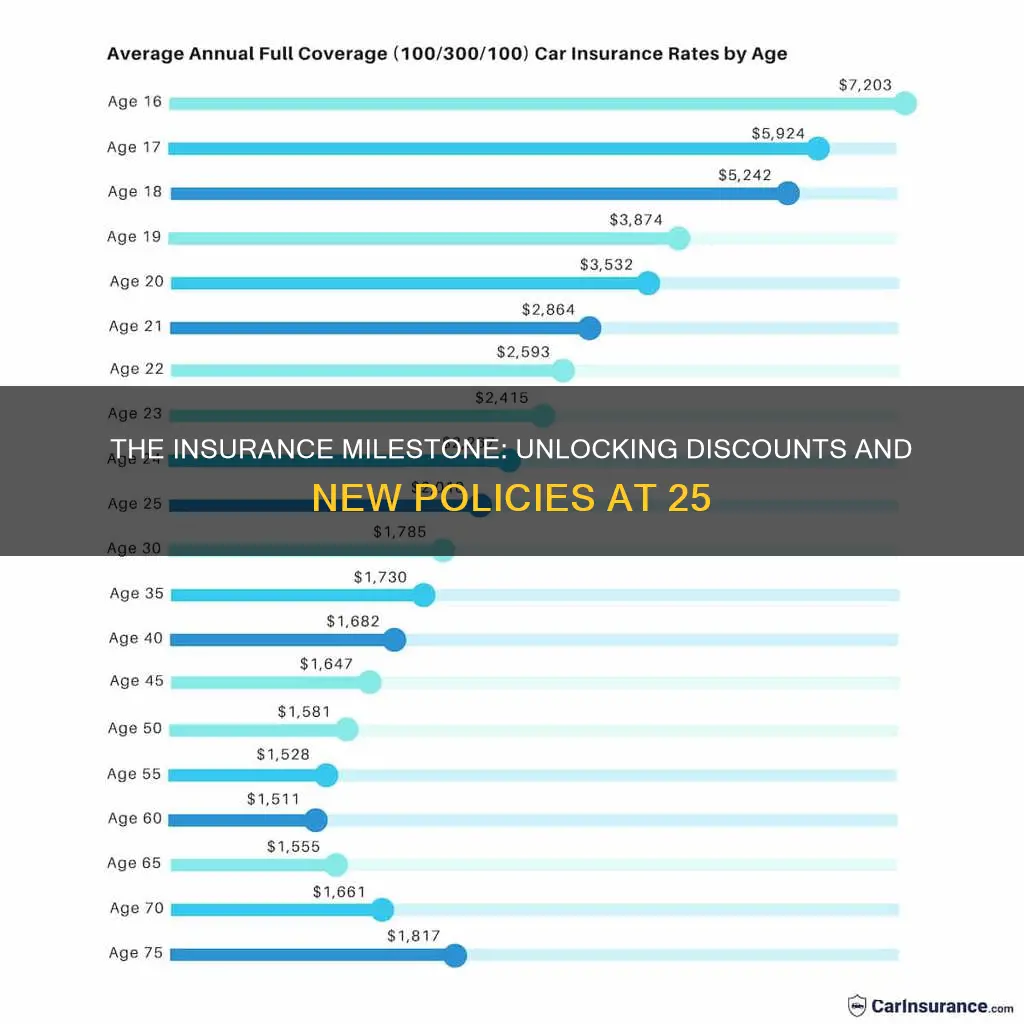

The cost of car insurance is largely dependent on the driver's age, with younger and less experienced drivers posing a greater risk of accidents and, therefore, facing higher insurance premiums. Generally, once a driver turns 25, their insurance rates decrease significantly as insurers consider them more mature and experienced, thus reducing their risk of accidents. However, it is not a given that insurance rates will drop exactly when a driver turns 25, as other factors such as claims history, driving record, and location can also influence the cost of insurance.

| Characteristics | Values |

|---|---|

| Average annual premium for full coverage | $2,854 |

| Average annual premium for minimum coverage | $782 |

| Average annual premium for males | $3,207 |

| Average annual premium for females | $3,000 |

| Average annual premium for 24-year-olds | $3,252 |

| Average annual premium for 18-year-olds | $7,179 |

| Average annual premium for 21-year-olds | $4,453 |

| Average annual premium for 19-year-olds | $3,708 |

| Average annual premium for 16-year-olds | $6,912 |

What You'll Learn

Insurance rates for males and females

In most states, gender is a factor in determining insurance rates. Males tend to pay more for insurance than females, especially during their teenage years and early adulthood. This is because insurers consider young males to be riskier drivers than females in the same age group. Men are more likely to drive at high speeds, be involved in drunk driving, and get into accidents.

However, as drivers get older, the gender gap in insurance rates narrows and eventually disappears. From age 25 onwards, males and females with similar driving records can expect to pay almost the same rates. In fact, women in their mid-to-late thirties may even see a slight increase in their insurance rates compared to men. The reason for this is not entirely clear, as there does not seem to be a constant risk factor in women's driving histories to explain the cost difference.

It is worth noting that some states have prohibited insurers from using gender as a factor in determining insurance rates. These states include California, Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. In these states, insurance rates are based on other factors such as age, driving history, credit score, and vehicle type.

Unlocking the Billing Process: Understanding Insurance Coverage for Residential Sober Living

You may want to see also

Driving history

A driver's history is one of the most important factors that insurance companies consider when determining policy pricing. A driving record provides a detailed snapshot of a person's driving history over the past five years. It includes information such as total demerit points, suspensions and reinstatements, driving convictions, and driver education courses completed.

Insurance companies view a person's driving record as a strong predictor of the types of claims they may make in the future. A clean driving record will get you the best car insurance rates. Conversely, a history of accidents, traffic violations, or driving under the influence will make you a higher risk to insure and result in higher premiums.

The impact of a person's driving record on their insurance rates depends on the severity and frequency of violations or accidents. For example, speeding tickets, distracted driving, and other moving violations remain on a driving record for three years and can increase premium prices during that time. At-fault collisions are reflected on the record for three years but can affect insurance costs for up to five years. More serious violations, such as DUI convictions, can stay on a person's driving record for up to ten years and significantly increase insurance rates.

Insurance companies typically review a person's driving record when they apply for a new policy, get a new quote, or renew their existing policy. They also check the driving record when adding or removing drivers, changing coverages, or adding a vehicle.

While a person's driving history is a significant factor in determining insurance rates, other factors are also considered, such as age, gender, marital status, vehicle type, location, and credit history.

Navigating Insurance Changes When Moving: A Comprehensive Guide

You may want to see also

Credit history

How Credit History Affects Insurance Rates

Your credit history can impact your insurance rates because it indicates how likely you are to file a claim. A good credit score demonstrates financial stability and responsibility, which insurers view as a sign that you are less likely to file a claim. As a result, insurers may offer lower rates to individuals with good credit scores.

Improving Your Credit Score to Get Better Insurance Rates

Improving your credit score can help lower your insurance rates. Here are some strategies to achieve that:

- Open new credit accounts as soon as possible and manage them responsibly.

- Keep existing credit accounts open, especially if they do not incur annual fees.

- Be cautious about opening new accounts that you do not need, as new accounts are typically younger and will lower the average age of your credit accounts.

- Make timely payments on all your debts and maintain a low credit utilization ratio.

- Monitor your credit report regularly to identify any discrepancies or areas for improvement.

- Take advantage of authorized user status on a family member's credit card with a long credit history.

It is important to note that while improving your credit score can positively impact your insurance rates, it is just one of many factors that insurers consider when determining your rates. Other factors, such as age, driving history, location, and vehicle type, also play a significant role in calculating insurance premiums.

Maximizing Reimbursement: Navigating Insurance Billing for Surgery at ASCs

You may want to see also

Location

The location of the insured person is a significant factor in determining insurance rates. Insurance companies use state information to measure risk based on traffic conditions, accident rates, and theft likeliness. The location of the insured within the state also affects insurance rates. Insurance companies use zip codes to provide a basis for rates.

People in urban areas tend to pay more than those in suburban and rural areas due to higher rates of accidents, theft, and vandalism. For example, Louisiana and Florida have some of the highest average full-coverage rates for 25-year-old drivers, while Hawaii and North Carolina have some of the lowest.

In some states, such as California, Hawaii, Massachusetts, and Michigan, auto insurance companies are prohibited from using an individual's credit history to determine rates. However, in most states, credit history is a factor, as those with worse credit are statistically more likely to file claims.

Insurance rates can also vary depending on the specific city or area within a state. For instance, certain cities, like Detroit, are known for having higher insurance rates due to higher rates of accidents, theft, and vandalism.

Additionally, insurance rates can be influenced by the density of the population in a particular area. Rates are often weighted based on the population density in each geographic region, which can result in variations in rates for different zip codes or areas within a state.

Term Insurance and the Question of Maturity Benefits: Unraveling the Mystery

You may want to see also

Vehicle type

The type of vehicle you drive can have a significant impact on the cost of your auto insurance premium. Insurers consider various factors, including the vehicle's value, safety features, size, age, repair costs, theft rates, and more. Here are some key aspects to consider:

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, electronic stability control, and theft-deterrent systems, often have lower insurance premiums. Insurance companies take these features into account when assessing the risk of accidents and the potential cost of repairs.

- Vehicle Age: Generally, older vehicles are cheaper to insure than newer ones. This is because older cars are typically worth less, and it costs less to replace or repair them in the event of a total loss.

- Vehicle Size: Larger vehicles tend to have higher price tags, which often correlates with higher insurance premiums. However, smaller cars are more prone to theft and statistically more likely to be involved in accidents, so a larger vehicle may be cheaper to insure.

- Engine Size: Cars with more horsepower may lead to higher premiums as they are associated with riskier driving behaviors, such as speeding.

- Cost of Repairs: Vehicles with expensive specialized features or those requiring specialized repair technicians and parts can increase insurance rates. German car makes like Volkswagens, BMWs, and Audis tend to be more expensive to repair.

- Safety Ratings: The Insurance Institute for Highway Safety (IIHS) and the National Highway Traffic Safety Administration (NHTSA) publish vehicle safety ratings and crash test data. Vehicles with higher safety ratings may qualify for lower insurance premiums.

- Theft Rates: If you drive a vehicle that is in high demand with chop shops or has a high theft rate, your insurance rates may be higher. The National Insurance Crime Bureau's Hot Wheels report can provide insights into theft rates for specific makes and models.

- Vehicle Use: Insurance companies consider whether your vehicle is used for personal or business purposes and whether it is used for commuting or pleasure. Commuting vehicles tend to be driven more miles and are on the road during rush hours, increasing the risk of accidents. As a result, insurance for commuting vehicles may be slightly more expensive.

- Mileage: The number of miles you drive annually can also impact your insurance rates. Higher mileage indicates greater exposure to risk, potentially leading to higher premiums.

The Policyholder's Shield: Unraveling the Provision that Safeguards Insured Terms

You may want to see also

Frequently asked questions

Yes, insurance rates tend to decrease when a driver turns 25. This is because drivers are considered more mature and less prone to accidents by this age.

The decrease in insurance rates varies depending on the company and other factors. On average, rates drop by about 11% at age 25. Some companies, like Progressive, see a 9% decrease, while others see a more significant drop of around 13-20%.

No, insurance providers typically don't change rates mid-policy term. So, you'll likely have to wait until your next renewal period to see a decrease in your premium.

Several factors can impact your insurance rates, including your marital status, location, vehicle type, driving record, credit history, and annual mileage. Insurance companies use these factors to assess the risk of insuring you and determine your rate accordingly.