The VFW Insurance Program, administered by Lockton Affinity, offers life insurance to its members. This includes Individual Term Life Insurance, Group Term Life Insurance for members under 50, and Senior Term Life Insurance for members aged 50-74. All VFW members in good standing also receive up to $1,000 of Accidental Death and Dismemberment Insurance protection at no cost, underwritten by Securian Life Insurance Company.

| Characteristics | Values |

|---|---|

| Insurance type | Individual Term Life Insurance, Group Term Life Insurance, Senior Term Life Insurance |

| Who is it for? | VFW members, spouses of VFW members |

| Age range | 18-49 (Group Term Life Insurance), 50-74 (Senior Term Life Insurance) |

| Additional/supplementary coverage | $50,000 member benefit, $20,000 boost to spouse's life coverage |

| Medical exam required? | No |

| Health questions asked? | No |

| Acceptance | Guaranteed |

| Cost | Economical group rates |

What You'll Learn

No-cost accidental death protection

The VFW Insurance Program, administered by Lockton Affinity, offers No-cost Accidental Death Protection to all VFW members in good standing. This protection is underwritten by the Securian Life Insurance Company and offers up to $1,000 of Accidental Death and Dismemberment Insurance at no cost to the member. If a covered member's death occurs as a result of an accident while travelling as a fare-paying passenger in a commercial vehicle, an additional VFW Travel Accident Benefit of $1,500 is payable, bringing the total benefit to a maximum of $2,500.

All benefits reduce to 50% at age 75, regardless of the age at enrollment. Claims for accidents occurring before August 1, 2018, should be directed to (800) 626-0027, while claims for accidents occurring after August 1, 2018, should be reported to (877) 850-0183.

The VFW Insurance Program has been providing exclusive access to life planning products and insurance for veteran and active-duty VFW members for over 30 years. The program includes only the highest-quality carriers, ensuring that VFW members receive the best products on the market.

In addition to the No-cost Accidental Death Protection, the VFW Insurance Program also offers life insurance plans that require no medical exams, insurance plans with limits up to $3,000,000, and insurance for grandchildren.

Dave Ramsey's Take on Term and Whole Life Insurance

You may want to see also

Group term life insurance

Under group term life insurance, employers usually cover the cost of basic coverage, with additional coverage available for an extra premium paid by the employee. The standard amount of coverage is usually equivalent to the insured employee's annual salary, although employers can choose different benefit levels. Employees are typically automatically enrolled in the base coverage once they meet certain requirements, such as working a specific number of hours per week or being employed for a certain period.

However, there are also some disadvantages to consider. Group term life insurance coverage may not be sufficient for many families, and the amount of coverage is often limited based on factors such as tenure, salary, number of dependents, and employment status. The coverage also tends to end when an individual's employment is terminated, although some employers may allow former employees to maintain their coverage or convert the group term policy to an individual permanent policy.

It is worth noting that employers can provide up to $50,000 of tax-free group term life insurance coverage per employee without any tax consequences. Any amount exceeding this threshold that is paid by the employer must be recognised as a taxable benefit and included on the employee's W-2 form.

The VFW (Veterans of Foreign Wars) offers various insurance products and services to its members, including life insurance options. While the specific details of their group term life insurance offering are unclear, they do provide individual term life insurance and senior term life insurance for members under 50, allowing them to boost their coverage by up to $20,000.

Life Insurance: Credit Rating Impact and You

You may want to see also

Senior term life insurance

There are a variety of senior life insurance plans to choose from at price points that make sense for your lifestyle. The right plan for you will depend on your age, how long you may desire coverage for, and how much coverage you need.

Term life insurance is a great option for seniors if you have an idea of how long you may want coverage for. You can choose the specific length of your plan, typically 10, 20, or 30 years. The older you are, the less variety there may be in term lengths and the fees will likely rise as you age. However, term life insurance is still a popular choice for those looking for a policy that can provide benefits for their loved ones.

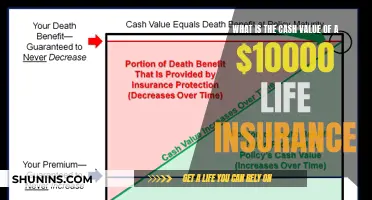

Whole life insurance is another option for seniors and will provide coverage for your entire life. Unlike term life insurance, the benefits of whole life insurance will typically be payable to your beneficiary no matter when you pass. Whole life insurance can be a good option if you want to be certain that your family will receive benefits upon your death.

Final expense insurance is a permanent life insurance policy that offers a small death benefit when you pass away. Your beneficiaries can use the payout to cover your funeral, burial costs, and other end-of-life expenses. Since final expense insurance is a smaller type of plan, it typically comes with lower premiums than other permanent life insurance policies.

The VFW Senior Term Life Plan allows you to quickly and conveniently boost your or your spouse's life coverage by up to $20,000. This benefit program is an ideal opportunity to supplement any existing insurance you may have, reinforce a safety net that has diminished in value due to inflation as you got older, and add important extra coverage to help pay off a mortgage, medical bills, or final expenses.

Whole Life Insurance: Cash Surrender Value After Modifications?

You may want to see also

Individual term life insurance

Features of Individual Term Life Insurance:

- Fixed Term: The most common form of term life insurance, fixed-term policies have a fixed coverage amount and premium payment for the selected term.

- Increasing Term: This type of policy allows you to increase the value of your death benefit over time, resulting in slightly higher premiums. These policies tend to deliver a larger payout.

- Decreasing Term: In contrast, decreasing term policies reduce the coverage amount and premium payments over time, making them suitable for those who anticipate needing less coverage towards the end of the term.

- Annual Renewable: Annual renewable term life insurance provides coverage for one year and must be renewed by the end of the policy term to continue coverage. The premiums usually increase with each renewal.

Benefits of Individual Term Life Insurance:

- Affordability: Term life insurance is known for its low cost, as it only covers you for a set period. This makes it an accessible option for those on a budget or with short-term coverage needs.

- More Coverage: Due to its affordability, term life insurance allows you to purchase a larger death benefit, providing greater financial security for your loved ones.

- Tax-Free Payout: The death benefit paid to beneficiaries from a term life insurance policy typically does not count as taxable income.

- Guaranteed Protection and Premium: With a term policy, the death benefit and premium amount remain fixed and guaranteed throughout the term.

When considering individual term life insurance, it is essential to research insurers and plans to find the right coverage and rate for your specific needs and budget. Additionally, term life insurance may be suitable if you are married, starting a family, or have financial commitments, such as a mortgage, that you want to ensure are covered in the event of your unexpected passing.

PERS and Life Insurance: What's the Deal?

You may want to see also

Medicare supplemental insurance

The VFW Insurance Program, administered by Lockton Affinity, offers a range of insurance products and services exclusively to veteran or active-duty VFW members. One of the benefits offered is Medicare Supplemental Insurance, also known as Medigap.

The VFW Insurance Program has been offering exclusive benefits to its members for over 30 years, ensuring they receive high-quality insurance products at preferred rates. The program provides a range of coverage options for veterans and their families, including life insurance, auto insurance, and health and wellness insurance.

The VFW's Medicare Supplemental Insurance is provided by Humana, ensuring that even with Medicare, veterans won't get stuck paying out-of-pocket expenses.

RNDC: Whole Life Insurance Options and Benefits

You may want to see also

Frequently asked questions

The VFW Senior Term Life Insurance is an easy way to add extra coverage for senior members. It is administered by AGIA and offers an opportunity to replace coverage that ends after retirement or cutting back on work hours.

The VFW Group Term Life Insurance is administered by AGIA and is available for members aged 18-49. It is a convenient way to set up more protection as members build their careers and their family responsibilities grow.

The VFW Individual Term Life Insurance is offered by Life Insurance Central and allows members to protect their family's financial security with tailored Term Life Insurance Plans.