When it comes to insurance, the identity of the primary driver can significantly impact coverage and costs. This is because insurance companies often consider the driving record, age, and experience of the primary driver when determining premiums and coverage terms. Understanding the implications of the primary driver's status is crucial for policyholders to ensure they receive appropriate coverage and potentially save on insurance expenses. This paragraph sets the stage for a discussion on the importance of identifying the primary driver in insurance policies.

| Characteristics | Values |

|---|---|

| Legal Implications | The primary driver is legally responsible for the vehicle and can be held liable for any accidents or claims. |

| Premium Cost | Insurance companies often offer lower premiums to the primary driver, as they are considered less risky. |

| Coverage and Exclusions | The primary driver's coverage may exclude certain high-risk activities or drivers, affecting the overall policy. |

| Liability and Claims | If the primary driver is involved in an accident, they may face higher insurance premiums and potential legal consequences. |

| Policy Customization | Insurance policies can be tailored to the primary driver's needs, allowing for personalized coverage. |

| Risk Assessment | Insurance providers assess the primary driver's risk profile, considering factors like driving history and age. |

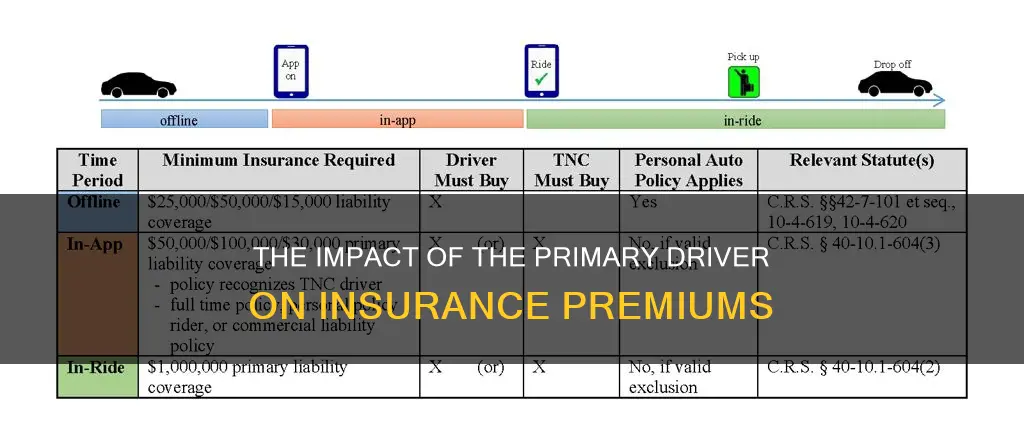

| Vehicle Usage | The primary driver's usage of the vehicle (e.g., personal or commercial) can impact insurance rates and coverage. |

| Family or Household Members | Including family or household members as secondary drivers can affect the primary driver's premium and policy terms. |

| Age and Experience | Younger or less experienced primary drivers may face higher insurance rates due to perceived risk. |

| Driving Record | A clean driving record can result in lower premiums for the primary driver. |

| Location and Usage-Based Factors | Regional regulations and usage-based insurance (UBI) programs can influence the impact of the primary driver on insurance. |

What You'll Learn

- Legal Implications: Who is listed as the primary driver can affect insurance coverage and liability in legal disputes

- Premium Costs: Insurance companies may charge higher premiums based on the primary driver's age, gender, and driving record

- Policy Coverage: The primary driver's profile influences the extent of coverage, including deductibles and policy limits

- Accident Claims: Insurance claims may be more complex if the primary driver is not the policyholder or the actual driver at fault

- Fraud Risks: Misrepresentation of the primary driver can lead to fraud, affecting policyholders and insurance providers

Legal Implications: Who is listed as the primary driver can affect insurance coverage and liability in legal disputes

The primary driver listed on an insurance policy can have significant legal implications, especially in the event of an accident or legal dispute. When an insurance company assesses a claim, they consider the details provided by the policyholder, including the primary driver's information. This is crucial because it directly impacts the insurance coverage and the liability of the parties involved.

In many jurisdictions, insurance policies often include clauses that specify the primary driver's responsibilities and limitations. For instance, if the primary driver is involved in an accident, the insurance company may require them to report the incident promptly and provide accurate details. Failure to do so could result in a denial of coverage or increased premiums. Additionally, the primary driver's status can influence the insurance company's decision on whether to settle a claim or pursue legal action against the at-fault party.

Liability in legal disputes is another critical aspect. If the primary driver is not the one at fault but is listed as such on the policy, it could potentially lead to legal complications. In such cases, the insurance company might argue that the primary driver's listing was incorrect, and the policyholder could face legal consequences for misrepresentation. Conversely, if the primary driver is accurately identified as the at-fault party, the insurance company may be more inclined to provide coverage and support the policyholder's legal defense.

Furthermore, the primary driver's status can impact the distribution of damages in a legal settlement. Insurance companies often have specific guidelines for allocating damages based on the primary driver's role. This includes considerations for medical expenses, property damage, and other relevant costs. Properly identifying the primary driver ensures that the insurance company can accurately assess and allocate these damages, protecting both the policyholder and the insurance provider.

In summary, the primary driver's listing on an insurance policy is a critical detail that can influence insurance coverage, liability, and legal proceedings. Policyholders should ensure that the information provided is accurate and up-to-date to avoid potential legal and financial complications. Understanding these legal implications is essential for anyone involved in insurance claims and legal disputes related to motor vehicle accidents.

Full Coverage Auto Insurance: Allstate's Comprehensive Plan Explained

You may want to see also

Premium Costs: Insurance companies may charge higher premiums based on the primary driver's age, gender, and driving record

The primary driver on an insurance policy can significantly impact the cost of premiums. Insurance companies often consider the age, gender, and driving record of the primary driver when calculating premiums. Younger drivers, especially males, tend to be statistically higher-risk drivers, as they are more likely to engage in risky behaviors and have less experience behind the wheel. As a result, insurance providers may charge higher premiums for policies with younger primary drivers, particularly males.

Age is a critical factor in determining premium costs. Younger drivers, typically those under 25, are considered high-risk due to their lack of experience and the higher likelihood of accidents. Insurance companies often use age-based tiers to categorize drivers, with younger individuals falling into higher-risk categories and facing higher premiums. Additionally, gender plays a role, with male drivers often being charged more due to statistical trends indicating higher accident rates among men.

The driving record of the primary driver is another crucial aspect. Insurance companies closely examine the driving history of the individual named on the policy. A clean driving record with no accidents or traffic violations can result in lower premiums, as the driver is considered less of a risk. Conversely, a history of accidents, speeding tickets, or other traffic violations may lead to increased premiums, as the insurance provider assesses a higher risk of future claims.

Furthermore, the insurance company may also consider the primary driver's marital status, occupation, and the type of vehicle they drive. These factors can influence the premium rate, as certain occupations or vehicle types may be associated with higher risk. For instance, professions with a higher risk of accidents or those involving driving long distances may result in elevated premium costs.

In summary, insurance companies use various factors, including age, gender, and driving record, to determine the primary driver's impact on premium costs. Understanding these considerations can help individuals make informed decisions when selecting insurance policies and primary drivers, potentially saving money on insurance premiums.

Does Travelers Auto Insurance Cover Rental Trucks?

You may want to see also

Policy Coverage: The primary driver's profile influences the extent of coverage, including deductibles and policy limits

The primary driver's profile is a critical factor in determining the terms and conditions of an insurance policy, especially when it comes to coverage and financial responsibility. Insurance companies use this information to assess risk and tailor their policies accordingly. Here's how the primary driver's profile influences policy coverage:

Risk Assessment and Premiums: Insurance providers consider various factors about the primary driver, such as age, gender, driving experience, and driving record. These factors contribute to the overall risk assessment. For instance, younger and less experienced drivers are often considered higher-risk, which may result in higher insurance premiums. Conversely, older, more experienced drivers with a clean record might enjoy lower rates. The primary driver's profile helps insurers understand the likelihood of accidents, claims, and potential losses, allowing them to set appropriate premiums.

Deductibles and Policy Limits: The primary driver's profile directly impacts the deductibles and policy limits. Deductibles refer to the amount the insured person must pay out of pocket before the insurance coverage kicks in. Higher deductibles often lead to lower premiums, but they also mean the driver is responsible for a more significant portion of any claim. Insurance companies may offer different deductibles based on the primary driver's age, driving history, and overall risk profile. Policy limits, on the other hand, determine the maximum amount the insurance will pay for a covered loss. These limits can vary depending on the primary driver's profile, with higher limits potentially available for more experienced and responsible drivers.

Coverage Types and Add-ons: The primary driver's profile can also influence the types of coverage offered and any additional benefits. For instance, if the primary driver has a history of accidents or traffic violations, the insurance company might suggest comprehensive coverage, which includes protection against non-collision events like theft, vandalism, or natural disasters. Additionally, add-ons like rental car coverage, roadside assistance, or personal injury protection may be recommended based on the driver's profile and the insurance provider's assessment of their needs.

Understanding these points is essential for individuals to make informed decisions when purchasing insurance. It highlights the importance of disclosing accurate information about the primary driver to ensure the policy provides adequate coverage and financial protection. By considering the primary driver's profile, insurance companies can offer tailored policies that meet specific needs, ensuring a more comprehensive and personalized insurance experience.

Auto Insurance: Commercial Coverage Explained

You may want to see also

Accident Claims: Insurance claims may be more complex if the primary driver is not the policyholder or the actual driver at fault

When it comes to insurance claims, the identity of the primary driver can significantly impact the process and outcome, especially in cases where the primary driver is not the policyholder or the driver at fault. This scenario often introduces a layer of complexity that requires careful navigation to ensure a fair and accurate resolution. Here's an overview of why this distinction matters:

In many insurance policies, the primary driver is the individual whose name appears on the policy and who has the authority to use the vehicle. This person is typically the one who pays the premiums and is covered under the policy's terms. However, accidents can occur when the vehicle is driven by someone other than the primary driver, such as a family member, friend, or rental driver. In these cases, determining liability and coverage can become intricate. For instance, if a policyholder lends their car to a friend who then gets into an accident, the insurance company might need to consider the friend's driving record, the circumstances of the loan, and the policy's specific provisions regarding non-primary drivers.

The complexity arises when the primary driver is not the actual driver at fault. This situation can lead to disputes over who is responsible for the accident and who should file the claim. Insurance companies often require proof of the driver's identity and their relationship to the policyholder. They may request police reports, witness statements, or even a court order to establish the correct driver and their fault. This process can delay the claims settlement and may require additional documentation and investigations.

Furthermore, insurance policies often have clauses that address these scenarios. Some policies might provide coverage for additional drivers, while others may have restrictions or exclusions. For example, a policy might offer coverage for family members but exclude friends or rental drivers. Understanding these policy details is crucial to managing expectations and ensuring that the insurance company processes the claim correctly.

In summary, when the primary driver is not the policyholder or the driver at fault, insurance claims can become more intricate. It is essential for all parties involved to provide accurate information, understand the policy terms, and navigate the claims process carefully to ensure a fair resolution. This attention to detail can help prevent disputes and streamline the process, ultimately benefiting both the insurance company and the policyholder.

Usaa Auto Insurance for Rental Cars: Is It Worth the Hype?

You may want to see also

Fraud Risks: Misrepresentation of the primary driver can lead to fraud, affecting policyholders and insurance providers

The primary driver on an insurance policy is a crucial piece of information, and misrepresentation of this role can have significant fraud implications. When an individual or entity deliberately misrepresents who is the primary driver, it opens up avenues for fraudulent activities that can harm both policyholders and insurance providers.

One common scenario is when a policyholder lists a family member or a friend as the primary driver to lower insurance premiums. This practice, known as 'fronting', can be fraudulent as it misrepresents the actual driving habits and risks associated with the vehicle. Insurance companies often use driving records and demographics to calculate premiums. By listing a less risky driver, policyholders can manipulate these calculations, potentially receiving lower premiums than they should. However, if the listed driver is involved in an accident or has a poor driving record, the insurance provider may face higher claims and increased costs, impacting other policyholders.

Misrepresentation of the primary driver can also occur in commercial insurance settings. For instance, a business owner might list a trusted employee as the primary driver to avoid higher premiums for themselves. This could be a fraudulent act if the owner's driving record is poor and they want to avoid the financial burden of higher insurance costs. In such cases, the insurance provider may not have all the necessary information to accurately assess the risk, leading to potential financial losses.

The consequences of such fraud can be far-reaching. Policyholders who engage in misrepresentation may face increased premiums or even policy cancellations if the insurance company discovers the fraud. Insurance providers, on the other hand, might incur significant financial losses, which could impact their overall stability and ability to provide coverage to honest policyholders. Furthermore, the insurance industry's reputation could suffer, as instances of fraud erode trust between consumers and providers.

To mitigate these fraud risks, insurance companies should implement robust verification processes. This includes verifying the driving records and demographics of all listed drivers and ensuring that the primary driver is accurately represented. Policyholders should also be encouraged to provide accurate and up-to-date information to avoid any potential issues. By maintaining transparency and accuracy, insurance providers can protect themselves and their customers from the detrimental effects of fraud.

Auto Insurance Rates: Family of 2's Average Costs

You may want to see also

Frequently asked questions

Yes, it can significantly impact the insurance rates and coverage. Insurance companies often use the primary driver's information to determine the premium and assess risk. The primary driver is typically the person who uses the vehicle most frequently and is considered the main policyholder. This individual's driving record, age, and experience can influence the insurance rates for all drivers listed on the policy.

If the primary driver on an insurance policy changes, it's essential to inform the insurance company promptly. The new primary driver's details will be used to recalculate the premiums, as the insurance provider will reassess the risk based on the updated information. This change might affect the overall cost of the policy and the coverage terms.

In some cases, adding a secondary driver who is a family member or a regular driver of the vehicle can sometimes result in lower insurance premiums. Insurance companies may offer discounts for multiple drivers on the same policy, especially if they have similar driving records and live in the same household. However, the specific circumstances and the insurance provider's policies will determine the impact on the overall cost.