Temporarysection-break-double:

Temporary life insurance is a short-term policy that provides coverage during the application process for a permanent life insurance policy. It serves as a stopgap measure to protect individuals and their beneficiaries while they wait for their official policy to be approved and come into effect. This type of insurance is typically offered by the same company that the applicant has submitted their permanent life insurance application to and is designed to cover the duration of the underwriting process. Temporary life insurance ensures that beneficiaries receive a payout in the event that the applicant passes away during the application period.

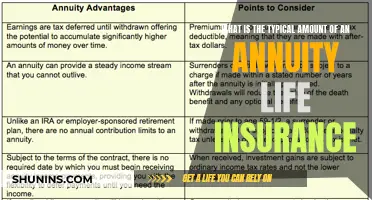

| Characteristics | Values |

|---|---|

| Type of insurance | Temporary life insurance is a type of short-term coverage. |

| Purpose | To provide interim coverage while waiting for a permanent life insurance policy to be approved. |

| Coverage period | Typically up to 90 days, but can vary depending on the insurer and specific circumstances. |

| Cost | Usually equivalent to the first month's premium of the permanent policy. |

| Eligibility | Depends on factors such as age, health, and medical history. |

| Payout | In the event of the insured person's death during the coverage period, the beneficiaries will receive a death benefit. |

| Application process | Temporary life insurance can be added to the initial life insurance application if offered by the insurer. |

| Termination | Ends when the permanent policy is approved or denied, or if the applicant cancels the application. |

What You'll Learn

Temporary life insurance is a short-term policy

The purpose of temporary life insurance is to protect your beneficiaries while you wait for your insurer to approve your application. If you pass away after you apply but before receiving your final offer of coverage, your beneficiaries will still receive a payout. This payout is usually equal to the coverage amount for which you applied, up to a limit.

Temporary life insurance is only available if you buy a longer life insurance policy—it cannot be purchased on its own. It is designed as a stopgap to fill the waiting period between applying for a permanent policy and receiving approval. The application process can take up to four to six weeks, depending on the policy type and coverage amount.

Temporary life insurance coverage typically begins as soon as you sign your application and receive a temporary insurance receipt. It usually lasts for a maximum of 60 to 90 days, though the exact timeline varies by insurer. Coverage ends when a set period passes after the application is filed, your policy becomes active, or you request a refund or terminate your proposed coverage.

U.S. Life Insurance: Who Gets the Payout?

You may want to see also

It covers the applicant during the insurer's underwriting process

Temporary life insurance is a short-term coverage option that you can buy while waiting for your official life insurance policy to come into effect. It covers the applicant during the insurer's underwriting process, which can take up to four to six weeks. During this time, the applicant is left uninsured, and temporary life insurance acts as a stopgap measure.

The underwriting process is how an insurance company evaluates its risk and profitability of offering a policy. It is a complex process that involves data, statistics, and guidelines provided by actuaries. Underwriters are trained professionals who use this information to predict the likelihood of risks and set insurance premiums accordingly.

Temporary life insurance provides immediate coverage to the applicant through a binding contract known as a Temporary Insurance Agreement (TIA). Once the TIA is in force, it binds the insurance company to pay the coverage amount if a claim is made, even if the full underwriting process is not complete. This ensures that the applicant's loved ones receive financial support in the event of their death during the application process.

The cost of temporary life insurance is generally based on the initial quote from the insurance company, which may reflect the premiums for the final policy. The temporary coverage ends once the official policy becomes active or after a set period, usually 60 to 90 days.

It is important to note that temporary life insurance is not available as a standalone policy and is only offered during the life insurance application process.

Globe Insurance: Term Life Insurance Options and Availability

You may want to see also

It is not available as a standalone policy

Temporary life insurance is not available as a standalone policy. It is offered as a form of coverage until your full life insurance policy is approved. This means that it acts as a bridge, providing interim protection while you wait for your permanent life insurance policy to come into effect.

The need for temporary life insurance arises due to the time-consuming process of applying for and obtaining approval for a traditional life insurance policy. The application and underwriting process can take several weeks, and during this waiting period, temporary life insurance ensures that you have some form of coverage in place. It is designed to fill the gap and provide peace of mind during this transition.

Temporary life insurance is typically offered by the same insurance company to which you've submitted your application for a long-term life insurance policy. It is not something that can be purchased separately or independently. This type of insurance is intended to be a supplementary option, giving you immediate coverage while the full policy is being processed and underwritten.

The cost of temporary life insurance is generally equivalent to the first month's premium for the full policy coverage you are applying for. This means that the premium you pay is based on the initial quote from the insurance company, which is likely to reflect the premiums for your final, long-term policy.

It is important to note that temporary life insurance is not a permanent solution and should not be relied upon as a long-term insurance strategy. It is designed specifically to address the gap in coverage that occurs while waiting for approval on a more comprehensive life insurance policy.

Life Insurance and Disaster: What's Covered and What's Not?

You may want to see also

It is also known as a Temporary Insurance Agreement (TIA)

Temporary life insurance is also known as a Temporary Insurance Agreement (TIA). It is a binding contract that grants immediate life insurance coverage to the applicant. This type of insurance is designed to fill a gap in coverage during the waiting period for a traditional life insurance policy to be approved. It is important to note that TIA is not an insurance policy or product that can be purchased on its own but is instead a way for applicants to receive interim coverage.

The TIA comes into force once the applicant signs their application and receives a temporary insurance receipt, which serves as proof of coverage during the underwriting process. This process can take a few days to several weeks, depending on whether additional information or a medical examination is required. During this time, the TIA provides peace of mind and protection for the applicant's dependents.

The cost of temporary life insurance is generally equivalent to the first month's premium for the policy coverage being applied for. It is based on the initial life insurance quote, which takes into account factors such as age, weight, smoking status, health, and coverage needs. The premium paid towards temporary coverage is essentially a deposit, and if the policy is approved, this amount is applied to the first month's premium. If the coverage is denied or the applicant decides not to proceed, the initial premium is refunded.

Temporary life insurance coverage typically ends after a set period, usually 60 to 90 days, or when the official policy is activated. It is worth noting that temporary insurance does not cost anything beyond the initial premium payment, even if the insurer takes a few weeks or months to make a decision.

Term Life Insurance: Who Owns the Policy?

You may want to see also

It is not the same as term life insurance

Temporary life insurance is not the same as term life insurance. Here are the key differences:

Nature of the Policy

Temporary life insurance is a short-term coverage option offered during the life insurance application process before your official policy goes into effect. It serves as a stopgap measure to provide immediate protection while you wait for your permanent life insurance policy to be approved and come into force. On the other hand, term life insurance is a type of policy that you can choose to purchase for a specific period, such as 10, 15, 20, or more years.

Duration

Temporary life insurance is designed to cover the duration of the underwriting process and typically lasts until your permanent policy is approved and activated, or until a set period (usually 60 to 90 days) passes after the application is filed. In contrast, term life insurance provides coverage for a fixed period, such as 10, 20, or 30 years, depending on the chosen term.

Availability

Temporary life insurance is not available as a standalone policy and can only be added during the application process for a longer life insurance policy. It is not something you can purchase on its own. Term life insurance, on the other hand, is a distinct type of policy that you can choose to purchase based on your coverage needs.

Cost

The cost of temporary life insurance is generally based on the initial quote or the first month's premium of the permanent policy you are applying for. It is not an additional cost but rather a deposit that will be credited towards your first month's premium once your permanent policy is approved. Term life insurance premiums, on the other hand, are typically based on factors such as age, health, and life expectancy, and they increase with age.

Cash Value

Temporary life insurance does not accumulate cash value because it lacks a savings component. It solely provides a death benefit during the waiting period before your permanent policy takes effect. In contrast, term life insurance policies also do not have a cash value component, which is one of the reasons they are generally cheaper than other types of insurance.

Renewal and Conversion

Temporary life insurance does not involve a renewal process as it is tied to the approval of your permanent policy. It ends once your permanent policy becomes active or after a set period. Term life insurance policies, on the other hand, can be renewed for additional terms, and some even offer the option to convert them into permanent coverage. However, the premiums will be recalculated based on your age at the time of renewal, and the cost will be higher.

Heart Attacks: Life Insurance Impact and Your Coverage

You may want to see also

Frequently asked questions

Temporary life insurance is short-term coverage you can buy while waiting for your life insurance application to be approved.

You can add temporary coverage to your initial life insurance application, as long as your insurer offers this feature. The death benefit will be equal to the amount of coverage for which you've applied, up to a limit.

The cost of temporary life insurance is generally equivalent to the first month's premium for the policy coverage that you are applying for.

Temporary life insurance usually lasts a maximum of 90 days. However, it may expire earlier if your life insurance application is approved or denied, or if you decide not to proceed with coverage.