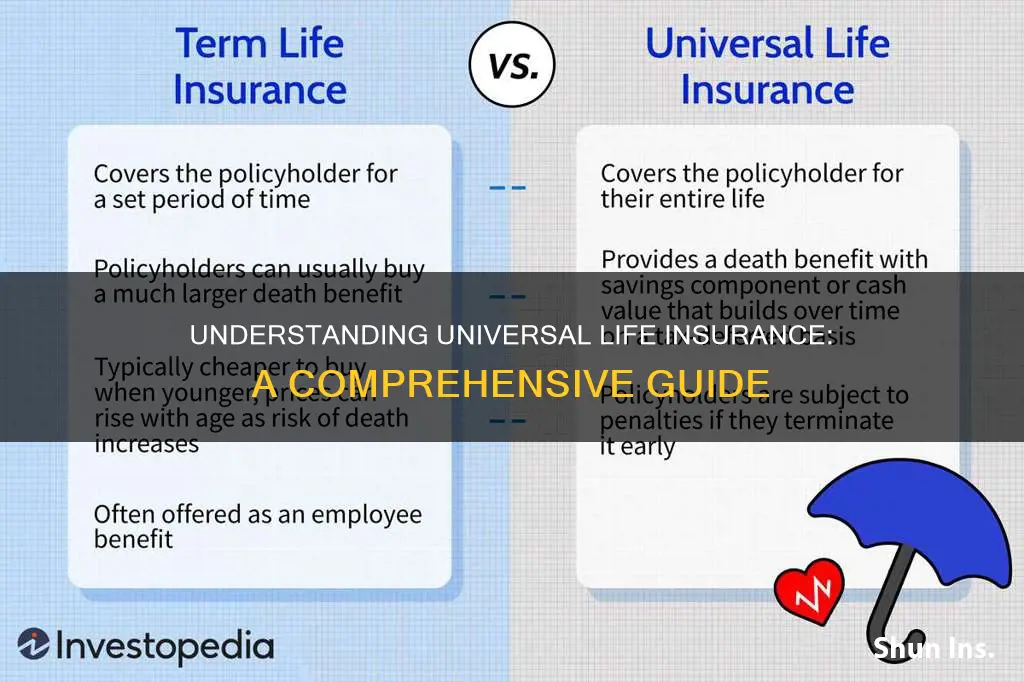

Universal life insurance is a type of permanent life insurance that offers both an insurance policy and an investment component. Unlike term life insurance, which provides coverage for a specified period, universal life insurance provides lifelong coverage. Policyholders can adjust their premiums and death benefits over time, allowing for flexibility in managing their insurance needs. This type of insurance combines the security of a death benefit with the potential for cash value accumulation, which can be borrowed against or withdrawn. It is a popular choice for those seeking long-term financial protection and investment opportunities in a single product.

What You'll Learn

- Definition: Universal life insurance is a long-term policy with a flexible premium and investment component

- Benefits: Offers lifelong coverage, potential cash value growth, and customizable death benefits

- Premiums: Payments can vary based on age, health, and investment performance

- Investment Options: Allows policyholders to allocate funds to various investment accounts

- Flexibility: Provides control over policy design, allowing adjustments over time

Definition: Universal life insurance is a long-term policy with a flexible premium and investment component

Universal life insurance is a comprehensive and flexible financial product designed to provide long-term coverage and investment opportunities. This type of insurance offers a unique approach to life insurance, allowing policyholders to customize their coverage and adapt it to their changing needs over time.

At its core, universal life insurance is a long-term commitment, typically lasting for the entire lifetime of the insured individual. Unlike traditional term life insurance, which provides coverage for a specified period, universal life insurance offers a permanent solution. This means that once the policy is in force, the coverage remains in effect as long as the premiums are paid, providing a sense of security and financial protection for the insured and their beneficiaries.

One of the key features of universal life insurance is its flexibility in premium payments. Policyholders have the freedom to choose how much they want to pay in premiums, allowing for customization based on their financial situation and goals. This flexibility is particularly advantageous for individuals who may experience fluctuations in income or those who prefer to invest a portion of their premium payments into an investment component. The investment aspect of universal life insurance is a significant benefit, as it allows policyholders to potentially grow their money over time.

The investment component of universal life insurance is a critical feature that sets it apart from other insurance products. Policyholders can allocate a portion of their premiums into an investment account, which is managed by the insurance company. This investment account can be used to build cash value, which can be borrowed against or withdrawn to meet financial needs. The growth of the investment component is typically tied to market performance, providing an opportunity for policyholders to benefit from potential market gains.

In summary, universal life insurance is a long-term financial commitment that offers flexibility in premium payments and a robust investment component. This type of insurance provides individuals with a way to secure their loved ones' financial future while also allowing them to potentially grow their money over time. Understanding the features and benefits of universal life insurance is essential for anyone seeking a comprehensive and adaptable life insurance solution.

Tramadol Use: Denying Life Insurance, Affecting Lives

You may want to see also

Benefits: Offers lifelong coverage, potential cash value growth, and customizable death benefits

Universal life insurance is a type of permanent life insurance that offers a range of benefits and unique features. One of its key advantages is lifelong coverage, ensuring that the insured individual is protected throughout their entire life. This is in contrast to term life insurance, which provides coverage for a specified period, typically 10, 20, or 30 years. With universal life, the coverage is permanent, providing peace of mind and long-term financial security.

Another significant benefit is the potential for cash value growth. Unlike term life insurance, which primarily focuses on death benefits, universal life policies accumulate cash value over time. This cash value can grow tax-deferred and can be used for various purposes. Policyholders can borrow against this cash value or even withdraw funds (though withdrawals may reduce the policy's cash value and death benefit). This feature allows individuals to build a substantial cash reserve, which can be utilized for various financial goals, such as funding education, starting a business, or supplementing retirement income.

Furthermore, universal life insurance offers customizable death benefits. This flexibility allows individuals to tailor the policy to their specific needs and preferences. Policyholders can choose the amount of death benefit they want to provide for their beneficiaries, ensuring that their loved ones receive the financial support they need in the event of the insured's passing. This customization is particularly valuable as it allows individuals to adapt the policy to changing circumstances and financial goals over time.

The lifelong coverage aspect of universal life insurance is particularly appealing to those seeking long-term financial protection. It provides a sense of security, knowing that the insured individual and their family are protected regardless of future changes in health or financial status. Additionally, the potential for cash value growth and the ability to customize death benefits make universal life insurance a versatile and adaptable financial tool.

In summary, universal life insurance offers a comprehensive set of benefits, including lifelong coverage, the potential for cash value accumulation, and customizable death benefits. These features make it an attractive option for individuals seeking long-term financial security and the ability to adapt their insurance policy to their evolving needs. Understanding these advantages can help individuals make informed decisions about their insurance coverage and ensure they have the right protection in place for themselves and their loved ones.

Reliance Nippon Life Insurance: Is It Worth Investing In?

You may want to see also

Premiums: Payments can vary based on age, health, and investment performance

Universal life insurance is a type of permanent life insurance that offers a unique combination of death benefit protection and an investment component. Unlike traditional term life insurance, where premiums are fixed for a specified period, universal life insurance premiums are flexible and can change over time. This flexibility is a key feature that sets universal life insurance apart and allows it to adapt to various life circumstances.

The premium payments in universal life insurance are directly linked to the policyholder's age, health, and the performance of the investment portion of the policy. As the policyholder ages, the premium payments typically increase to reflect the higher risk associated with insuring an older individual. This is a standard practice in the insurance industry, as older individuals may have a higher likelihood of claiming the death benefit. Additionally, the health of the policyholder plays a significant role in determining premium rates. Insurers often consider factors such as medical history, lifestyle choices, and overall health to assess the risk of insuring an individual. A healthier individual may be offered lower premiums, while those with pre-existing health conditions might face higher costs.

The investment performance of the policy is another critical factor affecting premium payments. Universal life insurance policies include an investment component, often referred to as an investment account or an investment reserve. The performance of these investment accounts directly impacts the policy's cash value, which, in turn, influences the premium payments. If the investment accounts perform well, the policyholder may benefit from higher cash values, which can be used to pay premiums or increase the death benefit. Conversely, if the investments underperform, the policyholder might need to pay higher premiums to maintain the desired level of coverage. This dynamic nature of premium payments allows policyholders to potentially reduce costs over time if their investments grow, providing a sense of financial flexibility.

It's important to note that the specific terms and conditions of universal life insurance policies can vary widely between different insurance providers. Policyholders should carefully review the policy documents to understand how their age, health, and investment performance will influence premium payments. Additionally, seeking professional advice from insurance agents or financial advisors can help individuals make informed decisions about universal life insurance, ensuring they choose a policy that aligns with their specific needs and financial goals.

In summary, universal life insurance offers a flexible premium structure that adjusts based on age, health, and investment performance. This adaptability allows policyholders to manage their insurance costs effectively while ensuring they have the necessary death benefit protection. Understanding these factors is crucial for individuals considering universal life insurance as part of their financial planning strategy.

Credit Life Insurance: What It Is and Why It Matters

You may want to see also

Investment Options: Allows policyholders to allocate funds to various investment accounts

Universal life insurance is a type of permanent life insurance that offers a unique feature: it combines a death benefit with an investment component. This means that, in addition to providing financial protection for your loved ones upon your passing, the policy also allows you to allocate a portion of your premium payments into various investment accounts. These investment options can be tailored to your financial goals and risk tolerance, offering a flexible and potentially lucrative way to grow your money.

The investment aspect of universal life insurance is a key differentiator from other life insurance products. With traditional term life insurance, the premiums are solely used to cover the death benefit and have no investment component. In contrast, universal life insurance allows you to direct a portion of your premium into an investment account, which can be invested in various assets such as stocks, bonds, and mutual funds. This investment strategy can provide an opportunity for your money to grow over time, potentially outpacing the growth of traditional savings accounts or certificates of deposit (CDs).

One of the advantages of the investment options in universal life insurance is the ability to customize your investment strategy. Policyholders can choose from a range of investment accounts, each with its own level of risk and potential return. For instance, you might opt for a more conservative approach by investing in fixed-income securities, which offer a steady stream of income but with lower potential growth. Alternatively, you could take on more risk by investing in stocks, which historically provide higher returns but also come with a higher degree of volatility. This flexibility allows you to align your investment strategy with your financial objectives and risk profile.

Additionally, the investment accounts within a universal life insurance policy often offer a degree of diversification, which is a crucial aspect of a well-rounded investment portfolio. By allocating funds across different investment options, you can potentially reduce risk and maximize returns. Diversification might include a mix of large-cap stocks, small-cap stocks, international equities, and fixed-income securities. This approach can help smooth out the volatility of any single investment and provide a more stable growth trajectory over the long term.

It's important to note that while the investment options in universal life insurance can be advantageous, they also come with certain risks. The value of your investments can fluctuate, and there is always the possibility of losing some or all of your investment. Therefore, it is essential to carefully consider your financial goals, risk tolerance, and time horizon before making investment decisions. Consulting with a financial advisor can be beneficial to ensure that your investment strategy aligns with your overall financial plan and objectives.

Stryker's Life Insurance Benefits for Employees Explained

You may want to see also

Flexibility: Provides control over policy design, allowing adjustments over time

Universal life insurance offers a unique level of flexibility, empowering policyholders with the ability to customize and adjust their insurance policies according to their evolving needs and circumstances. This flexibility is a significant advantage, as it allows individuals to take control of their financial security and make informed decisions about their insurance coverage.

One of the key aspects of this flexibility is the ability to design a policy that suits specific requirements. When purchasing universal life insurance, policyholders can choose the initial death benefit, which represents the amount of coverage provided in the event of the insured's death. This initial choice sets the foundation for the policy and ensures that the coverage aligns with the individual's current financial obligations and goals. Over time, as life circumstances change, policyholders can adjust this death benefit, increasing or decreasing it as needed. For example, a policyholder might start with a higher death benefit to cover substantial financial commitments, such as a mortgage or children's education, and then gradually reduce it as these obligations diminish.

The flexibility of universal life insurance also extends to the investment component of the policy. Policyholders can allocate a portion of their premiums to an investment account, which grows over time based on market performance. This investment aspect provides an opportunity to potentially accumulate wealth, as the earnings from the investment account can be used to increase the policy's cash value. By regularly reviewing and adjusting the investment strategy, individuals can optimize their returns and ensure that their policy's value aligns with their financial objectives.

Furthermore, this type of insurance allows for policy adjustments without the need for extensive medical exams or waiting periods. When policyholders want to increase their coverage or make significant changes, they can simply adjust the policy's premium payments and death benefit. This process is often more straightforward and less invasive compared to traditional life insurance policies, where changes might require a new medical evaluation.

In summary, universal life insurance provides a flexible and adaptable approach to financial planning. It empowers individuals to take charge of their insurance coverage, ensuring that it remains relevant and appropriate as their life circumstances change. With the ability to customize and adjust policies, universal life insurance offers a valuable level of control and peace of mind for those seeking long-term financial security.

Life Insurance Beneficiaries: Divorce and Your Entitlements

You may want to see also

Frequently asked questions

Universal Life Insurance is a type of permanent life insurance that offers flexibility and potential long-term savings. It provides coverage for the entire life of the insured individual and allows policyholders to build cash value over time, which can be used for various purposes, such as loaning back to the policyholder, increasing the death benefit, or taking out withdrawals.

This insurance policy involves regular premium payments, and a portion of each premium goes towards funding the death benefit and the remaining amount is invested in an investment component. The cash value grows tax-deferred, and policyholders can access it through loans or withdrawals. The death benefit is typically guaranteed and can be increased by paying additional premiums.

One of the key benefits is the flexibility it offers. Policyholders can adjust their premiums and death benefits according to their changing needs and financial goals. It also provides a way to build wealth over time due to the investment component, and the cash value can be used for various financial purposes. Additionally, it offers lifelong coverage, ensuring financial protection for the insured's beneficiaries.