Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual. While it offers several benefits, such as guaranteed death benefit and potential investment growth, it is not suitable for everyone and can have some drawbacks. This primer aims to explore the reasons why whole life insurance might not be the best choice for certain individuals, including its potential for high costs, limited flexibility, and the complexity of understanding its long-term implications. By examining these aspects, readers can make informed decisions about their insurance needs and explore alternative options that better align with their financial goals and priorities.

What You'll Learn

- High Cost: Whole life insurance can be expensive, especially for older individuals, due to its lifelong coverage

- Limited Flexibility: It offers less flexibility compared to term life, with fixed premiums and a guaranteed death benefit

- Investment Component: The investment aspect may not perform as expected, impacting overall returns

- Complexity: Understanding the policy and its long-term implications can be challenging for some policyholders

- Tax Implications: Tax treatment varies, and some policies may have unfavorable tax consequences for certain individuals

High Cost: Whole life insurance can be expensive, especially for older individuals, due to its lifelong coverage

Whole life insurance, while offering lifelong coverage, can be a significant financial commitment, particularly for older individuals. The cost of this type of insurance is often higher compared to other insurance products due to several factors. Firstly, the longer coverage period means that the insurance company has to account for potential risks and uncertainties over an extended time frame. As a result, the premiums are calculated to ensure the policyholder's benefits are secure throughout their entire life. This calculation takes into account the possibility of the insured individual living much longer than the average life expectancy, which increases the overall cost.

For older individuals, the financial burden of whole life insurance can be substantial. As people age, their health and life expectancy may become a concern for insurance providers, leading to higher premium rates. Additionally, older individuals might have already invested in other financial instruments or have limited disposable income, making it challenging to afford the long-term commitment of whole life insurance. The initial cost of the policy, as well as the ongoing premiums, can be a significant expense, especially when compared to term life insurance, which provides coverage for a specific period.

The expense is further exacerbated by the fact that whole life insurance policies often include additional features and benefits. These may include an investment component, where a portion of the premium is invested in various financial instruments, offering potential returns over time. While this can provide some financial growth, it also contributes to the overall higher cost of the policy. The combination of lifelong coverage, investment features, and the need to account for long-term risks results in higher premiums, making whole life insurance less accessible to those on a tighter budget.

In summary, the high cost of whole life insurance is a significant consideration, especially for older individuals. The lifelong coverage, investment aspects, and the need to manage long-term risks contribute to the financial burden. It is essential for individuals to carefully evaluate their financial situation and understand the implications of such a long-term commitment before opting for whole life insurance. Exploring alternative insurance options or seeking professional advice can help individuals make informed decisions that align with their financial goals and capabilities.

Estate Life Insurance: Funeral Reimbursement Explained

You may want to see also

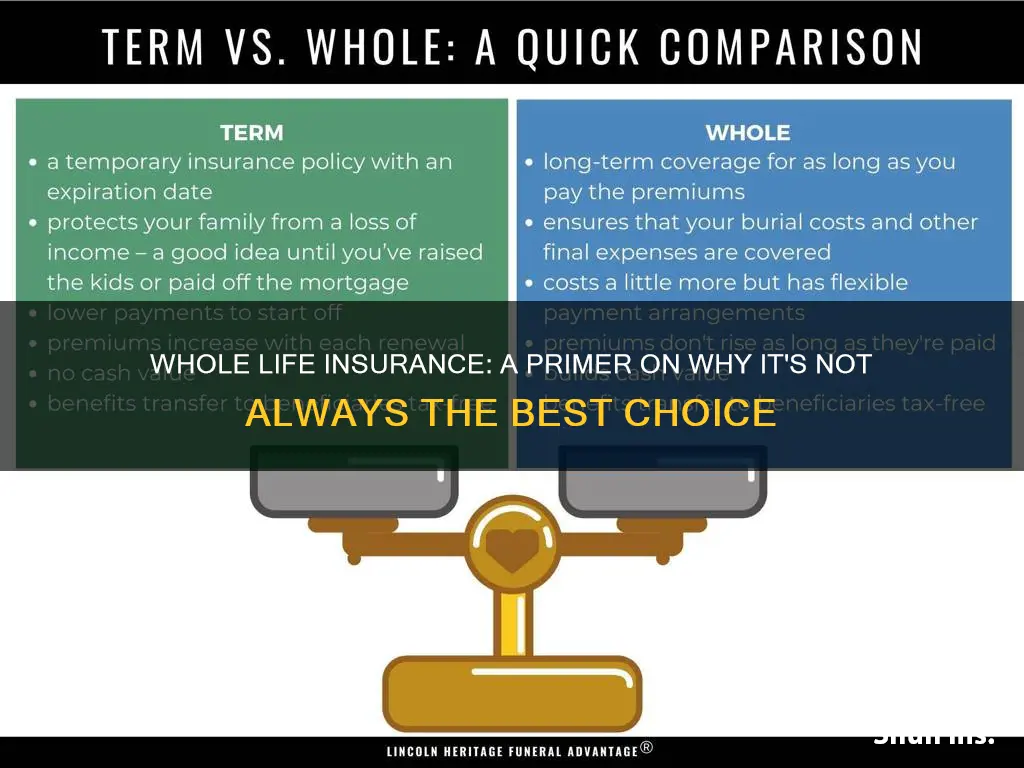

Limited Flexibility: It offers less flexibility compared to term life, with fixed premiums and a guaranteed death benefit

Whole life insurance, while providing lifelong coverage and a guaranteed death benefit, does come with certain limitations that may not suit everyone's needs. One of the primary drawbacks is its limited flexibility compared to term life insurance.

In whole life insurance, the policyholder pays a fixed premium for the entire term of the policy, typically for the policyholder's entire life. This fixed premium structure means that the cost of insurance remains constant throughout the policy's duration. However, this lack of flexibility can be a disadvantage in certain situations. For instance, if the policyholder's financial circumstances change significantly, they may find themselves paying more for insurance than they can afford. On the other hand, if they decide to reduce their coverage, they might be locked into the same premium amount, which could be a financial burden.

Term life insurance, in contrast, offers more flexibility. It provides coverage for a specified term, such as 10, 20, or 30 years, and the premium is typically lower than that of whole life insurance for the same coverage amount. This flexibility allows individuals to adjust their coverage as their financial situation and needs evolve. If someone's financial situation improves, they can opt for a longer term or increase their coverage without the constraint of a fixed premium. Conversely, if their needs change, they can choose a shorter term or reduce coverage, potentially saving money.

The guaranteed death benefit is a double-edged sword. While it ensures that the beneficiary receives a payout upon the policyholder's death, it also means that the insurance company has a guaranteed return on their investment. This can be a significant advantage for the insurance company but may limit the policyholder's ability to access their own funds. Unlike other investment vehicles, whole life insurance does not offer easy access to cash value, and any loans or withdrawals may have penalties.

In summary, the limited flexibility of whole life insurance, with its fixed premiums and guaranteed death benefit, can be a consideration for those seeking more adaptable coverage. It is essential to understand these limitations to make an informed decision about life insurance that aligns with one's financial goals and changing circumstances.

Suicide and Life Insurance: What's the Payout Impact?

You may want to see also

Investment Component: The investment aspect may not perform as expected, impacting overall returns

The investment component of whole life insurance is a key feature that can significantly impact the overall returns and value of the policy. However, it is important to understand that this aspect is not without its risks and potential drawbacks. When considering the investment side of whole life insurance, it's crucial to recognize that the performance of these investments is not guaranteed and can vary over time.

One of the primary concerns is the potential underperformance of the investment portfolio. Insurance companies often invest a portion of the premiums collected in various financial instruments, such as stocks, bonds, and mutual funds. While these investments aim to grow over time, market volatility and economic fluctuations can lead to subpar returns. For instance, if the stock market experiences a downturn, the value of the investment portfolio may decline, affecting the policyholder's overall gains. This volatility can be a significant risk, especially for those seeking stable and consistent returns.

Additionally, the investment component of whole life insurance may not offer the same level of diversification as a standalone investment portfolio. Insurance companies might focus on specific asset classes or regions, which could limit the policyholder's exposure to a diverse range of investments. A lack of diversification increases the risk of significant losses if certain investments underperform. It is essential for policyholders to carefully review the investment options and strategies employed by the insurance company to ensure they align with their risk tolerance and financial goals.

Furthermore, the fees and charges associated with the investment component should be considered. Insurance companies often incur expenses related to managing and administering these investments, which may be passed on to policyholders. High fees can eat into the potential returns, reducing the overall value of the policy. It is advisable to scrutinize the fee structure and understand how it might impact long-term growth.

In summary, while the investment aspect of whole life insurance can provide an opportunity for growth, it is not without its challenges. Policyholders should be aware of the potential risks, including market volatility, limited diversification, and associated fees, which can influence the overall returns. Conducting thorough research and seeking professional advice can help individuals make informed decisions regarding the investment component of their whole life insurance policy.

Zurich Life Insurance: Is It Worth the Investment?

You may want to see also

Complexity: Understanding the policy and its long-term implications can be challenging for some policyholders

Whole life insurance, while often marketed as a comprehensive financial product, can indeed present certain complexities that may be difficult for some individuals to fully grasp. One of the primary challenges lies in the intricate nature of the policy itself. These policies are long-term commitments, often spanning several decades, and they involve various technical terms and concepts that can be hard to comprehend for those without a financial background. For instance, understanding the difference between the death benefit, which is the payout upon the insured's passing, and the cash value, which grows over time, requires a certain level of financial literacy. Policyholders might struggle to grasp the nuances of how their premiums are invested and how the cash value accumulates, especially when considering the potential for market fluctuations.

The complexity often extends to the long-term implications of the policy. Unlike term life insurance, which provides coverage for a specified period, whole life insurance offers lifelong coverage. This means that the policyholder is committed to paying premiums for the duration of their life, and the insurance company is obligated to pay out the death benefit to the designated beneficiaries. The long-term nature of the policy can be daunting, as it requires a deep understanding of the policy's potential impact on one's financial situation over several decades. For example, policyholders might need to consider how the policy's premiums affect their overall savings, investments, and retirement plans.

Additionally, the investment component of whole life insurance can be particularly intricate. The cash value of the policy grows through investments, and these investments are often subject to market risks. Understanding how market performance influences the policy's value and the potential for investment gains or losses can be challenging. Policyholders must be aware of the risks associated with market volatility and how it can impact their policy's overall performance. This aspect of complexity may deter some individuals from fully comprehending the long-term financial implications.

Furthermore, the tax implications of whole life insurance can add another layer of complexity. The cash value of the policy may grow tax-deferred, and certain withdrawals or loan amounts can be tax-free. However, understanding the tax rules and how they apply to the policy's growth and withdrawals can be intricate. Misunderstanding these implications could lead to unintended tax consequences, making it essential for policyholders to seek professional advice to navigate this aspect effectively.

In summary, the complexity of whole life insurance policies stems from their long-term nature, intricate technical terms, and the potential for market and tax-related risks. Policyholders should be encouraged to seek clarification on any confusing aspects and to carefully review the policy's terms and conditions. While whole life insurance can provide valuable financial protection, a thorough understanding of its complexities is essential to make informed decisions and ensure the policy aligns with the policyholder's long-term financial goals and needs.

Life Insurance Agents: Continuing Education Strategies for Success

You may want to see also

Tax Implications: Tax treatment varies, and some policies may have unfavorable tax consequences for certain individuals

When considering whole life insurance, it's crucial to understand the potential tax implications that can impact your financial decisions. The tax treatment of life insurance policies can vary significantly, and certain policies may result in unfavorable tax consequences for specific individuals. Here's a detailed breakdown of this aspect:

Tax treatment of life insurance policies is complex and often depends on various factors, including the type of policy, the insured individual, and the beneficiary. Generally, life insurance proceeds paid out upon the death of the insured are typically tax-free and not subject to income tax. This is a significant advantage, as it provides a tax-free benefit to the beneficiaries, ensuring that the entire death benefit is received without any tax liability. However, this favorable treatment is not universal.

For individuals who own a whole life insurance policy, the tax situation can become more intricate. Whole life insurance policies accumulate cash value over time, and this cash value can be borrowed against or withdrawn. When you take out a loan or make a withdrawal, the policy's cash value may be reduced, and the loan or withdrawal amount is generally taxable as ordinary income. This means that the policyholder may face a tax burden when accessing the policy's cash value, which could be an essential consideration when evaluating the overall cost and benefits of the policy.

Furthermore, the tax implications can vary depending on the jurisdiction and the specific policy details. Some policies may have complex tax treatments, especially those with investment components or variable benefits. For instance, policies with investment features might be subject to capital gains tax when the policy's value increases over time. Understanding these nuances is vital for individuals to make informed decisions and potentially avoid unexpected tax liabilities.

In summary, while whole life insurance can provide long-term financial security, the tax implications should not be overlooked. The tax treatment of life insurance policies can vary, and certain policies may result in unfavorable tax consequences, especially when accessing the policy's cash value or dealing with investment components. It is essential to consult with financial advisors and tax professionals to navigate these complexities and ensure that your insurance choices align with your overall financial goals and tax situation.

Haven Life Insurance: Your Secure Login Guide

You may want to see also

Frequently asked questions

One of the main drawbacks of whole life insurance is its cost. It is generally more expensive compared to term life insurance, especially for younger and healthier individuals. The higher premiums are due to the policy's guaranteed death benefit and the accumulation of cash value over time, which can make it less affordable for those on a tight budget.

Whole life insurance policies often include an investment component, where a portion of the premium is invested in a separate account. This investment element allows policyholders to potentially earn interest and grow their money. However, it also means that the insurance company assumes investment risk, and the performance of these investments can vary, impacting the overall value of the policy.

Yes, whole life insurance is often viewed as a long-term financial commitment. It provides coverage for the entire lifetime of the insured, as long as the premiums are paid. While this ensures lifelong protection, it also means that the policyholder is locked into a long-term financial obligation, which may not be desirable if their circumstances change significantly over time.