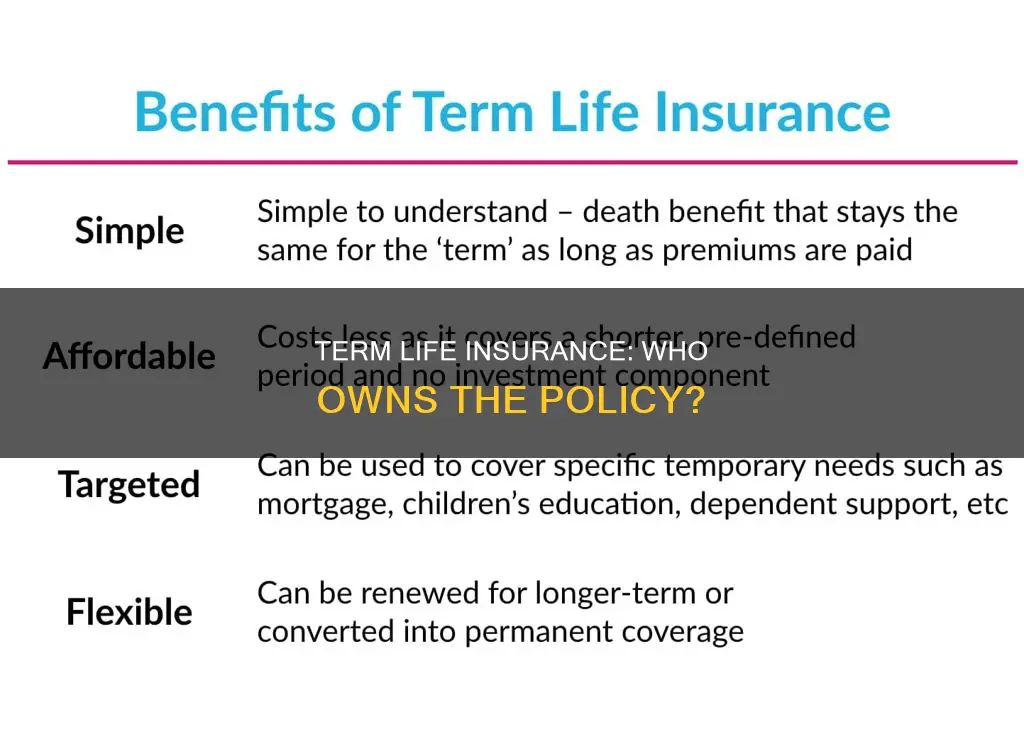

Term life insurance provides a death benefit for a specified period of time, after which the policyholder can either renew it for another term, convert it to permanent coverage, or let the policy lapse. The policyholder must pay a premium upfront or regular premiums for the policy to remain in force. When the insured person dies, the policy's named beneficiaries will receive the death benefit. The owner of the policy has control over all changes and rights, including the right to change beneficiaries, transfer ownership, and make material changes. The owner is not necessarily the same person as the insured, and while the owner may change, the insured person cannot.

What You'll Learn

Who can be the owner of a life insurance policy?

A life insurance policy typically involves three key parties: the owner, the insured, and the beneficiary. The owner of a life insurance policy has a critical role. They have control over it and are responsible for paying the premiums.

In most cases, the owner and the insured are the same person. However, the owner can be someone else, such as a spouse, partner, or parent. Here are some examples of who can be the owner of a life insurance policy:

- Spouse or partner: You can be the owner and the beneficiary of a policy on your spouse or partner.

- Any person or legal entity with an insurable interest: You can buy a policy on someone with whom you have a financial interest, or someone who has an insurable interest in you can purchase a life insurance contract on your life. For example, a parent who takes out a policy on their children if they have co-signed a private student loan.

- Trusts: Trusts can be set up to own life insurance policies, often as part of estate planning. This can provide control over the proceeds and may offer tax advantages.

- Businesses: Companies may own policies on key employees, partners, or shareholders. This can be part of succession planning, employee benefits, or agreements between business partners.

- Charitable organisations: Some people choose to make a charity the owner of a life insurance policy, which can be part of charitable giving strategies.

Rights and responsibilities of a policy owner

The owner of a life insurance policy has several exclusive rights, including:

- Choosing how much coverage and for how long.

- Naming and changing beneficiaries.

- Transferring policy ownership.

- Renewing or cancelling the policy.

Superannuation: Life Insurance, What's Covered?

You may want to see also

What rights does the owner have?

The owner of a life insurance policy has a great deal of control and several exclusive rights. The owner can be the insured person, or someone else, such as a spouse, parent, child, or even a corporation or trust entity. The owner is the person who pays the premiums, decides whether to maintain, renew or cancel the policy, and designates beneficiaries.

The owner of a life insurance policy has the right to:

- Change beneficiaries: this is significant because the beneficiaries are the people who will receive the death benefit payout.

- Transfer ownership to another party.

- Make material changes to the life insurance policy, such as increasing or lowering a death benefit, adding or deleting a rider, or requesting a rating change for the insured person.

- Take out loans or withdraw money from the policy.

- Use the policy as collateral for a loan.

- Sell the policy to another person in what is known as a viatical settlement.

- Surrender the contract, regardless of whether or not the insured person wishes to continue the policy.

- Make policy changes, such as changing dividend options, converting a term policy to whole life, dropping riders from the policy, changing the face amount, or changing beneficiaries (unless they are irrevocable).

New York Life: Guaranteed Issue Insurance Availability and Options

You may want to see also

Can you transfer ownership?

Yes, it is possible to transfer ownership of a life insurance policy. There are several ways to do this, depending on the specific circumstances and the type of policy involved. Here are some common methods:

Absolute Assignment

Absolute assignment involves transferring all rights and ownership of a life insurance policy from yourself to someone else or a legal entity. This transfer is usually permanent and irrevocable. If you use absolute assignment, you must notify your insurer, who will provide you with the necessary ownership forms.

Collateral Assignment

A collateral assignment allows you to use a life insurance policy to obtain a loan. This is a temporary arrangement where the original owner will regain control of the policy once they repay the loan or meet other specific criteria.

Irrevocable Life Insurance Trust (ILIT)

An ILIT is a type of trust that owns a life insurance policy as its primary asset. It is used to reduce or avoid estate taxes for beneficiaries.

Change of Beneficiary

Instead of transferring ownership, the policyholder can change the beneficiary designation on the policy. By changing the beneficiary, the policy proceeds will be paid directly to the new beneficiary upon the insured's death.

Sale or Gift

The policyholder may choose to sell the policy to another person or entity for a negotiated price or gift the policy to another individual or entity.

Corporation or Business

In some cases, a corporation or business entity may own a life insurance policy, and if the ownership structure of the company changes, the policy ownership may need to be transferred.

Life Insurance Beneficiary: Understanding the Certificate

You may want to see also

What is the role of the insured person?

The insured person is one of the primary parties in the legal contract of insurance. They are the entity whose financial losses are covered by the insurance policy. The insured person is typically financially responsible for the premium payments and can decide whether to maintain, renew or cancel the policy.

In the case of life insurance, the insured person is the individual whose life is covered under the insurance policy. If they die within the policy term, the life insurance benefits pass directly to the beneficiaries named in the policy. The insurer will pay the death benefit amount to the nominee.

The insured person can be the policyholder, or the owner of the policy, but not always. For example, a parent can be the policyholder of a life insurance policy for their child, in which case the child is the insured. The policyholder decides who the insured and beneficiaries are, and they have the right to modify the policy status.

Schwab's Life Insurance: What You Need to Know

You may want to see also

What is the role of the beneficiary?

A beneficiary is one of the three parties involved in an insurance contract, the other two being the policyholder and the insurer. The role of the beneficiary is to notify the insurance company about the death of the policyholder and initiate the claim process. They will need to fulfil all documentation requirements, provide necessary proofs and important information to the insurance company. The beneficiary will receive the benefit from the insurance company according to the frequency specified in the policy.

The policyholder can choose their spouse, kids, parents, other family members, friends, or even someone outside this circle as their beneficiary. However, it is generally advisable to select a beneficiary from their immediate family. The most important question to ask when choosing a beneficiary is: Who needs the money the most after you are gone?

If the policyholder fails to name a beneficiary, or if the beneficiary dies during the term of the policy and the policyholder does not update this information, the insurance company will follow specific measures mentioned in the insurance contract. In general, the sum assured will be offered to the heir of the policyholder's will, who will need to provide a waiver of legal proof or an indemnity to the insurance company. If there is no legal will, the benefit is usually passed to the immediate heir, including the spouse, children or parents of the policyholder.

Life Insurance: Accidental Death Abroad, Are You Covered?

You may want to see also

Frequently asked questions

The owner of a life insurance policy can be a single person, multiple people, or a corporation or trust entity. An owner can also be a township or a non-profit.

The owner of a life insurance policy has control over all of the policy's changes and rights. These include the right to change beneficiaries, transfer ownership, and make material changes to the policy.

Yes, you can transfer ownership of a life insurance policy. There are three methods to do so: absolute assignment, collateral assignment, and irrevocable life insurance trust (ILIT).