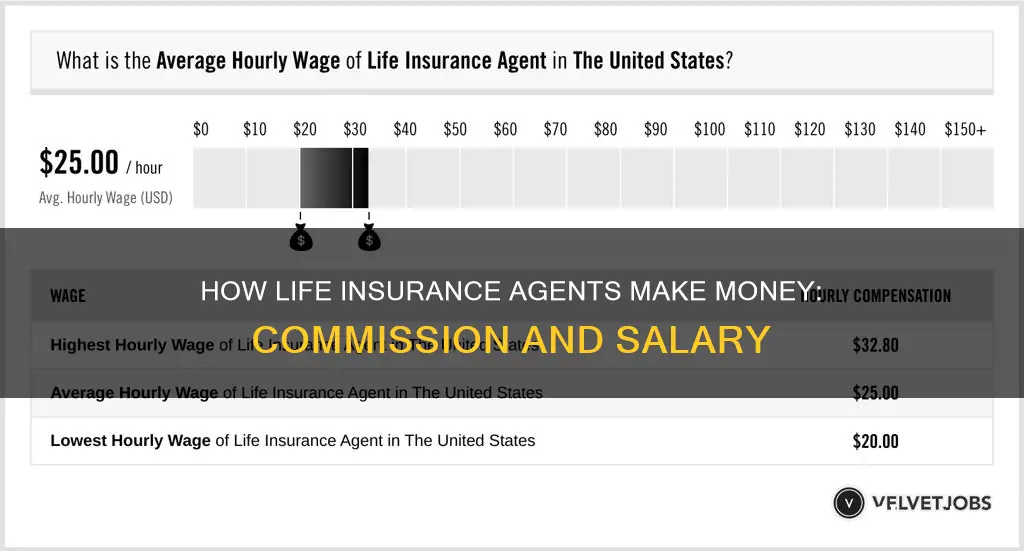

Life insurance agents are generally paid on a commission basis, which means that their income is directly linked to the number of policies they sell. While some life insurance agents earn a small base salary and employee benefits, the majority are independent contractors who receive no base salary or benefits. This means that their income is entirely dependent on their sales performance. The commission rates for life insurance agents can vary depending on the type of policy sold, with whole life insurance plans typically offering the highest commission rates. The average annual salary for life insurance agents ranges from $62,000 to $76,000, but there are some agents who earn significantly more, with the top 10% earning an estimated $134,000 per year. However, the job also comes with challenges such as negative public perception, high-pressure sales tactics, and limited paid time off.

| Characteristics | Values |

|---|---|

| Average annual salary | $62,000 to $76,000 |

| Salary range | $28,000 to $134,000 |

| Median salary | $59,000 |

| Salary in Dallas, TX | $74,935 |

| Salary range in Dallas, TX | $75,000 to $150,000 |

| Commission | 40% to 115% of the policy's first-year premiums |

| Commission after the first year | 1% to 2% |

| Commission for whole life insurance plans | More than 100% of the total premiums for the first year |

| Commission for universal life insurance plans | 100% of the premiums the policyholder pays in the first year |

| Commission for term life insurance plans | 30% to 80% |

| Commission for financial advisors | N/A |

What You'll Learn

Life insurance agents are paid on commission

Life insurance agents are typically paid on a commission basis, and they often receive no base salary or benefits. This means that their income is directly tied to their sales performance, and they only earn money when they make a sale. The commission-based pay structure can be financially unstable, especially for new agents who are still building their client base.

The commission rates for life insurance agents vary depending on the type of policy sold. Whole life insurance plans often offer the highest commission rates, sometimes exceeding 100% of the total premiums for the first year. Universal life insurance plans typically provide a commission of at least 100% of the first-year premiums up to a target level. Term life insurance plans generally have the lowest commissions, ranging from 30% to 80% of the annual premiums.

While some life insurance agents are salaried employees with a small base pay and benefits, they are often required to meet strict monthly sales quotas. Captive life insurance agents, who work exclusively with one insurance carrier, usually earn lower commissions compared to independent agents who represent multiple companies. However, independent agents often have to cover their business expenses, such as rent and advertising costs.

The challenge of finding qualified leads is a significant one for life insurance agents. Many agents have to resort to cold-calling and door-knocking to find potential customers. Additionally, life insurance is a difficult product to sell, as people are often reluctant to discuss their own mortality and the lack of instant gratification makes it harder to secure impulse purchases.

Despite the challenges, a career in life insurance sales can offer certain advantages. Jobs in this field are relatively easy to find, and the commission percentages are higher compared to other types of insurance sales. Life insurance agents also have the potential to earn passive income through renewal commissions as long as the policy remains in force. Building a solid client base and establishing strong relationships can lead to higher earnings over time.

Great-West Life Insurance: Breast Pump Coverage Explained

You may want to see also

Agents receive a higher commission for whole life insurance plans

Life insurance agents receive a large upfront commission based on the cost of the first year's policy premium. This can be a substantial percentage of the first year's policy cost. Agents also receive ongoing or residual commissions each year the policy is in force.

The commission structures vary by policy and company. However, life insurance agents typically receive 60% to 80% of the premiums paid in the first year as commission. They collect smaller commissions in the following years, with 5% to 10% of all the premiums paid over the life of the policy going towards commissions.

Whole life insurance, or permanent life insurance, is a type of policy that lasts until the policyholder's death and includes a tax-advantaged cash value savings component. Whole life insurance policies tend to be more expensive than term life insurance, which only lasts for a set term. Due to the higher cost of whole life insurance, agents receive a higher commission for selling these policies.

Whole life insurance policies can be challenging to sell because they are more expensive and do not offer the same flexibility as term life insurance. However, agents are incentivized to sell whole life insurance policies because of the higher commission.

In addition to the higher commission, whole life insurance policies may also offer other benefits to agents. For example, some companies may provide agents with an advance on their commissions, calculated based on the agent's earning potential. This can result in a higher upfront payment for the agent.

Overall, while whole life insurance policies may offer a higher commission for agents, it is important for customers to consider their own financial needs and seek advice from a financial advisor before purchasing any life insurance policy.

Life Insurance and Divorce: What's the Verdict?

You may want to see also

Life insurance agents face public disdain

Another reason for the public's negative perception of life insurance agents is the commission-based pay structure. Life insurance agents are typically classified as independent contractors and are paid solely through commissions on the policies they sell. This means their income is unpredictable and dependent on their sales performance. As a result, agents may be perceived as pushy or overly focused on making a sale rather than genuinely helping customers.

Furthermore, the public may view life insurance agents with suspicion due to negative experiences or a lack of trust in the insurance industry. Some people feel that insurance agents are out to get them or are only interested in sealing the deal without providing proper explanations. Misrepresentation of policies and a lack of service after a sale can contribute to this negative perception.

Additionally, life insurance agents are often seen as annoying and pestering due to their aggressive sales tactics. Cold calls, SMS blasts, emails, roadshows, and canvassing are common methods used to generate leads, which can be seen as intrusive and bothersome by potential customers.

Lastly, there is a stigma associated with the level of education and professionalism of life insurance agents. Some people view them as uneducated salespeople who are just trying to make a quick buck. However, this perception may be changing, as more millennials with university degrees are entering the industry.

Illinois Life Insurance: Payout Tax or Tax-Exempt?

You may want to see also

It is hard to make a living selling term life insurance

Life insurance agents are typically paid on a commission basis, which means that they only make money when they sell a policy. While some companies offer a small base salary and benefits, these often come with rigid production quotas. Life insurance agents are generally classified as independent contractors, so they can set their own schedules but have no guaranteed income. This means that they may work a full week and receive no paycheck if they don't make any sales.

Selling term life insurance can be particularly challenging because it is often seen as a temporary solution and may be more appealing to those who cannot afford other options. Term life insurance also does not build cash value over time, which can make it less attractive to buyers in the secondary market. Additionally, the product itself can be difficult to sell, as people are often reluctant to discuss their own mortality and the policy does not provide any instant gratification.

To be successful in selling term life insurance, agents must be willing to put in the time and effort to build a professional network and acquire clients. This may involve cold-calling, door-knocking, and other traditional sales methods. Even then, it can be challenging to find qualified leads, as many potential customers may have already been contacted by dozens of other agents.

While it is possible to make a living selling term life insurance, it is important to be aware of the challenges and be prepared to put in the necessary work.

Global Life: Health Insurance Provider?

You may want to see also

Life insurance agents are pressured to sell high-commission policies

Firstly, the job is demanding, with agents often working on a commission-only basis and facing challenges in finding qualified leads and prospects. This results in long working hours, especially during the initial years, to have any chance of earning a decent living. The pressure to meet sales targets and maintain client relationships can be intense, and agents may experience frequent rejection and disrespect from potential customers.

Secondly, the structure of the industry incentivizes the sale of high-commission policies. Life insurance companies typically classify their agents as independent contractors, offering no base salary, benefits, or guaranteed income. This means agents' earnings are solely dependent on the commissions they generate. Whole life and universal life insurance plans offer significantly higher commissions than term life insurance policies, sometimes exceeding 100% of the first-year premiums. As a result, agents are incentivized to push these higher-commission products to maximize their earnings.

Additionally, there is significant pressure on agents to sell high-commission policies due to the potential for substantial financial gains. The insurance industry, particularly life insurance, offers some of the highest commissions in the sales field. While it is challenging to sell life insurance, successful agents can earn substantial incomes, with the top 10% of earners making over $125,000 per year. The lure of such high earnings can motivate agents to employ aggressive sales tactics and focus on selling high-commission policies.

Furthermore, leadership and management within insurance companies often encourage the sale of high-commission policies. Recruiters and trainers may use unethical, high-pressure sales tactics and set aggressive sales quotas, creating a culture that prioritizes sales over genuine client needs. This top-down pressure influences agents to sell policies that generate higher commissions to meet company expectations and avoid termination.

Finally, the competitive nature of the industry contributes to the pressure on agents. With numerous agents vying for a limited number of clients, there is an inherent drive to secure sales and maximize earnings. This dynamic further incentivizes agents to sell high-commission policies to stand out in a crowded market and increase their chances of financial success.

In summary, life insurance agents face pressure to sell high-commission policies due to the demanding nature of the job, the commission-based structure of the industry, the potential for significant financial gains, the influence of company leadership, and the competitive dynamics of the insurance sales field.

Globe Life Insurance: Understanding the Waiting Periods

You may want to see also

Frequently asked questions

The average annual salary for a life insurance agent ranges from $62,000 to $76,000. However, salaries can vary depending on location, experience, and the type of insurance policies sold. Commissions for whole life insurance plans are often more than 100% of the total premiums for the first year, while term life insurance plans pay a lower commission of between 30% and 80%.

Selling life insurance can be a challenging career choice due to the competitive nature of the industry and the difficulty of finding qualified customers. Life insurance agents often work on straight commission, which can lead to financial instability, especially when starting out. Additionally, there is a high attrition rate among life insurance agents due to the demanding nature of the job, rigorous training and licensing requirements, and work-life balance issues.

Some pros of being a life insurance agent include flexible working hours, strong earning potential through commissions, and the opportunity to work with well-known brands. However, cons include commission-based earnings, which can be unpredictable, a difficult sales process due to the nature of the product, limited paid time off, and the potential for rejection and disrespect from potential customers.