer terms, such as 30 years, which can provide coverage until retirement age.

Level vs. Increasing Coverage: Term life insurance policies can be either level or increasing. A level term policy has the same coverage amount throughout the entire term, making it predictable and easy to plan for. In contrast, an increasing term policy starts with a lower coverage amount and gradually increases over time, often tied to inflation or specific financial goals. For example, if you choose a 10-year increasing term, the coverage will start at a lower level and increase annually to keep up with potential financial needs.

Review and Adjustment: It's important to regularly review and adjust your coverage as your life circumstances change. Life events such as marriage, the birth of a child, or a significant change in income should prompt a re-evaluation of your insurance needs. For instance, if you start a new high-paying job, you might consider increasing your coverage to match your higher earnings. Conversely, if you pay off your mortgage or your children become financially independent, you may opt for a lower coverage amount to avoid over-insuring.

By carefully considering the coverage amounts and terms available, you can tailor your term life insurance policy to fit your unique circumstances. This ensures that you have the right level of protection for your loved ones during the specified term, providing them with the financial security they need when you're no longer there. Remember, the key is to strike a balance between affordability and adequate coverage to meet your family's long-term financial goals.

Life Insurance's Fate: Unclaimed Funds and Legal Procedures

You may want to see also

Provider Reputation: Evaluate the financial strength and customer service ratings of insurance companies

When considering term life insurance providers, evaluating their reputation and reliability is crucial. This involves assessing their financial stability and customer service standards to ensure you're making an informed decision. Here's a guide on how to approach this aspect:

Financial Strength: One of the primary indicators of a reliable insurance provider is their financial stability. Term life insurance policies are long-term commitments, and you want to ensure that the company will be around to honor its obligations. Research the financial strength of potential insurers by examining their ratings from independent agencies like A.M. Best, Moody's, or Standard & Poor's. These ratings provide an assessment of the company's ability to meet its financial commitments. Look for insurers with an 'A' or higher rating, indicating a strong financial position. A financially stable company is more likely to pay out claims promptly and efficiently, providing peace of mind for policyholders.

Customer Service Ratings: Excellent customer service is essential when dealing with insurance, as it can significantly impact your overall experience. Check online reviews and ratings to gauge customer satisfaction. Websites like the Better Business Bureau (BBB) provide valuable insights into a company's customer service record. Look for insurers with consistently positive reviews, highlighting their responsiveness, helpfulness, and efficiency in handling claims and policy-related inquiries. Additionally, consider reaching out to current or past policyholders to gather firsthand feedback on their experiences with the insurer's customer service.

Online Presence and Transparency: A reputable insurance provider should have a transparent online presence, making it easy for potential customers to find information. Their website should offer detailed explanations of their products, coverage options, and pricing structures. Look for companies that provide clear and concise information about their term life insurance policies, ensuring you understand the terms and conditions. An insurer with a comprehensive online presence also demonstrates a commitment to customer education and transparency.

Industry Awards and Recognition: Keep an eye out for insurance companies that have received industry awards or recognition for their term life insurance offerings. These awards often highlight exceptional customer service, innovative products, or overall excellence in the industry. While awards should not be the sole criterion for your decision, they can provide an additional layer of assurance regarding the provider's reputation and commitment to quality.

By carefully evaluating the financial strength and customer service ratings of insurance companies, you can make a well-informed choice when selecting a term life insurance provider. This due diligence ensures that you're working with a reputable company that will provide the necessary support and financial security when it matters most.

Life Insurance: Job Loss and Your Coverage

You may want to see also

Medical Requirements: Be aware of any health questions or exams needed for a policy

When considering term life insurance, it's important to understand the medical requirements and processes involved in obtaining a policy. These requirements can vary depending on the insurance company and the type of coverage you choose. Here's an overview of what you need to know about medical considerations:

Health Questionnaires: Insurance companies often use detailed health questionnaires to assess your eligibility and determine the terms of your policy. These questionnaires typically ask about your medical history, current health status, and any pre-existing conditions or lifestyle factors that may impact your insurability. Be prepared to provide accurate and comprehensive information. Common questions may include your age, height, weight, smoking status, alcohol consumption, family medical history, and any existing or past medical conditions. It's crucial to disclose all relevant health information to ensure fair pricing and coverage.

Medical Exams: In some cases, insurance providers may require a medical examination to verify the information provided on the health questionnaire. This exam can vary in scope and may include a physical check-up, blood tests, and sometimes even a full-body MRI or other advanced imaging. The specific tests requested will depend on your age, overall health, and the amount of coverage you seek. For instance, older applicants or those with significant health concerns may undergo more extensive medical evaluations. It's essential to follow the insurance company's instructions regarding the timing and location of the exam.

Impact on Policy: The medical requirements and exams are designed to assess your risk profile as an insurance candidate. Insurance companies use this information to determine the premium rates and coverage limits. A history of chronic illnesses or unhealthy lifestyle choices may result in higher premiums or even denial of coverage. Conversely, a healthy lifestyle and medical history can lead to more favorable terms and lower costs. Transparency and honesty in your medical disclosures are vital to ensure you receive accurate pricing and the best possible policy.

Preparation Tips: To make the process smoother, it's advisable to gather your medical records and consult with your healthcare provider before applying for term life insurance. They can provide insights into any potential health concerns and ensure that your medical history is accurately represented. Additionally, maintaining a healthy lifestyle, managing any existing conditions, and being open and honest during the application process can contribute to a more positive outcome.

Remember, the medical requirements for term life insurance are in place to protect both you and the insurance company. By understanding these processes and being prepared, you can navigate the application process with confidence and increase your chances of securing the right coverage.

Life Insurance Options with Congestive Heart Failure

You may want to see also

Online Resources: Utilize online tools and calculators to estimate costs and find suitable plans

In today's digital age, the internet is a powerful resource for finding and comparing term life insurance options. Online tools and calculators have become invaluable assets for consumers, offering a convenient and efficient way to estimate costs and find suitable plans. Here's how you can leverage these online resources to make an informed decision:

Cost Estimation Tools: One of the most significant advantages of using online resources is the ability to estimate insurance costs quickly. Various websites and platforms provide term life insurance calculators that can give you an idea of the premiums you might pay based on your personal details. These tools typically ask for information such as your age, gender, smoking status, health conditions, and the desired coverage amount. By inputting this data, you can get an instant estimate, helping you understand the price range you can expect. This initial estimation is crucial as it allows you to set a budget and narrow down your options before delving into more detailed research.

Plan Comparison: Online resources also offer a comprehensive view of different insurance plans. Many websites aggregate data from various insurance providers, allowing you to compare multiple plans side by side. You can filter and sort these plans based on factors like coverage duration, death benefit, premium payment options, and additional benefits. This comparison feature enables you to assess the pros and cons of each plan, ensuring you choose one that aligns with your specific needs and preferences. Moreover, some online platforms provide customer reviews and ratings, giving you insights into the experiences of other policyholders.

Interactive Quizzes and Assessments: Another interactive approach to finding suitable term life insurance is through online quizzes and assessments. These tools guide you through a series of questions to determine your insurance needs and preferences. They consider factors like your family's financial situation, long-term goals, and potential risks. By the end of the quiz, you receive personalized recommendations, making it easier to decide on the coverage type and duration. These interactive resources are particularly useful for those who prefer a more guided and personalized approach to insurance shopping.

Online Research and Education: The internet also serves as an educational hub, providing valuable information about term life insurance. You can find detailed articles, blogs, and guides that explain the intricacies of different insurance policies, coverage options, and industry trends. By reading these resources, you'll gain a deeper understanding of the factors influencing insurance premiums and how to make the right choices. Additionally, online forums and communities can offer a platform to ask questions and share experiences, ensuring you make an informed decision.

When utilizing online resources, it's essential to cross-reference information from multiple sources to ensure accuracy and reliability. Remember, while these tools provide valuable insights, they should be used as a starting point for your research. Consulting with insurance professionals or agents can offer personalized advice and help you navigate the complexities of choosing the best term life insurance plan for your circumstances.

Life Insurance and AD&D: Stacking Your Coverage Benefits

You may want to see also

Frequently asked questions

The best place to get term life insurance depends on your individual needs and preferences. It's essential to consider several factors, such as the insurance company's reputation, financial stability, customer service, and the specific features and benefits of the policy. Researching and comparing different providers can help you find a reputable and reliable company that offers competitive rates and suitable coverage options.

To find a reputable insurance company, start by checking online reviews and ratings from trusted sources. Look for companies with a strong financial rating from agencies like A.M. Best or Moody's, indicating their financial stability. Additionally, consider the company's history, customer satisfaction ratings, and any complaints or issues raised by policyholders. It's also beneficial to seek recommendations from friends or family who have had positive experiences with their insurance providers.

Choosing a local insurance agent or broker can have its advantages. Local agents often provide personalized service and can offer tailored advice based on your specific needs. They can explain the policy details in your local language and culture, ensuring you understand the terms and conditions. Additionally, local agents can provide quick access to support and assistance, making it easier to file claims or address any concerns.

When shopping for term life insurance, it's crucial to avoid common pitfalls. Firstly, don't solely focus on the price; compare the overall value and coverage options. Avoid rushing the decision; take your time to research and understand the different policies. Be cautious of high-pressure sales tactics and always read the fine print to ensure you comprehend the terms and conditions. Lastly, don't neglect to review and update your coverage periodically to ensure it remains suitable as your circumstances change.

Yes, it is possible to obtain term life insurance without a medical exam, often referred to as "no-exam" or "simplified issue" life insurance. This type of policy typically involves a streamlined application process where the insurance company relies on your health and lifestyle information provided in the application. While the underwriting process may be less comprehensive, it can still provide coverage for a specific term, usually with lower coverage amounts compared to traditional policies that require a medical exam.