Group life insurance is a type of insurance offered by an employer or large-scale entity to its workers or members. It is typically inexpensive, and in some cases, even free. Coverage is generally basic and often calculated based on an employee's earnings, providing coverage worth one or two times their annual salary. Group life insurance is not permanent and typically ends when an employee leaves their job, whether through resignation, termination, or retirement. However, some companies may offer the option to convert group life insurance to an individual policy upon retirement, although this may come with higher premiums and a health examination.

| Characteristics | Values |

|---|---|

| Cost | Group life insurance is inexpensive and may be free for employees. |

| Coverage | Coverage is typically $10,000–$50,000 but can be one or two times the insured's annual salary. |

| Coverage conditions | Coverage is generally only valid while the insured is part of the group. |

| Coverage termination | Coverage ends when the insured leaves the group, e.g., through resignation, firing, retirement, etc. |

| Coverage conversion | Some companies allow conversion of group life insurance to an individual policy upon retirement, but this may come with higher premiums and a health examination. |

| Coverage portability | Group life insurance is not portable once the insured leaves the organization. |

| Policy control | The employer controls the policy and can make decisions that affect the insured's premiums. |

What You'll Learn

Group life insurance is tied to employment status

Group life insurance is a type of insurance offered by an employer or another large-scale entity, such as an association or labor organization, to its workers or members. It is typically inexpensive and may even be free for employees, as many members pay into the group policy.

However, it is important to note that the specific terms of group life insurance policies can vary depending on the employer or organization offering them. In some cases, individuals may be able to convert their group life insurance policy to an individual policy upon retirement, although this may come with higher premiums and could require a health examination. Additionally, employers typically do not continue to pay premiums for retired employees.

Group life insurance policies are also tied to employment status in terms of eligibility and coverage amounts. For example, group life insurance coverage may be limited to full-time employees or those who work a minimum number of hours per week. The amount of coverage provided may also vary based on an individual's position within the company, with highly paid executives and managers receiving more robust benefits than lower-level employees.

In summary, group life insurance is closely tied to employment status, as it is offered as an employment benefit, and coverage is typically contingent on maintaining employment with the company or membership in the group. While there may be options to convert group life insurance to individual policies upon retirement, this is not always the case, and retired individuals may need to seek alternative insurance options.

FAFSA and Cash Value Life Insurance: What You Need to Know

You may want to see also

Coverage typically ends at retirement

Group life insurance is a type of insurance that is offered by an employer or another large-scale entity, such as an association or labor organization, to its workers or members. It is typically inexpensive and may even be free for certain employees. However, it is important to note that group life insurance coverage normally ends at retirement.

When an individual retires, their employment status changes from active to inactive, and as a result, the life insurance benefit provided by their employer typically comes to an end. This is because group life insurance is generally tied to active employment status. Therefore, upon retirement, an individual is no longer considered an active employee, which leads to the termination of this particular benefit.

While group life insurance coverage usually ends at retirement, some companies may offer the option to convert group life insurance to an individual policy. However, this conversion often comes with certain challenges, such as higher premiums and the potential requirement of a health examination. It is important to carefully consider these challenges when planning for the future.

The option to convert group life insurance into an individual policy may seem like a convenient solution, but it is important to understand the potential drawbacks. In addition to higher premiums, the requirement of a health examination can be a significant factor, especially for individuals with health issues. These challenges highlight the importance of obtaining personal life insurance at a younger age, as it can provide long-term coverage and financial security for dependents.

In summary, while group life insurance can be a valuable benefit during employment, it typically ends at retirement. Retirees may have the option to convert their group coverage into an individual policy, but this comes with certain challenges and considerations. Therefore, it is important to plan accordingly and ensure that adequate coverage is in place to meet future needs.

Globe Life: Whole Life Insurance Options and Benefits

You may want to see also

Some companies may offer to convert to an individual policy

Group life insurance is a type of insurance offered by an employer or another large-scale entity, such as an association or labor organization, to its workers or members. It is typically inexpensive and may even be free for certain employees. However, it usually has a relatively low coverage amount and ends when an individual is no longer part of the group, including in the case of retirement.

Some companies may offer to convert group life insurance to an individual policy upon retirement, but this comes with certain challenges. Here are some key points to consider:

Higher Premiums

The converted individual policy will likely have higher premiums than the group policy. This is because individual policies are generally more expensive than group policies, where costs are shared among a larger number of people. This higher cost may be a significant factor in an individual's decision to convert their policy, especially if they are on a fixed income in retirement.

Health Examination

Converting to an individual policy may require a health examination, which is typically not required for group policies. This is an important consideration, especially for retirees, as health issues that arise with age can make insurance more expensive or even disqualify individuals from obtaining coverage. Therefore, the option to convert without a health examination is a valuable feature.

Loss of Group Benefits

By converting to an individual policy, the insured person will lose the benefits of being part of a group plan. Group plans often have lower premiums and guaranteed coverage without the need for medical underwriting. Additionally, group plans may offer the convenience of automatic payroll deductions for premium payments.

Portability

One advantage of converting to an individual policy is portability. Group life insurance is tied to employment or membership in an organization, and coverage typically ends when an individual leaves the group or retires. An individual policy, on the other hand, is not linked to employment or membership status and can provide long-term coverage, often up to 40 years or for life.

Customization

Individual policies can be customized based on an individual's specific needs, whereas group policies typically have standardized coverage levels. This flexibility allows the policyholder to adjust their coverage as their circumstances change over time.

In conclusion, while converting group life insurance to an individual policy upon retirement may be an option offered by some companies, it is important to carefully consider the challenges and benefits of such a conversion. The decision should be made based on an individual's unique circumstances, financial situation, and long-term planning goals.

Epilepsy and Life Insurance: What You Need to Know

You may want to see also

Basic coverage is usually free

Group life insurance is a type of term life insurance purchased by an employer or organization to cover a group of people. It is often offered as an employment benefit or membership perk at little to no cost to the insured individuals. The first $50,000 of group term life insurance coverage is tax-free for the employee. The IRS allows employers to provide up to $50,000 of coverage tax-free, and neither the insurance premiums nor the death benefit will be subject to income tax.

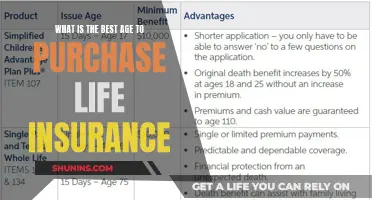

A basic employee group life insurance package typically provides $10,000–$50,000 worth of coverage. However, some employers may calculate the amount based on an employee's earnings, providing coverage that is worth one or two times their annual salary. This basic coverage is usually provided to employees at no cost.

Group life insurance is fairly inexpensive and may even be free since many members pay into the group policy. The cost of insurance for each individual is lower than if they were to purchase an individual policy.

Group life insurance is a good benefit to have, but it may not meet all your needs. Because it is linked to employment, if you change jobs, retire, or leave your job, the coverage will stop. This puts you at risk of being uninsured, especially if you have health issues that make finding new coverage difficult.

Additionally, the amount of coverage offered by your employer may not be sufficient to meet your loved ones' financial needs after you're gone. A basic $50,000 life insurance policy could pay funeral expenses and clear some debts, but a larger policy may be needed to cover expenses such as mortgage payments or college tuition.

For these reasons, it is often recommended to supplement group life insurance with an individual policy.

Dr. Scott Mosby: Sun Life Insurance Acceptance and Benefits

You may want to see also

Group life insurance is a type of term life insurance

Group life insurance is most commonly offered by employers, but individuals may also qualify for a policy through membership in a professional organization or even a credit union. A basic employee group life insurance package typically provides $10,000–$50,000 worth of coverage, but this can also be calculated based on earnings, providing coverage worth one or two times the individual's annual salary.

Many employer-sponsored life insurance policies include an accidental death and dismemberment (AD&D) rider at no charge to the employee. AD&D policies pay out when the insured suffers an accident that causes death or permanent injury, such as blindness or paralysis.

With group life insurance, coverage is guaranteed, but it may only be offered to full-time employees or those who work a minimum number of hours per week. Regardless, individuals will not have to undergo a medical exam to qualify.

In most cases, a group life policy only lasts as long as the individual is employed by or a member of the organization offering coverage. This means that coverage will likely expire if the individual voluntarily quits their job, is terminated, withdraws or cancels their membership, or stops paying dues or is no longer a member in good standing.

Upon retirement, group life insurance coverage may or may not be continued. Some companies will allow individuals to convert their group term life insurance to an individual policy when they retire, but employers typically will not cover the premiums for this.

Because coverage can expire, group life insurance is considered term life insurance rather than permanent life insurance. Most are one-year policies that are renewable annually and have no cash value. However, some organizations may offer group universal or variable universal life insurance that accrues a cash value, or insurance that lasts for a fixed number of years, such as a 30-year term life policy, instead of renewing annually.

Crate Carriers: Life Insurance Provision and Employee Benefits

You may want to see also

Frequently asked questions

Group life insurance is typically tied to your employment status, so it often ends when you retire. However, some companies may offer the option to convert your group life insurance to an individual policy, but this may come with higher premiums and a health examination.

The challenges of converting group life insurance to an individual policy include potentially higher premiums and the requirement of a health examination. These factors can make the conversion less appealing and more difficult to qualify for.

Buying personal life insurance at a younger age can result in lower premiums as insurance companies consider younger individuals as lower risk. Additionally, purchasing life insurance early provides long-term coverage, ensuring financial security for your dependents.