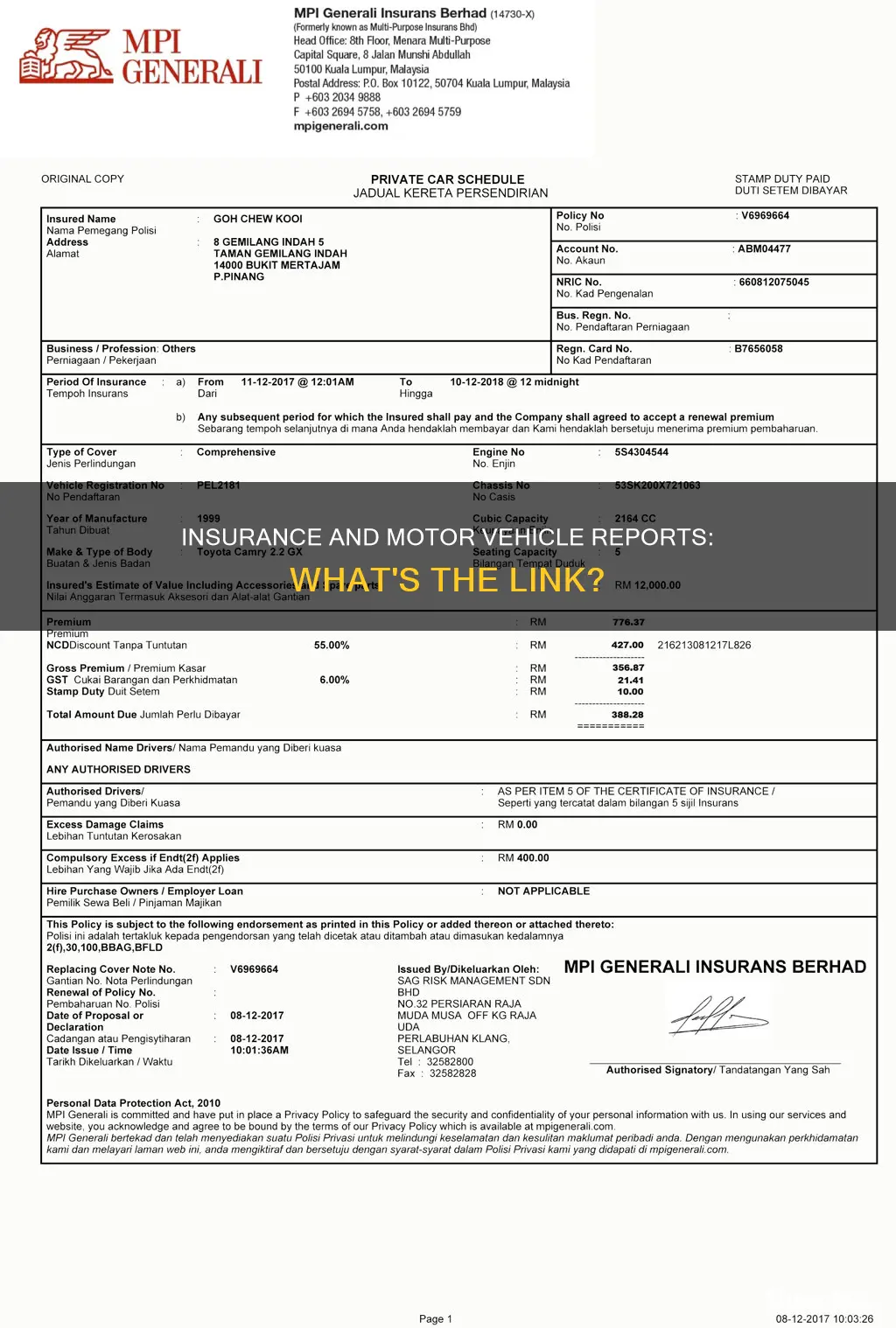

A Motor Vehicle Report (MVR) is a record of your driving history, which insurance companies use to determine your insurance rates and eligibility. The report includes information such as your driving license number, class, full name, date of birth, social security number, contact information, restrictions, suspensions, traffic violations, accidents, and vehicular crimes. It may also include unpaid parking tickets or child support payments, depending on the state. Insurance companies use the MVR to assess how risky you are as a driver and adjust their rates accordingly.

What You'll Learn

Driving history

A motor vehicle report (MVR) is a record of your driving history. It documents your driving record, including any traffic tickets, accidents, and violations. An MVR is used by car insurance companies to determine how to set rates. The higher the number of violations, the higher the insurance rate.

An MVR includes personal information such as your name, date of birth, address, gender, and age. It also includes your driver's license details, such as the driver's license number, the state in which the license was issued, the driver's license class, and any restrictions or endorsements.

License status

The MVR will show whether your driver's license is valid, suspended, revoked, or cancelled. It will also show the expiration date of the license.

Violations and penalties

This section outlines any traffic violations, collisions, or convictions, including speeding tickets, reckless driving, or DUI convictions. It also includes any fines, license points, suspensions, or revocations associated with these violations.

Timeframe

The timeframe of an MVR varies by state, with some states offering 3-year, 7-year, or lifetime driving records. Generally, more serious events like DUI convictions remain on your record for longer periods, while minor violations like speeding tickets may be removed after a few years.

Obtaining an MVR

You can obtain your MVR from your state's Department of Motor Vehicles (DMV) or driver's license agency. Some states also offer online services or mobile apps to request and view your MVR. There is usually a small fee for obtaining a copy of your MVR, and you may need to provide identification and fill out a request form.

Insuring Non-Operational Vehicles: Is It Necessary?

You may want to see also

Insurance rates

Motor Vehicle Reports (MVRs) are a key factor in determining insurance rates. An MVR is a record of a person's driving history, including any traffic violations, accidents, and driver's license details. Insurance companies use MVRs to assess how risky a driver is and set insurance rates accordingly. A history of violations and accidents will typically result in higher insurance rates, as this indicates a riskier driver who is more likely to file insurance claims. Conversely, a clean driving record can unlock discounts and lower insurance premiums.

The impact of an MVR on insurance rates can be seen in several ways. Firstly, it affects the premium, with any activity on an MVR typically raising the price of the insurance policy. Secondly, it can influence discounts offered by insurance companies, with many providing discounts to drivers with no traffic violations over a certain period, usually three to five years. Thirdly, it can determine eligibility for coverage, as insurance companies may deny coverage based on the number, frequency, or severity of violations listed on the MVR.

The information contained in an MVR is comprehensive and covers various aspects of a person's driving history. It includes details such as the driver's license class, restrictions, and endorsements, and personal information like age, height, and weight. Additionally, it documents traffic tickets, accident reports, DUI convictions, driver's license points, and vehicle-related crimes. The MVR also captures information about the driver's license status, including past and current statuses such as suspensions, revocations, and cancellations.

It is worth noting that MVRs may not capture all information indefinitely. While certain major violations like DUIs tend to remain on the record for extended periods, other violations like speeding tickets may be expunged sooner. Insurance companies typically focus on the most recent years of an MVR, and the timeframe considered can vary by state and insurance company. Therefore, it is advisable to review one's MVR before shopping for insurance to identify any inaccuracies and have them corrected.

Leasing a Car: Insurance Requirements

You may want to see also

Personal information

A Motor Vehicle Report (MVR) is an official record of your driving history. It contains personal information, such as:

- Your full name

- Date of birth

- Driver's license number

- Expiration date of your driver's license

- Status of your driver's license

- Driver's license class

- Social security number

- Contact information, such as your mailing address or phone number

- Personal details like your age, height, or weight

Your MVR also includes any motor vehicle events you've been involved in, including traffic citations, license suspensions, DUI convictions, and accident reports.

Insurance Write-Offs: What Happens When Your Car Is Totaled

You may want to see also

Traffic violations

The consequences of traffic violations on your insurance rates depend on the severity and frequency of the violations. For example, a history of speeding violations or accidents will result in higher insurance premiums. More serious violations, such as DUIs, can severely impact your insurance rates and may even result in insurance companies refusing to insure you.

It's important to note that the duration that violations remain on your MVR varies by state. For instance, in California, points for moving violations stay on your record for three years and three months, while in Illinois, they could remain for up to five years. Additionally, insurance companies typically focus on the most recent years of your MVR when determining insurance rates.

Understanding your MVR is crucial, as it not only affects your insurance rates but also your employability for driving-related jobs. By reviewing your MVR, you can identify and correct any inaccuracies and take steps to improve your driving record, such as completing traffic school to reduce points.

Vehicle Insurance: Comprehensive Coverage Explained

You may want to see also

License details

A Motor Vehicle Report (MVR) is a document that details a person's driving history, including various violations, suspensions, and restrictions. It is also known as a driving record. An MVR includes information about your driver's license, such as:

- Past and current driver's license statuses, including suspensions, revocations, and cancellations.

- Driver's license class.

- Special driver's license endorsements.

- Any restrictions on your license.

Your MVR also includes personal information, such as your name, date of birth, age, height, weight, and driver's license number. This information is used by insurance companies to determine their risk in insuring you and to set insurance rates. The better your driving record, the better your chances of getting affordable auto coverage.

In some states, your MVR is divided into two sections: your standard driving record and your lifetime driving record. Your standard driving record shows recent violations, usually within the last five to ten years. Your lifetime driving record shows every mark against you throughout your lifetime, but not all states maintain lifetime driving records.

Insurance Total Loss: What's Next?

You may want to see also

Frequently asked questions

A Motor Vehicle Report (MVR) is an official record of your driving history. It includes information such as your driver's license number, class, full name, date of birth, social security number, contact information, restrictions, suspensions, traffic violations, accidents, and vehicular crimes.

Insurance companies use your MVR to determine their risk in insuring you and to set your insurance rates. If your MVR indicates that you are prone to accidents or speeding violations, the insurance company may charge you higher premiums or may not insure you at all.

You can get a copy of your MVR by contacting your state's Department of Motor Vehicles (DMV) or the registry of motor vehicles. In most states, you can request a copy online, by mail, or in person, and there may be a small fee for this service.