Many people are curious about whether their insurance will cover the cost of essential medications. With the rising prices of healthcare, understanding the coverage options for prescription drugs is crucial. Insurance coverage for essential medications can vary widely depending on the insurance provider, the specific policy, and the type of medication. Some insurance plans may fully cover the cost of essential drugs, while others may require co-pays, coinsurance, or even deductibles. It's essential to review your insurance policy or consult with your insurance provider to determine the extent of coverage for your specific medication.

What You'll Learn

- Insurance Coverage Policies: Understand specific medication coverage under insurance plans

- Generic vs. Branded Meds: Explore differences in insurance coverage for generic and branded drugs

- Prescription Drug Benefits: Examine insurance benefits for prescription medications and their limitations

- Copayments and Deductibles: Learn about copayments and deductibles for medication expenses

- Medication Reimbursement Process: Discover the steps for insurance reimbursement of prescription medications

Insurance Coverage Policies: Understand specific medication coverage under insurance plans

When it comes to insurance coverage for medications, it's essential to understand the specific policies and provisions that apply to your insurance plan. Many insurance companies offer coverage for prescription drugs, but the extent of this coverage can vary significantly. Here's a breakdown of how to navigate insurance coverage for medications:

Review Your Insurance Policy: Start by thoroughly reviewing your insurance policy documents. Look for sections related to prescription drug coverage, often referred to as "pharmacy benefits" or "prescription drug plans." These sections will outline the medications that are covered, the coverage limits, and any specific requirements or restrictions. Pay close attention to the list of covered drugs, as this can vary between plans.

Understand Coverage Types: Insurance plans typically offer different types of coverage for medications. These may include preferred drug lists, standard drug lists, and specialty drug coverage. Preferred drugs are usually cheaper and more commonly prescribed, while standard drugs might have lower co-pays but could be less cost-effective. Specialty drugs, often used for complex conditions, may require additional authorization and have specific coverage rules.

Check for Prior Authorization: Some insurance plans require prior authorization for certain medications, especially specialty drugs. This means you or your healthcare provider must obtain approval from the insurance company before the medication can be dispensed. The process involves submitting medical justification and sometimes additional documentation to prove the necessity of the medication. Understanding this requirement is crucial to ensure timely access to the necessary treatment.

Explore Generic Options: Insurance plans often have better coverage for generic medications compared to brand-name drugs. Generic versions of the same medication are typically more affordable and equally effective. Encourage your healthcare provider to prescribe generic alternatives when possible, as this can help reduce out-of-pocket expenses.

Contact Your Insurance Provider: If you have specific questions or concerns about medication coverage, don't hesitate to reach out to your insurance provider. Their customer service team can provide detailed information about your plan's coverage, including any specific rules or requirements. They can also guide you through the process of obtaining necessary authorizations or referrals for specialized medications.

Unraveling Insurance Coverage: Medical Massage and Your Policy

You may want to see also

Generic vs. Branded Meds: Explore differences in insurance coverage for generic and branded drugs

The topic of insurance coverage for medications is an important one, especially when considering the financial implications for patients. When it comes to prescription drugs, there are two main categories to consider: generic and branded (or proprietary) medications. Understanding the differences in insurance coverage between these two types of drugs can help patients make informed decisions about their healthcare.

Generic Medications:

Generic drugs are essentially the same as branded medications in terms of active ingredients, quality, and effectiveness. They are often more affordable because they are produced by multiple manufacturers and do not carry the same research and development costs as branded drugs. Insurance companies often have favorable policies for generic medications due to their cost-effectiveness. When a patient requires a prescription, insurance providers may cover the entire cost of the generic version, especially if it is on their approved list of covered drugs. This can significantly reduce out-of-pocket expenses for individuals.

Branded (Proprietary) Medications:

Branded drugs are typically more expensive due to the research and development investments made by pharmaceutical companies to create and market these products. Insurance coverage for branded medications can vary widely. Some insurance plans may fully cover the cost of branded drugs, especially if they are considered essential or have no generic alternative available. However, many plans also require patients to pay a higher copay or even require prior authorization, which means the insurance company needs to approve the prescription before it is covered. This process can delay access to medication and may not always be guaranteed.

Insurance Coverage Differences:

The key difference in insurance coverage often lies in the price difference between generic and branded drugs. Insurance companies may have negotiated lower prices with generic drug manufacturers, making them more affordable and thus more likely to be covered in full or with lower copays. In contrast, branded drugs might be partially covered or require higher copays, especially if they are considered non-essential or have a generic alternative available. It is essential for patients to review their insurance plan's formulary (list of covered drugs) to understand what medications are included and any associated costs.

Patient Considerations:

When filling a prescription, patients should be aware of these coverage differences. If a branded drug is preferred by the prescribing physician but not covered by insurance, patients might consider requesting a generic alternative. However, it is crucial to note that sometimes, branded drugs are prescribed due to specific formulation or delivery system requirements that cannot be met by generics. In such cases, insurance coverage might still be available, but it may require additional steps or a higher copay.

Understanding Medicaid: Is It the Same as Medical Insurance?

You may want to see also

Prescription Drug Benefits: Examine insurance benefits for prescription medications and their limitations

When it comes to managing healthcare costs, understanding the coverage of prescription medications is crucial. Insurance plans often provide benefits for prescription drugs, but these can vary widely depending on the specific policy and the type of medication. Here's an overview of what you need to know about insurance benefits for prescription medications and their potential limitations.

Understanding Insurance Coverage:

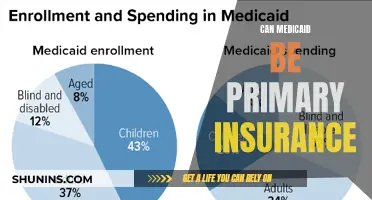

Insurance companies typically offer prescription drug coverage as part of their health insurance plans. These plans can be employer-sponsored, government-provided (like Medicare or Medicaid), or purchased individually. The coverage often includes a list of approved medications, known as a formulary, which may include generic, brand-name, and specialty drugs. When a medication is added to the formulary, it means the insurance company has agreed to cover a portion or all of the cost for that specific drug.

Benefits and Cost-Sharing:

Prescription drug benefits can vary significantly. Some plans may offer full coverage, meaning the insurance company pays for the entire cost of the medication. Others might require the patient to pay a copayment or coinsurance, which is a percentage of the drug's cost. For example, a plan might cover 80% of the cost, while the patient is responsible for the remaining 20%. Additionally, there may be annual or lifetime maximums, which limit the total amount the insurance will pay for a specific medication or type of medication.

Limitations and Exclusions:

Despite the benefits, insurance coverage for prescription drugs is not without limitations. Here are some common restrictions:

- Prior Authorization: Some medications may require prior authorization from the insurance company before they are covered. This process involves the healthcare provider submitting additional information to justify the need for the medication.

- Step Therapy: Insurance plans often implement step therapy, which requires patients to try less expensive medications first before moving on to more costly ones. This approach aims to balance cost-effectiveness and patient care.

- Exclusions and Restrictions: Certain medications, especially those with high costs or potential for abuse, may be excluded from coverage. Additionally, specific conditions or treatment protocols might have restrictions, requiring patients to meet certain criteria or use specific delivery methods.

- Generic vs. Brand-Name Drugs: While generics are typically more affordable, insurance plans may have different coverage policies. Some plans might cover brand-name drugs but not their generic equivalents, or vice versa.

Navigating the System:

Understanding your insurance plan's prescription drug benefits is essential for managing healthcare costs effectively. Patients should review their plan's formulary, understand the cost-sharing requirements, and be aware of any limitations or exclusions. Healthcare providers also play a crucial role in navigating these complexities by selecting appropriate medications and advocating for their patients' needs within the insurance system.

In summary, insurance coverage for prescription medications offers financial relief but comes with various limitations. Being informed about these benefits and restrictions empowers individuals to make informed decisions regarding their healthcare and medication choices.

Unveiling the Medical Mystery: How Far Back Do Life Insurers Look?

You may want to see also

Copayments and Deductibles: Learn about copayments and deductibles for medication expenses

When it comes to managing medication expenses, understanding copayments and deductibles is crucial. These terms are essential components of your health insurance plan and can significantly impact your out-of-pocket costs. Copayments, often referred to as copays, are fixed amounts you pay for specific medical services or prescriptions. For example, your insurance plan might require a $10 copay for a doctor's visit and a $20 copay for a prescription filled at a pharmacy. These copayments are typically lower for in-network providers and medications, as your insurance company has negotiated rates with these providers.

Deductibles, on the other hand, are the amount of money you pay out of pocket before your insurance coverage kicks in. For instance, if your annual deductible is $1,000, you must pay $1,000 in medical expenses before your insurance starts covering the costs. Once you meet your deductible, your insurance will cover a portion of your medication expenses, and you'll only be responsible for copayments. It's important to note that deductibles and copayments can vary depending on your insurance plan and the type of coverage you have.

To navigate these costs effectively, it's essential to review your insurance plan's formulary, which is a list of covered medications. Some plans may have preferred, standard, or non-covered tiers for medications, each with different copayment requirements. Understanding these tiers can help you choose the most cost-effective options. Additionally, consider whether your plan offers any prescription drug coverage or discounts, such as mail-order pharmacy programs or generic drug options, which can further reduce your medication expenses.

For those with high medication costs, it might be beneficial to explore options like generic drugs, which are often significantly cheaper than their brand-name counterparts. Many insurance plans have lower copayments for generic medications, making them a cost-effective choice. Another strategy is to use a pharmacy benefit manager (PBM) that offers lower prices on prescriptions, especially for high-cost medications.

In summary, copayments and deductibles are critical factors in managing medication expenses. By understanding these costs and exploring options like generic drugs and PBMs, you can make informed decisions to minimize your out-of-pocket expenses. Always review your insurance plan's details and consider consulting a healthcare professional or insurance advisor for personalized advice on managing medication costs effectively.

Medical Card Impact: Navigating Insurance Complexities

You may want to see also

Medication Reimbursement Process: Discover the steps for insurance reimbursement of prescription medications

The process of obtaining reimbursement for prescription medications from insurance companies can vary, but understanding the general steps can help streamline the procedure. Here's an overview of the medication reimbursement process:

- Verify Insurance Coverage: Begin by confirming that the specific medication prescribed is covered under your insurance plan. Insurance coverage for medications can vary widely, and it's essential to check the details of your policy. Contact your insurance provider or review your policy documents to ensure you have the correct information. Some medications may require prior authorization, meaning you'll need to obtain approval from the insurance company before the medication can be dispensed.

- Obtain Prescriber's Authorization: Once you have established that the medication is covered, you'll need to obtain a prescription from your healthcare provider. This prescription should include the medication's name, dosage, and any specific instructions. Ensure that your doctor is aware of the insurance coverage requirements to avoid any potential issues during the reimbursement process.

- Fill the Prescription: Visit a licensed pharmacy to fill your prescription. Provide the pharmacist with the necessary details, including your insurance information. The pharmacist will then process the claim with your insurance company on your behalf. They may also provide you with any relevant forms or documentation required for the reimbursement process.

- Reimbursement Submission: The pharmacy will submit a claim to your insurance company for the medication costs. This claim typically includes details such as your personal information, the medication's details, the quantity, and the cost. The insurance company will review the claim and, if approved, process the reimbursement. The reimbursement amount may vary depending on your insurance plan's coverage and any applicable copayments or coinsurance.

- Follow-up and Appeal (if necessary): If your claim is denied or delayed, it's essential to follow up with your insurance provider to understand the reason for the rejection. You may need to provide additional documentation or clarify certain aspects of the prescription. In some cases, you can appeal the decision, but this process often requires specific procedures and timeframes, so it's best to act promptly.

Remember, the reimbursement process can vary between insurance companies and countries, so it's crucial to familiarize yourself with your specific insurance provider's policies and procedures. Always keep records of your prescriptions, receipts, and any correspondence with the insurance company to ensure a smooth and efficient reimbursement process.

Georgia Medicaid Coverage: Ozempic and Diabetes Management

You may want to see also

Frequently asked questions

Yes, many insurance plans do cover ED medications, but the extent of coverage can vary. It's important to check with your insurance provider to understand your specific coverage and any potential out-of-pocket expenses.

Insurance coverage for ED medications often depends on the diagnosis and the insurance company's policies. Generally, a prescription from a healthcare provider is required, and the medication must be deemed medically necessary. Some plans may also require prior authorization or a specific treatment plan.

Without insurance, the cost of ED medications can be a financial burden. Some pharmaceutical companies offer patient assistance programs or discount cards that can help reduce the out-of-pocket cost. Additionally, generic versions of ED drugs may be more affordable and could be an option to consider.

To maximize your coverage, consider the following: review your insurance plan's formulary (list of covered drugs) and understand the tier system for medications. Generic versions of ED drugs are usually more affordable and may be preferred by insurance plans. Also, discuss your options with your healthcare provider, who can guide you on the most suitable treatment and help navigate the insurance process.