Life insurance companies consider a person's weight when determining their eligibility and premiums. While being overweight alone may not result in a denial of coverage, it can increase an individual's risk category, leading to higher premiums. This is because insurers associate excess weight with an increased risk of weight-related health issues, such as high blood pressure, diabetes, and heart disease. To assess an individual's weight, insurers use criteria such as height-to-weight ratio, Body Mass Index (BMI), and build charts. While BMI is a common tool, it is not a perfect measure, and insurers often use their own build charts, which take into account factors such as muscle mass. Other factors that can influence life insurance rates include age, gender, occupation, lifestyle, and medical history. For those who are overweight, understanding these factors and how they impact life insurance is crucial for securing the best coverage options.

What You'll Learn

Body Mass Index (BMI)

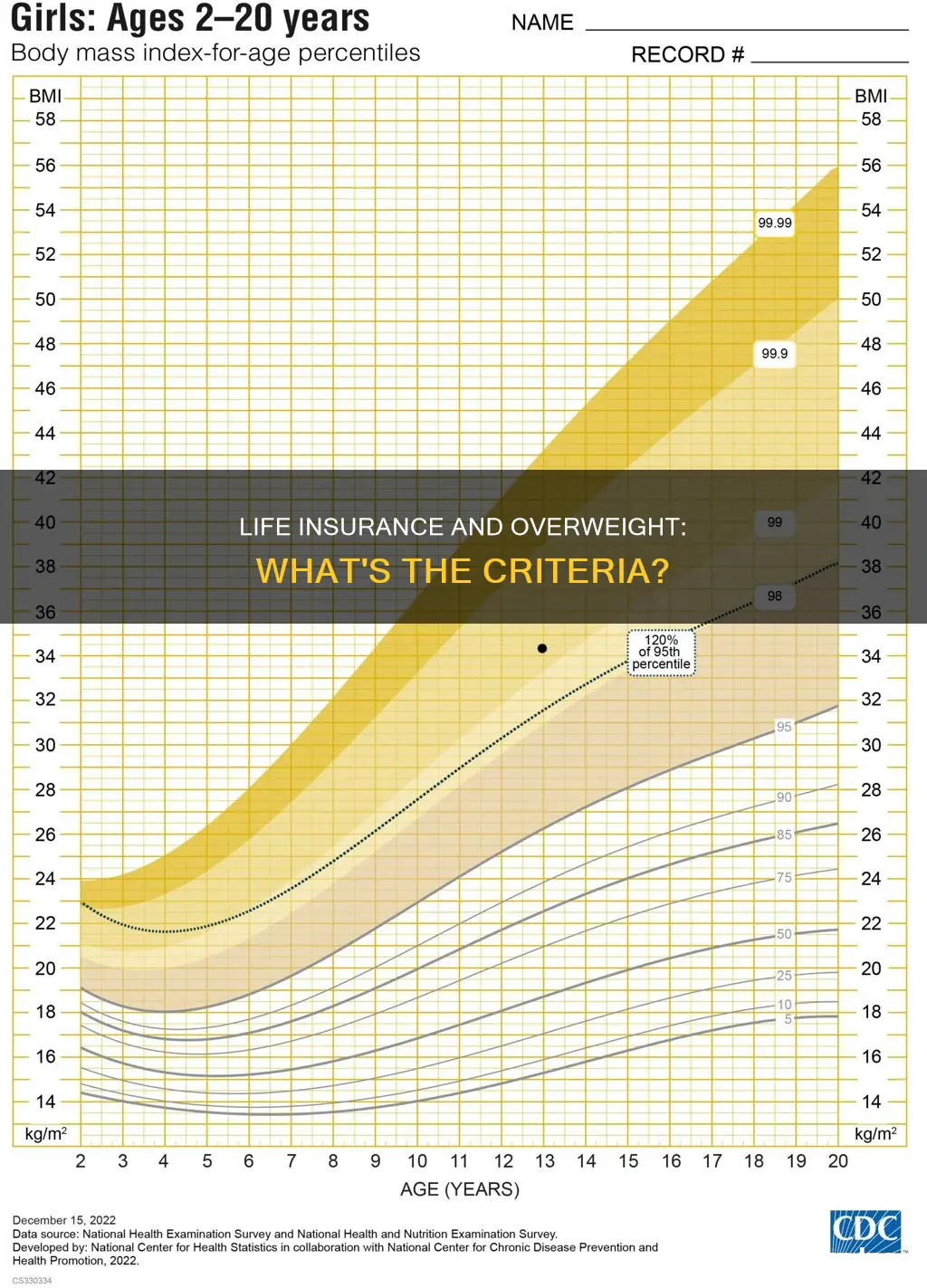

Body Mass Index, or BMI, is a calculation that shows whether an individual has a healthy weight in relation to their height. It is determined by dividing a person's weight in kilograms by the square of their height in metres. BMI is a useful tool for insurance companies to quickly assess an applicant's health and life expectancy.

BMI is categorised into underweight (below 18.5), healthy weight (18.5-24.9), overweight (25-29.9), and obese (30 and above). While BMI is not a perfect measure of healthy body weight, it can indicate whether further testing is required, as being overweight or underweight can have serious health consequences. For example, being overweight is linked to several health conditions, including hypertension, coronary heart disease, and cardiovascular disease.

BMI is an important factor in determining life insurance premiums. A high BMI may result in rate increases or even denial of coverage, as it indicates a higher risk of health complications. However, it is not the only factor considered, and insurers will also take into account other health conditions, age, family health history, and lifestyle choices.

It is worth noting that BMI has its limitations. It does not differentiate between muscle and fat mass, which can lead to inaccurate calculations for individuals with higher muscle content, such as athletes. Additionally, it does not consider factors like ethnicity and race, which can influence height and weight. Despite these limitations, BMI plays a significant role in assessing health and life insurance applications.

Chewing Tobacco: Life Insurance and Your Health

You may want to see also

Height-to-weight ratio

Life insurance companies use height-to-weight ratios, along with other factors, to determine whether an applicant qualifies for coverage and what price they will pay. This is often referred to as a "build chart".

It's important to note that height-to-weight ratios are not always accurate for everyone. For instance, athletes or active individuals with more muscle mass may have a lower height-to-weight ratio despite being in excellent shape and having less body fat. Therefore, insurers consider other factors as well, such as medical history, family history, and lifestyle choices.

Life Insurance Contracts: Effective Activation Explained

You may want to see also

Weight-related health conditions

Being overweight or obese can lead to several health complications, which can, in turn, affect your life insurance eligibility and premiums. Here are some of the weight-related health conditions that insurers consider:

Body Mass Index (BMI)

BMI is a numerical value calculated based on an individual's height and weight. It is used by insurers to estimate body fat and determine the risk of certain diseases or medical complications. A BMI of 25-29.9 is considered overweight, while a BMI of 30 and above is classified as obese. While a high BMI can result in higher insurance premiums, it is not the sole factor in determining insurance rates, as athletes or active individuals with higher muscle mass may have an overweight BMI despite having a healthy body fat percentage.

Height-to-weight ratio

In addition to BMI, insurers may also consider an individual's height-to-weight ratio. This compares an individual's height against their weight, allowing insurers to assess risk. However, this method may not be accurate for individuals with higher muscle mass, as they may have a lower height-to-weight ratio despite being in excellent shape.

Health conditions

Various health conditions are linked to being overweight or obese, and these conditions can significantly impact life insurance rates. These include:

- Type 2 diabetes: Nearly 9 in 10 people with type 2 diabetes are overweight or obese.

- High blood pressure (hypertension): Being overweight can increase blood pressure as the heart needs to work harder to pump blood to all cells, and excess fat can damage the kidneys, which help regulate blood pressure.

- Heart disease: Being overweight increases the risk of high blood pressure, high blood cholesterol, and high blood glucose, all of which are risk factors for heart disease.

- Stroke: Being overweight increases the risk of high blood pressure, the leading cause of strokes.

- Metabolic syndrome: This is a group of conditions, including high triglyceride levels, high blood glucose, and low HDL ("good") cholesterol levels, that increase the risk of heart disease, diabetes, and stroke.

- Fatty liver diseases: These develop when fat builds up in the liver and can lead to severe liver damage or even liver failure.

- Certain types of cancer: Being overweight is linked to an increased risk of developing cancers such as colon, rectum, and prostate cancer in men, and breast, uterine, and gallbladder cancers in women.

- Osteoarthritis: Excess weight puts more pressure on weight-bearing joints, increasing the risk of developing osteoarthritis.

- Sleep apnea: Obesity is a common cause of sleep apnea, as the excess fat around the neck can block the upper airway during sleep, interrupting breathing and causing snoring.

- Asthma: Obesity can increase the risk of developing asthma and make it more challenging to manage the condition.

- Gout: A type of arthritis caused by the buildup of uric acid crystals in the joints. Obesity is a risk factor for gout.

- Gallbladder and pancreas issues: Being overweight increases the risk of gallbladder diseases such as gallstones and can lead to inflammation of the pancreas (pancreatitis).

- Kidney disease: Obesity increases the risk of developing diabetes and high blood pressure, which are the most common causes of chronic kidney disease.

- Infertility: Obesity is linked to lower sperm count and quality in men and menstrual cycle and ovulation problems in women, affecting fertility.

- Sexual function problems: Being overweight increases the risk of erectile dysfunction in men and may contribute to sexual dysfunction in women.

- Mental health issues: Obesity can affect mental health and increase the risk of depression and anxiety.

Liquidity in Life Insurance: Understanding Cash Value and Options

You may want to see also

Weight-independent health factors

While weight is a factor in determining life insurance rates, it is not the only consideration. Insurers also take into account several weight-independent health factors when assessing an applicant's risk level and eligibility. Here are some key weight-independent health factors that can impact life insurance rates and coverage options:

Family Medical History: A family history of certain medical conditions, such as heart disease or diabetes, can influence life insurance rates. Insurers often view these conditions as potential risk factors, even if the applicant does not currently exhibit any symptoms. This is because individuals with a family history of specific diseases may be more likely to develop them in the future. As a result, insurers may charge higher premiums or impose additional requirements to mitigate their potential risks.

Lifestyle Habits: Lifestyle choices, such as smoking, alcohol consumption, and stress levels, play a significant role in health outcomes. Insurers may inquire about these habits to evaluate an applicant's overall lifestyle and risk level. For instance, if an applicant has a higher BMI and also smokes, the combination of these factors may lead to higher premiums than if only one of these factors was present. Insurers consider the cumulative impact of these lifestyle choices on an individual's health and longevity when determining rates.

Health History and Current Health Status: In addition to family medical history, an applicant's personal health history and current health status are crucial factors. Insurers will review medical records, including lab results, cholesterol levels, blood sugar levels, and other markers of overall health. Any existing health conditions, especially those linked to higher weight, such as sleep apnea, heart disease, or joint issues, can further impact insurance rates and eligibility. Underwriters will assess these factors alongside weight to determine the applicant's overall risk profile.

Age and Gender: Age and gender are fundamental factors in life insurance assessments. Older individuals generally face higher premiums since the risk of health issues and mortality increases with age. Additionally, men often pay significantly more for life insurance than women due to differences in life expectancy and health risks. These factors are independent of weight and are used by insurers to calculate risk and determine rates accordingly.

Driving Record: A history of driving under the influence (DUI) or other driving-related infractions can also impact life insurance rates. Insurers view these incidents as indicators of risky behaviour and may charge higher premiums as a result. This consideration is independent of an applicant's weight and health status, focusing instead on personal responsibility and risk assessment.

These weight-independent health factors play a crucial role in the life insurance underwriting process, helping insurers evaluate the overall risk profile of each applicant. By considering these factors alongside weight and build charts, insurers can make informed decisions about eligibility, risk classification, and premium rates for life insurance policies.

Designating Trust as Life Insurance Beneficiary: A Simple Guide

You may want to see also

Weight loss

If you are overweight, losing weight can help you get a better rate on your life insurance premium. However, delaying your life insurance application until you reach your goal weight is not recommended, as it could put your family at risk. Instead, it is better to secure a policy now and then reapply later if you achieve your weight-loss goals.

Maintain a calorie deficit

Eat a balanced diet

Focus on eating whole, unprocessed foods such as fruits, vegetables, lean proteins, and healthy fats. Reduce your intake of sugary foods, refined carbohydrates, and unhealthy fats.

Exercise regularly

In addition to creating a calorie deficit, regular exercise has numerous health benefits. Aim for at least 150 minutes of moderate-intensity aerobic activity or 75 minutes of vigorous activity per week. You can also incorporate strength training to build muscle and improve your overall fitness level.

Get enough sleep

Sleep is often overlooked when it comes to weight loss, but it plays a crucial role. Lack of sleep can disrupt the hormones that regulate hunger and fullness, leading to increased appetite and cravings for high-calorie foods. Aim for 7-9 hours of quality sleep per night.

Manage stress

Chronic stress can lead to unhealthy coping mechanisms, such as emotional eating. It can also increase the production of cortisol, a hormone that contributes to fat storage, especially around the abdomen. Find healthy ways to manage your stress, such as meditation, yoga, or spending time in nature.

Be consistent

Gerber Life Insurance: Doubling Benefits for Parents

You may want to see also

Frequently asked questions

Life insurance companies use your Body Mass Index (BMI) to determine whether you are overweight. A BMI of 25-29.9 is considered overweight, while a BMI of 30 and above is considered obese.

Being overweight can result in higher life insurance rates as it is linked to several health conditions such as heart disease, diabetes, and high blood pressure. Life insurance companies consider overweight individuals to be at greater risk of dying from these weight-related health issues.

Other factors that can impact your life insurance rates include age, gender, occupation, lifestyle, and family medical history.

It is rare for an insurance company to reject your application solely for being overweight. However, being overweight can result in weight-related illnesses, which can lower your chances of getting the best insurance premium. If you are morbidly obese, you may be denied standard life insurance coverage but may qualify for no-medical coverage.