Veterans Affairs Life Insurance (VALife) is a low-cost life insurance option for veterans with service-connected disabilities. VALife offers up to $40,000 in whole life insurance coverage, which begins two years after enrolment, provided that premiums are paid during this period. The policy also includes a cash value component, which starts to accumulate two years after the application is approved. Notably, VALife does not offer loans. When it comes to determining eligibility for VA benefits, there is some confusion about what constitutes an asset. While life insurance policies are generally excluded when determining assets, as the policyholder must be deceased to benefit from them, it is unclear whether the cash value of a life insurance policy would be considered a countable asset for VA benefits.

| Characteristics | Values |

|---|---|

| Maximum coverage | $40,000 |

| Minimum coverage | $10,000 |

| Premium payment methods | Monthly, annually, VA compensation deduction, military service retirement pay deduction, pre-authorized checking deduction, e-billing (pay.gov), debit card, credit card, PayPal, Amazon Pay |

| Premium rate increase | No |

| Premium waiver | No |

| Loan | No |

| Cash value | Yes, after 2 years of enrollment |

| Cash value usage | Extended term insurance, partial or full surrender of policy for cash value |

| Eligibility | Age 80 or younger with a VA service-connected disability rating; Age 81 or older with additional requirements |

What You'll Learn

Veterans' Group Life Insurance (VGLI)

Veterans Group Life Insurance (VGLI) is a form of life insurance that provides coverage for veterans who had Servicemembers' Group Life Insurance (SGLI) when they were on active duty. VGLI insures both active-duty and reserve service veterans, allowing them to maintain their life insurance coverage after leaving the military as long as they continue to pay the premiums.

To be eligible for VGLI, individuals must meet at least one of the following requirements:

- Part-time Servicemembers' Group Life Insurance (SGLI) as a member of the National Guard or Reserve and suffered an injury or disability while on duty that disqualified them for standard premium insurance rates.

- Had SGLI while in the military and are within 1 year and 120 days of being released from active duty of 31 or more days.

- Are within 1 year and 120 days of retiring or being released from the Ready Reserve or National Guard.

- Are within 1 year and 120 days of assignment to the Individual Ready Reserve (IRR) or Inactive National Guard (ING).

- Are within 1 year and 120 days of being placed on the Temporary Disability Retirement List (TDRL).

With VGLI, individuals can receive between $10,000 and $500,000 in term life insurance benefits, based on their previous SGLI coverage. They can also increase their coverage by $25,000 every 5 years, up to $500,000, until they turn 60 years old. The premium rates for VGLI are based on the individual's age and the desired amount of insurance coverage.

To apply for VGLI, individuals must do so within 1 year and 120 days of leaving the military. If they apply within 240 days, they are not required to provide proof of good health. However, if they apply after this period, they must submit evidence of their health status. Applications can be made through the Office of Servicemembers' Group Life Insurance (OSGLI) using the Prudential website or by mail or fax.

Temporary Life Insurance: What You Need to Know

You may want to see also

Service-Disabled Veterans Life Insurance (S-DVI)

If you have S-DVI, you have two options:

- Apply for the new program, Veterans Affairs Life Insurance (VALife), which began accepting applications on January 1, 2023, for Veterans with service-connected disabilities.

- Keep your existing S-DVI coverage.

If you apply for VALife before December 31, 2025, you can maintain your S-DVI coverage during the 2-year waiting period for VALife benefits. Your S-DVI coverage will end when your full VALife coverage begins, and you must pay premiums for both policies during the waiting period.

If you apply for VALife on or after January 1, 2026, your S-DVI coverage will end when your VALife application is approved. During the 2-year waiting period, you will only need to pay VALife premiums, but you will not have full coverage.

It is important to note that VALife does not offer premium waivers, so if you have a waiver for S-DVI premiums, it will not transfer to VALife.

Life Insurance and Drug Overdose: What's Covered?

You may want to see also

Veterans' Mortgage Life Insurance (VMLI)

- They must have a severe disability that was caused or worsened by their service.

- They must have received a Specially Adapted Housing (SAH) grant to buy, build, or modify a home to live more independently. This includes changes such as installing ramps or widening doorways.

- They must hold the title to the home.

- They must have a mortgage on the home.

- They must be under 70 years old.

VMLI offers up to $200,000 in mortgage life insurance, which is paid directly to the bank or lender that holds the mortgage. The amount of coverage equals the outstanding mortgage balance but does not exceed $200,000. It is important to note that VMLI is a decreasing-term insurance, meaning that the coverage amount decreases as the mortgage balance is paid down. If the mortgage is fully paid off, the VMLI coverage will end. Additionally, VMLI does not have any loan or cash value, nor does it pay dividends.

The cost of VMLI premiums is based on the current mortgage loan balance, the remaining number of mortgage payments, and the amount of VMLI coverage needed. Veterans can use the VMLI Premium Calculator to estimate their potential premium. It is also important to note that VMLI covers only the primary residence of the veteran, and any changes to the mortgage, such as transferring to a different lender or refinancing, must be communicated to the Department of Veterans Affairs.

U.S.A.A. Life Insurance: What You Need to Know

You may want to see also

Cash value life insurance pros and cons

Cash value life insurance is a permanent life insurance policy that lasts for the lifetime of the holder and features a cash value savings component. The policyholder can use the cash value for several purposes, including borrowing or withdrawing cash from it, or using it to pay policy premiums. Permanent life insurance policies such as whole life and universal life can accumulate cash value over time.

Pros of Cash Value Life Insurance

- Your beneficiaries receive a death benefit. Cash value life insurance is a permanent life insurance policy, which means it can remain in effect until you die as long as you pay the premiums.

- Participating life insurance policies have dividends. Many whole life insurance policies are "participating," meaning you can potentially get life insurance dividends if the policy is from a mutual insurance company.

- You can add riders for extra coverage. One of the most common life insurance riders is an accelerated death benefit, which is often automatically included at no extra charge.

- Cash value life insurance offers tax advantages. Your cash value accumulates on a tax-deferred basis. So as your cash value grows, the IRS doesn’t take a cut.

- Policies earn money that can be withdrawn or borrowed against during your lifetime.

- Policies typically last your lifetime.

Cons of Cash Value Life Insurance

- Cash value life insurance costs more than term life insurance. If you don’t need insurance for the duration of your life, and you don’t care about building cash value, term life insurance will give you the most coverage for your money.

- Cash value can take time to build. Some policies take a long time to build up any significant cash value. You could wait many years before you have a substantial amount to access.

- Cash value is not paid to beneficiaries in most cases. When you pass away, cash value typically reverts to the life insurance company. Your beneficiaries receive the policy’s death benefit amount minus any loans and withdrawals from the cash value you made.

- Your policy could lapse if you borrow too much. If you take loans or withdrawals from the policy, you also have to make sure you maintain a minimal cash value level or your policy could lapse.

- Taxes may apply. If you withdraw cash value or take the surrender value and terminate the policy, you can be taxed on the portion of the money that came from interest or investment gains.

- Managing policies often requires a hands-on approach.

- Cash value loans have relatively low net interest rates.

- Unpaid loans can reduce the death benefit paid to your beneficiaries.

COPD and Life Insurance: What's the Deal?

You may want to see also

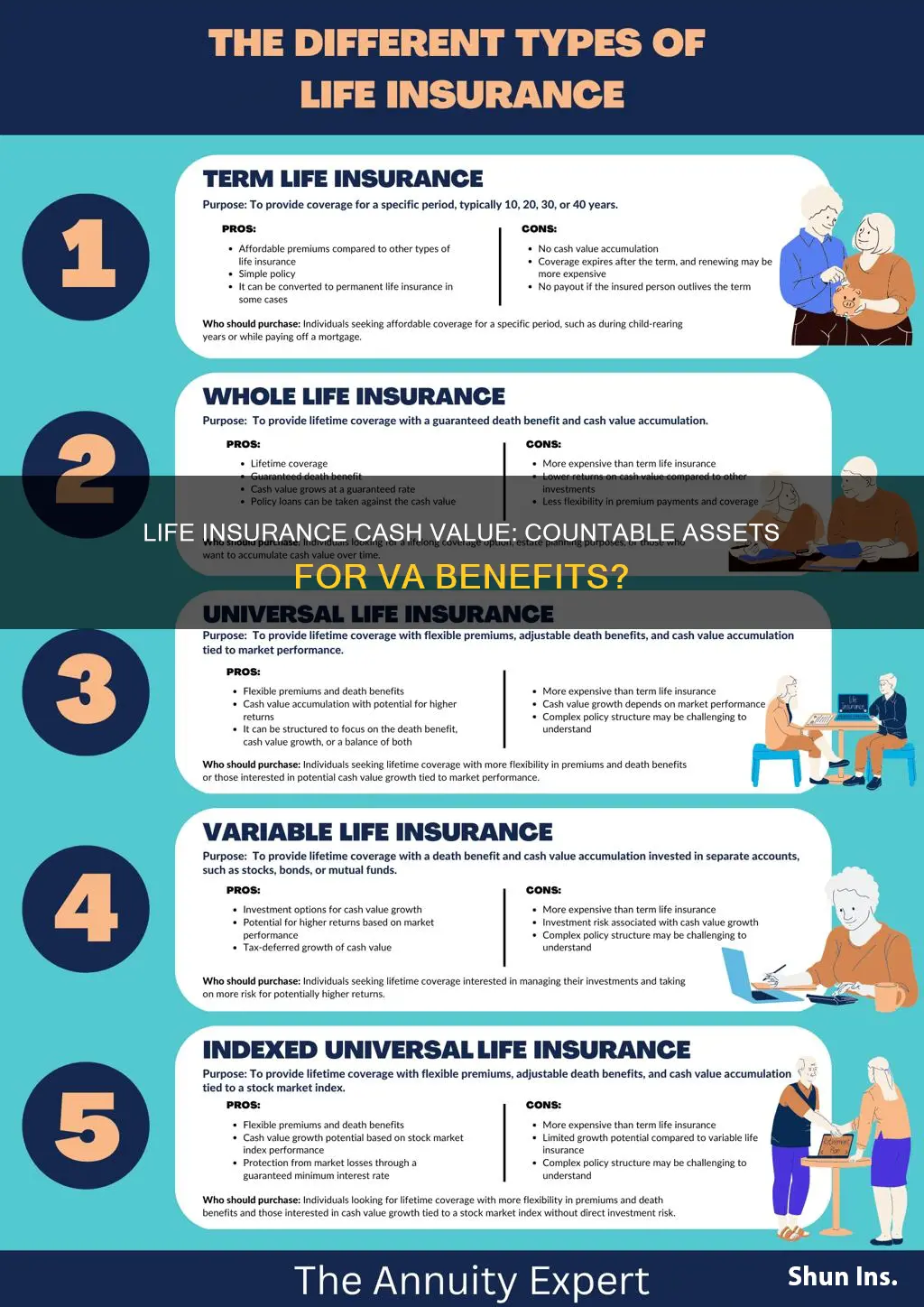

Cash value life insurance types

Cash value life insurance is a form of permanent life insurance that lasts for the lifetime of the holder and features a cash value savings component. Permanent life insurance policies such as whole life and universal life can accumulate cash value over time. Cash value life insurance is more expensive than term life insurance.

Whole Life Insurance

Whole life insurance is a type of permanent insurance that lasts the entire life of the policyholder, with premiums being paid regularly. The cash value of whole life insurance can still grow with potential tax savings, and the death benefit is guaranteed as long as the premiums are paid (subject to limitation and exclusions). The premiums in this type of plan are usually fixed.

Universal Life Insurance

Universal life insurance plans allow the ability to change the value of premium payments, giving more adjustability in different seasons of life. With universal life insurance, you can scale the death benefit up or down depending on your unique circumstances. The cash value of a universal life insurance policy can be used to pay for the premiums or other expenses, as needed.

Variable Life Insurance

Variable life insurance provides greater access to investment tools, like cash value. This type of plan tends to involve more risk, as the cash value will grow or diminish depending on how the investments chosen are doing.

Indexed Life Insurance

An indexed life insurance plan has a greater relationship with the stock market, as this is what is used to determine growth. The rate of return on the cash value within the life insurance policy depends on how the chosen index performs. While there is a certain level of risk involved in an indexed universal life insurance plan, you can typically still secure a guaranteed minimum interest rate.

Credit Life Insurance: What It Is and Why It Matters

You may want to see also

Frequently asked questions

VALife is a low-cost life insurance coverage option for veterans with service-connected disabilities. It provides up to $40,000 in whole life insurance coverage and starts to accumulate cash value two years after the application is approved.

You can apply for VALife through the VALife online application. You will receive an immediate decision, and if approved, you can print out a copy of your policy pages within 4-5 days by logging into your online account.

Premium rates for VALife depend on the veteran's age when they apply and the amount of coverage they want. The rates increase with age and vary based on whether the veteran chooses to pay monthly or annually. There is a 2.5% discount for paying premiums annually.

No, veterans cannot be insured under both VALife and S-DVI beyond the initial two-year enrollment period in VALife. If you enroll in VALife before January 1, 2026, your S-DVI will terminate after the two-year period. If you enroll on or after this date, your S-DVI will terminate as soon as your VALife policy is approved.

Your VALife policy will start earning cash value after the initial two years of enrollment. You can use the cash value for extended term insurance in the event of a policy lapse or surrender the full or partial policy amount (in increments of $10,000) for cash value.