Understanding the prevalence of life insurance among married couples is essential for financial planning and security. This paragraph introduces the topic by highlighting the importance of life insurance as a safeguard for families. It mentions that while it is a crucial aspect of financial planning, it is often overlooked, and many married couples may not have life insurance coverage. The paragraph aims to explore the percentage of married couples who have life insurance, shedding light on the potential financial risks and benefits for families.

What You'll Learn

- Demographic Differences: Age, income, and education vary in married couples' life insurance coverage

- Marital Status Impact: Widowed couples often have higher life insurance coverage compared to married peers

- Financial Dependence: Life insurance is crucial for couples where one partner is financially dependent on the other

- Health and Age: Older couples tend to have lower life insurance coverage due to health risks

- Policy Ownership: Spouses are often the primary policyholders, but joint ownership is becoming more common

Demographic Differences: Age, income, and education vary in married couples' life insurance coverage

Age, income, and education play significant roles in determining the life insurance coverage among married couples, revealing interesting demographic differences. Younger couples, often in their 20s and 30s, might not prioritize life insurance as a top financial priority. This could be attributed to their perceived invincibility and the belief that they have more time to build their financial security. However, as they progress through life, especially with the arrival of children or significant life events, the need for life insurance becomes more apparent. Many young couples start considering life insurance as a means to protect their growing families and secure their financial future.

In contrast, older married couples, typically in their 50s and 60s, may have a different perspective on life insurance. They might have already established their careers, raised their children, and accumulated assets. At this stage, life insurance can serve as a crucial tool for estate planning, ensuring that their loved ones are financially protected in the event of their passing. Additionally, older couples may have a more comprehensive understanding of the financial responsibilities they have towards their families, making life insurance a more integral part of their financial strategy.

Income levels also significantly influence life insurance coverage. Higher-income earners often have more financial resources and may view life insurance as a necessary component of their comprehensive financial plan. They might opt for higher coverage amounts to ensure that their families can maintain their standard of living and achieve their financial goals in the event of their untimely demise. Conversely, lower-income couples might face challenges in affording life insurance, especially if they have limited financial resources. However, they can explore more affordable options, such as term life insurance, which provides coverage for a specific period, or they may consider group life insurance through their employers.

Education level is another critical factor in this context. Couples with higher education levels tend to have a better understanding of the importance of life insurance and its potential benefits. They are more likely to recognize the value of financial planning and may have the knowledge to make informed decisions regarding life insurance coverage. On the other hand, those with lower educational attainment might face barriers to understanding the complexities of life insurance and may require more straightforward explanations and accessible resources to make informed choices.

In summary, demographic factors like age, income, and education significantly impact the life insurance coverage decisions made by married couples. Younger couples may start with basic coverage as they build their financial foundation, while older couples focus on comprehensive plans for estate planning. Income levels dictate the affordability and extent of coverage, and education influences the understanding and appreciation of life insurance's importance. Understanding these demographic differences is essential for financial advisors and insurance providers to tailor their services effectively and ensure that married couples have the necessary support to make informed choices regarding their life insurance coverage.

Indemnity Provisions: Double Benefits, Double Protection?

You may want to see also

Marital Status Impact: Widowed couples often have higher life insurance coverage compared to married peers

Widowed individuals often find themselves in a unique position when it comes to life insurance coverage, and this is especially true for those who have recently lost a spouse. The impact of marital status on life insurance decisions is significant, as the death of a partner can lead to a range of financial challenges and emotional stress. In the aftermath of a spouse's passing, many widowed couples recognize the importance of having adequate life insurance to provide financial security for themselves and their loved ones.

Research suggests that widowed couples are more likely to have higher life insurance coverage compared to their married counterparts. This is primarily due to the realization that life insurance can serve as a crucial financial safety net during a time of grief and uncertainty. When a spouse dies, the surviving partner often takes on additional responsibilities, such as managing finances, raising children, and maintaining a household. Life insurance proceeds can help alleviate some of these burdens by providing financial support to cover expenses, pay off debts, and ensure the well-being of dependent family members.

The decision to increase life insurance coverage is often driven by a sense of responsibility and a desire to protect one's family. Widowed individuals may feel a stronger motivation to secure their loved ones' future, as they have experienced the financial strain that can arise from the loss of a primary income earner. As a result, they are more inclined to review and potentially increase their life insurance policies to ensure that their beneficiaries receive the necessary financial support.

Additionally, the emotional impact of losing a spouse can prompt widowed individuals to re-evaluate their financial priorities. They may become more aware of the long-term financial implications of their decisions and seek to create a stable environment for their remaining family members. This heightened awareness can lead to more comprehensive life insurance planning, including higher coverage amounts and the inclusion of various policy riders to tailor the insurance to their specific needs.

In summary, the marital status of being widowed has a notable impact on life insurance coverage. Widowed couples often recognize the importance of life insurance as a means of financial security and support for their families. This realization, coupled with the emotional and practical challenges of losing a spouse, encourages them to seek higher life insurance coverage compared to married individuals. Understanding these dynamics can help individuals make informed decisions about their life insurance policies and ensure that their loved ones are protected during difficult times.

Life Insurance Cash Surrender: Taxable by CRA?

You may want to see also

Financial Dependence: Life insurance is crucial for couples where one partner is financially dependent on the other

Life insurance plays a vital role in ensuring financial security for couples, especially when one partner is financially dependent on the other. In many households, one individual might be the primary breadwinner, providing the majority of the income and covering essential expenses. If this primary earner were to pass away unexpectedly, the surviving partner could face significant financial challenges. This is where life insurance becomes an essential tool to safeguard the family's financial well-being.

Financial dependence in a marriage can take various forms. One partner might be the primary caregiver, managing the household and raising children, while the other focuses on career advancement and earning potential. In such cases, the stay-at-home parent's contribution, though often invaluable, might not be reflected in formal employment records. Life insurance can help compensate for the loss of this non-monetary contribution, ensuring that the dependent partner has the financial resources to maintain their standard of living and cover essential expenses.

The amount of life insurance required in this scenario depends on several factors. Firstly, it's essential to calculate the total annual income of the dependent partner and consider any additional expenses, such as mortgage payments, utility bills, and child-rearing costs. Secondly, the insurance policy should cover a substantial portion of these expenses to provide a safety net for the surviving partner. For instance, if the primary earner's income is $100,000 annually and the dependent partner's income is $0, a life insurance policy of at least $100,000 might be necessary to cover the family's immediate needs.

Moreover, life insurance can also help with long-term financial goals. For the dependent partner, this might include funding their children's education, saving for retirement, or even starting a business. The proceeds from the life insurance policy can be used strategically to achieve these milestones, ensuring that the family's financial future remains secure.

In summary, for couples where one partner is financially dependent on the other, life insurance is a critical component of financial planning. It provides a safety net during challenging times and enables the family to maintain their standard of living and work towards long-term financial goals. Consulting with a financial advisor can help determine the appropriate coverage amount and ensure that the life insurance policy aligns with the specific needs of the couple.

Life Insurance: Substandard Rating and What It Means

You may want to see also

Health and Age: Older couples tend to have lower life insurance coverage due to health risks

The relationship between health, age, and life insurance coverage is a critical aspect of financial planning, especially for married couples. As individuals age, their health status often becomes a significant factor in determining their eligibility for life insurance and the overall cost of the policy. Older couples, in particular, may face challenges when it comes to securing comprehensive life insurance coverage.

Aging brings various health concerns and increased medical expenses, which can directly impact life insurance rates. Insurers often consider the health history and current condition of potential policyholders. For older individuals, pre-existing conditions, chronic illnesses, or a history of serious health issues may lead to higher insurance premiums or even denial of coverage. This is because these factors contribute to a higher risk assessment for the insurer. For instance, conditions like heart disease, cancer, or diabetes can significantly affect life expectancy and the likelihood of making insurance claims.

Additionally, older couples might find it more challenging to qualify for certain types of life insurance, such as term life insurance, which typically offers coverage for a specified period. As age increases, the likelihood of developing health complications rises, making it harder to meet the underwriting criteria for these policies. As a result, older couples may need to explore alternative options, such as whole life insurance or universal life insurance, which often provide lifelong coverage and accumulate cash value over time.

Despite these challenges, older couples can still take steps to ensure they have adequate life insurance coverage. Regular health check-ups and maintaining a healthy lifestyle can help manage health risks and potentially lower insurance costs. Additionally, reviewing and comparing different insurance providers' policies can allow couples to find options that cater to their specific needs and age-related considerations. It is essential to understand that while age and health play a role, there are still opportunities for older couples to secure the financial protection they need for their families.

Suffolk County Correction Officers: Life Insurance Coverage Explained

You may want to see also

Policy Ownership: Spouses are often the primary policyholders, but joint ownership is becoming more common

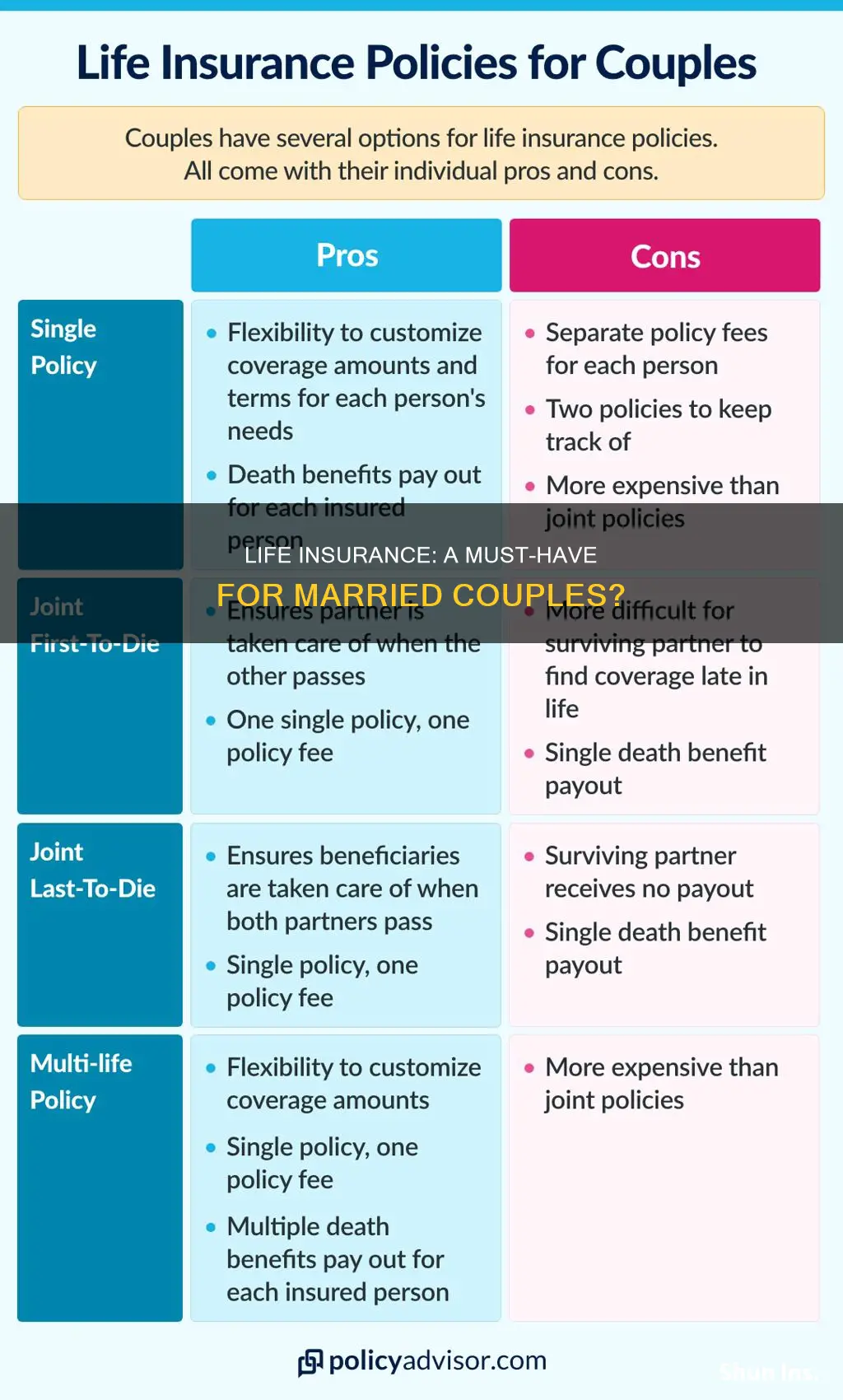

In the realm of life insurance, policy ownership is a crucial aspect that often involves married couples. Traditionally, it has been common for one spouse to be the primary policyholder, while the other is listed as a beneficiary. This approach ensures that the primary earner in the household is covered in the event of an untimely demise. However, there is a growing trend towards joint ownership of life insurance policies, reflecting a more collaborative and shared approach to financial planning.

Spouses are often the primary policyholders due to their role as the primary breadwinner or the one with a higher income. This is especially true in dual-income households, where both partners contribute significantly to the family's financial stability. By being the primary policyholder, the spouse can ensure that the family's financial obligations are met and that their loved ones are provided for in the event of their passing. For instance, a working spouse might purchase a life insurance policy to cover mortgage payments, children's education, and other long-term financial commitments.

Despite the traditional role of one spouse as the primary policyholder, joint ownership of life insurance is gaining popularity. This shift is driven by a desire for more equitable financial planning, where both partners actively participate in securing the family's future. Joint ownership allows both spouses to have a say in the policy's terms and conditions, ensuring that the coverage meets their specific needs. It also provides a sense of security and peace of mind, knowing that both partners are equally invested in the family's financial well-being.

The benefits of joint ownership are twofold. Firstly, it ensures that both spouses are protected by the same policy, providing a unified financial safety net. This is particularly important in cases where one spouse may have a lower income or no income, as the other can still rely on the policy's benefits. Secondly, joint ownership can simplify the process of updating the policy, as both partners can make changes or additions as needed, without the need for the other's explicit consent.

In conclusion, while spouses are often the primary policyholders in life insurance, the trend towards joint ownership is a positive development. It reflects a more collaborative and shared approach to financial planning, ensuring that both partners are actively involved in securing the family's future. This shift not only provides financial security but also fosters a sense of equality and mutual support within the marriage. As financial planning becomes increasingly complex, joint ownership of life insurance policies can be a valuable tool for married couples to navigate these challenges together.

Becoming a Licensed Health Life Insurance Agent: A Step-by-Step Guide

You may want to see also

Frequently asked questions

The percentage of married couples with life insurance varies widely, but according to a 2022 survey by the Insurance Information Institute, only about 25% of married couples in the United States have a combined life insurance policy. This number is lower compared to single individuals, who have a 35% likelihood of having life insurance.

Yes, several factors can impact the decision to purchase life insurance for married couples. Age is a significant factor, as younger couples might feel they have more time to plan, while older couples may be more concerned about providing financial security for their families. Additionally, the presence of children and the level of debt or financial obligations can also influence the likelihood of having life insurance.

Economic status plays a crucial role. Married couples with higher incomes and assets might feel they have sufficient financial resources to cover potential losses without insurance. However, those with lower incomes may view life insurance as a safety net, ensuring their families' financial stability in the event of their untimely demise.

One common misconception is that life insurance is only necessary for the primary breadwinner in a marriage. In reality, both partners can benefit from having individual policies, especially if one earns a substantial income and the other wants to ensure their family's financial well-being. Another myth is that life insurance is too expensive, but with various policy options available, it can be tailored to fit different budgets.