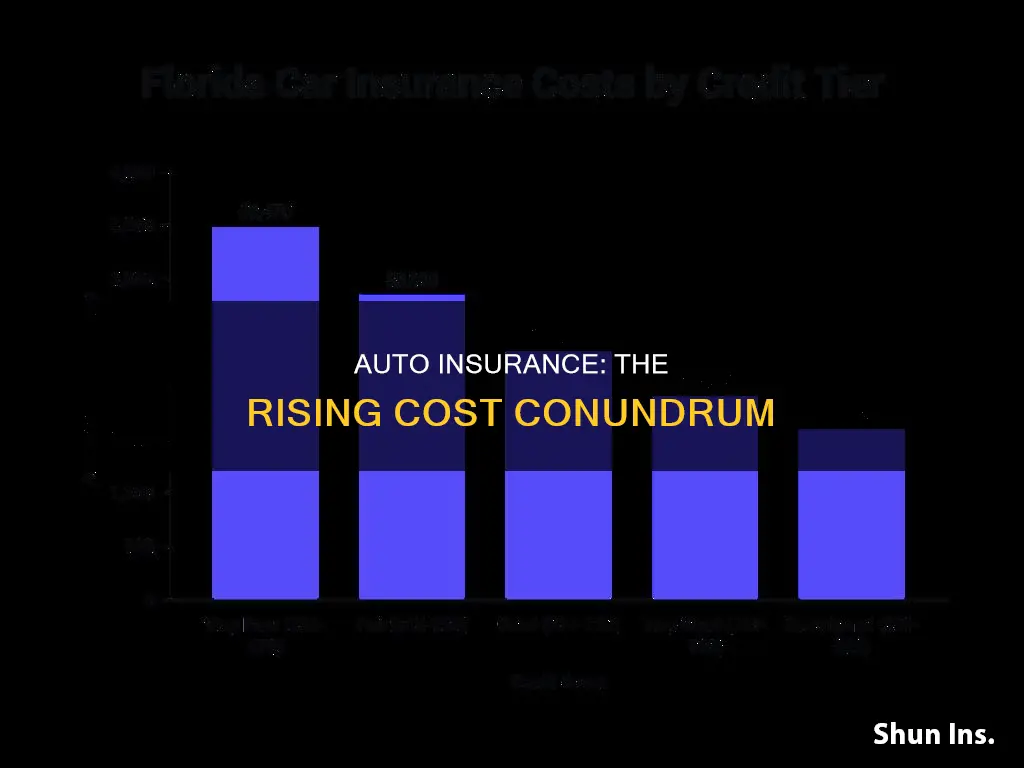

Car insurance rates are increasing across the US, with some states experiencing steeper hikes than others. There are several reasons for this, including inflation, supply chain issues, and changes in driving habits.

Inflation has impacted the cost of vehicle repairs, with more advanced cars requiring more expensive repairs. The cost of healthcare is also rising, which is relevant because car insurance covers the cost of medical care for crash victims.

Supply chain disruptions have made car parts harder to find and contributed to labour shortages, leading to increased repair costs.

Additionally, as people return to pre-pandemic driving patterns, there has been an increase in accidents, leading to more insurance claims.

Other factors that can cause insurance rates to increase include personal factors such as adding a new vehicle or driver to your policy, moving to a different address, or having a history of traffic violations or accidents.

To mitigate these rising costs, consumers can shop around for insurance providers, take advantage of discounts, and bundle their insurance policies.

| Characteristics | Values |

|---|---|

| Reason for increase | Car accidents, traffic violations, changing address, adding a new vehicle or driver, increases to claims in your ZIP code, increases to car repair/replacement cost, inflation, supply chain disruptions, changes in driving habits, broader factors (e.g. state insurance legislation changes, likelihood of claims in certain areas, rising auto repair prices) |

| Rate of increase | 8.4% in 2023, 4.9% in 2022, 17% in the past year |

What You'll Learn

Inflation and supply chain issues

The increasing sophistication of vehicle technology has also contributed to rising insurance costs. Modern cars are equipped with cameras, sensors, and advanced driver-assistance systems, which are more expensive to replace and repair. These technologies also contribute to higher labour costs, as they require specialized knowledge and skills to fix.

In addition to the direct impact on vehicle costs, inflation also affects medical costs associated with car accidents. As healthcare spending increases, the cost of treating injuries from car accidents rises. This, in turn, leads to higher insurance claims and, consequently, higher insurance rates.

Supply chain disruptions have been caused by various factors, including the COVID-19 pandemic, natural disasters, and changes in consumer demand. The pandemic initially reduced the demand for vehicle parts as fewer people were on the road. However, as people started driving again, the demand for vehicles and parts increased, while the supply remained constrained. This imbalance between supply and demand has contributed to the overall increase in auto insurance rates.

While inflation and supply chain issues are significant factors, other reasons for the rise in auto insurance rates include an increase in accidents, reckless driving behaviours, and changes in driving habits. Additionally, insurance companies have experienced losses due to an increase in bad driver behaviours, prompting them to push for higher premiums.

Traffic Cameras: Auto Insurance Claims Evidence

You may want to see also

Higher auto repair and healthcare costs

Auto insurance rates are influenced by a number of factors, including the costs of auto repairs and healthcare. Inflation has had a significant impact on vehicle repair and healthcare costs, which in turn has contributed to rising insurance rates.

The cost of repairing a vehicle after a collision can vary widely, depending on the severity and location of the damage, the type of car, the parts required, and the chosen repair shop. Repairs can range from a simple buff to remove a scuff, to complex work involving multiple panel replacements and frame straightening. The average collision repair cost is between $300 and $2,000 if the frame isn't bent, but this can increase significantly if the frame is damaged. For example, frame damage on a newer vehicle could push the cost of a rear-end collision repair upwards of $10,000.

In addition to collision repairs, routine maintenance costs have also been rising. A study by CarMD found that average auto repair costs rose by almost 3% in 2015 and 2016, with the average repair bill for routine maintenance reaching $398. This increase in maintenance and repair costs is reflected in the rising insurance rates.

Healthcare costs have also been on the rise, with the Centers for Medicare & Medicaid Services reporting a 9.7% increase in healthcare spending in 2020. When someone is injured in a car accident, the resulting medical costs are often higher than in previous years due to this increase in healthcare spending. As car insurance is designed to cover medical costs after an accident, any increase in healthcare costs will lead to higher insurance rates.

The complexity of modern vehicles also contributes to higher repair costs. Newer car models often feature advanced technology and safety sensors that require complex and expensive repair processes. For example, a simple bumper repair can become more complicated and costly if the bumper has sensors.

Supply chain disruptions and labor shortages have further impacted auto repair costs. Parts and labor are more expensive due to supply chain issues, and skilled workers are in shorter supply, leading to higher wages. All of these factors contribute to the overall increase in auto insurance rates.

Electric Vehicle Insurance: Higher Costs?

You may want to see also

Changes in driving habits

Driving habits changed significantly during the COVID-19 pandemic, and these changes have had a knock-on effect on auto insurance rates. When the pandemic began in 2020, there was an unprecedented reduction in driving levels as many people stopped commuting to work, school, and other activities. This led to a decrease in accidents and some insurance companies even refunded premiums to policyholders.

However, in 2021, driving patterns returned to pre-pandemic levels, resulting in a significant increase in auto insurance claims and accident severity. The National Highway Traffic Safety Administration reported an 18.4% increase in fatal crashes during the first six months of 2021 compared to the same period in 2020—the highest percentage increase on record. This shift back to pre-pandemic driving habits may have caused insurance carriers to rebuild their claim reserves, leading to higher premiums for consumers.

In addition to changes in driving habits, other factors that contribute to increasing auto insurance rates include inflation, supply chain disruptions, and broader societal and economic influences.

While auto insurance rates are expected to continue rising, there are ways to mitigate these increases. Safe drivers or those who drive less frequently may be able to take advantage of telematics programs offered by insurers, which use tracking devices or apps to monitor driving behavior and offer discounts for safe habits. Additionally, comparing quotes from different providers, adjusting coverage options, and taking advantage of various discounts can help drivers reduce their auto insurance costs.

Work Comp Insurance: Auto-Renewal?

You may want to see also

Adding a new driver or vehicle

Adding a New Driver

When adding a new driver to your policy, you will typically need to provide the following information:

- Full name and date of birth

- Social Security number

- Marital status

- Address (if different from the policyholder)

- Driving history, including the number of years they have held a license and details of any accidents and traffic violations

- Driver's license number, issuing state, and status

- Whether they need an SR-22 financial responsibility certificate

- Vehicle's make, model, year, and vehicle identification number (VIN) if you are sharing a policy covering both your vehicles

In most cases, insurance companies require you to add any licensed drivers in your household to your policy. This ensures that any accidents or claims involving other people driving your vehicle will be covered by your insurance company. It is also common for roommates or unmarried couples who live together to add each other to their policies or share a single policy.

Adding a new driver with a poor driving record or a teenage driver to your policy will likely result in higher premiums. This is because they are considered high-risk motorists. On the other hand, adding a more experienced driver with a clean driving record may even lower your insurance costs.

Adding a New Vehicle

Adding a new vehicle to your policy will also result in an increase in your premium, especially if the new vehicle is more expensive, less safe, or more costly to repair or replace than your previous one.

Unlicensed and Uninsured: Understanding Auto Insurance Coverage for Unlicensed Drivers

You may want to see also

Moving to a new address

Insurers consider the frequency, severity, and cost of claims based on a ZIP code and assign a risk level based on one's address. This means that if your new address is in an area with a high number of claims, you may see an increase in your insurance rates.

- Traffic and Population Density: People in big cities often pay more for car insurance than those in rural areas or suburbs due to increased traffic, creating a greater likelihood of accidents and claims. More traffic also means a greater chance of encountering uninsured drivers, which can lead to more complex and costly claims.

- Crime Rates: Cities often have higher crime rates, and moving to an area with higher crime rates can impact your insurance rates. Providers are aware of areas with higher rates of vehicle theft and vandalism claims. If your new address is in such an area, you may see an increase in your insurance rates.

- Weather Patterns: Regions that experience severe natural disasters, such as tornadoes, hurricanes, and wildfires, tend to handle more insurance claims. Moving to one of these regions could result in higher insurance rates.

- State Regulations: Different states have varying regulations for auto insurance. Some states may require higher minimum liability insurance, while others may mandate additional coverages such as Personal Injury Protection (PIP). Moving to a state with higher requirements can lead to an increase in your insurance rates.

It is important to note that while moving to a new address can result in higher insurance rates, it can also lead to a decrease in certain circumstances. For example, moving from a densely populated urban area to a rural area may result in lower insurance rates due to reduced risk factors.

When moving to a new address, it is crucial to notify your insurance provider as soon as possible. They will reassess your policy and rates based on your new location, and failing to do so may result in denied claims or policy cancellation.

Report Uninsured Vehicles: A Quick Guide

You may want to see also

Frequently asked questions

There are several reasons why auto insurance rates increase annually. One of the main reasons is that insurance companies pass on their expenses to customers if their total claim payouts exceed premium income. Other reasons include inflation, supply chain issues, and an increase in the number of claims.

Factors that influence the increase in auto insurance rates include the type of vehicle, driving history, age, gender, and coverage choices. The broader factors include state insurance laws, the likelihood of claims in certain areas, and rising auto repair prices.

To prevent auto insurance rates from rising, it is advisable to maintain a clean driving record, avoid accidents and traffic violations, and consider raising the coverage limits of your policy. Shopping around for insurance providers can also help in finding better rates.

The average increase in auto insurance rates varies by provider, location, and vehicle type. In 2023, car insurance rates were expected to rise by 8.4%. However, some areas may experience more significant increases due to factors such as climate change and reinsurance rates.