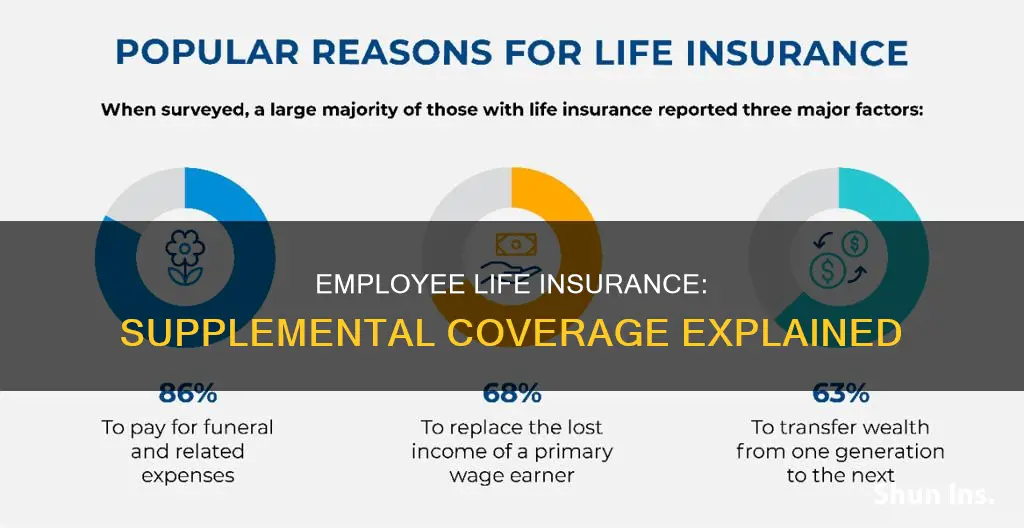

Supplemental life insurance is an optional coverage that provides an extra layer of protection on top of the group policy your employer provides. It is designed to boost the coverage of your employer's basic group life policy, allowing you to secure a higher death benefit than the base policy alone. Many employers offer supplemental options of three to five times your salary, with some policies extending up to 10 times. This added layer can provide the extra financial security needed for long-term goals, like paying off a mortgage, paying off other substantial debts or funding a child's education.

| Characteristics | Values |

|---|---|

| Cost | Supplemental life insurance is usually offered by employers at no cost, but employees can also purchase it |

| Coverage | Supplemental life insurance provides an extra layer of protection on top of the group policy provided by an employer |

| Accessibility | Supplemental life insurance is accessible and practical as it does not require a medical exam |

| Payout | Supplemental life insurance is associated with a lower payout than traditional life insurance policies |

| Purpose | Supplemental life insurance is designed to provide additional financial security for long-term goals, such as paying off a mortgage or funding a child's education |

What You'll Learn

- Supplemental life insurance is optional and can be offered by your employer at no cost, or as an option to purchase

- It provides an extra layer of protection on top of the group policy your employer provides

- It can help bridge the gap if you have more substantial financial needs, like covering a mortgage or ensuring your family’s long-term security

- Supplemental life insurance policies may include things like burial, final expense, accidental death and dismemberment, as well as traditional life insurance

- Supplemental coverage may also include optional life insurance for an employee’s spouse and dependent children

Supplemental life insurance is optional and can be offered by your employer at no cost, or as an option to purchase

Supplemental life insurance is optional coverage that can be offered by your employer at no cost, or as an option to purchase. It is designed to provide an extra layer of protection on top of the group policy your employer provides. This can be useful if you want to ensure your family's long-term security or cover more substantial financial needs, like a mortgage.

Supplemental life insurance is often associated with a much lower payout than traditional life insurance policies, and may include things like burial, final expense, accidental death and dismemberment, as well as traditional life insurance. It can be a good way to take advantage of additional protection for your family.

Many employers offer supplemental options of three to five times your salary, with some policies extending up to 10 times. This added layer can provide the extra financial security needed for long-term goals, like paying off a mortgage or funding a child's education.

Supplemental coverage may also include optional life insurance for an employee's spouse and dependent children. These amounts are often very minimal. Supplemental policies generally don't require a medical exam, making them accessible and practical, particularly for those who want more coverage without going through an extensive underwriting process.

Changing Life Insurance Beneficiary: A Letter's Power

You may want to see also

It provides an extra layer of protection on top of the group policy your employer provides

Supplemental life insurance is a type of voluntary insurance benefit that employees can pay for to boost the coverage of their employer's basic group life policy. It is designed to provide an extra layer of protection on top of the group policy your employer provides. This means that if you have more substantial financial needs, such as covering a mortgage or ensuring your family's long-term security, you can bridge the gap with supplemental life insurance.

Supplemental life insurance is often associated with a much lower payout than traditional life insurance policies, and may include things like burial, final expense, accidental death and dismemberment, as well as traditional life insurance. It is a convenient, employer-provided option to enhance coverage levels, and many employers offer supplemental options of three to five times your salary, with some policies extending up to 10 times.

Supplemental coverage may also include optional life insurance for an employee's spouse and dependent children. These amounts are often very minimal. Supplemental policies generally don't require a medical exam, making them accessible and practical, particularly for those who want more coverage without going through an extensive underwriting process.

Supplemental life insurance is a good way to take advantage of additional protection for your family. It can be purchased at work, or you can purchase life insurance from a private insurer to supplement your employer's basic plan.

Life Insurance Money: Strategies for Effective Distribution

You may want to see also

It can help bridge the gap if you have more substantial financial needs, like covering a mortgage or ensuring your family’s long-term security

Supplemental life insurance is a type of voluntary life insurance that is offered by employers as part of an employee benefits package. It is an optional coverage that provides an extra layer of protection on top of the group policy your employer provides. This means that it can help bridge the gap if you have more substantial financial needs, like covering a mortgage or ensuring your family's long-term security.

Supplemental life insurance is designed to boost the coverage your employer's basic group life policy provides, allowing you to secure a higher death benefit than the base policy alone. Many employers offer supplemental options of three to five times your salary, with some policies extending up to 10 times. This added layer can provide the extra financial security needed for long-term goals, such as paying off a mortgage or other substantial debts, or funding a child's education.

Since basic group life insurance through an employer may only cover one year's salary or a set amount, supplemental life insurance can be a convenient, employer-provided option to enhance coverage levels. Supplemental coverage may also include optional life insurance for an employee's spouse and dependent children. These amounts are often very minimal.

Supplemental life insurance policies may include things like burial, final expense, accidental death and dismemberment, as well as traditional life insurance. They generally don't require a medical exam, making them accessible and practical, particularly for those who want more coverage without going through an extensive underwriting process.

Universal Group Life Insurance: Good Idea or Not?

You may want to see also

Supplemental life insurance policies may include things like burial, final expense, accidental death and dismemberment, as well as traditional life insurance

Supplemental life insurance is an optional coverage that provides an extra layer of protection on top of the group policy your employer provides. It is designed to provide additional coverage and is typically associated with a much lower payout than traditional life insurance policies.

In many instances, the supplemental life insurance that your employer offers you is an AD&D insurance policy, and shouldn't be confused with a traditional life insurance policy. While an AD&D policy provides benefits to your beneficiaries when you die, the caveat is that your death must be caused by an accident. You may find that your workplace supplemental life insurance is a type of burial insurance policy.

Supplemental life insurance is a good way to take advantage of some additional protection for your family. Many employers offer supplemental options of three to five times your salary, with some policies extending up to 10 times. This added layer can provide the extra financial security needed for long-term goals, like paying off a mortgage, paying off other substantial debts or funding a child’s education.

Locating Your SBI Life Insurance Customer ID

You may want to see also

Supplemental coverage may also include optional life insurance for an employee’s spouse and dependent children

Supplemental life insurance is a type of voluntary or optional coverage that provides an extra layer of protection on top of the group policy provided by an employer. It is designed to boost the coverage of an employer's basic group life policy, allowing employees to secure a higher death benefit than the base policy alone. This added layer can provide the extra financial security needed for long-term goals, such as paying off a mortgage, covering other substantial debts, or funding a child's education.

Supplemental coverage may also include optional life insurance for an employee's spouse and dependent children. These amounts are often very minimal, but they can provide additional peace of mind and protection for the employee's family. Since basic group life insurance through an employer may only cover one year's salary or a set amount, supplemental life insurance can help bridge the gap if an employee has more substantial financial needs.

Supplemental life insurance is typically offered as an employer-provided benefit, with some companies offering it at no cost to employees, while others may require employees to pay an additional premium. It is a convenient way for employees to enhance their coverage levels without going through an extensive underwriting process, as medical exams are usually not required.

Pregnancy and Life Insurance: What Expectant Mothers Should Know

You may want to see also

Frequently asked questions

Supplemental life insurance is an optional coverage that provides an extra layer of protection on top of the group policy your employer provides.

You may be able to get supplemental life insurance through work, or you can purchase it from a private insurer to supplement your employer's basic plan.

Basic group life insurance is an affordable or free policy offered through an employer's benefits program. Supplemental life insurance lets you add to that coverage by paying an additional premium.

Supplemental life insurance is designed to boost the coverage your employer's basic group life policy provides, allowing you to secure a higher death benefit than the base policy alone. Many employers offer supplemental options of three to five times your salary, with some policies extending up to 10 times.