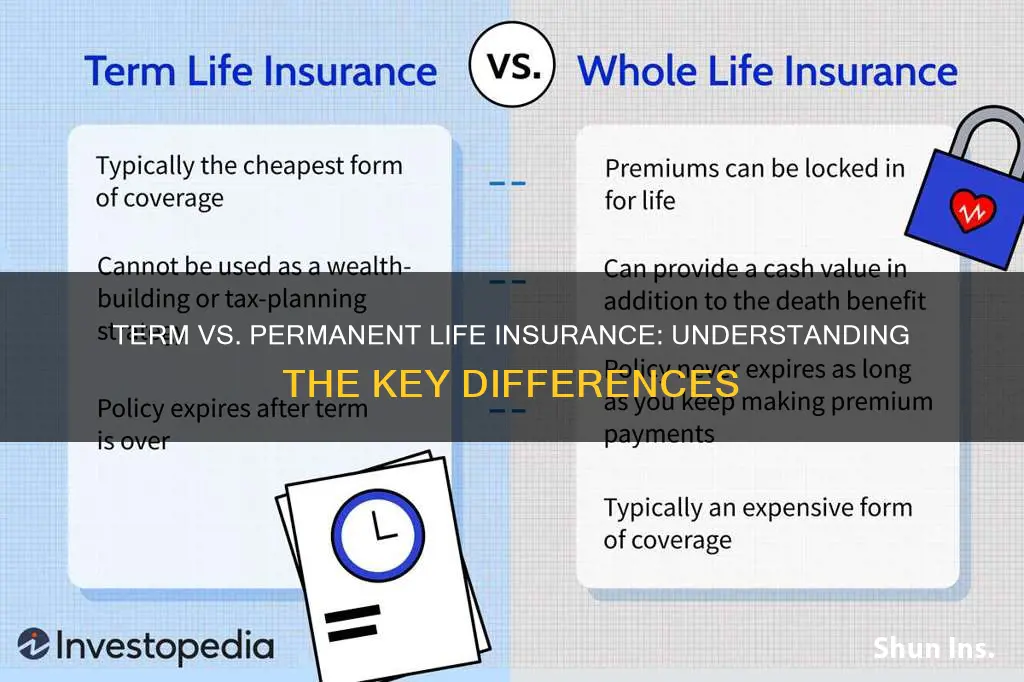

When considering life insurance, it's important to understand the differences between term and permanent policies. Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years, and is generally more affordable. On the other hand, permanent life insurance, also known as whole life insurance, offers lifelong coverage and includes a savings component, allowing policyholders to build cash value over time. The key distinction lies in their duration and long-term financial benefits, making it essential to choose the right type of insurance based on individual needs and financial goals.

What You'll Learn

- Coverage Duration: Term offers temporary protection, while permanent provides lifelong coverage

- Cost: Term is generally more affordable, permanent is more expensive but offers more benefits

- Flexibility: Term policies are flexible and can be canceled, permanent is non-cancellable

- Benefits: Permanent includes cash value, while term focuses on death benefit

- Long-Term Value: Permanent builds cash value, term provides pure insurance without investment

Coverage Duration: Term offers temporary protection, while permanent provides lifelong coverage

When comparing term and permanent life insurance, the most accurate statement regarding coverage duration is that term insurance offers temporary protection, whereas permanent insurance provides lifelong coverage. This fundamental difference in their design and purpose is crucial for individuals to understand when choosing the right insurance plan.

Term life insurance is a straightforward and cost-effective solution for a specific period. It provides coverage for a predetermined number of years, often ranging from 10 to 30 years. During this term, the policy offers financial protection to the beneficiary in the event of the insured's death. Once the term ends, the policy expires, and the coverage ceases unless the policyholder decides to renew or convert it. This type of insurance is ideal for individuals who want coverage for a particular period, such as covering mortgage payments or providing financial support to dependents during their children's education.

On the other hand, permanent life insurance, also known as whole life insurance, offers lifelong coverage. This insurance type is designed to provide protection for the entire lifetime of the insured individual. It accumulates cash value over time, which can be borrowed against or withdrawn, providing a financial safety net. Permanent insurance is a long-term commitment, and the death benefit is guaranteed to be paid out upon the insured's passing, regardless of when it occurs. This type of policy is suitable for those seeking long-term financial security and the peace of mind that comes with knowing their loved ones will be protected indefinitely.

The key distinction lies in the duration of coverage. Term insurance is a temporary solution, offering protection for a defined period, while permanent insurance provides a continuous safety net throughout one's life. Understanding this difference is essential for individuals to make informed decisions about their insurance needs and ensure they have adequate coverage for their specific circumstances.

In summary, when comparing term and permanent life insurance, the statement emphasizing the coverage duration is the most accurate. Term insurance provides temporary protection, while permanent insurance offers lifelong coverage, catering to different financial needs and long-term goals.

Best Life Insurance Options for the Over-50s

You may want to see also

Cost: Term is generally more affordable, permanent is more expensive but offers more benefits

When comparing term and permanent life insurance, one of the most critical factors to consider is the cost. Term life insurance is designed to provide coverage for a specific period, typically 10, 20, or 30 years. During this term, the policyholder pays a fixed premium, and the insurance company promises to pay a death benefit to the policy's beneficiaries if the insured person dies during that period. This type of insurance is generally more affordable because it is tailored to meet the needs of a specific time frame. For example, if you're insuring your children's education or a mortgage payment, you might choose a 20-year term policy, ensuring coverage during those critical years.

On the other hand, permanent life insurance, also known as whole life insurance, offers lifelong coverage. This means that once you purchase a permanent policy, you will pay premiums for as long as you live, and the death benefit will be paid to your beneficiaries regardless of when you pass away. While permanent life insurance provides more comprehensive coverage, it comes at a higher cost. The extended coverage and the accumulation of cash value within the policy contribute to the higher premiums. This type of insurance is often more expensive, especially for older individuals, as the insurance company takes on more risk by guaranteeing coverage for a lifetime.

The cost difference between term and permanent life insurance can be significant. For instance, a 30-year term policy might cost around 10-20% of the annual premium of a comparable permanent life insurance policy. This affordability is one of the primary reasons why term life insurance is a popular choice for many individuals, especially those with temporary financial goals or those who want to ensure their family's financial security during a specific period.

However, it's essential to understand that the higher cost of permanent life insurance is justified by the extended benefits it provides. Permanent life insurance offers a double advantage: it provides lifelong coverage, and the cash value component can grow over time, allowing policyholders to borrow against it or use it as an investment. This feature can be particularly valuable for long-term financial planning and can be a significant selling point for those seeking comprehensive insurance solutions.

In summary, while term life insurance is generally more affordable and suitable for specific time-bound needs, permanent life insurance offers more extensive benefits at a higher cost. The decision between the two should be based on an individual's financial goals, risk tolerance, and the desired level of coverage. Understanding the cost implications is crucial in making an informed choice when comparing term and permanent life insurance options.

Millennial Life Insurance: A Surprising Statistic You Need to Know

You may want to see also

Flexibility: Term policies are flexible and can be canceled, permanent is non-cancellable

When considering life insurance, understanding the flexibility offered by different policies is crucial. One of the key differences between term and permanent life insurance lies in their flexibility and long-term commitment.

Term life insurance is designed to provide coverage for a specific period, typically 10, 20, or 30 years. During this term, the policyholder pays regular premiums, and in return, the insurance company promises to pay a death benefit to the policy's beneficiaries if the insured individual passes away within the specified period. The beauty of term insurance is its flexibility. Policyholders can choose the duration of coverage that aligns with their current needs and financial goals. For instance, a young professional might opt for a 10-year term policy to cover their family during their children's early years. This flexibility allows individuals to adjust their coverage as their circumstances change, ensuring they have the right amount of protection when they need it most.

In contrast, permanent life insurance, also known as whole life insurance, offers lifelong coverage. Once the policy is in force, it remains active until the insured individual passes away, regardless of age or health status. Permanent insurance policies are non-cancellable, meaning the insurance company cannot terminate the policy, and the death benefit is guaranteed as long as the premiums are paid. While this provides long-term security, it also means that once the policy is purchased, the coverage is fixed, and adjustments become more challenging.

The flexibility of term insurance allows policyholders to make changes or cancel the policy if their needs or financial situation evolve. For example, if a policyholder's family size decreases, they might choose to convert their term policy into a permanent one or opt for a shorter term to reduce costs. This adaptability is particularly valuable for those who anticipate significant life changes or want to ensure their insurance needs are met without long-term commitments.

In summary, the statement that best compares term and permanent life insurances is that term policies offer flexibility and can be canceled, while permanent policies are non-cancellable. This distinction highlights the different levels of commitment and adjustability that policyholders can expect from each type of life insurance, allowing them to make informed decisions based on their unique circumstances and future plans.

Life Insurance for Incarcerated: Is It Possible?

You may want to see also

Benefits: Permanent includes cash value, while term focuses on death benefit

When comparing term and permanent life insurance, it's essential to understand the key benefits and features of each type of policy. One of the most accurate statements that highlights the differences is: "Term life insurance focuses on providing a death benefit during a specified period, while permanent life insurance includes a cash value component in addition to the death benefit."

Term life insurance is a straightforward and cost-effective solution for temporary coverage. It is designed to provide financial protection for a specific duration, typically 10, 20, or 30 years. The primary benefit of term life insurance is the guaranteed death benefit, which pays out a predetermined amount to the policyholder's beneficiaries if the insured individual passes away during the term. This type of insurance is ideal for individuals who want coverage for a particular period, such as until a child is financially independent or a mortgage is paid off.

On the other hand, permanent life insurance offers long-term financial security and a range of benefits. One of its key advantages is the inclusion of cash value. Permanent life insurance policies, such as whole life or universal life, accumulate cash value over time. This cash value is a portion of the premiums paid that grows tax-deferred. It can be borrowed against or withdrawn, providing a financial safety net for the policyholder. The cash value in permanent life insurance grows and can be used for various purposes, such as funding education expenses, starting a business, or providing additional financial security in retirement.

The statement emphasizes that term life insurance is a pure death benefit product, offering coverage for a defined period without the accumulation of cash value. In contrast, permanent life insurance provides both a death benefit and a long-term savings component. This comparison highlights the trade-off between term life's simplicity and cost-effectiveness and permanent life's comprehensive nature, which includes the potential for cash value accumulation.

Understanding these benefits is crucial for individuals to make informed decisions about their life insurance needs. Whether one chooses term or permanent life insurance depends on their specific goals, financial situation, and the desired level of long-term financial security.

Life Insurance and Hospice: What's the Deal?

You may want to see also

Long-Term Value: Permanent builds cash value, term provides pure insurance without investment

When comparing term and permanent life insurance, it's essential to understand the fundamental differences in their structures and long-term value propositions. Term life insurance is a straightforward policy designed to provide coverage for a specific period, typically 10, 20, or 30 years. Its primary purpose is to offer financial protection to beneficiaries during the chosen term. In contrast, permanent life insurance, also known as whole life insurance, offers coverage for the entire lifetime of the insured individual. This type of insurance provides a dual benefit: long-term financial protection and a cash value component.

The key distinction lies in the investment aspect. Term life insurance is a pure insurance product, where the premiums paid go directly towards providing coverage without any investment component. It is a simple, direct approach to securing financial protection for a defined period. On the other hand, permanent life insurance incorporates an investment element. A portion of the premium is invested, allowing it to grow over time, and this cash value can be borrowed against or withdrawn, providing financial flexibility.

Over the long term, permanent life insurance builds a significant cash value, which can be a valuable asset. This cash value can accumulate and grow, providing a financial reserve that can be used for various purposes, such as funding education, starting a business, or providing additional financial security in retirement. In contrast, term life insurance does not accumulate cash value; its primary function is to provide coverage during the specified term.

For those seeking long-term financial security and the potential for asset growth, permanent life insurance is an attractive option. It offers a comprehensive solution, combining insurance protection with an investment strategy. In contrast, term life insurance is ideal for individuals who prioritize pure insurance coverage for a defined period, especially when the primary goal is to secure financial protection for a specific duration, such as covering mortgage payments or providing for children's education.

Understanding these differences is crucial for individuals to make informed decisions about their life insurance needs. While term life insurance provides essential coverage at a lower cost, permanent life insurance offers a more comprehensive approach, building long-term value and providing financial flexibility. The choice between the two depends on an individual's financial goals, risk tolerance, and the desired level of long-term financial security.

Critical Illness: Is Life Insurance Enough?

You may want to see also

Frequently asked questions

The main distinction lies in their coverage duration. Term life insurance provides coverage for a specified period, typically 10, 20, or 30 years. It offers a death benefit if the insured dies during this term. In contrast, permanent life insurance, also known as whole life insurance, provides lifelong coverage. It offers a death benefit and a cash value component that grows over time, allowing policyholders to build a savings element within their insurance policy.

Term life insurance is generally more affordable and offers a straightforward coverage period. The premiums are typically lower because the insurance company doesn't have to account for the long-term commitment. Permanent life insurance, on the other hand, has higher premiums due to the lifelong coverage and the additional feature of cash value accumulation. The cost of permanent insurance increases over time as the policyholder ages, while term insurance rates remain constant throughout the policy term.

Both term and permanent life insurance can provide tax benefits. Premiums paid for term life insurance are generally not tax-deductible for individuals, but they can be an itemized deduction for businesses. Permanent life insurance, especially whole life, offers tax advantages as the cash value grows tax-free. Additionally, policyholders can take loans against the cash value, which are tax-free, and the death benefit is typically tax-free as well.

Yes, many term life insurance policies offer the option to convert to permanent insurance at a later date. This conversion privilege allows policyholders to switch from a temporary coverage to a lifelong policy without a medical examination, ensuring they maintain coverage even if their health status changes. It's a valuable feature, especially for those who initially opt for term life due to budget constraints but later decide to enhance their insurance coverage.