When an individual passes away without a designated beneficiary for their life insurance policy, the insurance company must follow specific legal procedures to ensure the policy's benefits are distributed according to the law. In such cases, the insurance company typically follows a predetermined order of priority, which may include the insured's estate, heirs, or other legal entities. This process can be complex and may require legal intervention to resolve any disputes or claims. Understanding these procedures is essential for both the insurance company and the deceased's beneficiaries to ensure a fair and lawful distribution of the policy's proceeds.

What You'll Learn

- Legal Default: Insurance company follows state law to determine distribution if no beneficiary is named

- Company Ownership: Policy proceeds typically go to the insurance company or the insured's estate

- Tax Implications: Unclaimed funds may be subject to estate taxes or escheat to the state

- Policy Lapse: Unclaimed funds can be used to pay any outstanding policy debts or fees

- Charitable Donation: Some policies allow for automatic donation to a charity if no beneficiary is specified

Legal Default: Insurance company follows state law to determine distribution if no beneficiary is named

If a life insurance policyholder fails to name a beneficiary, the insurance company is legally obligated to follow a specific distribution process, which varies depending on the state's laws. This legal default ensures that the insurance proceeds are distributed in a fair and structured manner, often prioritizing certain individuals or entities as per the state's guidelines. Understanding this process is crucial for anyone without a designated beneficiary, as it outlines the steps the insurance company must take to resolve the distribution of the policy's value.

In many states, the legal default is to distribute the insurance money to the policyholder's estate. This means the proceeds become part of the deceased's assets and are subject to the state's probate laws. The estate may include various assets, and the insurance payout is typically added to this pool. The next step in the distribution process depends on the state's laws and the complexity of the estate. In some cases, the insurance company might need to initiate a formal probate process to settle the estate and distribute the proceeds accordingly.

The distribution process can become more intricate if the policyholder has multiple beneficiaries or if the state has specific inheritance laws. For instance, some states may prioritize the distribution to the policyholder's spouse or children, ensuring they receive the insurance money before other potential heirs. This legal default helps prevent potential disputes and provides a clear path for the insurance company to follow, ensuring the policyholder's intentions, or lack thereof, are honored.

It is essential to note that while state laws dictate the distribution process, the insurance company's role is to facilitate this process. They will typically provide guidance and documentation to help the beneficiaries or the estate's representatives understand their rights and the steps required to claim the insurance proceeds. This legal default ensures that the distribution is handled efficiently and in compliance with the law.

In summary, when a life insurance policy is in force without a named beneficiary, the insurance company's legal obligation is to follow the state's distribution laws. This process ensures that the insurance proceeds are distributed according to the state's guidelines, often benefiting the policyholder's estate or designated heirs as per the state's regulations. Understanding this legal default is essential for anyone without a beneficiary, as it provides clarity on the potential distribution of their life insurance policy.

Smart Score Life Insurance: The Smartest Way to Insure

You may want to see also

Company Ownership: Policy proceeds typically go to the insurance company or the insured's estate

If a life insurance policy is in force and a beneficiary is not designated, the proceeds of the policy can fall into a few different categories, depending on the specific circumstances and the type of policy. In many cases, the insurance company or the insured's estate will be the primary recipients of the policy's benefits.

When an individual purchases a life insurance policy, they are the policyholder, and they have the authority to make decisions regarding the policy. If the policyholder does not name a beneficiary, the default setting is that the insurance company or the insured's estate will receive the proceeds. This is because the insurance company is the primary stakeholder in the policy's administration and has a vested interest in ensuring the policy's terms are fulfilled.

In the event of the insured's death, the insurance company will typically pay out the death benefit as per the policy's terms. The proceeds may then be used to settle any outstanding debts or taxes owed by the insured's estate. If there are no debts or specific instructions, the insurance company may return the proceeds to the insured's estate, which could include the insured's heirs or legal representatives. This process ensures that the insured's assets are distributed according to their wishes, even if they did not explicitly state them.

It's important to note that the insurance company's role is to facilitate the distribution of the proceeds and ensure the policy's obligations are met. They may provide guidance and support during the claims process, but they do not have the authority to make decisions on behalf of the insured or their estate. The insured's estate, including their heirs or legal representatives, will have the final say in how the proceeds are utilized.

In summary, if a life insurance policy lacks a designated beneficiary, the proceeds will generally go to the insurance company or the insured's estate. This ensures that the policy's benefits are managed and distributed according to the insured's intentions, even in the absence of explicit beneficiary information.

ICICI Prudential Life Insurance: Is It Worth the Investment?

You may want to see also

Tax Implications: Unclaimed funds may be subject to estate taxes or escheat to the state

When an individual passes away without a designated beneficiary for their life insurance policy, the fate of the unclaimed funds becomes a complex matter with significant tax implications. In such cases, the insurance company is obligated to follow specific legal procedures to ensure the proper handling of the policy's proceeds.

One of the primary considerations is the potential application of estate taxes. If the deceased individual owned the life insurance policy as an asset within their estate, the unclaimed funds could be subject to estate taxation. Estate taxes are levied on the value of the deceased's estate, and the life insurance payout may be included in this calculation. This means that the funds intended for the beneficiary could be taxed, reducing the overall value available to the intended recipient. The tax authorities may require the insurance company to report and remit these funds to the appropriate tax authorities, who will then apply the necessary tax rates and regulations.

Another critical aspect is the process of escheat, where unclaimed funds may revert to the state. Escheatment is a legal mechanism that allows the state to claim ownership of abandoned or unclaimed property. When a life insurance policy remains unclaimed, the state may step in and seize the funds, treating them as abandoned assets. This process ensures that the money is not left in limbo and can be utilized for public benefit. However, the state's claim on the funds may also trigger tax obligations. The state may impose taxes on the escheated funds, and the insurance company might be responsible for paying these taxes on behalf of the deceased individual's estate.

The tax implications of unclaimed life insurance funds can be intricate and vary depending on the jurisdiction and the specific circumstances of the case. It is essential for insurance companies to adhere to legal requirements and notify the appropriate authorities when a policy remains unclaimed. By doing so, they can help ensure that the funds are properly managed and that any tax liabilities are addressed, providing clarity and protection for all involved parties.

Borrowing from Life Insurance: What You Can and Can't Do

You may want to see also

Policy Lapse: Unclaimed funds can be used to pay any outstanding policy debts or fees

When a life insurance policy is in force, the proceeds are typically paid out to a designated beneficiary upon the insured individual's death. However, what happens if there is no beneficiary, and the policy remains unclaimed? In such cases, the life insurance company has a responsibility to handle the policy's proceeds according to legal and regulatory guidelines. One crucial aspect of this process is the potential use of unclaimed funds to settle any outstanding policy-related debts or fees.

Upon the insured's passing, the life insurance company initiates a process to identify and notify beneficiaries. If no beneficiary is found or contactable, the company must follow specific procedures to ensure the policy's proper administration. This includes verifying the insured's death, assessing the policy's value, and determining the next steps for the unclaimed funds. One of the primary considerations is to cover any outstanding debts or fees associated with the policy.

Outstanding policy debts can include various expenses incurred by the insurance company during the policy's administration. For instance, there may be costs associated with medical examinations, policy issuance, or any other services provided to the insured. Additionally, fees could include administrative charges, interest on loans taken from the policy's cash value, or any other financial obligations the insured had with the insurance provider. These debts are essential to settle to ensure the company's financial stability and to prevent any legal complications.

When the unclaimed funds are available, the insurance company will prioritize paying off these outstanding debts. This process is crucial to protect the interests of the company and to ensure that the policy's value is not depleted without a clear purpose. By addressing these debts, the company can maintain its financial integrity and fulfill its contractual obligations. It also provides a sense of closure to the policy's administration, allowing the company to move forward with other policyholders' claims or investments.

In summary, the handling of unclaimed life insurance funds without a designated beneficiary involves a careful process to identify and settle any outstanding policy-related debts or fees. This ensures that the insurance company's interests are protected, and the policy's value is utilized appropriately. It is a critical step in the administration of life insurance policies, especially when the usual beneficiary notification process fails.

Ace Your Life Insurance Agent Interview: Tips for Success

You may want to see also

Charitable Donation: Some policies allow for automatic donation to a charity if no beneficiary is specified

When an individual purchases a life insurance policy and fails to name a beneficiary, the insurance company has the discretion to handle the payout in various ways. One such option is to donate the proceeds to a charity or charitable organization. This practice is becoming increasingly popular as it provides a meaningful way to utilize the financial benefit of the policy while also supporting a cause.

Life insurance policies often offer the option to designate a charity as the recipient of the death benefit if no beneficiary is chosen. This feature allows the insurance company to contribute to a good cause, especially if the policyholder had previously expressed a desire to support a particular charity or cause. For instance, if an individual had mentioned their passion for environmental conservation to their insurance provider, the company might consider donating the payout to an environmental organization.

The process of donating to a charity is typically straightforward. Upon the insured individual's passing, the insurance company will review the policy details and, if no beneficiary is specified, initiate the donation process. This may involve contacting the chosen charity and providing the necessary information to facilitate the transfer of funds. The charity then receives the financial benefit, which can be used to support their mission and initiatives.

This automatic charitable donation feature can be a convenient and ethical way to manage life insurance proceeds. It ensures that the financial value of the policy is utilized for a good cause, especially if the policyholder had not had the opportunity to specify a beneficiary. Many insurance companies also provide options for policyholders to choose the charity they wish to support, allowing for a more personalized approach.

In summary, when a life insurance policy is in place without a designated beneficiary, the insurance company can automatically donate the payout to a charity. This practice aligns with the wishes of those who may have wanted their financial assets to contribute to a cause they cared about. It is a thoughtful and practical way to handle life insurance proceeds, ensuring a positive impact on society.

Adjustable Life Insurance: Cash Value Accessibility Explained

You may want to see also

Frequently asked questions

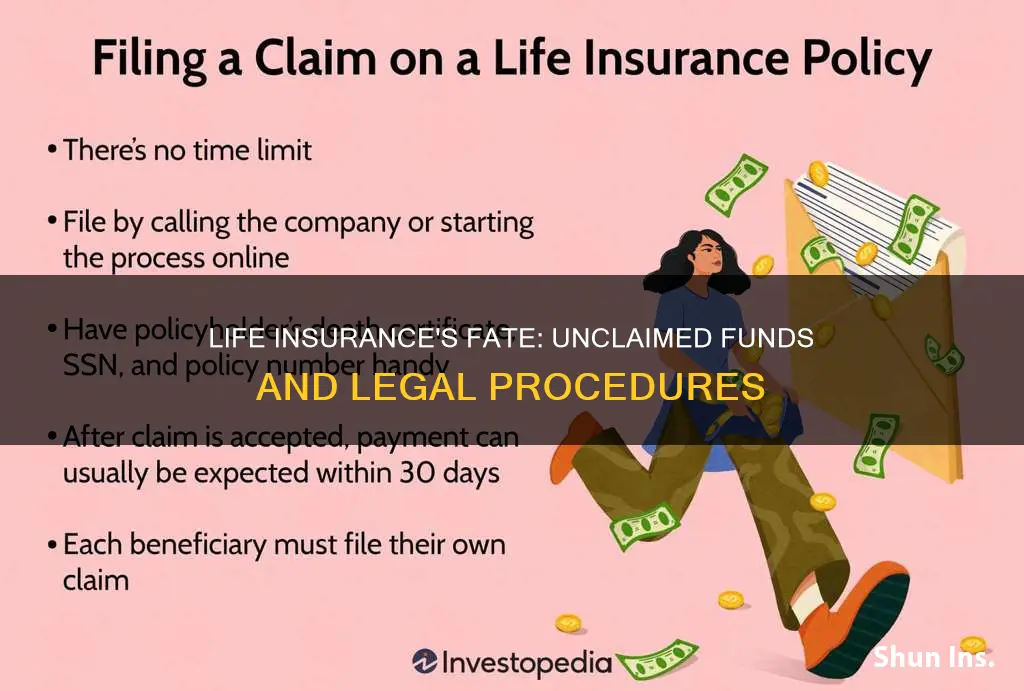

If a life insurance policy is in force and the insured individual passes away without a named beneficiary, the insurance company will typically follow a specific procedure to determine the distribution of the death benefit. The process can vary depending on the jurisdiction and the insurance company's policies, but here's a general overview:

- No Beneficiary Designations: If the policy was purchased before the introduction of beneficiary options or if the insured failed to designate a beneficiary, the insurance company may follow a default order of payment. This could include paying the death benefit to the insured's estate, the spouse, children, or other family members in a predetermined order of priority.

- Contacting the Insured's Estate: The insurance company will first attempt to locate the insured's estate or legal representatives. This could involve searching for the will or contacting the executor or administrator of the estate. If the insured had a will, it will likely specify how the life insurance proceeds should be distributed.

- Probate Court Involvement: If the insured's estate is not easily located or if there are disputes among potential beneficiaries, the insurance company may need to involve the probate court. The court will appoint a personal representative or executor to manage the estate and decide how to distribute the life insurance funds according to the law and the will (if available).

- No Legal heirs: In the absence of a will and no legal heirs, the insurance company may be required by law to distribute the death benefit equally among the insured's surviving family members, such as spouse, children, parents, or siblings, in a predetermined share.

- Policy Terms and Conditions: It's essential to review the specific terms and conditions of the life insurance policy, as these details can vary. Some policies may have provisions for unclaimed benefits or specific instructions for handling such situations.