The average cost of car insurance varies depending on factors such as age, location, vehicle type, credit history, and driving history. The national average cost of car insurance is $2,026 per year or $169 per month for full coverage, and $638 per year or $53 per month for state minimum coverage, according to Forbes Advisor's 2024 analysis. However, the cost of car insurance for a family of two will depend on the specific circumstances of the family, including the age and driving history of both individuals, the type of vehicle(s) they own, and their location.

| Characteristics | Values |

|---|---|

| Average monthly cost of car insurance for drivers in the U.S. | $196 for full coverage |

| $53 for minimum coverage | |

| Average annual cost of car insurance in the U.S. | $2,348 for full coverage |

| $639 for minimum coverage | |

| Average cost of car insurance in 2024 | $1,766 for full coverage |

| $497 for minimum coverage | |

| Average cost of car insurance in 2024 (Forbes Advisor) | $2,026 for full coverage |

| $638 for minimum coverage | |

| Average cost of car insurance in 2024 (U.S. News) | $2,068 |

| Average monthly cost of car insurance for a family | $241 and $246 |

| Average annual cost of car insurance for a family | $2,892 and $2,952 |

What You'll Learn

Average car insurance rates by state

The average cost of car insurance varies from state to state, with several factors influencing the rates. The national average annual cost for car insurance is $2,118 for full coverage and $497 for minimum coverage. The state with the highest average car insurance rates is New York, at $8,232 per year for full coverage and $2,490 per year for minimum coverage. The state with the lowest average full-coverage car insurance rates is Maine, at $1,460 per year.

Factors Affecting Car Insurance Rates by State

Several factors determine car insurance rates in each state, including:

- State insurance requirements: Each state has different insurance mandates, such as personal injury protection or medical payment coverage, which can impact the cost of insurance. For example, states that require PIP coverage tend to have higher car insurance prices.

- Population density: Sparsely populated states generally have lower insurance rates than highly populated ones. Urban drivers typically pay more for auto insurance than those in rural areas.

- Number of auto insurance claims: States with a higher number of car insurance claims tend to have higher insurance rates. This can be influenced by factors such as severe weather events, congested cities, and high crime rates.

- Cost of car insurance claims: The cost of car repairs and medical care varies by state, impacting insurance rates. States with higher claim payouts will generally have higher insurance costs.

- Frequency of lawsuits: States with a higher number of lawsuits related to car accidents tend to have higher insurance rates, as settlements can be larger.

States with the Most Expensive Car Insurance

In addition to New York, the following states have the most expensive car insurance rates:

- Florida

- Louisiana

- Pennsylvania

- Maryland

These states often have large urban areas, no-fault laws, a high frequency of lawsuits, and severe weather, all of which contribute to higher insurance rates.

States with the Cheapest Car Insurance

The states with the cheapest car insurance costs include:

- Idaho

- Vermont

- Ohio

- Maine

- Iowa

These states often have a large number of rural areas, milder weather, and competitive insurance markets, resulting in lower insurance rates.

Auto Insurance: ATV Accidents Covered?

You may want to see also

Average car insurance rates by provider

The average cost of car insurance varies depending on the provider chosen, as well as other factors such as age, location, vehicle type, credit score, and driving record. Here is a breakdown of the average annual and monthly costs for some of the largest car insurance companies in the US, for both full and minimum coverage:

USAA

USAA is a popular choice for military personnel, veterans, and their families, offering exclusive rates that are significantly lower than the national average. The average annual cost for full coverage is $1,335, while minimum coverage costs around $722 less at $613. On a monthly basis, full coverage with USAA costs approximately $111, and minimum coverage is roughly $51.

Erie

Erie Insurance is another affordable option, with average annual rates of $1,532 for full coverage and $976 for minimum coverage. This translates to monthly costs of around $128 and $81, respectively.

Auto-Owners

Auto-Owners Insurance provides competitive rates, with an average annual cost of $1,619 for full coverage and $1,031 for minimum coverage. The monthly cost for full coverage is approximately $135, while minimum coverage is about $86.

Geico

Geico is known for offering competitive rates, especially for drivers with good credit and a clean driving record. The average annual cost for full coverage is $1,714, while minimum coverage is $809. On a monthly basis, full coverage with Geico costs around $143, and minimum coverage is approximately $67.

Nationwide

Nationwide is another popular insurance provider with relatively low rates. The average annual cost for full coverage is $1,824, while minimum coverage is $1,062. This equates to monthly costs of about $152 for full coverage and $89 for minimum coverage.

It's important to note that these rates are averages and may not reflect the exact costs for an individual or family. The best way to determine the cost of car insurance is to obtain quotes from multiple providers and compare the coverage options and prices. Additionally, factors such as age, driving history, and vehicle type can significantly impact the final premium.

Auto Insurance in New Jersey: What's the Law?

You may want to see also

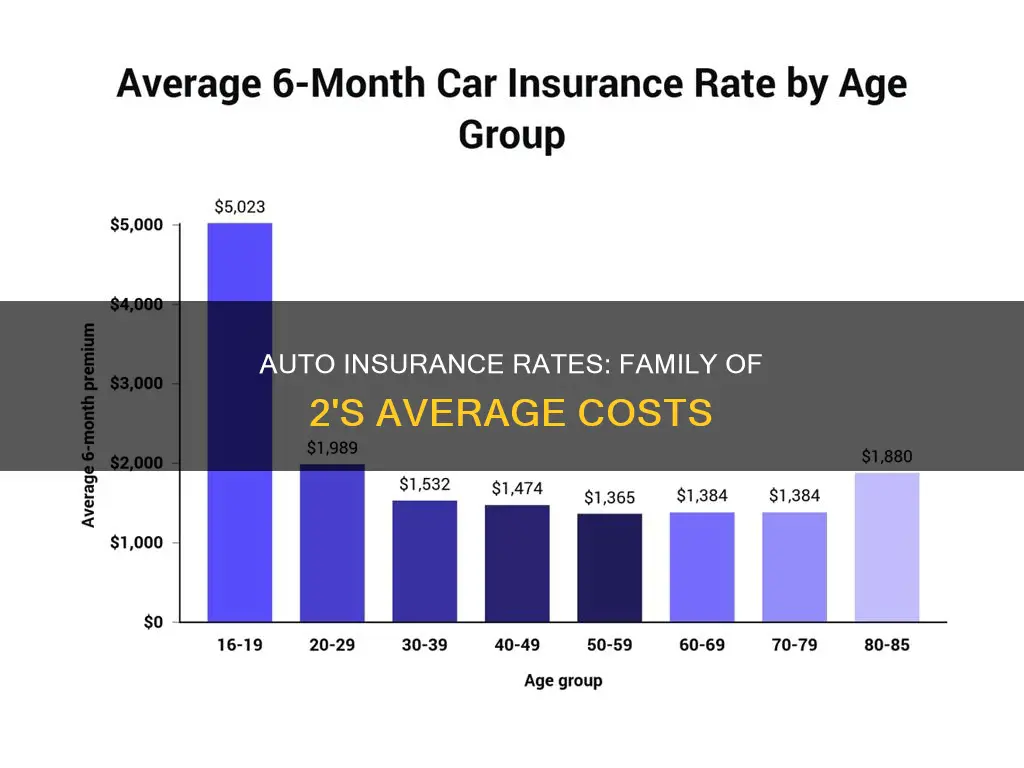

Average car insurance rates by age

Age is one of the most important factors in determining your car insurance rate. While there are good drivers in every age group, younger drivers are generally more likely to have accidents or take risks on the road. Experienced drivers are less likely to have accident claims, which means they cost less to insure.

Car insurance rates are highest for teens and young adults. Teen drivers between the ages of 16 and 19 are nearly three times as likely as drivers who are 20 or older to be in a fatal crash. According to the Insurance Institute for Highway Safety, drivers aged 16 to 19 are four times more likely to be in a car accident compared to older drivers. As a result, insurers frequently charge more to insure teen drivers to offset the higher costs associated with teen driving claims.

The cost of auto insurance coverage generally begins to drop by the time a driver reaches their early 20s. By age 25, drivers might notice a significant reduction in their premiums. Throughout adulthood, provided that drivers have a history of safe driving and no insurance claims, premiums generally continue to drop as drivers gain more experience.

Insurance rates are typically the lowest for middle-aged drivers, but car insurance costs for seniors may increase, even for those with a great driving record. Despite years of experience, older drivers can be more prone to car accidents due to physical, cognitive, or visual impairments. Rates rise again for senior drivers, as insurers associate advanced age with slower reaction times and a higher probability of accidents.

The average car insurance cost for teens is high but decreases when they turn 20. Rates are cheapest for drivers in their 40s, 50s, and 60s. Car insurance is cheapest around age 55, on average, as middle-aged drivers with experience on the road are the least expensive to insure due to their low accident and claims rates. Overall, car insurance is cheapest for drivers aged 35-65.

- For a 20-year-old male, the annual cost of a full coverage policy is $3,943 per year; for a female driver, the same policy costs $3,537 annually. For a 50/100/50 liability-only policy, premiums for a 20-year-old male are $1,275 per year and rates for a female are $1,192.

- For a 21-year-old male, the average annual cost for a full coverage policy is $3,231 per year, while 21-year-old females pay $2,958 per year for the same policy. Liability-only policies with limits of 50/100/50 cost $985 annually for females and $1,034 for males.

- For a 22-year-old male, the average annual rate for full coverage is $2,965 per year and for a female driver, the same policy costs $2,750 per year. For a liability-only policy with limits of 50/100/50, annual rates for a female are $918 and $950 for a male.

- For a 23-year-old male, the average full coverage rate is $2,756 per year, and $2,584 per year for a female driver. For a liability-only policy with 50/100/50 limits, an annual policy costs $856 for a female; for a male, the same policy costs $877.

- For a 24-year-old male, the average annual rate for full coverage is $2,594; for a female driver, the rate is $2,594 per year. For a liability-only policy with limits of 50/100/50, a male driver pays $823 annually while a female driver pays $812.

- The cost between a female and male nearly equalizes at age 25 at $737 per year for males and $743 per year for females for a liability-only policy with limits of 50/100/50. For a full-coverage policy, 25-year-old males pay $2,295 per year and 25-year-old females pay $2,224.

In addition to age, other factors that affect car insurance rates include address and ZIP code, driving record, credit score, vehicle type, and gender.

Does Your Auto Insurance Cover Other Drivers?

You may want to see also

Average car insurance rates by credit score

Credit scores can have a significant impact on car insurance rates, with drivers with poor credit often facing much higher premiums than those with good or excellent credit. This is because insurance companies use credit-based insurance scores to assess the likelihood of a customer filing claims, with those in lower credit tiers expected to file more. While the specific calculation of these insurance scores is not disclosed by insurers, they generally take into account factors such as total debt, payment history, and the length of credit history.

The impact of credit scores on insurance rates varies across states, with California, Hawaii, Massachusetts, and Michigan prohibiting or limiting the use of credit scores in determining rates. In other states, the difference in insurance rates between drivers with poor and excellent credit can be substantial, with average annual rates ranging from $2,031 for those with excellent credit to $4,366 or more for those with poor credit.

Improving one's credit score can be a crucial step in reducing car insurance costs. Strategies such as timely bill payment, maintaining a low credit utilization rate, and regularly monitoring one's credit report can help boost one's credit score and, consequently, lead to more favourable insurance rates. Additionally, shopping around for insurance quotes, comparing rates, and working with independent insurance agents can help individuals with poor credit find more affordable coverage options.

U-Haul Rental: Am I Covered?

You may want to see also

Average car insurance rates by driving record

The cost of car insurance varies depending on a number of factors, including age, gender, driving record, credit score, location, and vehicle type. Here is an overview of how average car insurance rates vary by driving record:

Average Car Insurance Rates for Drivers with a Clean Driving Record

Drivers with a clean driving record, meaning no accidents, speeding tickets, or other traffic violations, will typically pay lower insurance rates. The average cost of car insurance for a driver with a clean record can range from $1,300 to $2,800 per year for full coverage, depending on various factors. The specific rate will depend on the driver's age, gender, location, vehicle type, and other factors.

Average Car Insurance Rates After an At-Fault Accident

An at-fault accident on a driver's record can significantly increase their insurance rates. On average, drivers with an at-fault accident pay around 44% to 49% more for car insurance. For a 40-year-old driver with full coverage, an at-fault accident could increase their monthly premium from $196 to $281, and their annual premium by approximately $1,000. The exact increase will depend on the severity of the accident, the driver's insurance company, and other factors.

Average Car Insurance Rates After a Speeding Ticket

A speeding ticket can also lead to higher insurance rates, with drivers paying on average 22% to 27% more for full coverage. The increase will depend on the insurance company, with some companies having smaller increases than others. For example, Erie and Auto-Owners' rates remain below the national average even after a speeding ticket.

Average Car Insurance Rates After a DUI

A DUI conviction will result in a significant increase in car insurance rates, with drivers paying on average 83% to 94% more for full coverage. The increase will vary by state, with some states having much higher increases than others. For instance, the average cost of car insurance after a DUI in Idaho is $2,192 per year, while in Michigan, it is around $7,724 per year.

Auto Insurance Premiums: Understanding Costly Charge Consequences

You may want to see also

Frequently asked questions

The average auto insurance rate for a family of 2 depends on several factors, including age, location, vehicle type, credit history, and driving history. However, according to various sources, the average annual cost of car insurance in the US ranges from $1,766 to $2,348 for full coverage and $497 to $639 for minimum coverage.

The auto insurance rate for a family of 2 can be influenced by factors such as age, location, vehicle type, credit history, and driving history. Younger and older drivers often pay higher rates, and rates vary by state. The type of vehicle, credit history, and driving record can also impact the cost of insurance.

Adding additional drivers, especially teen drivers, to a family's auto insurance policy can significantly increase the cost. The number of vehicles insured can also affect the rate, with multi-car policies often offering discounts compared to insuring each vehicle separately.

There are several ways to save on auto insurance for a family of 2. Shopping around and comparing quotes from multiple insurers is a good way to find the best rates. Maintaining a clean driving record and good credit history can also help lower insurance costs. Additionally, bundling policies, such as home and auto insurance, can often lead to discounts.

When considering auto insurance for a family of 2, it is essential to compare rates and coverage options from multiple companies. Some recommended companies include Travelers, State Farm, and USAA, which offer a range of coverage options, discounts, and competitive rates. However, USAA is only available to military members, veterans, and their families.