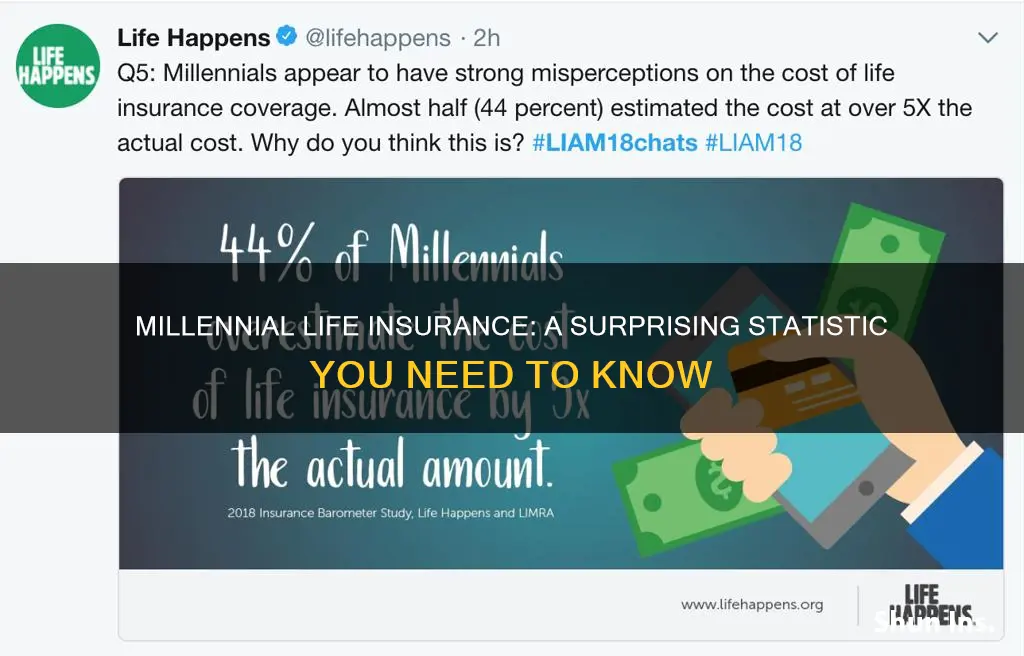

Millennials, often portrayed as financially cautious, have a surprising lack of life insurance coverage. Despite their awareness of the importance of financial planning, only a small percentage of millennials have life insurance, with many citing cost and complexity as barriers. This article aims to explore the reasons behind this trend and discuss potential solutions to encourage more millennials to secure their future with life insurance.

| Characteristics | Values |

|---|---|

| Age Group | 25-40 years old |

| Gender | Not specified, but typically, younger adults are less likely to have life insurance compared to older adults. |

| Marital Status | Single or married, with or without children |

| Income Level | Varies, but generally, higher income is associated with higher life insurance coverage |

| Education Level | College degree or higher |

| Employment Status | Employed or self-employed |

| Geographic Location | Urban or rural areas, with potential variations based on country or region |

| Life Insurance Type | Term life, whole life, or universal life insurance |

| Coverage Amount | Varies based on individual needs and financial goals |

| Percentage of Millennials with Life Insurance | Approximately 20-30% according to various sources, with a significant portion having no life insurance at all. |

What You'll Learn

- Demographic Breakdown: Age, income, and geographic distribution of millennials with life insurance

- Financial Awareness: Understanding the importance of life insurance among financially savvy millennials

- Cultural Factors: Impact of cultural norms and values on life insurance adoption

- Education and Awareness: The role of education in increasing life insurance coverage

- Market Trends: Recent trends in life insurance policies for millennials

Demographic Breakdown: Age, income, and geographic distribution of millennials with life insurance

The concept of life insurance among millennials is an important aspect of financial planning that varies across different demographic groups. Here's an analysis of the factors influencing this:

Age and Life Insurance: Age is a critical factor in the adoption of life insurance. Typically, younger individuals might not see the immediate need for life insurance, as they believe they are invincible. However, as millennials age, their perspectives often shift. Many start to consider life insurance as a safety net for their families and a way to secure their financial future. Statistics show that the percentage of millennials with life insurance increases significantly as they approach their 30s and 40s, indicating a growing awareness of long-term financial planning.

Income and Financial Stability: Income level plays a pivotal role in determining the likelihood of millennials having life insurance. Higher-income earners often have more financial resources and are more likely to prioritize long-term financial planning, including life insurance. They may view it as a necessary investment to protect their assets and provide for their loved ones. Conversely, lower-income millennials might face financial constraints that make purchasing life insurance a challenge. However, it's worth noting that many insurance providers now offer affordable plans tailored to the needs of younger, lower-income individuals.

Geographic Distribution: The geographic distribution of millennials with life insurance can vary based on regional economic factors and cultural norms. In regions with a higher cost of living and increased financial responsibilities, millennials might be more inclined to secure life insurance. For instance, urban areas with a dense population and higher living expenses may see a higher percentage of young adults with life insurance policies. Additionally, cultural and societal factors can influence the perception of life insurance. In some cultures, the idea of providing financial security for one's family is deeply ingrained, leading to higher adoption rates.

Regional Variations: Income and cost of living can vary significantly across different regions, impacting the affordability and necessity of life insurance. In metropolitan areas, where the cost of living is high, millennials might be more inclined to purchase life insurance to secure their financial future and that of their families. In contrast, in regions with a lower cost of living, the perceived need for life insurance may be less urgent. However, with the increasing trend of remote work and digital nomadism, the geographic distribution of millennials with life insurance might become more diverse, as this demographic embraces a more flexible lifestyle.

Understanding these demographic breakdowns can help insurance providers and financial advisors tailor their services to the specific needs of different millennial groups. It also highlights the importance of educating this generation about the long-term benefits of life insurance, ensuring they make informed financial decisions.

Life Insurance Klang: Protecting Your Family's Future

You may want to see also

Financial Awareness: Understanding the importance of life insurance among financially savvy millennials

Millennials, often referred to as the generation born between the early 1980s and the mid-1990s, are increasingly recognizing the importance of financial literacy and security. While they may have a reputation for being risk-averse, especially when it comes to money, the reality is that many millennials are becoming more financially savvy and proactive in planning for the future. One aspect of financial planning that is gaining traction among this generation is life insurance. Despite the common misconception that life insurance is only for the elderly or those with large families, millennials are starting to understand its value and are making informed decisions about their coverage.

The idea of life insurance can be daunting for many, as it often involves complex terminology and a range of policy options. However, for millennials, who are typically more tech-savvy and comfortable with online research, understanding the basics of life insurance is becoming more accessible. Online resources, financial advisors, and peer-to-peer learning platforms are all contributing to a more financially aware millennial population. This increased awareness is leading to a shift in mindset, where life insurance is no longer seen as a luxury but as a necessary tool for financial security.

So, what percentage of millennials actually have life insurance? According to recent studies, the number is growing. While it may not be as high as the percentage of older generations with coverage, the trend is positive. Millennials are starting to recognize that life insurance is not just about providing financial support to a spouse or children in the event of their death; it's also about protecting their own financial well-being. This includes covering potential debt, such as student loans or mortgages, and ensuring that their loved ones are financially secure.

For millennials, life insurance can be a way to build financial resilience and plan for the long term. It allows them to focus on their careers, education, and personal goals without the constant worry of financial instability. With the right policy, millennials can ensure that their loved ones are taken care of, and they can have peace of mind knowing that their financial future is protected. This generation is also more likely to shop around and compare policies, ensuring they get the best value for their money.

In conclusion, while the percentage of millennials with life insurance may not be as high as desired, the trend is encouraging. As more millennials become financially aware, they are making informed decisions about their future. Life insurance is an essential tool in their financial arsenal, providing protection and security for themselves and their loved ones. With the right guidance and resources, millennials can navigate the world of life insurance with confidence, ensuring a brighter and more secure financial future.

Employee Life Insurance: Understanding Your Supplemental Coverage

You may want to see also

Cultural Factors: Impact of cultural norms and values on life insurance adoption

Cultural norms and values play a significant role in shaping the adoption of life insurance, particularly among millennials, who are often seen as a generation that lags in this area. The cultural context of an individual or community can greatly influence their perception of risk, financial planning, and the importance of long-term security.

In many cultures, the concept of life insurance is relatively new and not deeply ingrained in traditional practices. For example, in some Asian countries, the idea of providing for one's family's future is often associated with savings and investments rather than insurance. This cultural shift towards financial security can make it challenging for life insurance companies to promote their products effectively. Millennials, being a generation that grew up with a different set of cultural norms, may not prioritize life insurance as a necessary financial tool.

One cultural factor that influences life insurance adoption is the level of financial literacy. In some societies, there is a lack of education and awareness about the benefits of life insurance and its role in financial planning. This can be a significant barrier, especially for millennials who may have different financial priorities compared to previous generations. For instance, in certain cultures, the focus is on immediate needs and short-term goals, making long-term financial planning less appealing. As a result, millennials might be less inclined to purchase life insurance, as they may not fully understand its value or see it as a priority.

Additionally, cultural values related to risk and uncertainty can impact life insurance decisions. In some cultures, there is a strong belief in self-reliance and the idea that one should not depend on external factors for financial security. This mindset can lead millennials to perceive life insurance as an unnecessary expense or a sign of weakness. They may prefer to take risks and believe that their efforts and skills will provide for their future, rather than relying on insurance policies.

To address these cultural factors, life insurance providers and financial advisors can employ various strategies. Educating millennials about the long-term benefits of life insurance and its ability to provide financial security for their loved ones can be an effective approach. Tailoring products to meet the specific needs and values of this generation, such as offering flexible payment options and customizable policies, can also encourage adoption. By understanding and respecting cultural norms while providing relevant and valuable information, the industry can work towards increasing the percentage of millennials who have life insurance coverage.

Get a Life Insurance License: PA Requirements Guide

You may want to see also

Education and Awareness: The role of education in increasing life insurance coverage

Millennials, born between the early 1980s and mid-1990s, are often portrayed as a generation that avoids traditional financial responsibilities, including life insurance. However, this stereotype may not accurately reflect the reality of this demographic. According to recent studies, while millennials may have a different approach to financial planning compared to previous generations, they are increasingly recognizing the importance of life insurance.

Education and awareness play a pivotal role in encouraging millennials to consider life insurance as a vital component of their financial strategy. Many millennials are well-versed in the digital world and have access to a vast amount of information online. However, when it comes to life insurance, they may lack the necessary knowledge to understand its benefits and the various types of policies available. This is where education becomes a powerful tool to bridge this knowledge gap.

Financial advisors and insurance companies can tailor educational initiatives to resonate with millennials. Creating comprehensive online resources, interactive webinars, and user-friendly guides can help simplify complex insurance concepts. For instance, explaining the difference between term life insurance and permanent life insurance policies in a relatable manner can empower millennials to make informed decisions. By providing clear and concise information, these resources can dispel misconceptions and highlight the long-term financial security that life insurance offers.

Additionally, educating millennials about the impact of life insurance on their overall financial well-being is essential. Many millennials are focused on building their careers and achieving financial milestones, such as buying a home or starting a business. Life insurance can provide a safety net, ensuring that their loved ones are financially protected in the event of their untimely demise. Emphasizing the peace of mind and security that life insurance offers can be a powerful motivator for this generation.

Furthermore, making life insurance more accessible and affordable is crucial to increasing coverage among millennials. Many millennials may perceive life insurance as an expensive luxury, especially when they are just starting their careers and dealing with student loan debt. Insurance providers can address this concern by offering flexible payment plans and term life insurance options that cater to their budget constraints. By making life insurance more affordable and adaptable, companies can encourage millennials to view it as a necessary investment in their future.

In conclusion, education and awareness are key to increasing life insurance coverage among millennials. By providing accessible and tailored educational resources, financial advisors, and insurance companies can empower this generation to make informed financial decisions. Understanding the unique needs and preferences of millennials can help create effective strategies to ensure that they recognize the long-term benefits of life insurance, ultimately leading to a more financially secure future.

Primerica Life Insurance: A Smart Savings Strategy?

You may want to see also

Market Trends: Recent trends in life insurance policies for millennials

The life insurance industry has witnessed a notable shift in recent years, particularly when it comes to engaging millennials. This demographic, often characterized by their tech-savviness and preference for digital solutions, has significantly influenced the way life insurance companies design and market their products. One of the most prominent trends is the increasing demand for simplified and customizable life insurance policies. Millennials, who are often busy with careers, personal goals, and financial responsibilities, appreciate policies that offer flexibility and ease of management.

In response to this trend, insurance providers have introduced more straightforward and transparent plans. These policies typically feature lower costs, fewer exclusions, and clearer terms, making them more accessible and appealing to millennials. For instance, term life insurance, which provides coverage for a specified period, has gained popularity among this generation due to its simplicity and affordability. Millennials can choose the duration of coverage that aligns with their financial goals, whether it's to secure their family's future for the next 10 years or to pay off a mortgage.

Another significant development is the integration of technology into life insurance. Millennials are accustomed to using technology for various aspects of their lives, and they expect the same level of convenience and accessibility in their financial decisions. Many insurance companies now offer online platforms and mobile apps that allow customers to compare policies, manage their policies, and even purchase coverage instantly. This digital transformation has not only made the process more efficient but has also attracted millennials who value convenience and speed.

Additionally, there is a growing interest in index-linked life insurance products among millennials. These policies offer the potential for higher returns based on market performance, appealing to those who want to grow their savings over time. By linking the policy's performance to market indices, millennials can benefit from increased wealth accumulation, providing a sense of financial security and growth. This trend reflects millennials' desire for investment-oriented products that offer both protection and the potential for long-term gains.

In conclusion, the life insurance market has adapted to the preferences and behaviors of millennials by introducing more accessible, customizable, and technologically advanced products. Simplified policies, term life insurance, digital platforms, and investment-oriented options are all part of a broader shift towards meeting the unique needs of this generation. As millennials continue to play a significant role in the insurance market, these trends are likely to shape the industry's future, ensuring that life insurance becomes an essential tool for financial security and planning for this tech-savvy generation.

Life Insurance: Funeral Costs Covered?

You may want to see also

Frequently asked questions

According to recent studies, only about 15-20% of millennials currently have life insurance. This is a concerning statistic as it indicates a lack of financial preparedness for a significant portion of the millennial generation.

There are several reasons for this trend. Firstly, millennials often have a longer time horizon for financial planning, believing they have more years to build wealth and secure their future. Secondly, the cost of life insurance might seem high compared to their income, especially for those in the early stages of their careers. Lastly, with the rise of digital-only lifestyles, many millennials prefer to manage their finances online, and the process of purchasing life insurance might seem too traditional or complicated.

Yes, several factors can impact a millennial's decision to purchase life insurance. These include their level of debt, such as student loans or mortgages, which can make them feel more vulnerable to financial loss. Additionally, the desire to provide financial security for their loved ones in the event of their untimely death is a significant motivator. Many millennials also appreciate the flexibility and customization options offered by modern life insurance policies, allowing them to choose coverage that aligns with their specific needs and budget.

Increasing the adoption of life insurance among millennials requires a multi-faceted approach. Firstly, financial advisors and insurance companies can play a crucial role by educating millennials about the long-term benefits of life insurance and how it can complement their existing financial plans. Simplifying the application process and offering digital-first solutions can also attract this tech-savvy generation. Moreover, employers can provide group life insurance plans as part of their benefits package, making it more accessible and affordable for millennials.