Life insurance companies are increasingly using credit checks as part of the application review process. However, while your credit history may have an impact on your life insurance rates, your credit score alone won't affect your life insurance premiums. Instead, events in your financial history that affect your credit score could also impact how an insurer evaluates your application.

When you apply for life insurance, the insurer will do a soft inquiry of your credit report. They are looking for particular information from within your credit history, such as whether you have filed for bankruptcy. This can impact your ability to be approved for a policy and its cost.

Your credit score won't be impacted if you fail to pay a life insurance premium, but the consequence is that the policy will lapse and you will lose coverage.

| Characteristics | Values |

|---|---|

| Does life insurance affect your credit rating? | No, life insurance does not directly affect your credit rating under any circumstances. |

| Do life insurance companies report payment history to credit bureaus? | No, life insurance companies do not report payment history, or even the fact that you own a life insurance policy, to any agencies. |

| Does a credit score affect life insurance premiums? | No, a credit score alone won't impact life insurance premiums. However, events in your financial history that affect your credit score could also affect how an insurer evaluates your application. |

| What is a soft inquiry? | A soft inquiry is when your credit report is checked, but your credit score is not impacted because the inquiry is not related to a specific application for credit. |

| Is a life insurance company checking your credit considered a soft inquiry? | Yes, a life insurance company checking your credit is considered a soft inquiry and therefore does not affect your credit score. |

What You'll Learn

Life insurance companies may check your credit history

A soft inquiry is when your credit report is checked, but your credit score is not affected because the inquiry is not related to a specific application for credit. A life insurance company checking your credit is considered a soft inquiry. Therefore, it will not impact your credit score.

However, your credit history may impact your life insurance rates. The credit data life insurers access varies by company, and each US state views this information differently. Your credit history is just one of many factors that your insurer will consider when determining your life insurance premium rates.

When a life insurance company checks your credit, it may be looking for particular information from within your credit history. For example, a bankruptcy filing in your credit report could impact your ability to be approved for a policy and its cost.

The company may also receive a credit-based insurance score that attempts to predict the likelihood that someone will miss a premium payment. It can use the score to help determine if it should require a medical exam, issue a policy, and how much to charge in premiums.

Farm Bureau of Michigan: Life Insurance Options and More

You may want to see also

Credit history may impact life insurance rates

In addition, your credit-based insurance score, which is based on data such as the amount of credit utilized, the length of your credit history, and outstanding debt amounts, can help an insurance company determine your financial risk. This score is used to predict the likelihood of you becoming involved in a future accident or insurance claim.

Life insurance companies may also look at your LexisNexis risk score, which is a composite score that considers your credit score, driving record, and other data to create an overall rating of how risky you are to insurance companies. A history of bankruptcy matters to life insurance companies because it could indicate poor decision-making or be a red flag for medical problems.

While your credit history may impact your life insurance rates, it is just one of many factors that insurers will consider. Other factors include your age, sex, health history, family medical history, hobbies, work, driving record, and criminal record. Ultimately, life insurance companies are evaluating the overall risk of insuring you and your likelihood of dying while the policy is active.

Life Insurance and Grand Mal Seizures: What You Need to Know

You may want to see also

Credit-based insurance scores are different from credit scores

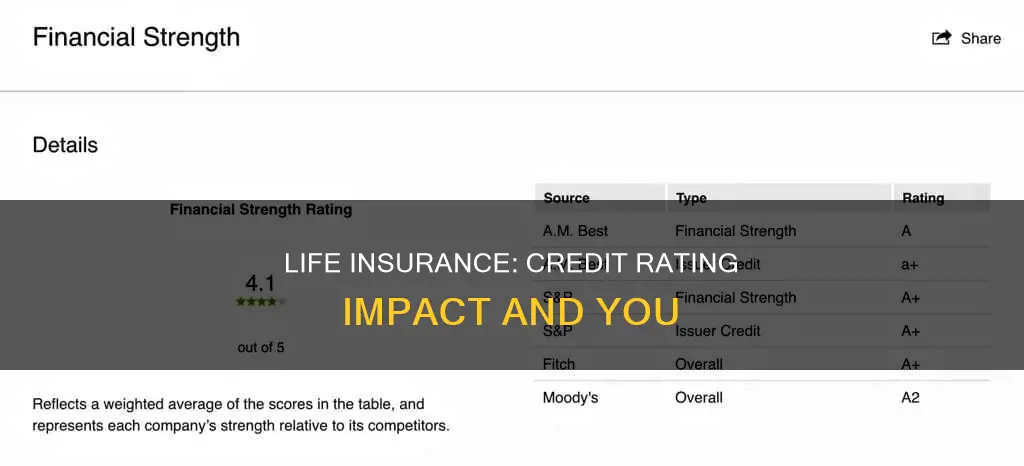

Credit-based insurance scores and credit scores are calculated differently and used for different purposes. While they are based on similar underlying information, they are not the same.

Credit scores are calculated based on your credit report and are used by creditors to determine whether to approve applications and choose the terms of your account. They predict the likelihood that someone will fall behind on their bills.

Credit-based insurance scores, on the other hand, are used by insurance companies to help set your premiums. They predict the likelihood that you will file insurance claims that cost the insurance company more than it collects in premiums.

Credit-based insurance scores are calculated using data such as the amount of credit utilised, the types of accounts, the length of credit history, outstanding debt amounts, new applications for credit, and the types of credit in use. These factors are weighted differently than they are for credit scores. For example, according to FICO, payment history is weighted at 40% in credit-based insurance scores, while it is just one of several factors considered in credit scores.

Additionally, credit-based insurance scores have different score ranges than credit scores. Credit scores typically range from 300 to 850, while credit-based insurance scores can have very different ranges, such as 200 to 997 for the LexisNexis Attract score.

It's important to note that insurers cannot use credit-based insurance scores as the sole factor in setting rates or approving applications. In some states, the use of credit-based insurance scores is restricted or prohibited altogether.

GAAP, Life Insurance, and DAC: What's Allowed?

You may want to see also

Soft credit inquiries don't affect your credit score

When you apply for life insurance, the insurance company will perform a soft credit inquiry to check your credit report and financial history. This is done to calculate an insurance score for you, which is an internal metric used to evaluate your overall financial risk.

Soft credit inquiries do not affect your credit score. They are considered "soft" because they are not connected to a specific application for new credit and are often done without your permission. For example, a lender you're currently doing business with may perform a soft credit inquiry to ensure you're still creditworthy. You can also trigger a soft inquiry yourself by checking your own credit.

While soft credit inquiries won't impact your credit score, they may or may not be recorded in your credit report, depending on the credit bureau. These inquiries are only visible to you and will typically remain on your credit report for 12 to 24 months.

On the other hand, hard credit inquiries, which occur when you apply for new credit, such as a loan or credit card, can impact your credit score. These inquiries are considered "hard" because they are connected to a specific application for new credit and typically require your authorization. Hard inquiries can remain on your credit report for about two years and may lower your credit score by a few points.

Life Insurance and Estate Tax Returns: What's the Connection?

You may want to see also

Credit history is one of many factors influencing life insurance costs

Your credit history may be used to calculate an insurance score, which is an internal metric used by the insurer to evaluate your overall financial risk. A poor insurance score could lead to higher premiums or application denials. Additionally, your credit score may be indirectly considered through reports and records such as the LexisNexis risk score, which takes into account your credit score, driving history, and other public data.

Other factors that influence life insurance costs include age, sex, health history, family medical history, hobbies, work, driving record, criminal record, and the type of policy. These factors are not included in a credit report or credit score but are obtained from various sources, including your application, medical records, and consumer reporting companies.

Life Insurance and Suicide: What Families Need to Know

You may want to see also

Frequently asked questions

No, having life insurance does not directly affect your credit rating. Life insurance companies do not report payment history to credit bureaus, so it is not a factor in your score.

Your credit score alone won't impact your life insurance application. However, events in your financial history that affect your credit score could also affect how an insurer evaluates your application.

A soft inquiry is when your credit report is checked but your credit score is not impacted because the inquiry is not related to a specific application for credit. A life insurance company checking your credit is considered a soft inquiry, so it does not affect your credit score.